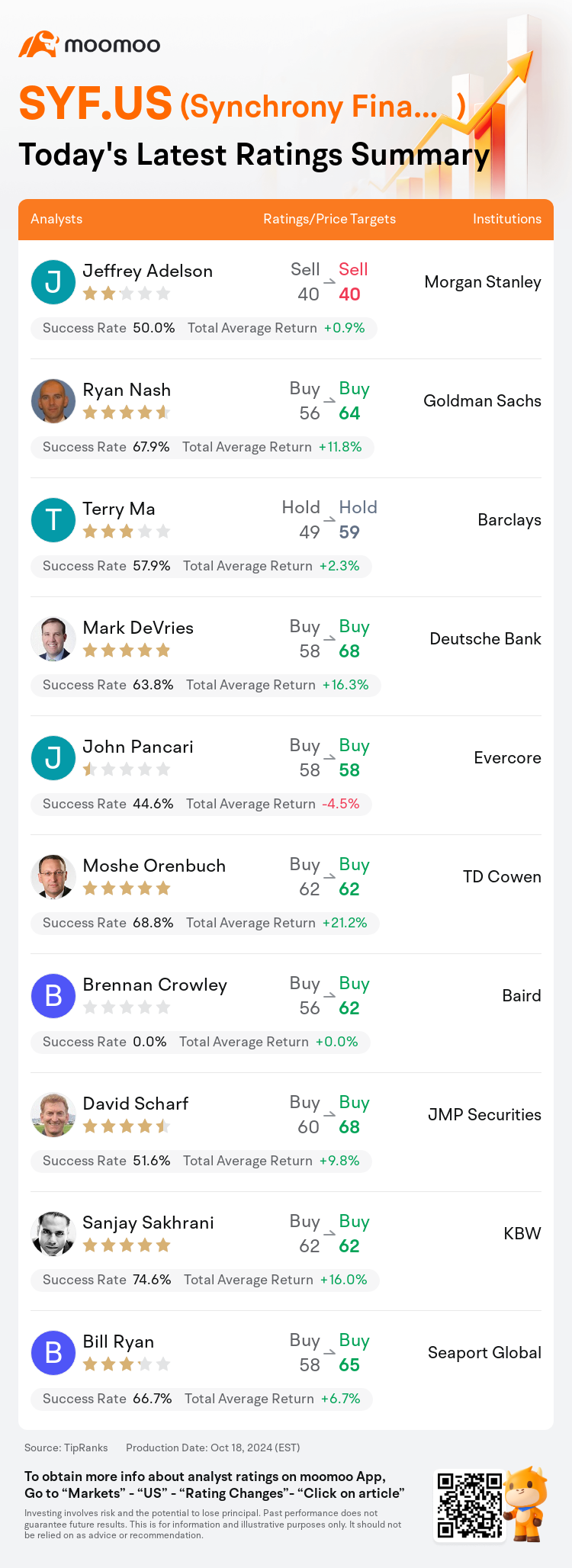

On Oct 18, major Wall Street analysts update their ratings for $Synchrony Financial (SYF.US)$, with price targets ranging from $40 to $68.

Morgan Stanley analyst Jeffrey Adelson maintains with a sell rating, and maintains the target price at $40.

Goldman Sachs analyst Ryan Nash maintains with a buy rating, and adjusts the target price from $56 to $64.

Barclays analyst Terry Ma maintains with a hold rating, and adjusts the target price from $49 to $59.

Barclays analyst Terry Ma maintains with a hold rating, and adjusts the target price from $49 to $59.

Deutsche Bank analyst Mark DeVries maintains with a buy rating, and adjusts the target price from $58 to $68.

Evercore analyst John Pancari maintains with a buy rating, and maintains the target price at $58.

Furthermore, according to the comprehensive report, the opinions of $Synchrony Financial (SYF.US)$'s main analysts recently are as follows:

Synchrony displayed a 'solid' EPS performance and the narrative around delinquency stabilization persists. However, persistent concerns remain regarding the potential for a late fee cap, credit expectations, and a deceleration in spending growth projected for 2025.

Post the Q3 report, the perception is that Synchrony has adequately addressed key areas of focus, namely mitigant impact and credit, to assuage any concerns.

