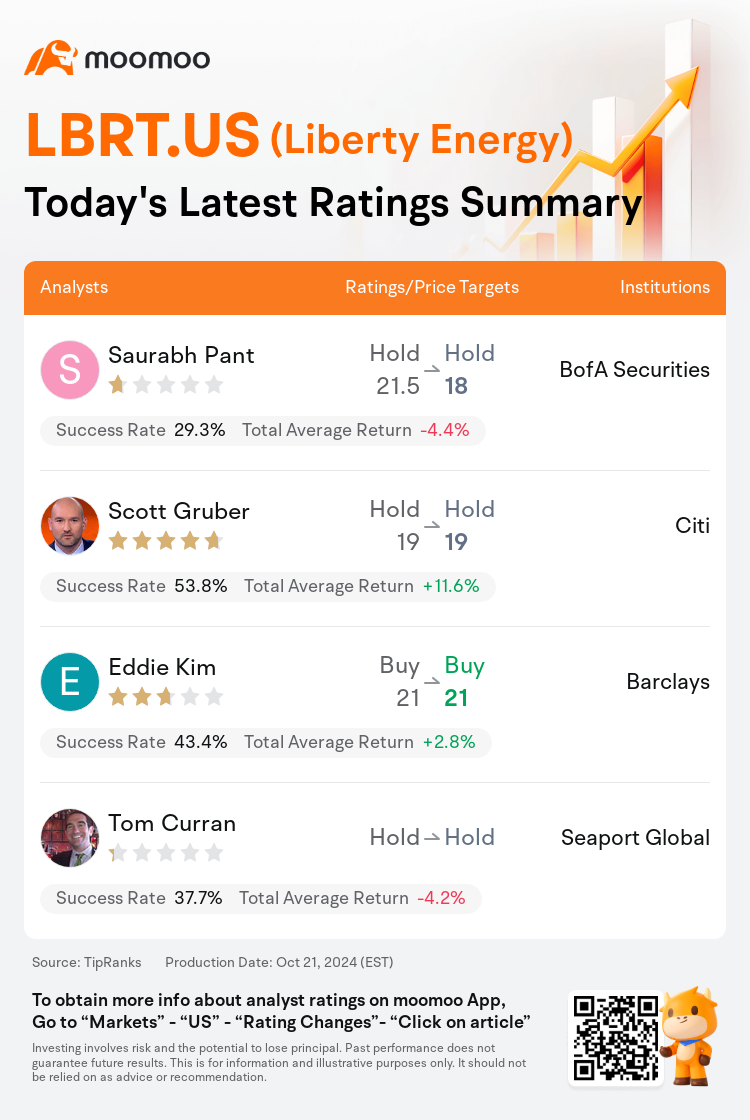

On Oct 21, major Wall Street analysts update their ratings for $Liberty Energy (LBRT.US)$, with price targets ranging from $18 to $21.

BofA Securities analyst Saurabh Pant maintains with a hold rating, and adjusts the target price from $21.5 to $18.

Citi analyst Scott Gruber maintains with a hold rating, and maintains the target price at $19.

Barclays analyst Eddie Kim maintains with a buy rating, and maintains the target price at $21.

Barclays analyst Eddie Kim maintains with a buy rating, and maintains the target price at $21.

Seaport Global analyst Tom Curran maintains with a hold rating.

Furthermore, according to the comprehensive report, the opinions of $Liberty Energy (LBRT.US)$'s main analysts recently are as follows:

Pricing challenges in the frac sector have extended to top-tier pumpers and equipment, which is reflected in Liberty Energy's recognition of 'slowing activity pressuring pricing inconsistent with [its] anticipated future demand.' It is anticipated that Liberty's realized pricing may face further weakening prior to an improvement.

Liberty Energy experienced a challenging quarter, missing Q3 EBITDA expectations by 5% and forecasting Q4 results that are 25% below the consensus. This has resulted in management losing some credibility with investors.

