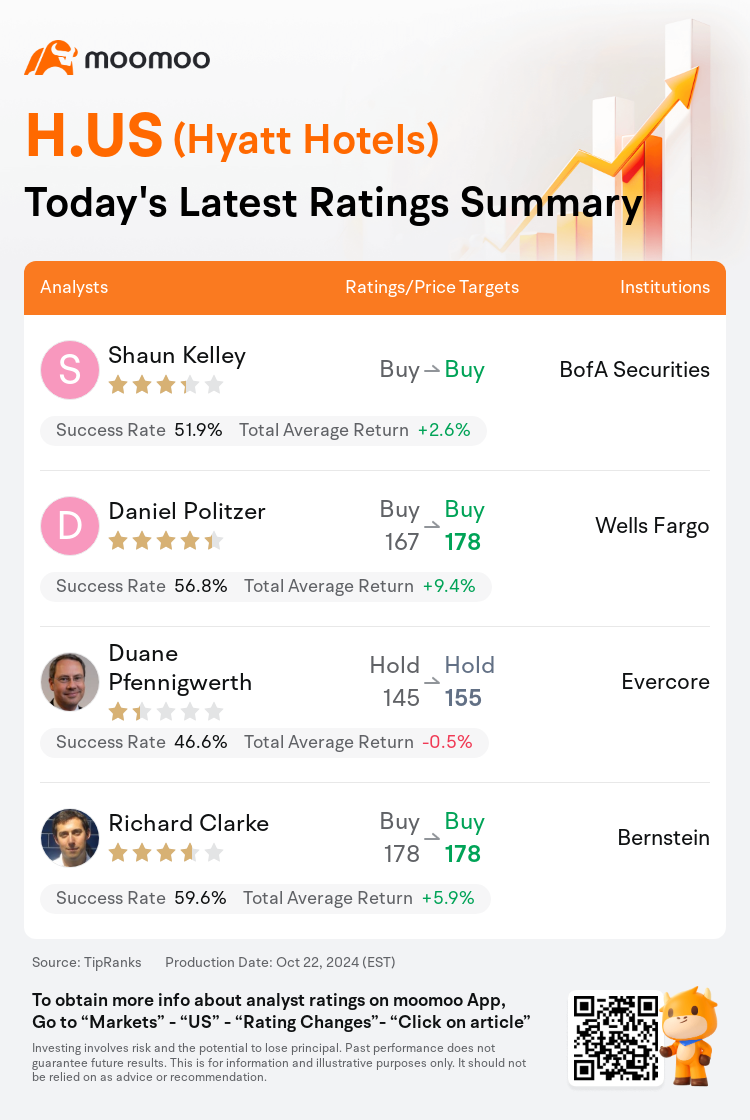

On Oct 22, major Wall Street analysts update their ratings for $Hyatt Hotels (H.US)$, with price targets ranging from $155 to $178.

BofA Securities analyst Shaun Kelley maintains with a buy rating.

Wells Fargo analyst Daniel Politzer maintains with a buy rating, and adjusts the target price from $167 to $178.

Evercore analyst Duane Pfennigwerth maintains with a hold rating, and adjusts the target price from $145 to $155.

Evercore analyst Duane Pfennigwerth maintains with a hold rating, and adjusts the target price from $145 to $155.

Bernstein analyst Richard Clarke maintains with a buy rating, and maintains the target price at $178.

Furthermore, according to the comprehensive report, the opinions of $Hyatt Hotels (H.US)$'s main analysts recently are as follows:

The expectation is that Q3 results for corporations in the Lodging sector will align with forecasted outlooks, although reaching the upper end may prove challenging for certain entities. With the finalized data for September, the U.S. RevPAR showed year-over-year improvement, and the sector is experiencing a positive effect, particularly when excluding China.

The firm anticipates that for the lodging sector, Q3 RevPAR may align with the lower end of company forecasts, with varied expectations for Q4 influenced by factors like weather and election events. Notably, robust net unit growth is underpinning premium valuations, although it is believed that current valuations already reflect much of this positive outlook.

The firm is adjusting estimates for its asset-light lodging brand coverage, with minor modifications to Q3 forecasts. This adjustment accounts for a somewhat softer Q3 domestic RevPAR, balanced by stronger performance in Europe and the Asia Pacific regions, excluding China. The firm also indicates a cautious stance on Q4 projections, considering factors such as an unfavorable calendar, short-term disruptions at certain major properties, and decelerating growth in China.

