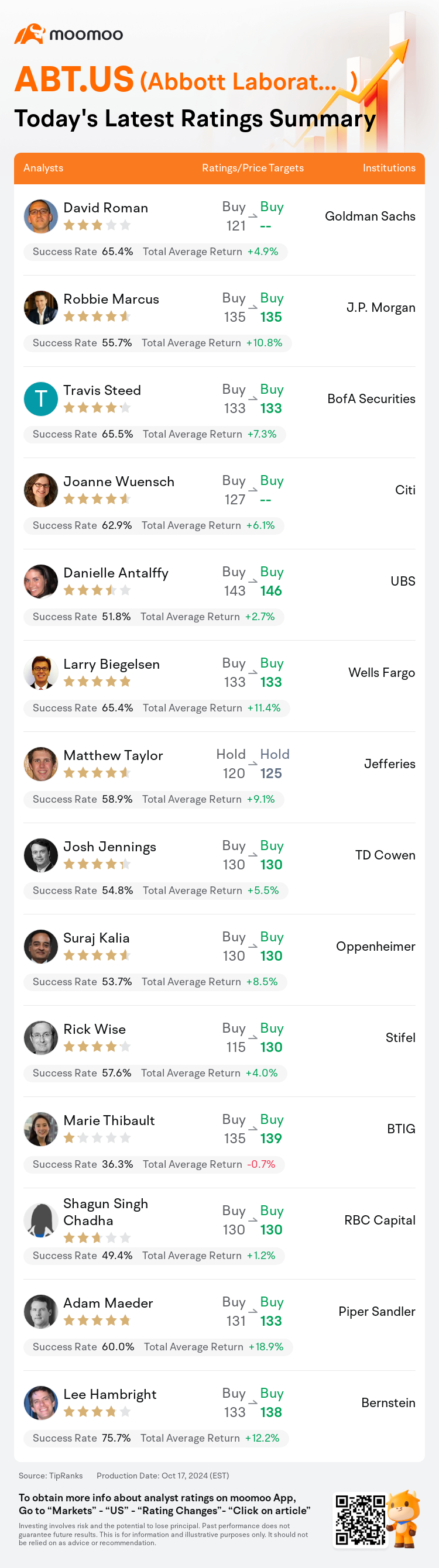

On Oct 17, major Wall Street analysts update their ratings for $Abbott Laboratories (ABT.US)$, with price targets ranging from $125 to $146.

Goldman Sachs analyst David Roman maintains with a buy rating.

J.P. Morgan analyst Robbie Marcus maintains with a buy rating, and maintains the target price at $135.

BofA Securities analyst Travis Steed maintains with a buy rating, and maintains the target price at $133.

BofA Securities analyst Travis Steed maintains with a buy rating, and maintains the target price at $133.

Citi analyst Joanne Wuensch maintains with a buy rating.

UBS analyst Danielle Antalffy maintains with a buy rating, and adjusts the target price from $143 to $146.

Furthermore, according to the comprehensive report, the opinions of $Abbott Laboratories (ABT.US)$'s main analysts recently are as follows:

Abbott's slight surpassing of sales and EPS estimates reinforces the belief in the company's capacity to maintain double-digit MedTech sales growth in the coming period, alongside high single-digit growth in total sales. Analysts consider the enduring growth trajectory of Abbott's MedTech business to be undervalued. Furthermore, Abbott is recognized for offering a high-quality opportunity for high single-digit to low double-digit sales growth.

Following the Q3 results, Abbott is considered to be well-positioned to handle any competition from pulsed field ablation, and the potential for leadless pacing is expected to possibly spur growth in cardiac rhythm management to exceed 3%. While operational performance has been strong, it's assessed that current market expectations are already reflective of this, and the company's valuation is deemed reasonable when compared to its peers.

While acknowledging Abbott's positive trajectory post the third-quarter report, analysts continue to search for indications of enduring operating margin growth following the conclusion of the Testing phase.

Abbott's third-quarter sales exceeded consensus expectations, bolstered by a strong showing in the MedTech segment and revenue from COVID tests. The company also maintained its organic growth guidance for FY24 and raised the mid-point of its EPS forecast. Despite these positive developments, a cautious stance is maintained due to valuation and pending litigation concerns, though the company's performance is seen in a favorable light.

Abbott management indicated optimism about the company's potential for sustained high-single-digit revenue growth and double-digit earnings growth. Specifically, the CEO's comments suggested that high-single digit revenue and 10% earnings per share growth are seen as a feasible baseline. With numerous new offerings in the rapidly expanding Diabetes Care and Structural Heart markets, Abbott's comprehensive medical device portfolio appears poised for superior growth within the medical technology sector.

