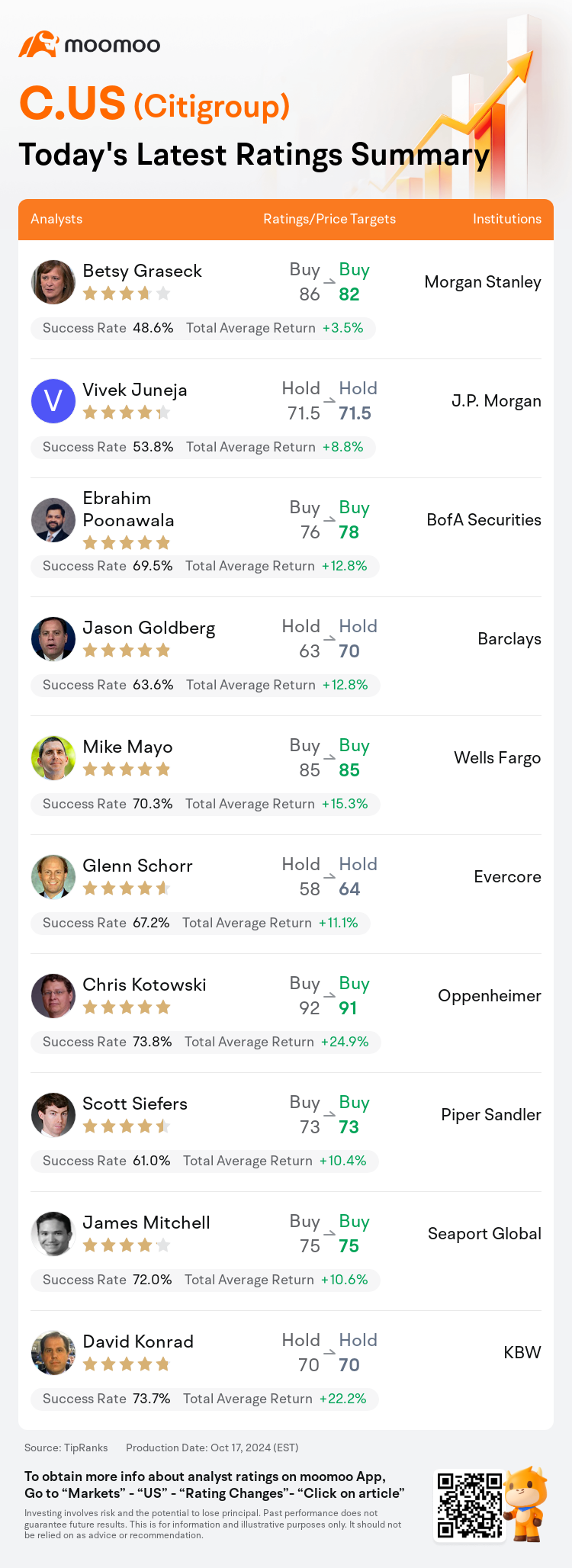

On Oct 17, major Wall Street analysts update their ratings for $Citigroup (C.US)$, with price targets ranging from $64 to $91.

Morgan Stanley analyst Betsy Graseck maintains with a buy rating, and adjusts the target price from $86 to $82.

J.P. Morgan analyst Vivek Juneja maintains with a hold rating, and maintains the target price at $71.5.

BofA Securities analyst Ebrahim Poonawala maintains with a buy rating, and adjusts the target price from $76 to $78.

BofA Securities analyst Ebrahim Poonawala maintains with a buy rating, and adjusts the target price from $76 to $78.

Barclays analyst Jason Goldberg maintains with a hold rating, and adjusts the target price from $63 to $70.

Wells Fargo analyst Mike Mayo maintains with a buy rating, and maintains the target price at $85.

Furthermore, according to the comprehensive report, the opinions of $Citigroup (C.US)$'s main analysts recently are as follows:

Despite surpassing both BofA's and consensus earnings per share estimates for Q3, experiencing a 16% and 13% beat respectively, the company's shares declined. The downturn in share value intensified when management provided an unsatisfactory initial response regarding the potential for a regulatory-imposed asset cap. Although the CEO later clarified that there is no such asset cap, the initial uncertainty contributed to the stock undergoing some profit-taking, particularly since it was trading close to its year-to-date peak just before the earnings announcement.

