Market Whales and Their Recent Bets on NIO Options

Market Whales and Their Recent Bets on NIO Options

Whales with a lot of money to spend have taken a noticeably bullish stance on NIO.

有很多钱可供支配的大户对NIO采取了明显的看好态度。

Looking at options history for NIO (NYSE:NIO) we detected 11 trades.

查看纽交所NIO的期权历史记录,我们发现了11笔交易。

If we consider the specifics of each trade, it is accurate to state that 45% of the investors opened trades with bullish expectations and 36% with bearish.

如果我们考虑每笔交易的具体情况,准确地说,45% 的投资者是采取看好期权的策略,36% 采取看淡的策略。

From the overall spotted trades, 3 are puts, for a total amount of $129,000 and 8, calls, for a total amount of $736,779.

从所有已发现的交易中,有3笔看跌,总金额为129,000美元;8笔看涨,总金额为736,779美元。

What's The Price Target?

目标价是多少?

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $3.0 to $7.5 for NIO over the recent three months.

根据交易活动,显然重要的投资者正在瞄准纽交所NIO股票在最近三个月内的价格区间,从3.0美元到7.5美元。

Insights into Volume & Open Interest

成交量和持仓量分析

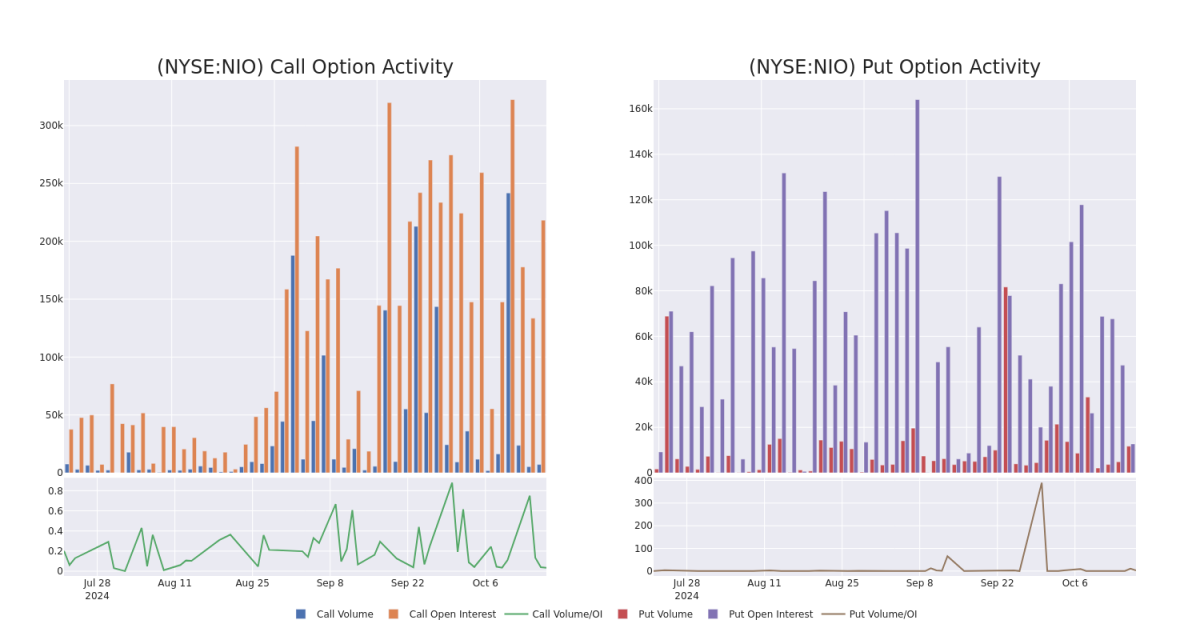

Looking at the volume and open interest is an insightful way to conduct due diligence on a stock.

这些数据可以帮助您跟踪Coinbase Glb期权的流动性和利益,以给定的行权价格为基础。

This data can help you track the liquidity and interest for NIO's options for a given strike price.

这些数据可以帮助您跟踪NIO期权特定行使价的流动性和兴趣。

Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of NIO's whale activity within a strike price range from $3.0 to $7.5 in the last 30 days.

