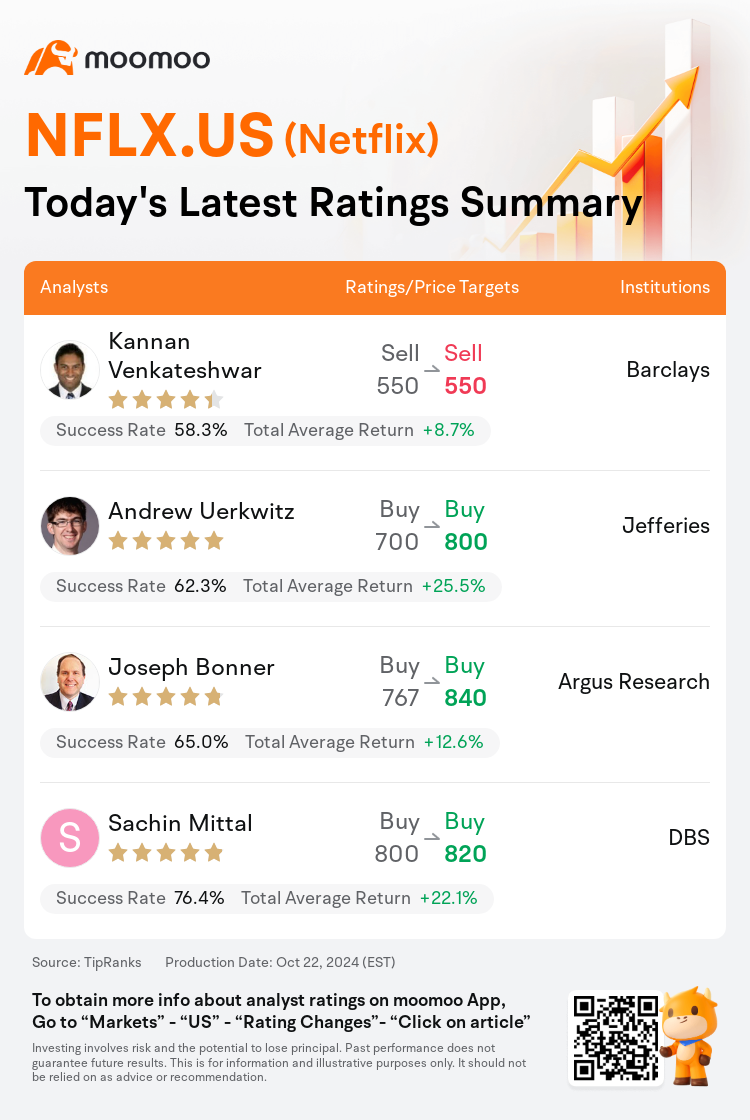

On Oct 22, major Wall Street analysts update their ratings for $Netflix (NFLX.US)$, with price targets ranging from $550 to $840.

Barclays analyst Kannan Venkateshwar maintains with a sell rating, and maintains the target price at $550.

Jefferies analyst Andrew Uerkwitz maintains with a buy rating, and adjusts the target price from $700 to $800.

Argus Research analyst Joseph Bonner maintains with a buy rating, and adjusts the target price from $767 to $840.

Argus Research analyst Joseph Bonner maintains with a buy rating, and adjusts the target price from $767 to $840.

DBS analyst Sachin Mittal maintains with a buy rating, and adjusts the target price from $800 to $820.

Furthermore, according to the comprehensive report, the opinions of $Netflix (NFLX.US)$'s main analysts recently are as follows:

Netflix exhibited a robust third-quarter performance with impressive overall financial results. This includes exceeding expectations in operating income, earnings per share, and free cash flow. The company stands out as a leading entity in the media sector with multiple avenues for growth. Notably, the rapid expansion of its advertising business is projected to see a significant increase by 2025 and is anticipated to spur continued growth in subsequent years.