The intensification of the downcycle is evidenced by Liberty Energy idling two fleets and experiencing margin compression due to pricing concessions. Seasonal improvements are anticipated in the first half of 2025, although exploration and production companies are expected to persist in seeking pricing concessions amidst oil price uncertainties. A more rapid decline in EBITDA compared to capital expenditures has led to a reduced free cash flow estimate for Liberty in 2025, which suggests a modest yield at the present stock price. Furthermore, with the first quarter facing seasonal working capital challenges, the company's capacity to repurchase shares may be constrained in the near term without resorting to leveraging its balance sheet.

Liberty Energy's reported EBITDA fell short of expectations, indicating a subdued forecast for frac activity and pricing towards the end of 2024. Despite a less optimistic view on the company's second half outlook and its lowered free cash flow profile, the anticipated update on Liberty Power Innovations in early 2025 is seen as a potential catalyst for the company's stock.

Liberty Energy's Q4 guidance and comments indicating price headwinds were described as 'lackluster.' Nonetheless, expectations are set for enhanced performance in the first half of 2025 after a seasonal decrease in Q4.

Here are the latest investment ratings and price targets for $Liberty Energy (LBRT.US)$ from 4 analysts:

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

美东时间10月21日,多家华尔街大行更新了$Liberty Energy (LBRT.US)$的评级,目标价介于18美元至21美元。

美银证券分析师Saurabh Pant维持持有评级,并将目标价从21.5美元下调至18美元。

花旗分析师Scott Gruber维持持有评级,维持目标价19美元。

巴克莱银行分析师Eddie Kim维持买入评级,维持目标价21美元。

巴克莱银行分析师Eddie Kim维持买入评级,维持目标价21美元。

Seaport Global分析师Tom Curran维持持有评级。

此外,综合报道,$Liberty Energy (LBRT.US)$近期主要分析师观点如下:

压价挑战在压裂板块已蔓延到顶尖抽油机和设备,这在liberty energy认为"活动减缓对价格造成的不一致性与[其]预期未来需求相压"中得到体现。预计liberty的实现定价可能在改善之前面临进一步的疲软。

liberty energy度过了具有挑战性的一个季度,Q3 EBITDA预期不达标5%,并预测Q4结果将低于共识25%。这导致管理层在投资者中失去了一些可信度。

压价让liberty energy停用两支舰队并经历边际拉缩。预计2025年上半年将出现季节性改善,尽管勘探和生产公司有望在石油价格不确定性持续下寻求价格让步。与资本支出相比,EBITDA下降更为迅速导致2025年liberty自由现金流预估减少,这意味着在当前股价的情况下收益有限。此外,由于第一季度面临季节性营运资本挑战,公司未来一段时间内回购股票的能力可能受到限制,而无需依靠其资产负债表。

liberty energy报告的EBITDA低于预期,显示2024年底压裂活动和定价的预测较为保守。尽管对公司下半年展望和其下调的自由现金流概况持谨慎乐观态度,但预计2025年初对liberty power innovations的更新被视为该公司股票的潜在催化剂。

liberty energy的Q4指引和表示价格风险的评论被描述为"平淡无奇"。尽管如此,2025年上半年在Q4出现季节性减少后,性能有望提升。

以下为今日4位分析师对$Liberty Energy (LBRT.US)$的最新投资评级及目标价:

提示:

TipRanks为独立第三方,提供金融分析师的分析数据,并计算分析师推荐的平均回报率和胜率。提供的信息并非投资建议,仅供参考。本文不对评级数据和报告的完整性与准确性做出认可、声明或保证。

TipRanks提供每位分析师的星级,分析师星级代表分析师所有推荐的过往表现,通过分析师的总胜率和平均回报率综合计算得出,星星越多,则该分析师过往表现越优异,最高为5颗星。

分析师总胜率为近一年分析师的评级成功次数占总评级次数的比率。评级的成功与否,取决于TipRanks的虚拟投资组合是否从该股票中产生正回报。

总平均回报率为基于分析师的初始评级创建虚拟投资组合,并根据评级变化对组合进行调整,在近一年中该投资组合所获得的回报率。

巴克莱银行分析师Eddie Kim维持买入评级,维持目标价21美元。

巴克莱银行分析师Eddie Kim维持买入评级,维持目标价21美元。

Barclays analyst Eddie Kim maintains with a buy rating, and maintains the target price at $21.

Barclays analyst Eddie Kim maintains with a buy rating, and maintains the target price at $21.