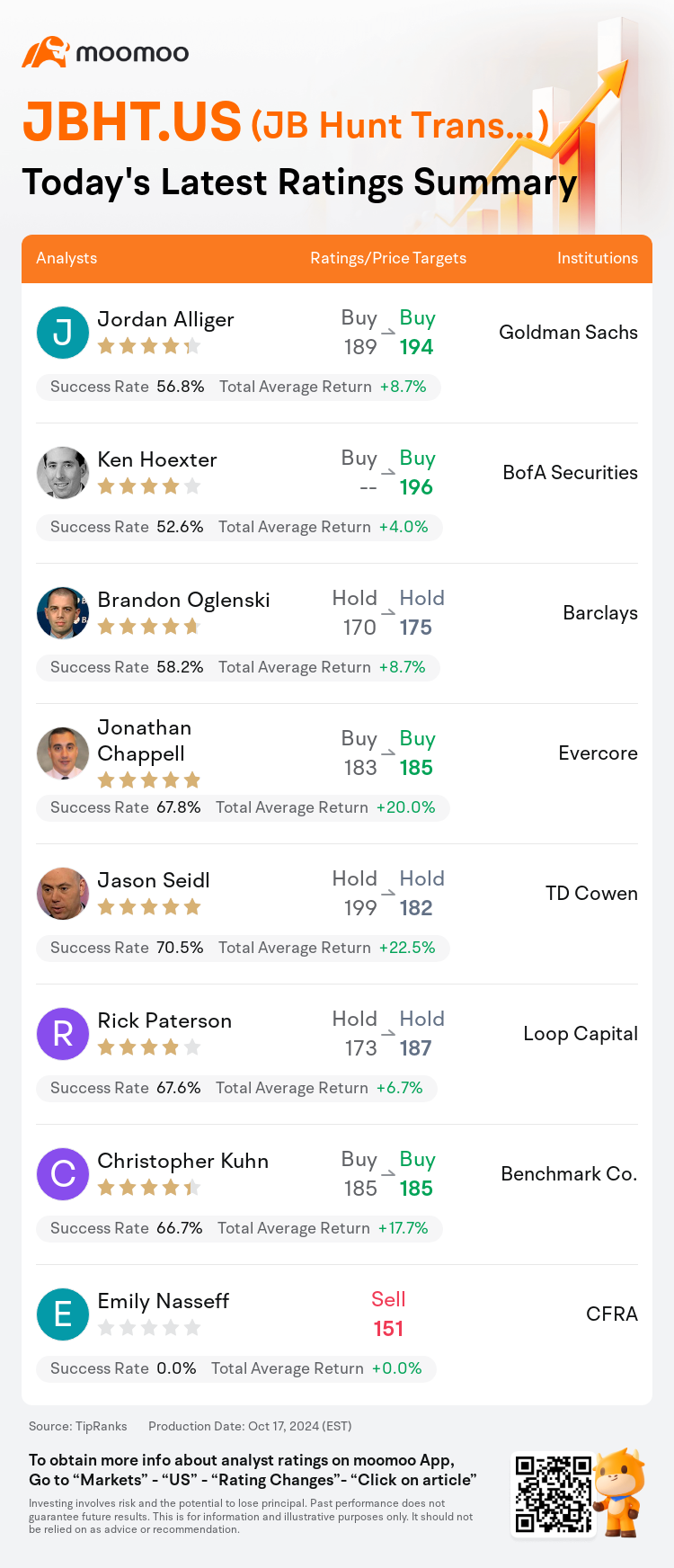

On Oct 17, major Wall Street analysts update their ratings for $JB Hunt Transport Services (JBHT.US)$, with price targets ranging from $151 to $196.

Goldman Sachs analyst Jordan Alliger maintains with a buy rating, and adjusts the target price from $189 to $194.

BofA Securities analyst Ken Hoexter maintains with a buy rating, and sets the target price at $196.

Barclays analyst Brandon Oglenski maintains with a hold rating, and adjusts the target price from $170 to $175.

Barclays analyst Brandon Oglenski maintains with a hold rating, and adjusts the target price from $170 to $175.

Evercore analyst Jonathan Chappell maintains with a buy rating, and adjusts the target price from $183 to $185.