Here are the latest investment ratings and price targets for $Abbott Laboratories (ABT.US)$ from 14 analysts:

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

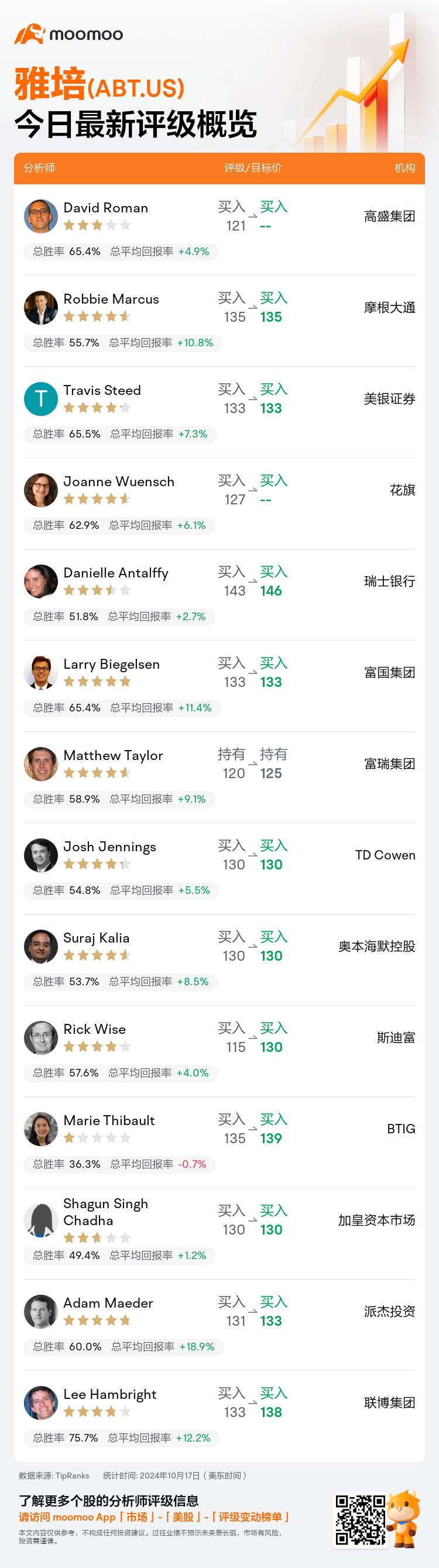

美东时间10月17日,多家华尔街大行更新了$雅培 (ABT.US)$的评级,目标价介于125美元至146美元。

高盛集团分析师David Roman维持买入评级。

摩根大通分析师Robbie Marcus维持买入评级,维持目标价135美元。

美银证券分析师Travis Steed维持买入评级,维持目标价133美元。

美银证券分析师Travis Steed维持买入评级,维持目标价133美元。

花旗分析师Joanne Wuensch维持买入评级。

瑞士银行分析师Danielle Antalffy维持买入评级,并将目标价从143美元上调至146美元。

此外,综合报道,$雅培 (ABT.US)$近期主要分析师观点如下:

Abbott略微超过销售额和每股收益预期,强化了对该公司在未来能够维持两位数医疗科技销售增长以及整体销售高个位数增长能力的信心。分析师认为Abbott医疗科技业务持续增长轨迹被低估。此外,Abbott以提供高质量的机会实现高个位数至低两位数销售增长而闻名。

根据第三季度结果,Abbott被认为处于良好位置,能够应对来自脉冲场消融的任何竞争,同时预计无极心率调节可能会带动心脏节律管理增长超过3%。虽然运营业绩强劲,但被评估认为当前市场预期已经反映了这一点,与同行相比,公司的估值被认为是合理的。

尽管承认Abbott第三季度报告后的正面发展轨迹,分析师们继续寻找测试阶段结束后持续营业利润率增长迹象。

Abbott第三季度销售额超过共识预期,得益于医疗科技部门的表现和COVID测试收入。该公司还保持了2024财年的有机增长指导预期,并提高了每股收益预测的中值。尽管出现这些积极发展,由于估值和待解诉讼问题,依然保持谨慎立场,尽管公司的表现被看好。

Abbott管理层对公司可持续实现高个位数营业收入增长和两位数盈利增长表示乐观。具体来说,CEO的评论暗示高个位数营收和10%每股收益增长被视为合理基准。在不断扩大的糖尿病护理和结构心脏市场中推出众多新产品,Abbott全面的医疗器械组合似乎有望在医疗技术板块内实现突出增长。

以下为今日14位分析师对$雅培 (ABT.US)$的最新投资评级及目标价:

提示:

TipRanks为独立第三方,提供金融分析师的分析数据,并计算分析师推荐的平均回报率和胜率。提供的信息并非投资建议,仅供参考。本文不对评级数据和报告的完整性与准确性做出认可、声明或保证。

TipRanks提供每位分析师的星级,分析师星级代表分析师所有推荐的过往表现,通过分析师的总胜率和平均回报率综合计算得出,星星越多,则该分析师过往表现越优异,最高为5颗星。

分析师总胜率为近一年分析师的评级成功次数占总评级次数的比率。评级的成功与否,取决于TipRanks的虚拟投资组合是否从该股票中产生正回报。

总平均回报率为基于分析师的初始评级创建虚拟投资组合,并根据评级变化对组合进行调整,在近一年中该投资组合所获得的回报率。

美银证券分析师Travis Steed维持买入评级,维持目标价133美元。

美银证券分析师Travis Steed维持买入评级,维持目标价133美元。

BofA Securities analyst Travis Steed maintains with a buy rating, and maintains the target price at $133.

BofA Securities analyst Travis Steed maintains with a buy rating, and maintains the target price at $133.