Despite an EPS beat fueled by robust capital markets and decreased expenses, the share performance was impacted negatively by the steady expense guidance for 2024. This outlook implies a quarter-over-quarter increase of 2% in Q4 expenses, which may affect the earnings run-rate leading into 2025. Subsequent to the earnings report, there has been a revision in the 2025 EPS estimate downwards by 4% to $7.46, factoring in elevated expenses and a dip in net interest income, which is somewhat balanced by an uptick in fee income.

The company's Q3 earnings surpassed estimates, supported by fee income, with trading and investment banking fees outperforming intra-quarter guidance.

Citi's third quarter earnings per share of $1.51 surpassed estimates, outdoing both the $1.43 forecast and the consensus of $1.31. Despite this, the company's shares declined by 5.1% on a day when the S&P 500 saw only a 0.7% drop and the BKX rose by 0.3%. During the Q&A session, key issues raised included credit card losses reaching the higher end of expectations, speculation on an unannounced asset cap, uncertainties around the Banamex IPO launch by 2025, and how the company plans to achieve its 2026 expense guidance of $51-$53 billion compared to this year's $53.8 billion.

Here are the latest investment ratings and price targets for $Citigroup (C.US)$ from 10 analysts:

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

美东时间10月17日,多家华尔街大行更新了$花旗集团 (C.US)$的评级,目标价介于64美元至91美元。

摩根士丹利分析师Betsy Graseck维持买入评级,并将目标价从86美元下调至82美元。

摩根大通分析师Vivek Juneja维持持有评级,维持目标价71.5美元。

美银证券分析师Ebrahim Poonawala维持买入评级,并将目标价从76美元上调至78美元。

美银证券分析师Ebrahim Poonawala维持买入评级,并将目标价从76美元上调至78美元。

巴克莱银行分析师Jason Goldberg维持持有评级,并将目标价从63美元上调至70美元。

富国集团分析师Mike Mayo维持买入评级,维持目标价85美元。

此外,综合报道,$花旗集团 (C.US)$近期主要分析师观点如下:

尽管第三季度超过了美国银行和一致每股收益预期,分别超出了16%和13%,但该公司股票下跌。当管理层对可能实施资产上限的潜在问题给出不满意的初步回应时,股价下跌势头加剧。尽管CEO后来澄清称没有这样的资产上限,但最初的不确定性导致股票出现一些盈利回吐,特别是在接近年内高点的交易前夕。

尽管EPS受益于强劲的资本市场和费用下降而超越预期,但2024年的稳健支出指引对股票表现产生了负面影响。这一展望意味着Q4支出环比增长2%,这可能会影响2025年的盈利率。在财报发布后,2025年的EPS估值下调4%至7.46美元,考虑到费用上升和净利息收入下降,但手续费收入有所增加。

该公司的第三季度盈利超出预期,受到手续费收入的支持,交易和投资银行费用优于季中预测。

花旗第三季度每股收益为1.51美元,超出了预期,同时也超过了1.43美元的预测和1.31美元的一致预期。尽管如此,当标普500指数仅下跌0.7%,BKX上涨0.3%的情况下,该公司的股价下跌了5.1%。在问答环节中,提出的关键问题包括信用卡损失达到预期较高水平,对未宣布的资产上限的猜测,对2025年前巴纳梅克斯IPO发布的不确定性,以及公司如何实现2026年的510-530亿美元的费用指引,相比今年的538亿美元。

以下为今日10位分析师对$花旗集团 (C.US)$的最新投资评级及目标价:

提示:

TipRanks为独立第三方,提供金融分析师的分析数据,并计算分析师推荐的平均回报率和胜率。提供的信息并非投资建议,仅供参考。本文不对评级数据和报告的完整性与准确性做出认可、声明或保证。

TipRanks提供每位分析师的星级,分析师星级代表分析师所有推荐的过往表现,通过分析师的总胜率和平均回报率综合计算得出,星星越多,则该分析师过往表现越优异,最高为5颗星。

分析师总胜率为近一年分析师的评级成功次数占总评级次数的比率。评级的成功与否,取决于TipRanks的虚拟投资组合是否从该股票中产生正回报。

总平均回报率为基于分析师的初始评级创建虚拟投资组合,并根据评级变化对组合进行调整,在近一年中该投资组合所获得的回报率。

美银证券分析师Ebrahim Poonawala维持买入评级,并将目标价从76美元上调至78美元。

美银证券分析师Ebrahim Poonawala维持买入评级,并将目标价从76美元上调至78美元。

BofA Securities analyst Ebrahim Poonawala maintains with a buy rating, and adjusts the target price from $76 to $78.

BofA Securities analyst Ebrahim Poonawala maintains with a buy rating, and adjusts the target price from $76 to $78.