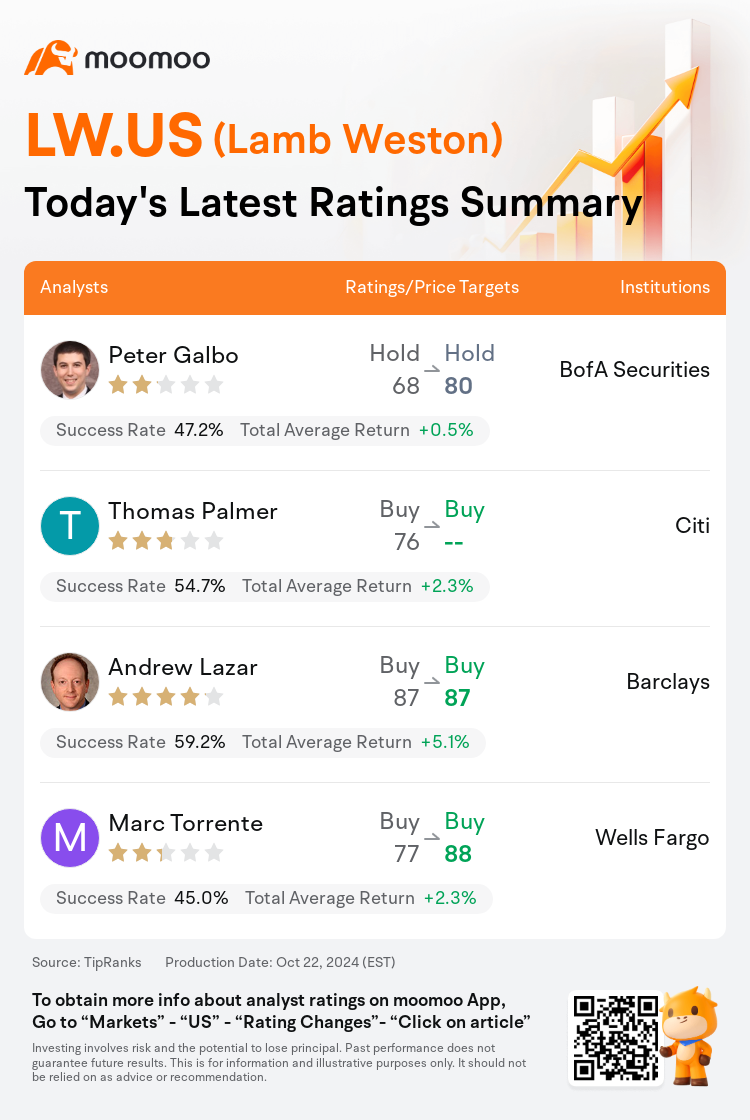

On Oct 22, major Wall Street analysts update their ratings for $Lamb Weston (LW.US)$, with price targets ranging from $80 to $88.

BofA Securities analyst Peter Galbo maintains with a hold rating, and adjusts the target price from $68 to $80.

Citi analyst Thomas Palmer maintains with a buy rating.

Barclays analyst Andrew Lazar maintains with a buy rating, and maintains the target price at $87.

Barclays analyst Andrew Lazar maintains with a buy rating, and maintains the target price at $87.

Wells Fargo analyst Marc Torrente maintains with a buy rating, and adjusts the target price from $77 to $88.

Furthermore, according to the comprehensive report, the opinions of $Lamb Weston (LW.US)$'s main analysts recently are as follows:

Expectations for Lamb Weston's shares to appreciate in the coming year are rooted in fundamental enhancements like a rebound in volume, operational leverage, and a more favorable pricing landscape. Additionally, there is anticipation of another possible path to value creation given the track record of successful activism in the food sector.

After an activist investor disclosed a significant stake in Lamb Weston and indicated plans to engage with the board and management about the company's series of self-imposed errors, analysts acknowledge the move. They note that given Lamb Weston's lackluster stock performance since the start of the year, the emergence of activist interest is not unexpected. The involvement of an investor with a background in the agricultural sector alongside the activist is perceived as adding substantial influence.

