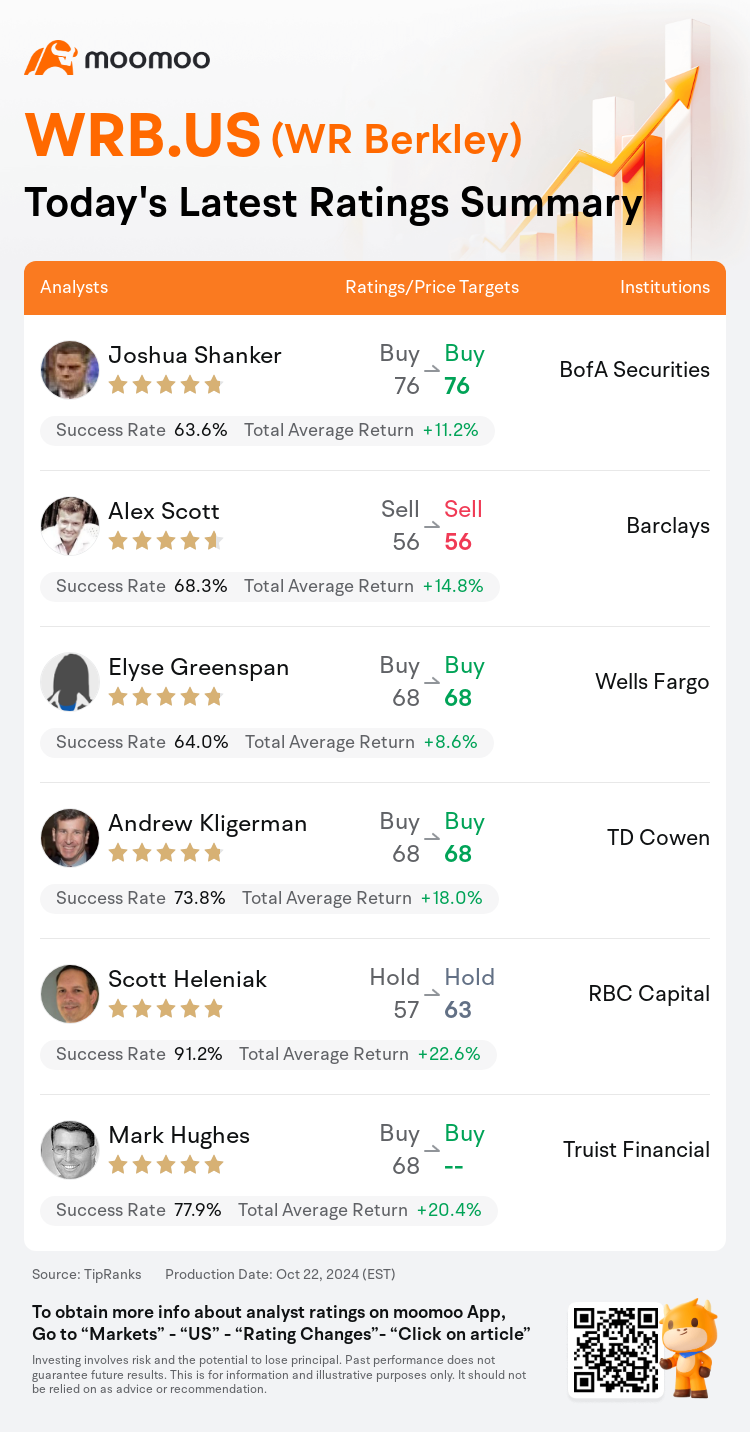

On Oct 22, major Wall Street analysts update their ratings for $WR Berkley (WRB.US)$, with price targets ranging from $56 to $76.

BofA Securities analyst Joshua Shanker maintains with a buy rating, and maintains the target price at $76.

Barclays analyst Alex Scott maintains with a sell rating, and maintains the target price at $56.

Wells Fargo analyst Elyse Greenspan maintains with a buy rating, and maintains the target price at $68.

Wells Fargo analyst Elyse Greenspan maintains with a buy rating, and maintains the target price at $68.

TD Cowen analyst Andrew Kligerman maintains with a buy rating, and maintains the target price at $68.

