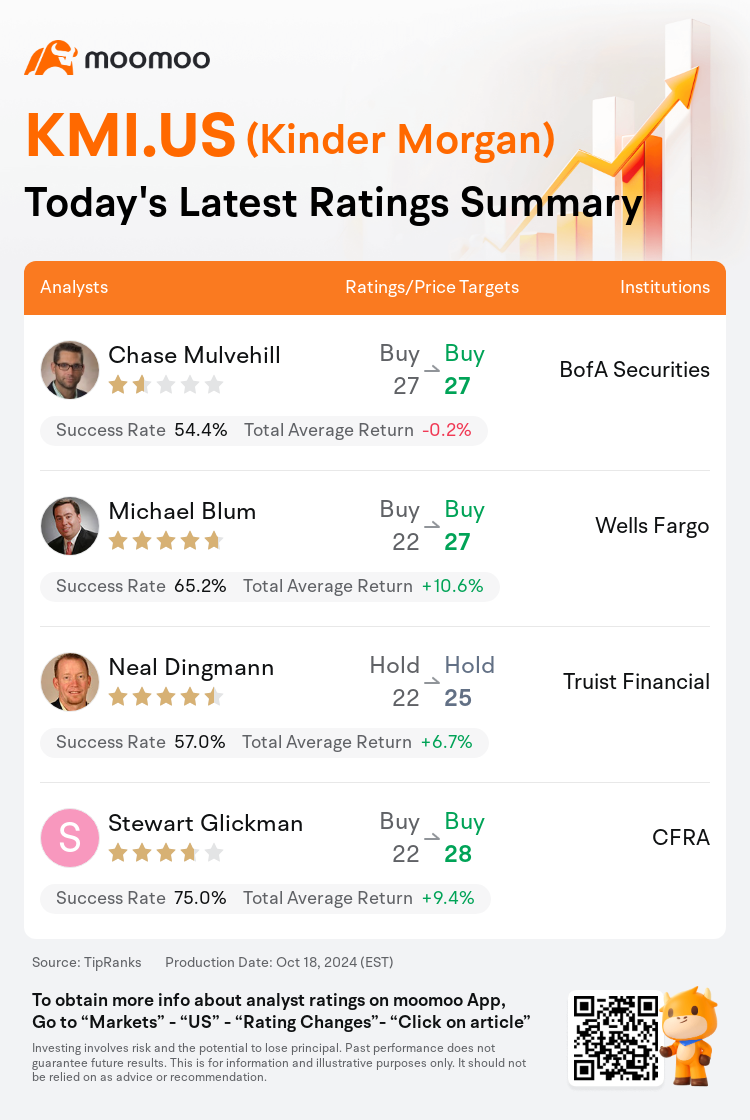

On Oct 18, major Wall Street analysts update their ratings for $Kinder Morgan (KMI.US)$, with price targets ranging from $25 to $28.

BofA Securities analyst Chase Mulvehill maintains with a buy rating, and maintains the target price at $27.

Wells Fargo analyst Michael Blum maintains with a buy rating, and adjusts the target price from $22 to $27.

Truist Financial analyst Neal Dingmann maintains with a hold rating, and adjusts the target price from $22 to $25.

Truist Financial analyst Neal Dingmann maintains with a hold rating, and adjusts the target price from $22 to $25.

CFRA analyst Stewart Glickman maintains with a buy rating, and adjusts the target price from $22 to $28.

Furthermore, according to the comprehensive report, the opinions of $Kinder Morgan (KMI.US)$'s main analysts recently are as follows:

After a period of stagnation, the fundamental business for Kinder Morgan is anticipated to remain stable or experience a slight increase. This comes as the impact of contract expirations that previously diminished EBITDA is largely concluding. Looking ahead, the company is expected to be favorably positioned to benefit from an increase in gas-fired and AI-powered electricity generation over the next five years. Additionally, it is projected to achieve strong to very strong returns on investments in existing infrastructure.

The firm observes that while the third quarter results were somewhat below expectations, the full-year forecast continues to be largely achievable. Additionally, the sanctioning of two new gas projects, along with the ongoing evaluation of two substantial gas projects, are noteworthy developments.

The firm is revising its models to accommodate changes in commodity prices, the effects of hurricanes, and weaknesses in dry gas production. It is anticipated that the majority of companies will continue to support their 2024 forecasts. There are warnings that for the company in question, immediate challenges associated with low natural gas prices may counterbalance the potential growth related to datacenters and artificial intelligence in the long run.

Here are the latest investment ratings and price targets for $Kinder Morgan (KMI.US)$ from 4 analysts:

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

美东时间10月18日,多家华尔街大行更新了$金德尔摩根 (KMI.US)$的评级,目标价介于25美元至28美元。

美银证券分析师Chase Mulvehill维持买入评级,维持目标价27美元。

富国集团分析师Michael Blum维持买入评级,并将目标价从22美元上调至27美元。

储亿银行分析师Neal Dingmann维持持有评级,并将目标价从22美元上调至25美元。

储亿银行分析师Neal Dingmann维持持有评级,并将目标价从22美元上调至25美元。

CFRA分析师Stewart Glickman维持买入评级,并将目标价从22美元上调至28美元。

此外,综合报道,$金德尔摩根 (KMI.US)$近期主要分析师观点如下:

金德尔摩根的基本业务预计将保持稳定或略有增长,这是由于之前导致息税折旧及摊销前利润下降的合同到期的影响基本结束。展望未来,预计该公司将从未来五年内燃气和人工智能电力发电量增加中受益,并预计在现有基础设施投资方面实现强劲到非常强劲的回报。

公司观察到,虽然第三季度结果略低于预期,但全年预测仍然大体可实现。此外,批准两个新的燃气项目,以及正在评估两个重要的燃气项目是值得关注的进展。

公司正在调整其模型以适应商品价格的变化、飓风的影响以及干燥燃气产量的弱点。预计大多数公司将继续支持其2024年的预测。有警告称,对于所讨论的公司,与数据中心和人工智能相关的潜在增长可能会受到与长期低天然气价格相关的即时挑战的制约。

以下为今日4位分析师对$金德尔摩根 (KMI.US)$的最新投资评级及目标价:

提示:

TipRanks为独立第三方,提供金融分析师的分析数据,并计算分析师推荐的平均回报率和胜率。提供的信息并非投资建议,仅供参考。本文不对评级数据和报告的完整性与准确性做出认可、声明或保证。

TipRanks提供每位分析师的星级,分析师星级代表分析师所有推荐的过往表现,通过分析师的总胜率和平均回报率综合计算得出,星星越多,则该分析师过往表现越优异,最高为5颗星。

分析师总胜率为近一年分析师的评级成功次数占总评级次数的比率。评级的成功与否,取决于TipRanks的虚拟投资组合是否从该股票中产生正回报。

总平均回报率为基于分析师的初始评级创建虚拟投资组合,并根据评级变化对组合进行调整,在近一年中该投资组合所获得的回报率。

储亿银行分析师Neal Dingmann维持持有评级,并将目标价从22美元上调至25美元。

储亿银行分析师Neal Dingmann维持持有评级,并将目标价从22美元上调至25美元。

Truist Financial analyst Neal Dingmann maintains with a hold rating, and adjusts the target price from $22 to $25.

Truist Financial analyst Neal Dingmann maintains with a hold rating, and adjusts the target price from $22 to $25.