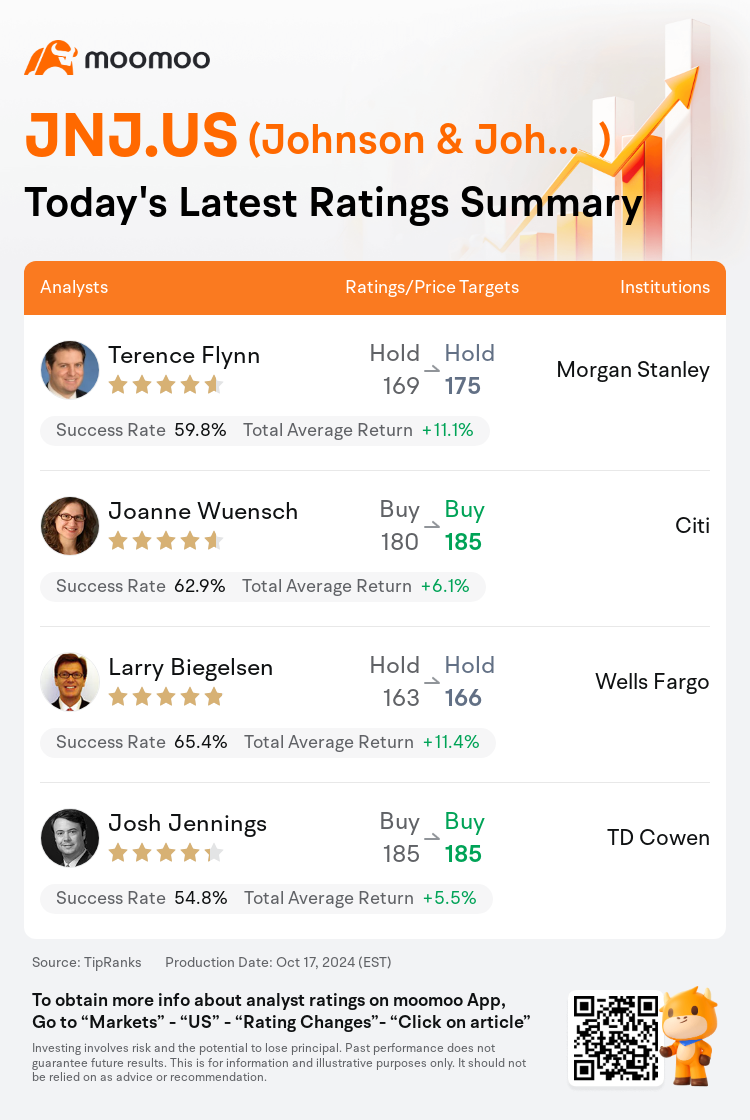

On Oct 17, major Wall Street analysts update their ratings for $Johnson & Johnson (JNJ.US)$, with price targets ranging from $166 to $185.

Morgan Stanley analyst Terence Flynn maintains with a hold rating, and adjusts the target price from $169 to $175.

Citi analyst Joanne Wuensch maintains with a buy rating, and adjusts the target price from $180 to $185.

Wells Fargo analyst Larry Biegelsen maintains with a hold rating, and adjusts the target price from $163 to $166.

Wells Fargo analyst Larry Biegelsen maintains with a hold rating, and adjusts the target price from $163 to $166.

TD Cowen analyst Josh Jennings maintains with a buy rating, and maintains the target price at $185.

Furthermore, according to the comprehensive report, the opinions of $Johnson & Johnson (JNJ.US)$'s main analysts recently are as follows:

Johnson & Johnson's third-quarter results were largely in line with market expectations, thanks to the robust performance of its Innovative Medicine business, which helped to balance the challenges within the MedTech sector. Management's early commentary on the 2025 outlook conveyed a strong belief in achieving over $57 billion in sales from Innovative Medicine. The company's growth goals for MedTech between 2024 and 2027, aiming for the higher spectrum of 5%-7%, were noted, although this target is considered to be quite optimistic.

Following a third-quarter report which aligned with general expectations, the pharmaceutical segment surpassed forecasts while the medical technology division fell short. The company's outlook for 2025 remained largely in line with prior projections, leading to slight revisions in estimates.

Following Johnson & Johnson's third-quarter report, the company's movement towards resolving talc litigation and integrating several medical technology acquisitions, along with providing 'level-set 2025 commentary,' supports a positive perspective on the shares.

Johnson & Johnson's Q3 earnings exceeded expectations, reporting a 5.6% underlying growth excluding Covid-related contributions, which was primarily fueled by performance in Innovative Medicine, while MedTech experienced a lag, partly due to seasonal variations and challenges in the Asia Pacific region. Post-Q3 results indicate that the company is making significant operational strides, particularly with the advancement of its pipeline execution.

Johnson & Johnson's sales growth forecast for 2024 suggests a slowdown in growth during Q4, yet the management's remarks about 2025 appear promising for EPS expansion. Additionally, the company is of the view that substantial headway has been achieved in dealing with the talc litigation.