RBC Capital analyst Scott Heleniak maintains with a hold rating, and adjusts the target price from $57 to $63.

Furthermore, according to the comprehensive report, the opinions of $WR Berkley (WRB.US)$'s main analysts recently are as follows:

The assessment of W. R. Berkley indicates that the company has historically been valued more highly compared to its peers, likely owing to its consistent long-term growth in equity which surpasses that of other top-tier industry counterparts.

The company has exhibited consistent performance with robust combined ratios even in the face of increased catastrophe losses. Additionally, the firm noted a rise in the expense ratio, attributed to initiatives for growth and technological investments, alongside a slowdown in premium growth relative to recent trends. Nonetheless, there is an ongoing recognition of growth prospects throughout various segments of the business.

W. R. Berkley's Q3 operating EPS outperformed estimates, coming in higher than both the anticipated figure and the consensus forecast. The quarter was regarded as satisfactory, though some may find it slightly underwhelming when compared to another peer's results, due to lower-than-expected NPW growth and marginal rate increases. There is some indication of rate acceleration in certain insurance lines, but overall, it is challenging to predict a significant rate increase throughout W. R. Berkley's portfolio that would result in the anticipated 10%-15% growth in the next quarter. It is suggested that the general consensus is aligned with this perspective.

W. R. Berkley reported EPS that aligned with forecasts, even considering a 5-cent impact from foreign exchange. The company experienced lighter premium growth, while the underlying margin surpassed expectations alongside a modest $1M of prior year development.

Here are the latest investment ratings and price targets for $WR Berkley (WRB.US)$ from 6 analysts:

