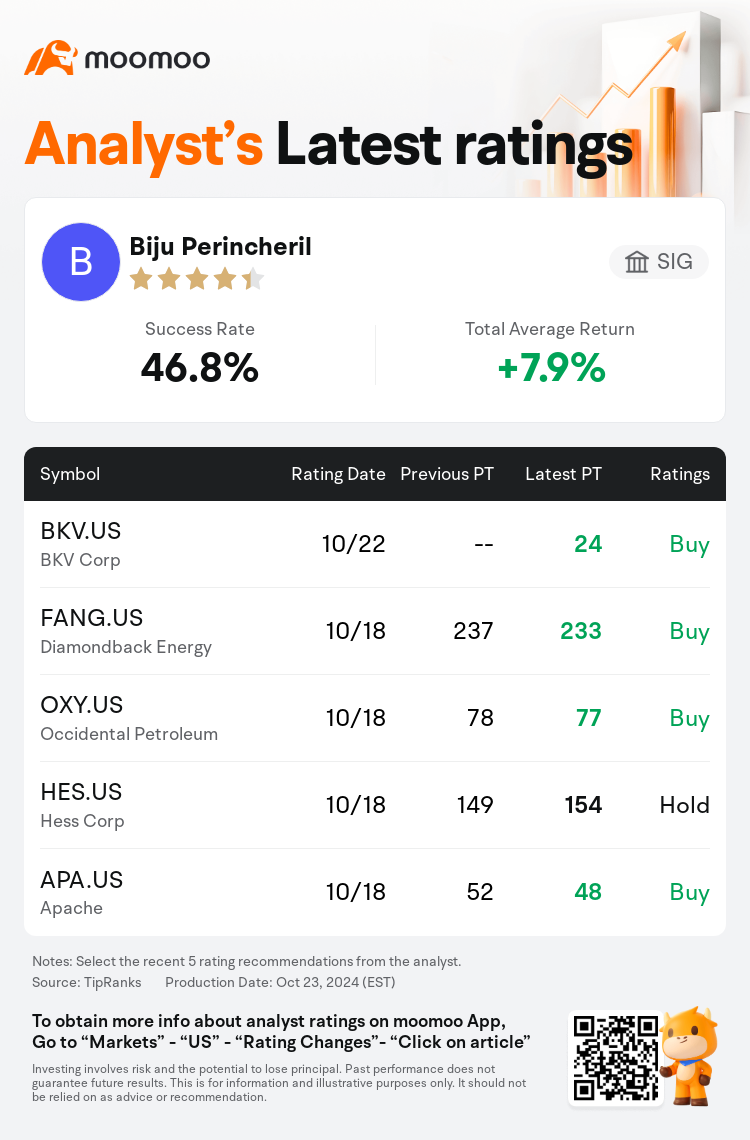

SIG analyst Biju Perincheril initiates coverage on $BKV Corp (BKV.US)$ with a buy rating, and sets the target price at $24.

According to TipRanks data, the analyst has a success rate of 46.8% and a total average return of 7.9% over the past year.

Furthermore, according to the comprehensive report, the opinions of $BKV Corp (BKV.US)$'s main analysts recently are as follows:

Furthermore, according to the comprehensive report, the opinions of $BKV Corp (BKV.US)$'s main analysts recently are as follows:

BKV Corp. differentiates itself from the exploration and production sector by integrating a core of gas production with an expansion strategy that emphasizes power and carbon capture. Despite concerns regarding the complexity of the business and potential growth risks at the present valuation, the opportunity for growth in the two segments of BKV that command higher multiples is perceived as being significantly undervalued.

The company presents a unique opportunity with its involvement in power and carbon capture growth sectors, which could catalyze an increase in its share value, according to a sum-of-the-parts methodology. Due to its comparatively modest scale, investors could benefit from a disproportionate advantage linked to two enduring trends: the expansion in power and the shift towards energy transition.

The U.S. natural gas producer is noted for its integrated operations that span natural gas midstream and downstream sectors, including direct ownership of a power plant complex in Texas. The company recently achieved a milestone by initiating its first carbon capture project. Additionally, it entered into an agreement this past June to sell Carbon Sequestered Gas (CSG) to an industrial end-user, obtaining pricing superior to Henry Hub. It is anticipated that the company will disclose more sales agreements related to CSG in conjunction with the expansion of its carbon capture, utilization, and storage (CCUS) business.

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

海纳国际分析师Biju Perincheril首予$BKV Corp (BKV.US)$买入评级,目标价24美元。

根据TipRanks数据显示,该分析师近一年总胜率为46.8%,总平均回报率为7.9%。

此外,综合报道,$BKV Corp (BKV.US)$近期主要分析师观点如下:

此外,综合报道,$BKV Corp (BKV.US)$近期主要分析师观点如下:

BKV公司通过将燃料币生产核心与强调电力和碳捕获的扩展策略整合,从勘探和生产板块区别开来。尽管对业务复杂性和潜在增长风险的担忧存在于当前估值,但认为BKV在两个命令更高倍数的板块中增长机会被明显低估。

该公司以参与电力和碳捕获增长领域的机会为特色,这可能会在其股票价值方面催化增长,根据零部件法。由于其相对适中的规模,投资者可能会从与两种持久趋势相关的不成比例优势中受益:电力扩张和能源转型的转变。

这家美国天然气生产商以其涵盖天然气中游和下游板块的综合运营而闻名,包括在德克萨斯州拥有的发电厂综合体的直接所有权。该公司最近通过启动其第一个碳捕获项目实现了一个里程碑。此外,它于今年6月与一个工业最终用户达成协议,出售碳封存天然气(CSG),获得优于Henry Hub的价格。预计该公司将与其碳捕获、利用和封存(CCUS)业务扩张相结合地披露更多与CSG相关的销售协议。

提示:

TipRanks为独立第三方,提供金融分析师的分析数据,并计算分析师推荐的平均回报率和胜率。提供的信息并非投资建议,仅供参考。本文不对评级数据和报告的完整性与准确性做出认可、声明或保证。

TipRanks提供每位分析师的星级,分析师星级代表分析师所有推荐的过往表现,通过分析师的总胜率和平均回报率综合计算得出,星星越多,则该分析师过往表现越优异,最高为5颗星。

分析师总胜率为近一年分析师的评级成功次数占总评级次数的比率。评级的成功与否,取决于TipRanks的虚拟投资组合是否从该股票中产生正回报。

总平均回报率为基于分析师的初始评级创建虚拟投资组合,并根据评级变化对组合进行调整,在近一年中该投资组合所获得的回报率。

此外,综合报道,$BKV Corp (BKV.US)$近期主要分析师观点如下:

此外,综合报道,$BKV Corp (BKV.US)$近期主要分析师观点如下:

Furthermore, according to the comprehensive report, the opinions of

Furthermore, according to the comprehensive report, the opinions of