Here are the latest investment ratings and price targets for $Hyatt Hotels (H.US)$ from 4 analysts:

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

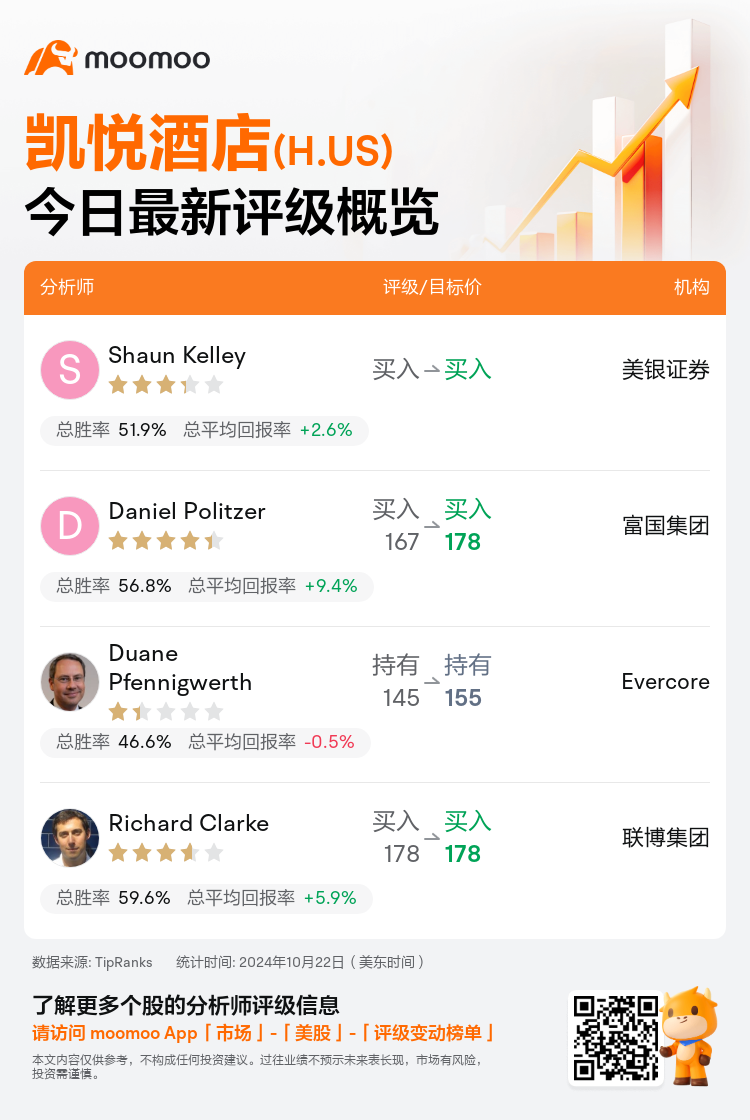

美东时间10月22日,多家华尔街大行更新了$凯悦酒店 (H.US)$的评级,目标价介于155美元至178美元。

美银证券分析师Shaun Kelley维持买入评级。

富国集团分析师Daniel Politzer维持买入评级,并将目标价从167美元上调至178美元。

Evercore分析师Duane Pfennigwerth维持持有评级,并将目标价从145美元上调至155美元。

Evercore分析师Duane Pfennigwerth维持持有评级,并将目标价从145美元上调至155美元。

联博集团分析师Richard Clarke维持买入评级,维持目标价178美元。

此外,综合报道,$凯悦酒店 (H.US)$近期主要分析师观点如下:

预计第三季度住宿板块企业的业绩将与预测的前景一致,尽管对于某些实体来说,达到最高水平可能具有挑战性。随着九月份的最终数据,美国RevPAR呈现年增长,该板块正在经历积极影响,特别是在不包括中国的情况下。

公司预计,住宿板块的第三季度RevPAR可能会与公司预测的下限相符,并且受天气和选举活动等因素影响,对第四季度的预期存在差异。值得注意的是,强劲的净单位增长支撑着高估值,尽管人们认为目前的估值已经反映了很多这一积极前景。

公司正在调整对其资产轻的住宿品牌覆盖率的估计,对第三季度的预测进行细微调整。这一调整考虑到第三季度国内RevPAR略微疲软,但欧洲和亚太地区(不包括中国)的表现较好,公司还对第四季度的预测持谨慎态度,考虑到不利的日历、某些主要物业的短期干扰以及中国增长的放缓。

以下为今日4位分析师对$凯悦酒店 (H.US)$的最新投资评级及目标价:

提示:

TipRanks为独立第三方,提供金融分析师的分析数据,并计算分析师推荐的平均回报率和胜率。提供的信息并非投资建议,仅供参考。本文不对评级数据和报告的完整性与准确性做出认可、声明或保证。

TipRanks提供每位分析师的星级,分析师星级代表分析师所有推荐的过往表现,通过分析师的总胜率和平均回报率综合计算得出,星星越多,则该分析师过往表现越优异,最高为5颗星。

分析师总胜率为近一年分析师的评级成功次数占总评级次数的比率。评级的成功与否,取决于TipRanks的虚拟投资组合是否从该股票中产生正回报。

总平均回报率为基于分析师的初始评级创建虚拟投资组合,并根据评级变化对组合进行调整,在近一年中该投资组合所获得的回报率。

Evercore分析师Duane Pfennigwerth维持持有评级,并将目标价从145美元上调至155美元。

Evercore分析师Duane Pfennigwerth维持持有评级,并将目标价从145美元上调至155美元。

Evercore analyst Duane Pfennigwerth maintains with a hold rating, and adjusts the target price from $145 to $155.

Evercore analyst Duane Pfennigwerth maintains with a hold rating, and adjusts the target price from $145 to $155.