Synchrony's Q3 results demonstrated ongoing advancements towards credit stabilization and compensations for lost late fees. Despite the uncertainties arising from legal and political events, the anticipated impact on late fee revenue appears to be diminishing.

The company's third-quarter earnings per share of $1.94 exceeded expectations, bolstered by robust net interest income and margin strength. The new full-year 2024 earnings per share guidance, which excludes the Pets Best gain, assumes there will be no late fee rule in effect in 2024, contrasting with previous forecasts that incorporated an October 1 implementation.

The firm highlights Synchrony's third-quarter earnings surpassing expectations, emphasizing that the company's fundamentals remain robust with core performance aligning with projections. It's noted that credit trends at the company are showing signs of stability and that the observed growth normalization is indicative of the company's commitment to credit discipline within the current economic context.

Here are the latest investment ratings and price targets for $Synchrony Financial (SYF.US)$ from 10 analysts:

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

美东时间10月18日,多家华尔街大行更新了$Synchrony Financial (SYF.US)$的评级,目标价介于40美元至68美元。

摩根士丹利分析师Jeffrey Adelson维持卖出评级,维持目标价40美元。

高盛集团分析师Ryan Nash维持买入评级,并将目标价从56美元上调至64美元。

巴克莱银行分析师Terry Ma维持持有评级,并将目标价从49美元上调至59美元。

巴克莱银行分析师Terry Ma维持持有评级,并将目标价从49美元上调至59美元。

德意志银行分析师Mark DeVries维持买入评级,并将目标价从58美元上调至68美元。

Evercore分析师John Pancari维持买入评级,维持目标价58美元。

此外,综合报道,$Synchrony Financial (SYF.US)$近期主要分析师观点如下:

Synchrony展示了'稳健的'每股收益表现,并围绕拖欠稳定的叙述仍在持续。然而,仍存在对晚付费上限、信用预期以及2025年预计支出增速放缓的持续担忧。

发布Q3报告后,人们认为Synchrony已充分解决了关注重点领域,即缓和影响和信用,以缓解任何担忧。

Synchrony的Q3业绩表现出对信用稳定的持续进展,并对丢失的晚付费进行了补偿。尽管存在法律和政治事件带来的不确定性,但对晚付费收入的预期影响似乎在减弱。

该公司第三季度每股收益为1.94美元,超出预期,得益于强劲的净利息收入和边际强劲。新的2024全年每股收益指引,不包括Pets Best收益,在假定2024年不会实施晚付费规则的情况下,与之前整合10月1日实施在内的预测形成对比。

公司强调了Synchrony第三季度超出预期的收益,强调公司基本面仍然稳固,核心表现与预期一致。指出公司信用趋势显示出稳定迹象,观察到的增长正常化表明公司在当前经济背景下恪守信用纪律的承诺。

以下为今日10位分析师对$Synchrony Financial (SYF.US)$的最新投资评级及目标价:

提示:

TipRanks为独立第三方,提供金融分析师的分析数据,并计算分析师推荐的平均回报率和胜率。提供的信息并非投资建议,仅供参考。本文不对评级数据和报告的完整性与准确性做出认可、声明或保证。

TipRanks提供每位分析师的星级,分析师星级代表分析师所有推荐的过往表现,通过分析师的总胜率和平均回报率综合计算得出,星星越多,则该分析师过往表现越优异,最高为5颗星。

分析师总胜率为近一年分析师的评级成功次数占总评级次数的比率。评级的成功与否,取决于TipRanks的虚拟投资组合是否从该股票中产生正回报。

总平均回报率为基于分析师的初始评级创建虚拟投资组合,并根据评级变化对组合进行调整,在近一年中该投资组合所获得的回报率。

巴克莱银行分析师Terry Ma维持持有评级,并将目标价从49美元上调至59美元。

巴克莱银行分析师Terry Ma维持持有评级,并将目标价从49美元上调至59美元。

Barclays analyst Terry Ma maintains with a hold rating, and adjusts the target price from $49 to $59.

Barclays analyst Terry Ma maintains with a hold rating, and adjusts the target price from $49 to $59.