我们可以看到在过去30天内,NIO所有的主力活动中,看涨和看跌的成交量和持仓量分别在3.0美元到7.5美元的行使价区间内发生了变化。

NIO Call and Put Volume: 30-Day Overview

NIO看涨和看跌期权成交量:30天概览

Biggest Options Spotted:

最大的期权交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| NIO | CALL | SWEEP | BEARISH | 01/17/25 | $0.95 | $0.95 | $0.95 | $5.00 | $287.2K | 52.2K | 88 |

| NIO | CALL | SWEEP | BEARISH | 01/17/25 | $0.65 | $0.62 | $0.62 | $6.00 | $186.0K | 40.6K | 318 |

| NIO | CALL | SWEEP | NEUTRAL | 02/21/25 | $1.1 | $1.1 | $1.1 | $5.00 | $99.0K | 4.3K | 1.6K |

| NIO | PUT | SWEEP | BEARISH | 11/22/24 | $0.22 | $0.2 | $0.22 | $4.50 | $44.0K | 1.9K | 4.5K |

| NIO | PUT | SWEEP | BULLISH | 10/25/24 | $0.44 | $0.43 | $0.43 | $5.50 | $43.0K | 10.7K | 4.0K |

| 标的 | 看跌/看涨 | 交易类型 | 情绪 | 到期日 | 卖盘 | 买盘 | 价格 | 执行价格 | 总交易价格 | 未平仓合约数量 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| NIO | 看涨 | SWEEP | 看淡 | 01/17/25 | 0.95美元 | 0.95美元 | 0.95美元 | $5.00。 | 287.2千美元 | 52.2千美元 | 88 |

| NIO | 看涨 | SWEEP | 看淡 | 01/17/25 | $0.65 | $0.62 | $0.62 | $6.00 | $186.0K | 40.6千 | 318 |

| NIO | 看涨 | SWEEP | 中立 | 02/21/25 | $1.1 | $1.1 | $1.1 | $5.00。 | $99.0千 | 4.3千 | 1.6K |

| NIO | 看跌 | SWEEP | 看淡 | 11/22/24 | $0.22 | $0.2 | $0.22 | 每桶4.50美元 | $44.0K | 1.9K | 4.5K |

| NIO | 看跌 | SWEEP | 看好 | 10/25/24 | $0.44 | $0.43 | $0.43 | 5.50美元 | $43.0K | 10.7K | 4.0K |

About NIO

关于NIO

Nio is a leading electric vehicle maker, targeting the premium segment. Founded in November 2014, Nio designs, develops, jointly manufactures, and sells premium smart electric vehicles. The company differentiates itself through continuous technological breakthroughs and innovations such as battery swapping and autonomous driving technologies. Nio launched its first model, its ES8 seven-seater electric SUV, in December 2017, and began deliveries in June 2018. Its current model portfolio includes midsize to large sedans and SUVs. It sold over 160,000 EVs in 2023, accounting for about 2% of the China passenger new energy vehicle market.

蔚来是一家领先的新能源车制造商,专注于高端市场。成立于2014年11月,蔚来设计、研发、合作制造和销售高端智能新能源车。该公司通过持续的技术突破和创新,如电池交换和自动驾驶技术,实现了自身的差异化。蔚来于2017年12月推出了其首款车型——ES8七座电动SUV,并于2018年6月开始交付。目前的车型组合包括中大型轿车和SUV。2023年该公司销售了超过16万辆新能源车,占据中国乘用车新能源市场约2%的份额。

In light of the recent options history for NIO, it's now appropriate to focus on the company itself. We aim to explore its current performance.

考虑到NIO最近的期权交易历史,现在适合关注公司本身。我们旨在探讨其当前表现。

Where Is NIO Standing Right Now?

蔚来现在处于什么位置?

- Trading volume stands at 18,037,925, with NIO's price down by -5.54%, positioned at $5.21.

- RSI indicators show the stock to be is currently neutral between overbought and oversold.

- Earnings announcement expected in 47 days.

- 交易量为18,037,925股,蔚来的股价下跌了-5.54%,定位在$5.21。

- RSI指标显示该股票目前处于超买和超卖之间的中立状态。

- 财报公布还有47天。

Unusual Options Activity Detected: Smart Money on the Move

检测到期权异动:智慧资金在行动。

Benzinga Edge's Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

Benzinga Edge的期权异动模块可以提前发现潜在的市场热点。了解大笔的资金在您喜欢的股票上的仓位变动。点击这里获取访问权限。

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest NIO options trades with real-time alerts from Benzinga Pro.

期权交易存在着更高的风险和潜在回报。精明的交易员通过不断学习、调整策略、监控多个因子,并密切关注市场动向来管理这些风险。通过Benzinga Pro实时警报了解最新的NIO期权交易。

From the overall spotted trades, 3 are puts, for a total amount of $129,000 and 8, calls, for a total amount of $736,779.

From the overall spotted trades, 3 are puts, for a total amount of $129,000 and 8, calls, for a total amount of $736,779.