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

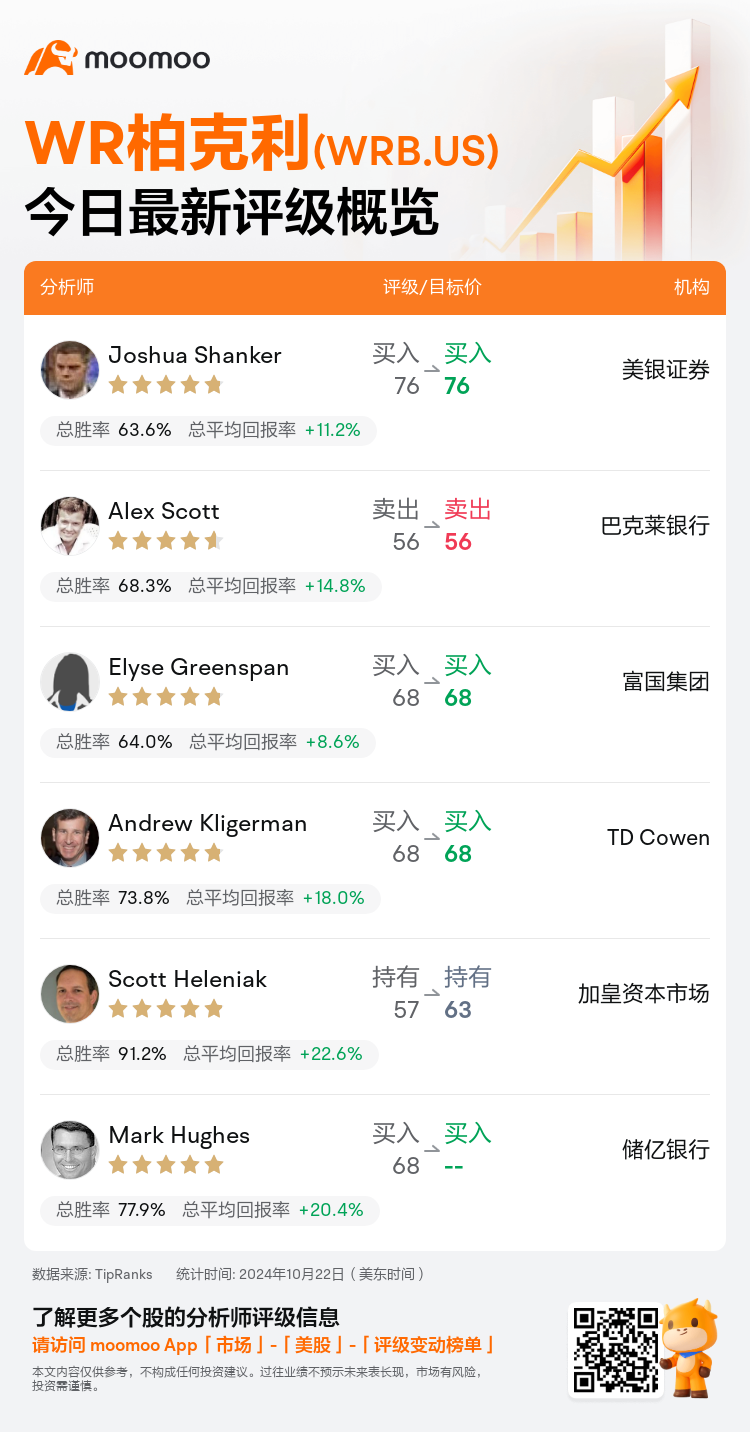

美东时间10月22日,多家华尔街大行更新了$WR柏克利 (WRB.US)$的评级,目标价介于56美元至76美元。

美银证券分析师Joshua Shanker维持买入评级,维持目标价76美元。

巴克莱银行分析师Alex Scott维持卖出评级,维持目标价56美元。

富国集团分析师Elyse Greenspan维持买入评级,维持目标价68美元。

富国集团分析师Elyse Greenspan维持买入评级,维持目标价68美元。

TD Cowen分析师Andrew Kligerman维持买入评级,维持目标价68美元。

加皇资本市场分析师Scott Heleniak维持持有评级,并将目标价从57美元上调至63美元。

此外,综合报道,$WR柏克利 (WRB.US)$近期主要分析师观点如下:

W. R. Berkley的评估表明,该公司在历史上相对于同行被更高地评估,这很可能是因为其股本的长期稳健增长超过了其他顶级行业对手。

即使面临灾难损失增加,该公司展现了稳健的绩效表现。此外,该公司注意到费用比率上升,归因于增长和技术投资方面的举措,以及与最近趋势相比保费增长放缓。尽管如此,对业务各个领域增长前景的认可仍在持续。

W. R. Berkley的第三季度营运每股收益超过预期,高于预期数字和共识预测。该季度被认为令人满意,尽管与另一家同行的结果相比,有些人可能会觉得略显不足,这是由于NPW增长低于预期和微不足道的费率增加。在某些保险业务线上显示出费率加速的迹象,但总体上,很难预测W. R. Berkley投资组合中将会有大幅度的费率增长,以实现下个季度预期的10%-15%的增长。建议整体共识与这一观点保持一致。

W. R. Berkley报告的每股收益符合预测,甚至考虑到5分的外汇影响。公司经历了较低的保费增长,而基本利润超出预期,同时有着适度的100万美元的去年发展。

以下为今日6位分析师对$WR柏克利 (WRB.US)$的最新投资评级及目标价:

提示:

TipRanks为独立第三方,提供金融分析师的分析数据,并计算分析师推荐的平均回报率和胜率。提供的信息并非投资建议,仅供参考。本文不对评级数据和报告的完整性与准确性做出认可、声明或保证。

TipRanks提供每位分析师的星级,分析师星级代表分析师所有推荐的过往表现,通过分析师的总胜率和平均回报率综合计算得出,星星越多,则该分析师过往表现越优异,最高为5颗星。

分析师总胜率为近一年分析师的评级成功次数占总评级次数的比率。评级的成功与否,取决于TipRanks的虚拟投资组合是否从该股票中产生正回报。

总平均回报率为基于分析师的初始评级创建虚拟投资组合,并根据评级变化对组合进行调整,在近一年中该投资组合所获得的回报率。

富国集团分析师Elyse Greenspan维持买入评级,维持目标价68美元。

富国集团分析师Elyse Greenspan维持买入评级,维持目标价68美元。

Wells Fargo analyst Elyse Greenspan maintains with a buy rating, and maintains the target price at $68.

Wells Fargo analyst Elyse Greenspan maintains with a buy rating, and maintains the target price at $68.