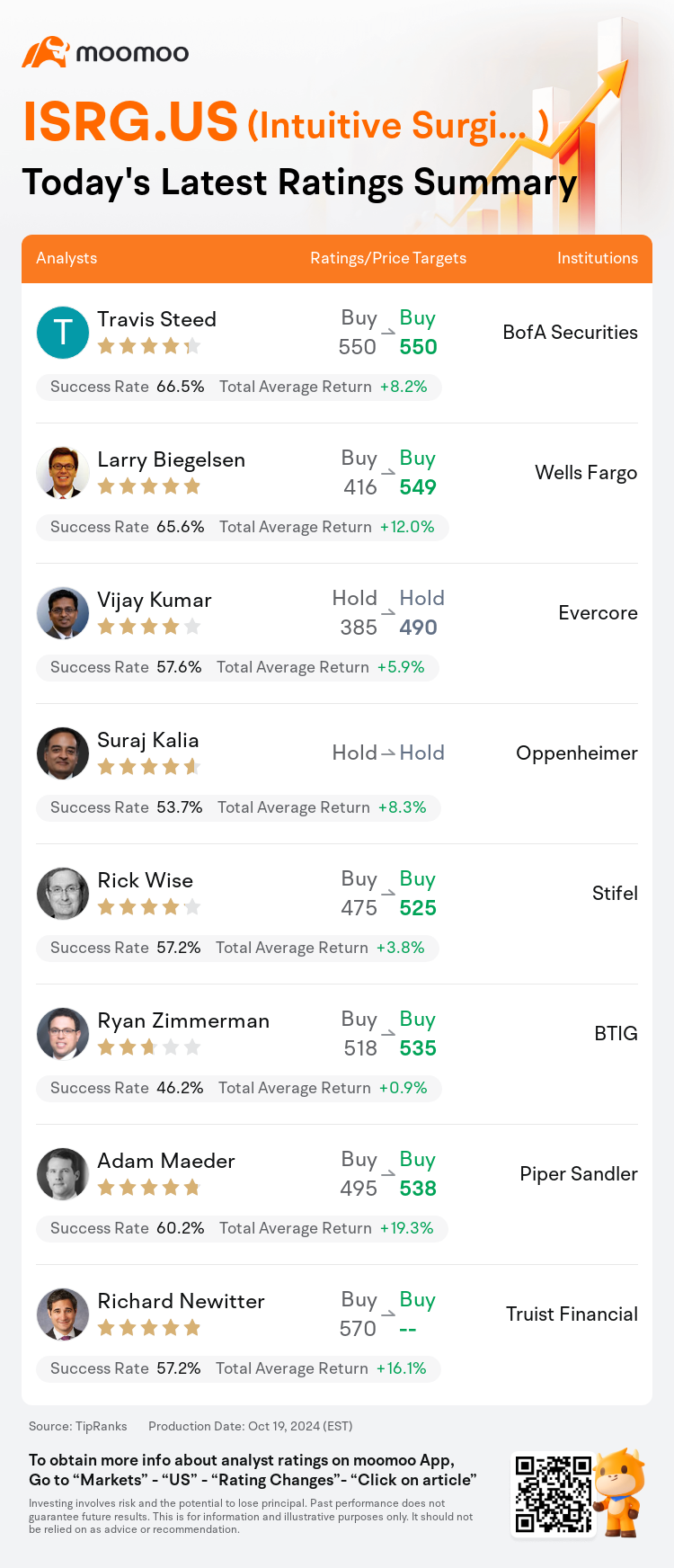

On Oct 19, major Wall Street analysts update their ratings for $Intuitive Surgical (ISRG.US)$, with price targets ranging from $490 to $550.

BofA Securities analyst Travis Steed maintains with a buy rating, and maintains the target price at $550.

Wells Fargo analyst Larry Biegelsen maintains with a buy rating, and adjusts the target price from $416 to $549.

Evercore analyst Vijay Kumar maintains with a hold rating, and adjusts the target price from $385 to $490.

Evercore analyst Vijay Kumar maintains with a hold rating, and adjusts the target price from $385 to $490.

Oppenheimer analyst Suraj Kalia maintains with a hold rating.

Stifel analyst Rick Wise maintains with a buy rating, and adjusts the target price from $475 to $525.

Furthermore, according to the comprehensive report, the opinions of $Intuitive Surgical (ISRG.US)$'s main analysts recently are as follows:

The company's Q3 earnings surpassed expectations, characterized by a 'strong quarter' with significant placements of the Da Vinci 5 system, a surge in procedure volumes, and maintained margin discipline. Additionally, the company's management has revised its FY24 procedure volume growth forecast to a range of 16%-17%, from the previously estimated 15.5%-17%. This adjustment takes into account the potential for a continued decline in bariatric procedures and growing challenges in Asia, such as extended physician strikes in Korea, while also considering a scenario where bariatric procedures stabilize at current rates and the situation in Korea and China does not deteriorate further.