Following the disclosure of a significant investment by an activist investor in Lamb Weston and their intention to prompt the consideration of a sale, there is added pressure on the management of the company, especially considering the 34% decline in share value year-to-date prior to the announcement. It is considered somewhat unlikely that there will be considerable interest from any of the major branded companies. Lamb Weston experiences greater fluctuations in its financial performance due to its substantial involvement with the foodservice sector and is subject to the influence of overarching market trends and the annual potato crop's quality.

Lamb Weston's shares experienced a significant increase following the announcement that an activist acquired a substantial stake, which may act as a catalyst for hastened strategic initiatives. While there are ongoing discussions regarding short-term outcomes, there is optimism surrounding the company's prospects for recovery.

The revelation that an activist entity disclosed a significant stake in Lamb Weston is perceived positively, as it is expected to catalyze a heightened sense of urgency within the company to enhance its performance. Discussions regarding strategic alternatives with the board are anticipated.

Here are the latest investment ratings and price targets for $Lamb Weston (LW.US)$ from 4 analysts:

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

美东时间10月22日,多家华尔街大行更新了$Lamb Weston (LW.US)$的评级,目标价介于80美元至88美元。

美银证券分析师Peter Galbo维持持有评级,并将目标价从68美元上调至80美元。

花旗分析师Thomas Palmer维持买入评级。

巴克莱银行分析师Andrew Lazar维持买入评级,维持目标价87美元。

巴克莱银行分析师Andrew Lazar维持买入评级,维持目标价87美元。

富国集团分析师Marc Torrente维持买入评级,并将目标价从77美元上调至88美元。

此外,综合报道,$Lamb Weston (LW.US)$近期主要分析师观点如下:

预计 Lamb Weston 的股票在未来一年有望上涨,这基于一系列基本的增强措施,如成交量的回升、运营杠杆以及更有利的价格格局。此外,鉴于食品行业成功激活的记录,还有另一种可能的增值途径备受期待。

在一个激进投资者披露持有 Lamb Weston 的重大股份,并表示计划与董事会和管理层就公司一系列自我引起的错误进行沟通后,分析师们对此举表示认可。他们指出,鉴于 Lamb Weston 自年初以来股票表现平平,激进投资者的兴趣出现并不意外。一位具有农产品行业背景的投资者和激进投资者的参与被视为具有重大影响力。

在一家激进投资者披露对 Lamb Weston 的重大投资,并表明意图促使考虑出售后,公司管理层面临额外压力,尤其是考虑到在公布之前该公司股票价值年初以来下跌了34%。被视为较不可能有任何主要品牌公司表现出相当的兴趣。Lamb Weston 由于与餐饮服务行业的强劲联系,在其财务表现上经历了更大的波动,受制于整体市场趋势和年度马铃薯作物质量的影响。

在激进投资者收购 Lamb Weston 的重要股份并宣布后,该公司的股价出现了显著增长,这可能成为加速启动战略举措的催化剂。尽管存在关于短期结果的讨论,但围绕公司复苏前景的乐观情绪仍在持续。

激进实体披露持有 Lamb Weston 的重大股比,这一信息被视为积极的,因为预计它将在公司内部引发提高绩效的紧迫感。与董事会关于战略替代方案的讨论备受期待。

以下为今日4位分析师对$Lamb Weston (LW.US)$的最新投资评级及目标价:

提示:

TipRanks为独立第三方,提供金融分析师的分析数据,并计算分析师推荐的平均回报率和胜率。提供的信息并非投资建议,仅供参考。本文不对评级数据和报告的完整性与准确性做出认可、声明或保证。

TipRanks提供每位分析师的星级,分析师星级代表分析师所有推荐的过往表现,通过分析师的总胜率和平均回报率综合计算得出,星星越多,则该分析师过往表现越优异,最高为5颗星。

分析师总胜率为近一年分析师的评级成功次数占总评级次数的比率。评级的成功与否,取决于TipRanks的虚拟投资组合是否从该股票中产生正回报。

总平均回报率为基于分析师的初始评级创建虚拟投资组合,并根据评级变化对组合进行调整,在近一年中该投资组合所获得的回报率。

巴克莱银行分析师Andrew Lazar维持买入评级,维持目标价87美元。

巴克莱银行分析师Andrew Lazar维持买入评级,维持目标价87美元。

Barclays analyst Andrew Lazar maintains with a buy rating, and maintains the target price at $87.

Barclays analyst Andrew Lazar maintains with a buy rating, and maintains the target price at $87.