Q3 outcomes and Q4 forecasts surpassed expectations, with indications pointing towards sustained robust double-digit revenue growth and ongoing margin improvement. Analysts note that Netflix is well-positioned to maintain its status as the world's preeminent and most rapidly expanding streaming service, with projections to enhance earnings by 20%-30% yearly over an extended period. This growth is anticipated to be supported by the introduction of additional growth avenues, including monetized account sharing, advertising, live streaming content, and gaming expansions.

Netflix's Q3 outcomes surpassed expectations, and the discussions highlighted a continuation of robust double-digit revenue growth with margin expansion anticipated in 2025. Analysts perceive Netflix as a primary beneficiary amid a stabilizing streaming market. The platform's advertising subscriber base is projected to achieve significant scale by 2025.

Following the Q3 report, Netflix has demonstrated robust financial performance with an increase in Q3 revenue and operating income, leading to an elevated 2024 forecast in terms of revenue growth, operating margin, and free cash flow. The company has also shared a projection for 2025 revenue, suggesting a growth rate of 11%-13%, and an anticipated operating margin of 28%. The company continues to be a highly favored selection.

Following Netflix's 'Beat & Raise Q3 EPS results,' it is noted that a record high operating margin of 30% seems fairly sustainable. The outlook for Q4 suggests significant potential for surpassing Street subscriber estimates, which is attributed to an exceptionally compelling content lineup and the announcement of selective price increases, with expectations of additional hikes.

Here are the latest investment ratings and price targets for $Netflix (NFLX.US)$ from 4 analysts:

