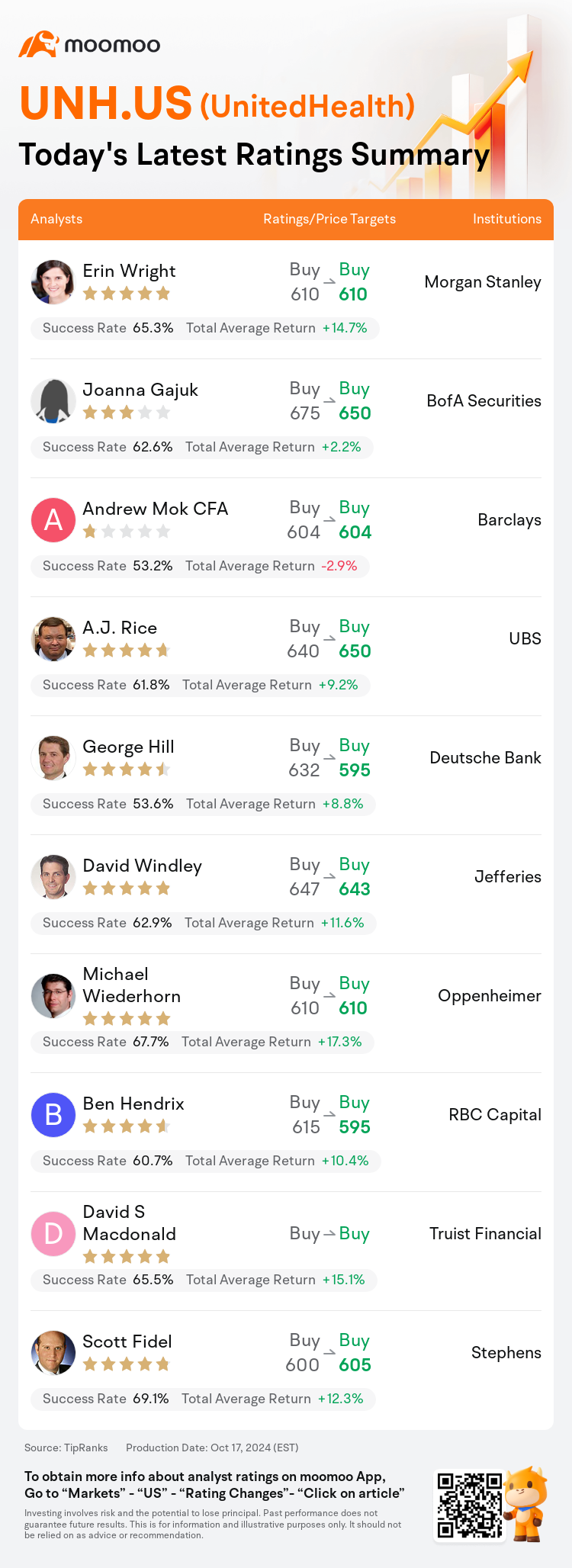

On Oct 17, major Wall Street analysts update their ratings for $UnitedHealth (UNH.US)$, with price targets ranging from $595 to $650.

Morgan Stanley analyst Erin Wright maintains with a buy rating, and maintains the target price at $610.

BofA Securities analyst Joanna Gajuk maintains with a buy rating, and adjusts the target price from $675 to $650.

Barclays analyst Andrew Mok CFA maintains with a buy rating, and maintains the target price at $604.

Barclays analyst Andrew Mok CFA maintains with a buy rating, and maintains the target price at $604.

UBS analyst A.J. Rice maintains with a buy rating, and adjusts the target price from $640 to $650.

Deutsche Bank analyst George Hill maintains with a buy rating, and adjusts the target price from $632 to $595.

Furthermore, according to the comprehensive report, the opinions of $UnitedHealth (UNH.US)$'s main analysts recently are as follows:

UnitedHealth's early indication of FY25 EPS being approximately $30 at the high-end, which was seen as a more conservative forecast compared to previous practices, appeared to exert pressure on the company's shares. Nonetheless, this forecast is perceived as 'a low bar' that the company is expected to surpass with ease, according to an analyst in a post-earnings briefing.

