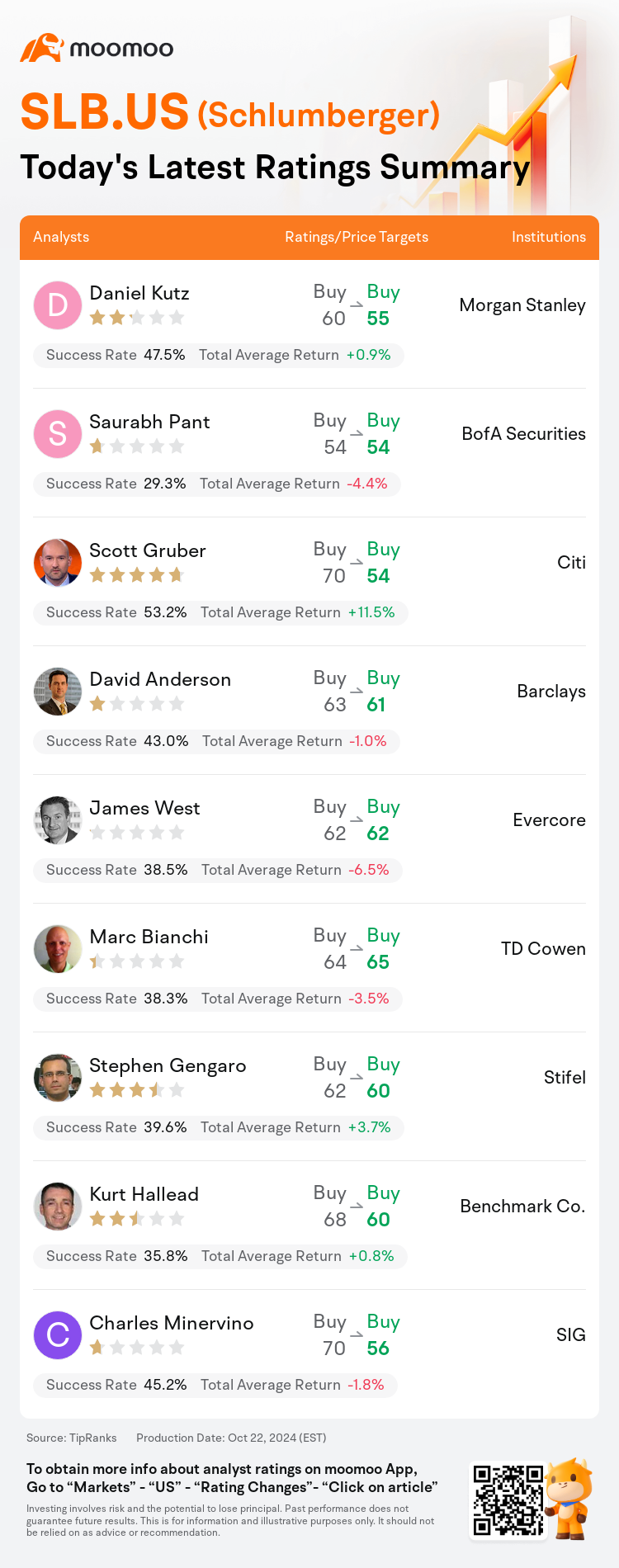

On Oct 22, major Wall Street analysts update their ratings for $Schlumberger (SLB.US)$, with price targets ranging from $54 to $65.

Morgan Stanley analyst Daniel Kutz maintains with a buy rating, and adjusts the target price from $60 to $55.

BofA Securities analyst Saurabh Pant maintains with a buy rating, and maintains the target price at $54.

Citi analyst Scott Gruber maintains with a buy rating, and adjusts the target price from $70 to $54.

Citi analyst Scott Gruber maintains with a buy rating, and adjusts the target price from $70 to $54.

Barclays analyst David Anderson maintains with a buy rating, and adjusts the target price from $63 to $61.

Evercore analyst James West maintains with a buy rating, and maintains the target price at $62.

