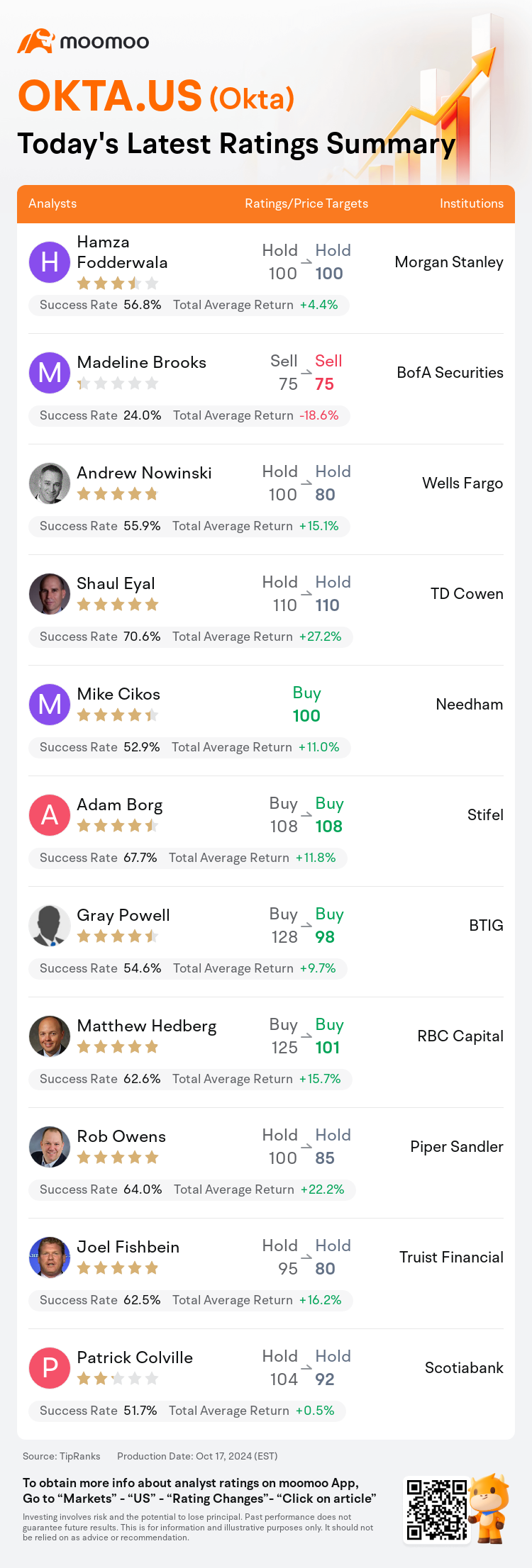

On Oct 17, major Wall Street analysts update their ratings for $Okta (OKTA.US)$, with price targets ranging from $75 to $110.

Morgan Stanley analyst Hamza Fodderwala maintains with a hold rating, and maintains the target price at $100.

BofA Securities analyst Madeline Brooks maintains with a sell rating, and maintains the target price at $75.

Wells Fargo analyst Andrew Nowinski maintains with a hold rating, and adjusts the target price from $100 to $80.

Wells Fargo analyst Andrew Nowinski maintains with a hold rating, and adjusts the target price from $100 to $80.

TD Cowen analyst Shaul Eyal maintains with a hold rating, and maintains the target price at $110.

Needham analyst Mike Cikos initiates coverage with a buy rating, and sets the target price at $100.

Furthermore, according to the comprehensive report, the opinions of $Okta (OKTA.US)$'s main analysts recently are as follows:

Okta is acknowledged as a distinct frontrunner in the crucial identity management sector, and its stock's valuation appears quite reasonable. Nevertheless, the company is confronting rising competition, particularly from a major technology corporation, while its execution has experienced unevenness in recent years. At present, there remains a lack of assurance in the company's ability to achieve a lasting and solid improvement in its fundamentals.