After the stock experienced a sell-off following guidance for 2025 that didn't meet expectations, analysts maintain a positive outlook on UnitedHealth, highlighting its stronger positioning compared to competitors and the potential for gains in market share. Despite the pressures on rates and reimbursements within the Medicare Advantage industry, UnitedHealth is perceived to be in a favorable position to navigate these challenges due to its profitable Medicare Advantage business. Nonetheless, there has been a slight reduction in earnings per share estimates, as well as in the applied multiple, subsequent to the company's third-quarter financial report.

The reduction in the forecast for UnitedHealth's FY25 and FY26 EPS is to account for the sustained 'elevated' Medicare coding intensity beyond the resumption of prior authorization and Medicaid acuity challenges. These conditions are anticipated to be temporary, according to the analyst's perspective shared with investors.

The firm's assessment indicates that UnitedHealth's Q3 outcomes were unsatisfactory, chiefly due to elevated medical expenses and an initial EPS forecast for 2025 that did not meet expectations. Previously, there was a cautious stance on MA MCOs heading into Q3 earnings, yet there was optimism that UnitedHealth could return to long-term EPS growth targets by 2025. Nonetheless, persistent challenges, coupled with UnitedHealth's choice to continue organic investments, suggest that the realization of this growth expectation may be deferred to 2026.

Here are the latest investment ratings and price targets for $UnitedHealth (UNH.US)$ from 10 analysts:

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

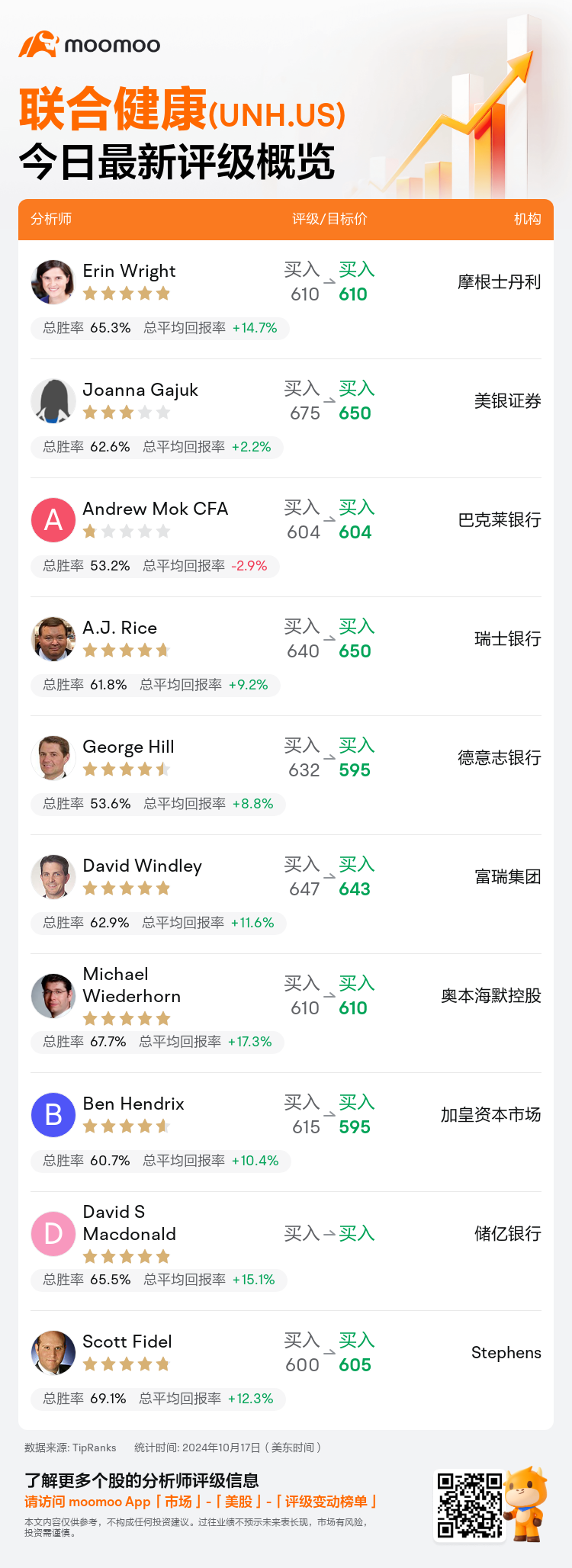

美东时间10月17日,多家华尔街大行更新了$联合健康 (UNH.US)$的评级,目标价介于595美元至650美元。

摩根士丹利分析师Erin Wright维持买入评级,维持目标价610美元。

美银证券分析师Joanna Gajuk维持买入评级,并将目标价从675美元下调至650美元。

巴克莱银行分析师Andrew Mok CFA维持买入评级,维持目标价604美元。

巴克莱银行分析师Andrew Mok CFA维持买入评级,维持目标价604美元。

瑞士银行分析师A.J. Rice维持买入评级,并将目标价从640美元上调至650美元。

德意志银行分析师George Hill维持买入评级,并将目标价从632美元下调至595美元。

此外,综合报道,$联合健康 (UNH.US)$近期主要分析师观点如下:

联合健康在FY25年份EPS高端约为30美元的初步迹象被视为比以往更为保守,似乎对公司股票施加了压力。然而,根据一位分析师在盈利后的简报中表示,这一预测被认为是“一个低门槛”,公司预计将轻松超越。

股票在2025年的指引后经历了一轮抛售,未达预期的分析师对联合健康仍持积极态度,强调其相对竞争对手更强的定位以及市场份额增长潜力。尽管医疗保险行业的费率和赔付受到压力,但由于盈利能力强大的医疗保险业务,联合健康被认为处于有利位置以应对这些挑战。然而,公司第三季度财报后盈利预期和应用多重估值均有轻微下调。

对联合健康FY25年和FY26年EPS预测的调低考虑了持续“高水平”的医疗保险编码密度,超越预授权恢复和医疗救助需求挑战。根据分析师与投资者共享的观点,这些条件被预期为暂时性。

公司评估显示,联合健康Q3业绩不佳,主要由于医疗支出增加和2025年的初步EPS预测未达预期。此前,在进入Q3盈利的医疗保险组织管理者持谨慎态度,但也看到联合健康可能在2025年前恢复长期EPS增长目标的乐观情绪。然而,持续的挑战,加上联合健康选择继续有机投资,暗示该增长预期实现可能推迟至2026年。

以下为今日10位分析师对$联合健康 (UNH.US)$的最新投资评级及目标价:

提示:

TipRanks为独立第三方,提供金融分析师的分析数据,并计算分析师推荐的平均回报率和胜率。提供的信息并非投资建议,仅供参考。本文不对评级数据和报告的完整性与准确性做出认可、声明或保证。

TipRanks提供每位分析师的星级,分析师星级代表分析师所有推荐的过往表现,通过分析师的总胜率和平均回报率综合计算得出,星星越多,则该分析师过往表现越优异,最高为5颗星。

分析师总胜率为近一年分析师的评级成功次数占总评级次数的比率。评级的成功与否,取决于TipRanks的虚拟投资组合是否从该股票中产生正回报。

总平均回报率为基于分析师的初始评级创建虚拟投资组合,并根据评级变化对组合进行调整,在近一年中该投资组合所获得的回报率。

巴克莱银行分析师Andrew Mok CFA维持买入评级,维持目标价604美元。

巴克莱银行分析师Andrew Mok CFA维持买入评级,维持目标价604美元。

Barclays analyst Andrew Mok CFA maintains with a buy rating, and maintains the target price at $604.

Barclays analyst Andrew Mok CFA maintains with a buy rating, and maintains the target price at $604.