Furthermore, according to the comprehensive report, the opinions of $Schlumberger (SLB.US)$'s main analysts recently are as follows:

The estimation of upstream spending growth is witnessing a slowdown. The deceleration of revenue growth, especially in international markets, is noted as a significant challenge to SLB's stock. The anticipated international growth is now adjusted to 2% for the year 2025, a decrease from the previous 4.5%. Despite these challenges, it is expected that SLB's digital business will contribute to growth, even in the face of potentially stagnant upstream spending.

SLB consistently achieved its targets, with a particularly strong quarter in digital. However, attention has shifted towards the anticipated slowing of the spending cycle in 2025, prompting a revision of projections.

Acknowledging the current macroeconomic uncertainties, it is challenging to declare a clean slate post the third quarter. However, the recent adjustments may have alleviated a notably burdensome impediment affecting the stock.

Despite a deceleration in international growth rates, current quarterly outcomes, forthcoming quarter projections, and the long-term forecast up to 2025 reinforce the perspective that the investment risk/reward profile for SLB shares is still attractive. Furthermore, it is anticipated that SLB will continue to achieve substantial growth and generate strong free cash flow in the ensuing years.

SLB is positioned optimally to benefit from the intensifying international and offshore upcycle, which is currently in its early to middle phases, with an enhanced outlook for several years of growth in revenue, EBITDA, and free cash flow. Analysts have observed that the company's operational leverage is starting to reflect positively and is likely to maintain this trend as volumes increase, the cycle progresses, and pricing conditions get better. Despite a revision in the 2026 earnings per share forecast due to a recent asset sale in Canada, a deceleration in short-cycle activity growth, and strong performance in the Digital segment, SLB is still regarded as a top selection.

Here are the latest investment ratings and price targets for $Schlumberger (SLB.US)$ from 9 analysts:

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

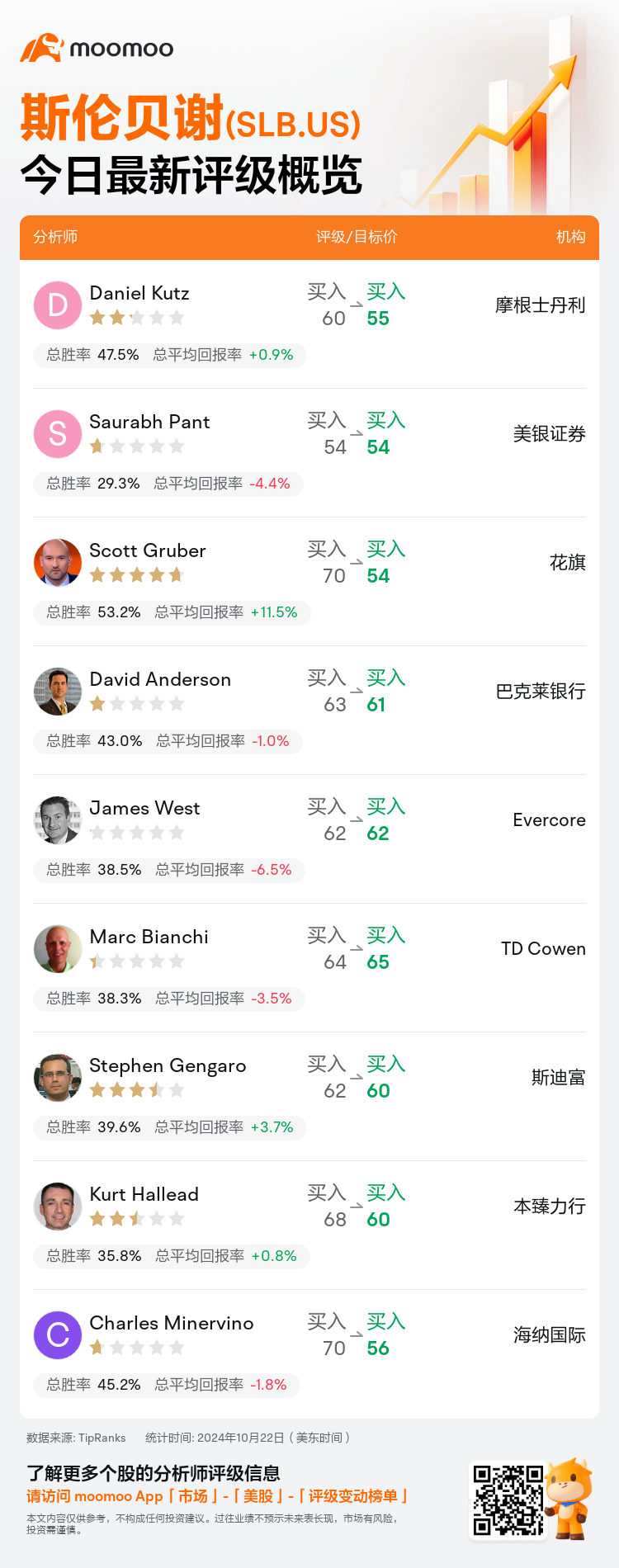

美东时间10月22日,多家华尔街大行更新了$斯伦贝谢 (SLB.US)$的评级,目标价介于54美元至65美元。

摩根士丹利分析师Daniel Kutz维持买入评级,并将目标价从60美元下调至55美元。

美银证券分析师Saurabh Pant维持买入评级,维持目标价54美元。

花旗分析师Scott Gruber维持买入评级,并将目标价从70美元下调至54美元。

花旗分析师Scott Gruber维持买入评级,并将目标价从70美元下调至54美元。

巴克莱银行分析师David Anderson维持买入评级,并将目标价从63美元下调至61美元。

Evercore分析师James West维持买入评级,维持目标价62美元。

此外,综合报道,$斯伦贝谢 (SLB.US)$近期主要分析师观点如下:

上游支出增长的估计出现减速。尤其是在国际市场,营业收入增长的减缓被认为是SLB股票面临的重要挑战。预期的国际增长已调整至2025年2%,较之前的4.5%有所下降。尽管面临这些挑战,预计SLB的数字业务将为增长做出贡献,即使在潜在的上游支出停滞的情况下。

SLb始终实现其目标,尤其是在数字领域表现强劲的一季。然而,注意力已转向2025年支出周期预期放缓,促使修订预测。

鉴于当前宏观经济不确定性,很难在第三季度结束后宣布一片净土。然而,最近的调整可能已减轻了影响股票的负担较重的障碍。

尽管国际增长率放缓,但当前季度业绩、即将到来的季度预测以及长期预测直至2025年均加强了投资风险/回报比对SLb股票仍然具有吸引力的观点。此外,预计SLb将继续实现实质性增长,并在接下来的几年产生强劲的自由现金流。

SLb处于最佳位置,从不断加剧的国际和离岸上游周期中受益,目前这一周期处于初至中期阶段,未来数年营业收入、EBITDA和自由现金流增长前景看好。分析师们注意到,公司的运营杠杆开始积极反映,并且随着量增加、周期进展和价格条件变得更好,有可能保持这一趋势。尽管由于加拿大最近的资产出售、短周期活动增长放缓以及数字业绩出色,2026年每股收益预测出现修订,SLb仍被视为首选。

以下为今日9位分析师对$斯伦贝谢 (SLB.US)$的最新投资评级及目标价:

提示:

TipRanks为独立第三方,提供金融分析师的分析数据,并计算分析师推荐的平均回报率和胜率。提供的信息并非投资建议,仅供参考。本文不对评级数据和报告的完整性与准确性做出认可、声明或保证。

TipRanks提供每位分析师的星级,分析师星级代表分析师所有推荐的过往表现,通过分析师的总胜率和平均回报率综合计算得出,星星越多,则该分析师过往表现越优异,最高为5颗星。

分析师总胜率为近一年分析师的评级成功次数占总评级次数的比率。评级的成功与否,取决于TipRanks的虚拟投资组合是否从该股票中产生正回报。

总平均回报率为基于分析师的初始评级创建虚拟投资组合,并根据评级变化对组合进行调整,在近一年中该投资组合所获得的回报率。

花旗分析师Scott Gruber维持买入评级,并将目标价从70美元下调至54美元。

花旗分析师Scott Gruber维持买入评级,并将目标价从70美元下调至54美元。

Citi analyst Scott Gruber maintains with a buy rating, and adjusts the target price from $70 to $54.

Citi analyst Scott Gruber maintains with a buy rating, and adjusts the target price from $70 to $54.