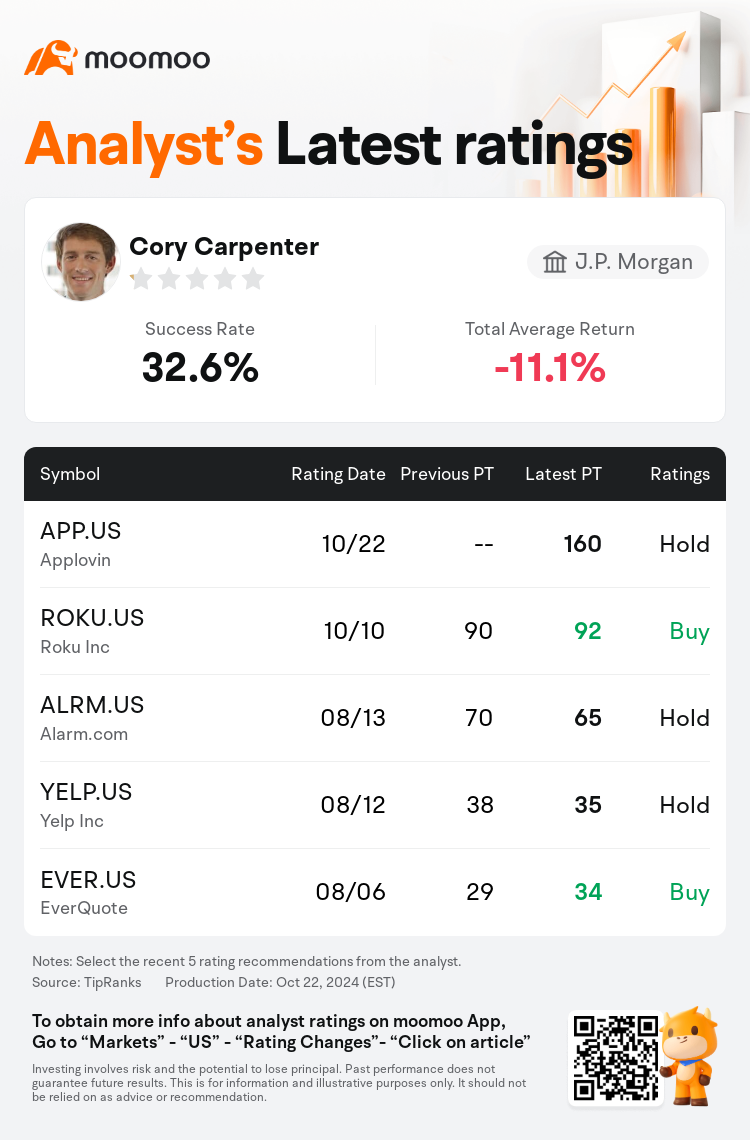

J.P. Morgan analyst Cory Carpenter initiates coverage on $Applovin (APP.US)$ with a hold rating, and sets the target price at $160.

According to TipRanks data, the analyst has a success rate of 32.6% and a total average return of -11.1% over the past year.

Furthermore, according to the comprehensive report, the opinions of $Applovin (APP.US)$'s main analysts recently are as follows:

Furthermore, according to the comprehensive report, the opinions of $Applovin (APP.US)$'s main analysts recently are as follows:

The firm updated its estimates across its video game coverage in anticipation of upcoming earnings. Although global video game industry growth appears to be lukewarm, stable mobile trends are seen as a positive sign and there is an expectation for console spending to pick up next year. This anticipated increase is thought to be driven by a robust lineup of games and the potential release of a new generation Switch.

The introduction of AppLovin's AI engine, Axon 2.0, in the second quarter of 2023 is seen as a significant factor in advancing the company's growth and profitability, a development that has yet to be fully appreciated by the market and industry observers. The view of the company as one with substantial growth potential has led to an increase in the growth estimates for the Software section for the years 2025 and 2026. This adjustment is grounded in a stronger conviction in the company's foundational business surrounding mobile game advertisements, which has also motivated a revision of the valuation multiple applied to the projected EBITDA for the year 2026.

AppLovin has established itself as essential infrastructure within the mobile gaming sector, demonstrating its significance as an investment opportunity in big data and artificial intelligence. Analysts note that while the company's stock price has experienced rapid appreciation, any potential pullback may present a buying opportunity. However, the belief is that this re-evaluation is justifiable and will persist, given the substantial prospects for growth anticipated in the company's primary area of operation.