Here are the latest investment ratings and price targets for $Johnson & Johnson (JNJ.US)$ from 4 analysts:

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

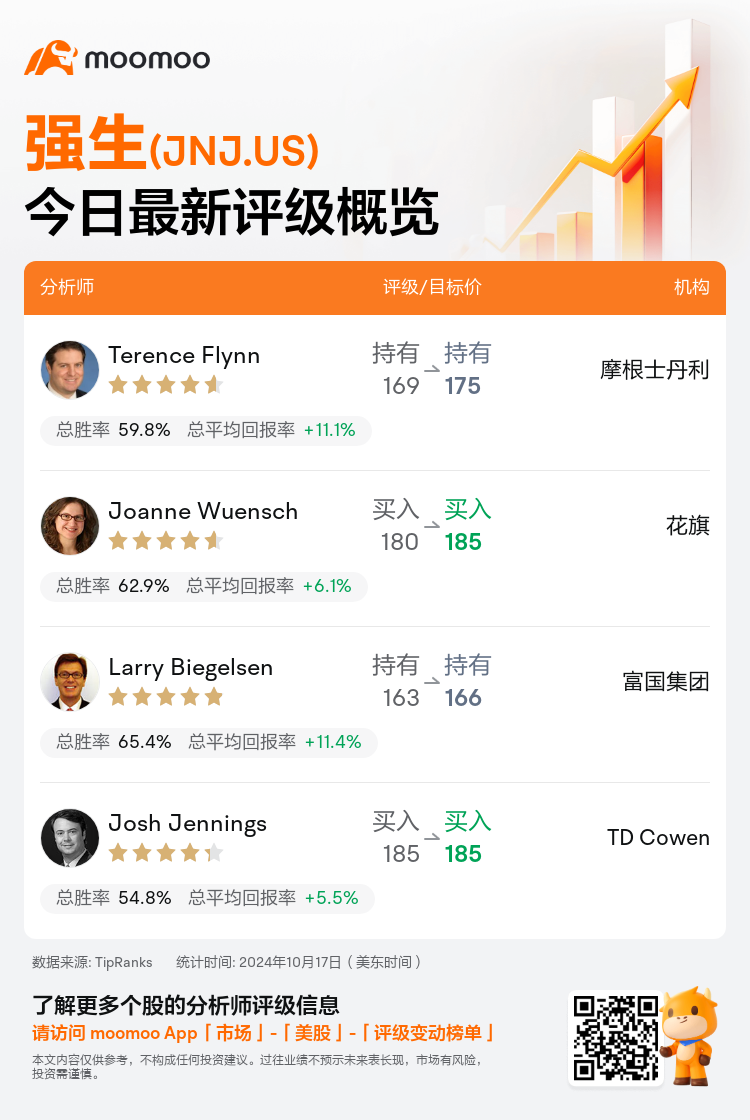

美东时间10月17日,多家华尔街大行更新了$强生 (JNJ.US)$的评级,目标价介于166美元至185美元。

摩根士丹利分析师Terence Flynn维持持有评级,并将目标价从169美元上调至175美元。

花旗分析师Joanne Wuensch维持买入评级,并将目标价从180美元上调至185美元。

富国集团分析师Larry Biegelsen维持持有评级,并将目标价从163美元上调至166美元。

富国集团分析师Larry Biegelsen维持持有评级,并将目标价从163美元上调至166美元。

TD Cowen分析师Josh Jennings维持买入评级,维持目标价185美元。

此外,综合报道,$强生 (JNJ.US)$近期主要分析师观点如下:

强生公司第三季度的业绩基本符合市场预期,这要归功于其创新药物业务的强劲表现,有助于平衡医疗科技板块内部的挑战。管理层对2025年展望的早期评论表明对从创新药物业务实现超过570亿美元销售额的强烈信心。公司对2024年至2027年医疗科技板块的增长目标,旨在达到5%-7%的较高区间,虽然这一目标被认为相当乐观。

根据第三季度报告与普遍预期相符,制药领域超过预期,而医疗技术分部表现不佳。公司对2025年的展望基本符合先前的预期,导致估算略有调整。

强生公司第三季度报告后,公司在解决滑石诉讼、整合数家医疗技术收购,并提供"校正2025年评论"方面的举措,支持股价的积极看法。

强生公司第三季度盈利超过预期,报告显示去除与Covid相关贡献后的5.6%基础增长,主要得益于创新药物的表现,而医疗科技则受制于季节变化和亚太地区的挑战,呈现滞后。第三季度结果表明公司正在取得重大的运营进展,尤其是在推进其管线执行方面。

强生公司2024年的销售增长预测表明在第四季度增长放缓,但管理层对2025年的评论看起来有利于每股收益的扩张。此外,公司认为在应对滑石诉讼方面已取得实质性进展。

以下为今日4位分析师对$强生 (JNJ.US)$的最新投资评级及目标价:

提示:

TipRanks为独立第三方,提供金融分析师的分析数据,并计算分析师推荐的平均回报率和胜率。提供的信息并非投资建议,仅供参考。本文不对评级数据和报告的完整性与准确性做出认可、声明或保证。

TipRanks提供每位分析师的星级,分析师星级代表分析师所有推荐的过往表现,通过分析师的总胜率和平均回报率综合计算得出,星星越多,则该分析师过往表现越优异,最高为5颗星。

分析师总胜率为近一年分析师的评级成功次数占总评级次数的比率。评级的成功与否,取决于TipRanks的虚拟投资组合是否从该股票中产生正回报。

总平均回报率为基于分析师的初始评级创建虚拟投资组合,并根据评级变化对组合进行调整,在近一年中该投资组合所获得的回报率。

富国集团分析师Larry Biegelsen维持持有评级,并将目标价从163美元上调至166美元。

富国集团分析师Larry Biegelsen维持持有评级,并将目标价从163美元上调至166美元。

Wells Fargo analyst Larry Biegelsen maintains with a hold rating, and adjusts the target price from $163 to $166.

Wells Fargo analyst Larry Biegelsen maintains with a hold rating, and adjusts the target price from $163 to $166.