TD Cowen analyst Jason Seidl maintains with a hold rating, and adjusts the target price from $199 to $182.

Furthermore, according to the comprehensive report, the opinions of $JB Hunt Transport Services (JBHT.US)$'s main analysts recently are as follows:

J.B. Hunt's third-quarter earnings per share (EPS) of $1.49 declined by 9% compared to the same period last year, yet surpassed the anticipated $1.35 and the consensus estimate of $1.39. This outperformance was driven by higher-than-expected Intermodal Load growth, as shippers accelerated their shipments in preparation for a potential East Coast Port strike. In light of these results, the EPS estimate for 2024 has been revised upward marginally to $5.70, while the 2025 EPS forecast remains at $7.80, notably above the consensus average of $7.27.

Expectations were moderate, but improved intermodal volume and yield trends have contributed to a slightly more positive outlook as 2024 approaches. This is despite apprehensions that recent activity may be spurred by temporary 'pull forward' measures.

The firm's analysis following J.B. Hunt's Q3 results indicates that while earnings exceeded expectations, the performance closely mirrored that of previous quarters, with the observation that demand was consistently weak.

J.B. Hunt's Q3 earnings per share surpassed the general expectations, supported by intermodal volumes that contributed to the positive outcome. Although not specified in detail, inventory strategies played a significant role in the results. Despite the positive aspects observed during the quarter, there remain challenges regarding pricing, volume, and cost savings that will require attention in the upcoming year.

Here are the latest investment ratings and price targets for $JB Hunt Transport Services (JBHT.US)$ from 8 analysts:

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

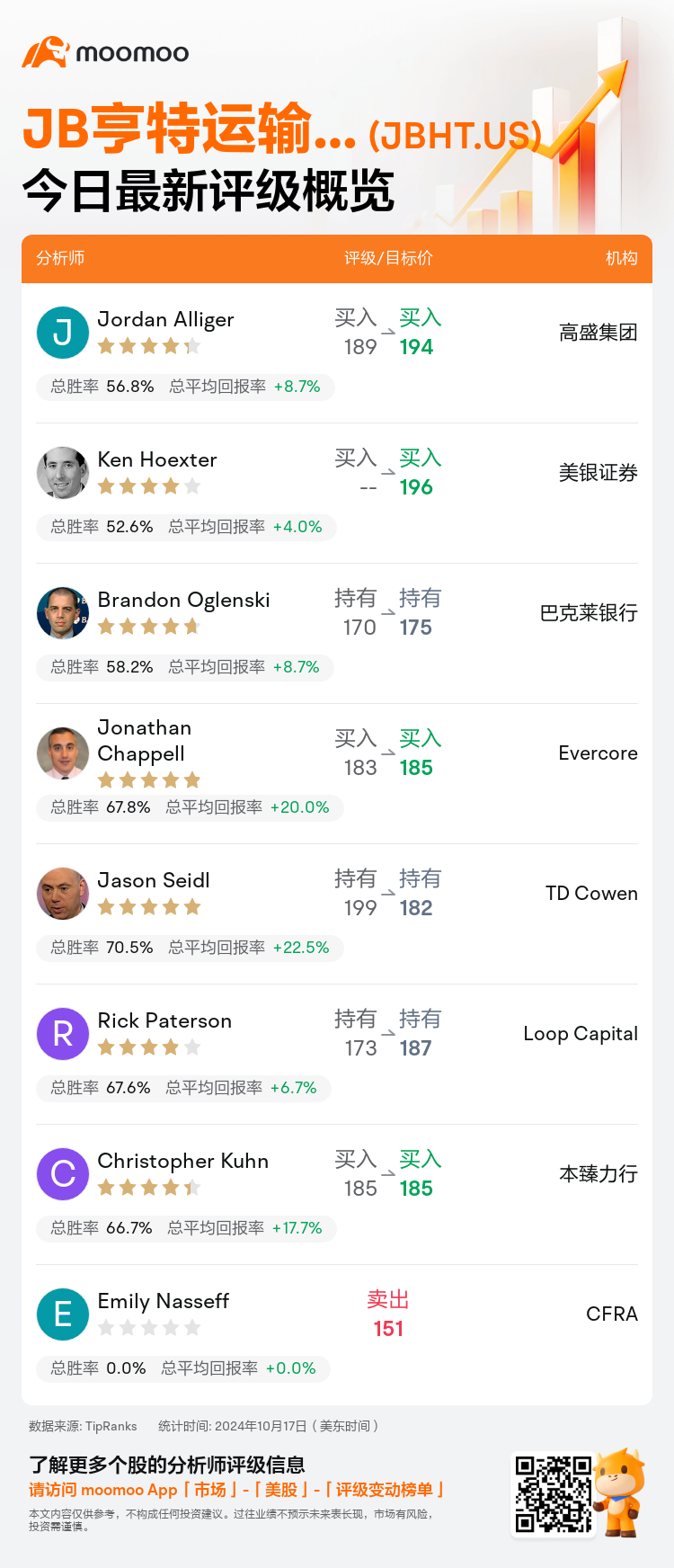

美东时间10月17日,多家华尔街大行更新了$JB亨特运输服务 (JBHT.US)$的评级,目标价介于151美元至196美元。

高盛集团分析师Jordan Alliger维持买入评级,并将目标价从189美元上调至194美元。

美银证券分析师Ken Hoexter维持买入评级,目标价196美元。

巴克莱银行分析师Brandon Oglenski维持持有评级,并将目标价从170美元上调至175美元。

巴克莱银行分析师Brandon Oglenski维持持有评级,并将目标价从170美元上调至175美元。

Evercore分析师Jonathan Chappell维持买入评级,并将目标价从183美元上调至185美元。

TD Cowen分析师Jason Seidl维持持有评级,并将目标价从199美元下调至182美元。

此外,综合报道,$JB亨特运输服务 (JBHT.US)$近期主要分析师观点如下:

J.b.亨特(J.b. Hunt)第三季度每股收益(EPS)为1.49美元,较去年同期下降了9%,但超过了预期的1.35美元和共识预估的1.39美元。这一超出表现得益于超出预期的联运货量增长,承运商加快了装运以应对潜在的东海岸港口罢工。鉴于这些结果,2024年的EPS预估略有上调至5.70美元,而2025年的EPS预测保持在7.80美元,明显高于共识平均值7.27美元。

预期是中等的,但改善的联运成交量和良好的运价趋势为逼近的2024年增添了一丝积极的展望。尽管担忧最近的活动可能受到暂时性的“提前拉动”措施的推动。

公司在J.b.亨特(J.b. Hunt)第三季度业绩发布后的分析表明,尽管收益超出预期,但表现与前几季度非常接近,观察到需求一直较为疲弱。

J.b.亨特(J.b. Hunt)第三季度每股收益超出了一般预期,得益于联运货量对积极结果的贡献。虽未详细说明,但库存策略在成果中发挥了重要作用。尽管季度内观察到了一些积极因素,但在未来一年,仍存在关于定价、成交量和成本节约方面的挑战,需要引起关注。

以下为今日8位分析师对$JB亨特运输服务 (JBHT.US)$的最新投资评级及目标价:

提示:

TipRanks为独立第三方,提供金融分析师的分析数据,并计算分析师推荐的平均回报率和胜率。提供的信息并非投资建议,仅供参考。本文不对评级数据和报告的完整性与准确性做出认可、声明或保证。

TipRanks提供每位分析师的星级,分析师星级代表分析师所有推荐的过往表现,通过分析师的总胜率和平均回报率综合计算得出,星星越多,则该分析师过往表现越优异,最高为5颗星。

分析师总胜率为近一年分析师的评级成功次数占总评级次数的比率。评级的成功与否,取决于TipRanks的虚拟投资组合是否从该股票中产生正回报。

总平均回报率为基于分析师的初始评级创建虚拟投资组合,并根据评级变化对组合进行调整,在近一年中该投资组合所获得的回报率。

巴克莱银行分析师Brandon Oglenski维持持有评级,并将目标价从170美元上调至175美元。

巴克莱银行分析师Brandon Oglenski维持持有评级,并将目标价从170美元上调至175美元。

Barclays analyst Brandon Oglenski maintains with a hold rating, and adjusts the target price from $170 to $175.

Barclays analyst Brandon Oglenski maintains with a hold rating, and adjusts the target price from $170 to $175.