The projection for Intuitive Surgical's revenue outperformance in FY25 appears to be reflected in current market expectations. Following the company's quarterly financial disclosure, it's indicated that the estimate for FY25 earnings per share has been adjusted upward by approximately 3%.

Intuitive Surgical reported robust third-quarter results, outperforming expectations in two crucial aspects - placements of their DV5 systems and growth in procedures. The company is witnessing significant growth momentum following the U.S. approval of the da Vinci 5 system. The early adoption of DV5 is progressing faster than the previous fourth-generation system's launch, with promising signs of potential growth acceleration in the coming years.

The company's Q3 earnings and revenue surpassed expectations, alongside an 18% increase in procedure volume, which also exceeded the consensus forecast by 100 basis points. The expectation is for the growth momentum to persist, especially with the widening array of regulatory clearances for Dv5, anticipating sustained expansion into the latter part of FY25.

The firm has once again raised their expectations, reinforcing their belief in the ongoing potential for growth which supports the company's high valuation. The company is seen as a top-tier long-term growth pick following its performance that surpassed estimates and showed growth acceleration on almost all fronts.

Here are the latest investment ratings and price targets for $Intuitive Surgical (ISRG.US)$ from 8 analysts:

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

美东时间10月19日,多家华尔街大行更新了$直觉外科公司 (ISRG.US)$的评级,目标价介于490美元至550美元。

美银证券分析师Travis Steed维持买入评级,维持目标价550美元。

富国集团分析师Larry Biegelsen维持买入评级,并将目标价从416美元上调至549美元。

Evercore分析师Vijay Kumar维持持有评级,并将目标价从385美元上调至490美元。

Evercore分析师Vijay Kumar维持持有评级,并将目标价从385美元上调至490美元。

奥本海默控股分析师Suraj Kalia维持持有评级。

斯迪富分析师Rick Wise维持买入评级,并将目标价从475美元上调至525美元。

此外,综合报道,$直觉外科公司 (ISRG.US)$近期主要分析师观点如下:

公司的第三季度收益超过预期,以“强劲季度”为特点,达芬奇5系统的重大放置、建设程序量的激增和保持边际纪律。此外,公司管理层已将FY24程序量增长预测调整为16%-17%的区间,而之前的估计为15.5%-17%。此调整考虑到肥胖病程序持续减少的潜力以及亚洲不断增长的挑战,例如韩国延长的医生罢工,同时考虑到肥胖病程序在当前速率稳定和韩国和中国情况没有进一步恶化的情况。

直觉外科公司营收在FY25年的超预期表现似乎已反映在目前的市场预期中。根据公司季度财务披露,FY25年每股收益预估已上调约3%。

直觉外科公司报告了强劲的第三季度业绩,两个关键方面超出预期——DV5系统的放置和程序增长。伴随着达芬奇5系统获得美国批准,公司目前正在经历显著的增长势头。DV5的早期采用速度比之前的第四代系统的推出速度更快,显示出未来几年潜在增长加速的迹象。

公司的第三季度收益和营业收入超出预期,程序量增加18%,也超出了市场预期100个基点。预计增长势头将继续,特别是随着DV5获得更广泛的监管批准,预计将持续扩张至FY25年后期。

该公司再次提高了他们的预期,并强化了他们对持续增长潜力的信念,这支持了公司的高估值。在超出估计并几乎在全部方面显示增长加速的表现之后,该公司被视为长期增长首选。

以下为今日8位分析师对$直觉外科公司 (ISRG.US)$的最新投资评级及目标价:

提示:

TipRanks为独立第三方,提供金融分析师的分析数据,并计算分析师推荐的平均回报率和胜率。提供的信息并非投资建议,仅供参考。本文不对评级数据和报告的完整性与准确性做出认可、声明或保证。

TipRanks提供每位分析师的星级,分析师星级代表分析师所有推荐的过往表现,通过分析师的总胜率和平均回报率综合计算得出,星星越多,则该分析师过往表现越优异,最高为5颗星。

分析师总胜率为近一年分析师的评级成功次数占总评级次数的比率。评级的成功与否,取决于TipRanks的虚拟投资组合是否从该股票中产生正回报。

总平均回报率为基于分析师的初始评级创建虚拟投资组合,并根据评级变化对组合进行调整,在近一年中该投资组合所获得的回报率。

Evercore分析师Vijay Kumar维持持有评级,并将目标价从385美元上调至490美元。

Evercore分析师Vijay Kumar维持持有评级,并将目标价从385美元上调至490美元。

Evercore analyst Vijay Kumar maintains with a hold rating, and adjusts the target price from $385 to $490.

Evercore analyst Vijay Kumar maintains with a hold rating, and adjusts the target price from $385 to $490.