After attending the Oktane 2024 event and engaging with customers, partners, and employees, there is a focus on the company's expansion through new products, growth strategies, and the challenges associated with the number of seats. Management anticipates that these seat count challenges may continue into the first half of the next fiscal year but expects them to normalize as they move into the second half of FY26. The company's valuation is still considered appealing.

Okta possesses a comprehensive platform, yet it continues to face challenges due to pricing and competitive pressures. Despite management pinpointing significant growth drivers, projections for FY26 are perceived as overly optimistic.

Okta has faced significant growth challenges due to pressures on seat expansion as customers' buying patterns shift in the current economic climate. Despite this, it's anticipated that the bulk of the renewal cycle has passed, and pressures from existing customers will lessen. Furthermore, the implementation of go-to-market strategies through sales incentives and partnerships is seen as completing the set of tactics to reignite growth and enhance margins.

Here are the latest investment ratings and price targets for $Okta (OKTA.US)$ from 11 analysts:

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

美东时间10月17日,多家华尔街大行更新了$Okta (OKTA.US)$的评级,目标价介于75美元至110美元。

摩根士丹利分析师Hamza Fodderwala维持持有评级,维持目标价100美元。

美银证券分析师Madeline Brooks维持卖出评级,维持目标价75美元。

富国集团分析师Andrew Nowinski维持持有评级,并将目标价从100美元下调至80美元。

富国集团分析师Andrew Nowinski维持持有评级,并将目标价从100美元下调至80美元。

TD Cowen分析师Shaul Eyal维持持有评级,维持目标价110美元。

Needham分析师Mike Cikos首予买入评级,目标价100美元。

此外,综合报道,$Okta (OKTA.US)$近期主要分析师观点如下:

okta在关键的身份管理板块被认可为独特的领先者,其股票估值似乎相当合理。然而,该公司面临着不断加剧的竞争,尤其是来自一家主要科技公司,而其执行能力在近年来经历了波动。目前,对该公司能否实现基本面持久稳固的改善仍存在缺乏信心。

参加了2024年Oktane活动并与客户、合作伙伴和员工互动后,公司专注于通过新产品、增长策略和与座位数量相关的挑战来扩张。管理层预计这些座位计数挑战可能持续到下一个财政年度的上半年,但预计它们将在进入FY26下半年时趋于正常。该公司的估值仍被视为有吸引力。

okta拥有一套全面的平台,但由于定价和竞争压力而继续面临挑战。尽管管理层确定了重要的增长驱动因素,但对FY26的预期被视为过于乐观。

由于客户的购买模式在当前经济环境中发生转变导致座位扩张压力增加,okta面临着重大增长挑战。尽管如此,预计大部分续订周期已经过去,并且来自现有客户的压力将减轻。此外,通过销售奖励和合作伙伴关系实施营销策略被视为完成重新激发增长和增强利润的一整套策略。

以下为今日11位分析师对$Okta (OKTA.US)$的最新投资评级及目标价:

提示:

TipRanks为独立第三方,提供金融分析师的分析数据,并计算分析师推荐的平均回报率和胜率。提供的信息并非投资建议,仅供参考。本文不对评级数据和报告的完整性与准确性做出认可、声明或保证。

TipRanks提供每位分析师的星级,分析师星级代表分析师所有推荐的过往表现,通过分析师的总胜率和平均回报率综合计算得出,星星越多,则该分析师过往表现越优异,最高为5颗星。

分析师总胜率为近一年分析师的评级成功次数占总评级次数的比率。评级的成功与否,取决于TipRanks的虚拟投资组合是否从该股票中产生正回报。

总平均回报率为基于分析师的初始评级创建虚拟投资组合,并根据评级变化对组合进行调整,在近一年中该投资组合所获得的回报率。

富国集团分析师Andrew Nowinski维持持有评级,并将目标价从100美元下调至80美元。

富国集团分析师Andrew Nowinski维持持有评级,并将目标价从100美元下调至80美元。

Wells Fargo analyst Andrew Nowinski maintains with a hold rating, and adjusts the target price from $100 to $80.

Wells Fargo analyst Andrew Nowinski maintains with a hold rating, and adjusts the target price from $100 to $80.