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

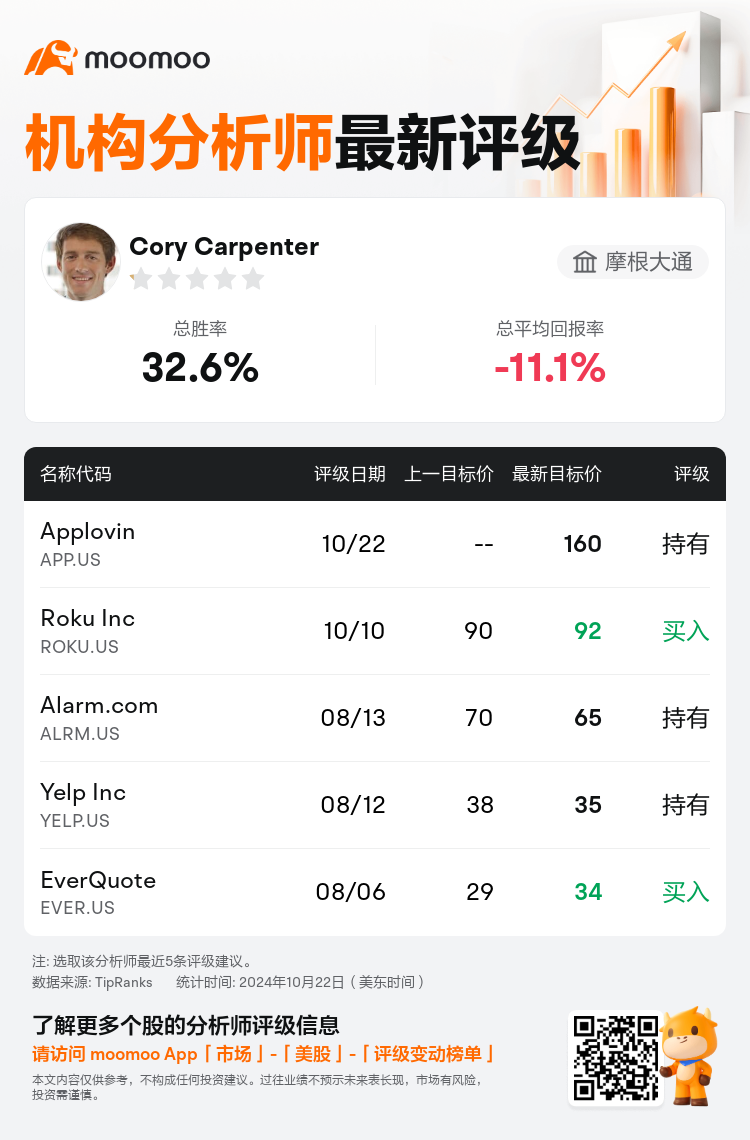

摩根大通分析师Cory Carpenter首予$Applovin (APP.US)$持有评级,目标价160美元。

根据TipRanks数据显示,该分析师近一年总胜率为32.6%,总平均回报率为-11.1%。

此外,综合报道,$Applovin (APP.US)$近期主要分析师观点如下:

此外,综合报道,$Applovin (APP.US)$近期主要分析师观点如下:

该公司更新了其视频游戏业务的估值,以期待即将公布的收益。尽管全球视频游戏行业增长似乎温和,但稳定的手游趋势被视为一个积极的信号,预计明年主机消费将有所增加。预期的增长被认为将由一系列强大的游戏和新一代交换机的潜在发布推动。

AppLovin在2023年第二季度推出的AI引擎Axon 2.0被视为推动公司增长和盈利能力的重要因素,这一发展尚未得到市场和行业观察者的充分重视。公司被视为具有巨大增长潜力的看法导致了对2025年和2026年软件板块增长预期的提高。这一调整基于对公司围绕手游广告的基础业务更加坚定的信念,这也促使对2026年预计EBITDA的估值倍数进行修订。

AppLovin已经确立了自己作为手游板块中必不可少的基础设施,展示了作为大数据和人工智能投资机会的重要性。分析师指出,尽管公司股价经历了快速增长,但任何潜在的回调都可能带来购买机会。然而,人们认为这种重新评估是合理的,并会持续下去,考虑到公司主要经营领域预期的巨大增长前景。

提示:

TipRanks为独立第三方,提供金融分析师的分析数据,并计算分析师推荐的平均回报率和胜率。提供的信息并非投资建议,仅供参考。本文不对评级数据和报告的完整性与准确性做出认可、声明或保证。

TipRanks提供每位分析师的星级,分析师星级代表分析师所有推荐的过往表现,通过分析师的总胜率和平均回报率综合计算得出,星星越多,则该分析师过往表现越优异,最高为5颗星。

分析师总胜率为近一年分析师的评级成功次数占总评级次数的比率。评级的成功与否,取决于TipRanks的虚拟投资组合是否从该股票中产生正回报。

总平均回报率为基于分析师的初始评级创建虚拟投资组合,并根据评级变化对组合进行调整,在近一年中该投资组合所获得的回报率。

此外,综合报道,$Applovin (APP.US)$近期主要分析师观点如下:

此外,综合报道,$Applovin (APP.US)$近期主要分析师观点如下:

Furthermore, according to the comprehensive report, the opinions of

Furthermore, according to the comprehensive report, the opinions of