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

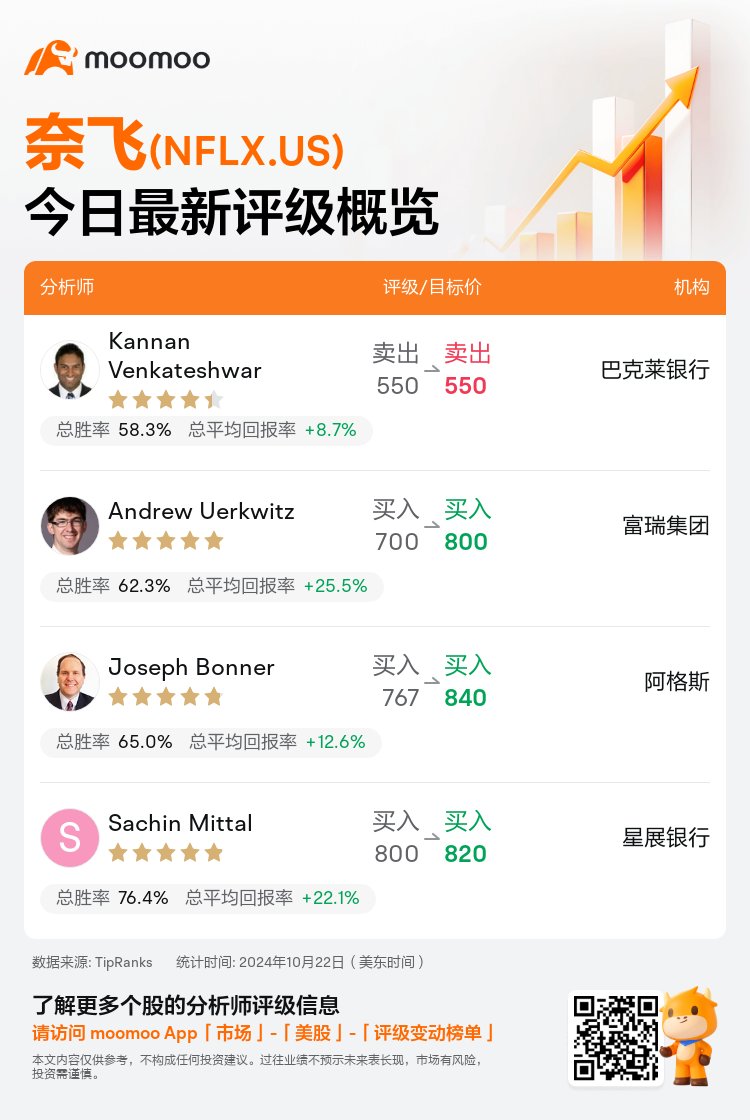

美东时间10月22日,多家华尔街大行更新了$奈飞 (NFLX.US)$的评级,目标价介于550美元至840美元。

巴克莱银行分析师Kannan Venkateshwar维持卖出评级,维持目标价550美元。

富瑞集团分析师Andrew Uerkwitz维持买入评级,并将目标价从700美元上调至800美元。

阿格斯分析师Joseph Bonner维持买入评级,并将目标价从767美元上调至840美元。

阿格斯分析师Joseph Bonner维持买入评级,并将目标价从767美元上调至840美元。

星展银行分析师Sachin Mittal维持买入评级,并将目标价从800美元上调至820美元。

此外,综合报道,$奈飞 (NFLX.US)$近期主要分析师观点如下:

奈飞在第三季度表现强劲,整体财务业绩令人印象深刻。这包括营业收入、每股收益和自由现金流超出预期。该公司在媒体板块脱颖而出,在多个增长途径上处于领先地位。值得注意的是,其广告业务的快速扩张预计到2025年将显著增长,并有望在随后的几年推动持续增长。

第三季度业绩和第四季度预测均超出预期,迹象表明持续强劲的两位数营业收入增长和持续的利润率改善。分析师指出,奈飞有望保持其作为全球领先和最快速扩张的流媒体概念地位,预计在未来一段时间内每年提高20%-30%的收益。这种增长预计将得到额外增长途径的支持,包括账户分享、广告、直播内容和arvr游戏扩展。

奈飞第三季度业绩超出预期,讨论突出了预计在2025年继续强劲的两位数营业收入增长和利润率扩张。分析师认为,在稳定的流媒体市场中,奈飞是一个主要受益者。预计该平台的广告订阅用户群体将在2025年达到重要规模。

在第三季度报告后,奈飞展现出强劲的财务表现,第三季度营业收入和营业利润增加,导致2024年的营业收入增长、营业利润率和自由现金流预测提升。该公司还分享了2025年的营业收入预测,预计增长率为11%-13%,并预期2025年的营业利润率为28%。该公司仍然备受青睐。

根据奈飞的“超额完成第三季度每股收益”的结果,值得注意的是,30%的创纪录营业利润率似乎是相当可持续的。第四季度的前景显示超过街道预期的潜力显著增加,这归因于非常引人注目的内容阵容和宣布选择性提价的消息,预计还会有额外的提价。

以下为今日4位分析师对$奈飞 (NFLX.US)$的最新投资评级及目标价:

提示:

TipRanks为独立第三方,提供金融分析师的分析数据,并计算分析师推荐的平均回报率和胜率。提供的信息并非投资建议,仅供参考。本文不对评级数据和报告的完整性与准确性做出认可、声明或保证。

TipRanks提供每位分析师的星级,分析师星级代表分析师所有推荐的过往表现,通过分析师的总胜率和平均回报率综合计算得出,星星越多,则该分析师过往表现越优异,最高为5颗星。

分析师总胜率为近一年分析师的评级成功次数占总评级次数的比率。评级的成功与否,取决于TipRanks的虚拟投资组合是否从该股票中产生正回报。

总平均回报率为基于分析师的初始评级创建虚拟投资组合,并根据评级变化对组合进行调整,在近一年中该投资组合所获得的回报率。

阿格斯分析师Joseph Bonner维持买入评级,并将目标价从767美元上调至840美元。

阿格斯分析师Joseph Bonner维持买入评级,并将目标价从767美元上调至840美元。

Argus Research analyst Joseph Bonner maintains with a buy rating, and adjusts the target price from $767 to $840.

Argus Research analyst Joseph Bonner maintains with a buy rating, and adjusts the target price from $767 to $840.