Top 3 Industrials Stocks That Could Blast Off In October

Top 3 Industrials Stocks That Could Blast Off In October

The most oversold stocks in the industrials sector presents an opportunity to buy into undervalued companies.

工业板块中最超卖的股票提供了一个买入被低估的公司的机会。

The RSI is a momentum indicator, which compares a stock's strength on days when prices go up to its strength on days when prices go down. When compared to a stock's price action, it can give traders a better sense of how a stock may perform in the short term. An asset is typically considered oversold when the RSI is below 30, according to Benzinga Pro.

RSI指标是一种动量指标,它比较了股票在价格上涨时的强度与在价格下跌时的强度。与股票的价格走势进行比较,可以给交易者更好的了解股票短期内表现的良好程度。当RSI低于30时,资产通常被认为是超卖的,根据Benzinga Pro的数据。

Here's the latest list of major oversold players in this sector, having an RSI near or below 30.

以下是本行业板块最近的主要超卖股票列表,RSI接近或低于30。

General Electric Co (NYSE:GE)

通用电气公司(纽交所:GE)

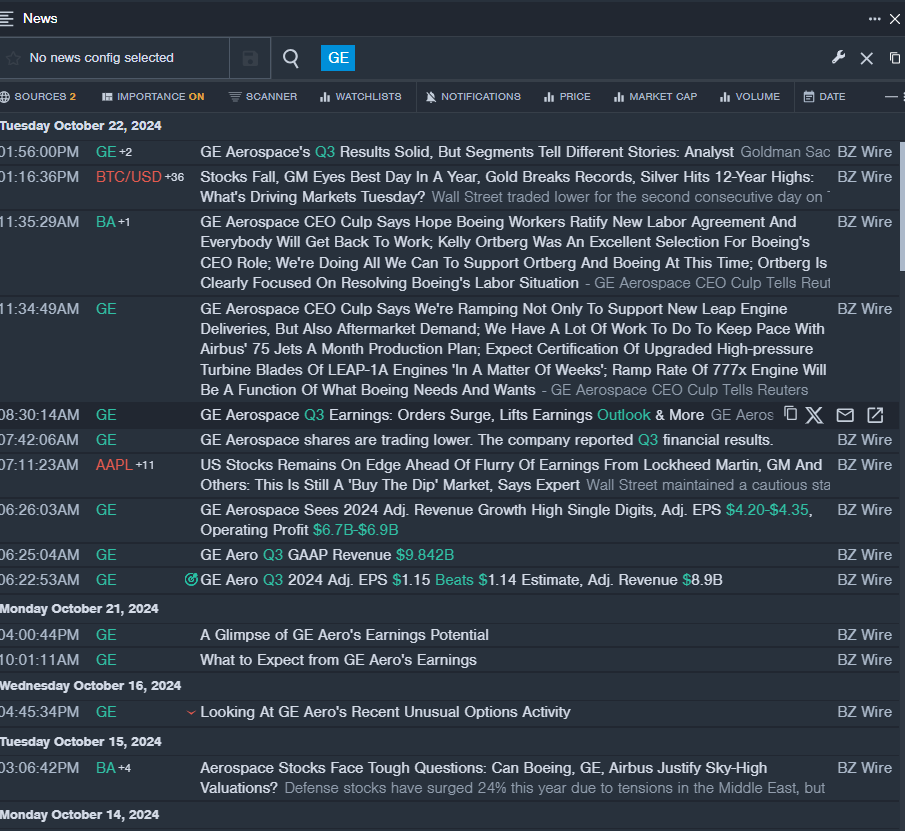

- On Oct. 22, the company reported adjusted revenue growth of 6% Y/Y to $8.943 billion and GAAP revenue of $9.84 billion. "The GE Aerospace team delivered strong results, with demand driving orders up 28%. We grew earnings 25% and produced substantial free cash flow, both largely driven by services. Given the strength of our results and 4Q expectations, we're raising our earnings and cash guidance for the year," commented GE Aerospace Chairman and CEO H. Lawrence Culp, Jr. The analyst consensus was $9.022 billion.. The company's stock fell around 7% over the past five days and has a 52-week low of $84.32.

- RSI Value: 26.67

- GE Price Action: Shares of General Electric fell 9.1% to close at $176.66 on Tuesday.

- Benzinga Pro's real-time newsfeed alerted to latest GE news.

- 在10月22日,该公司报告调整后的营业收入同比增长6%,达到89.43亿美元,以及98.4亿美元的通用会计准则(GAAP)营业收入。 “通用电气航空航天团队取得了强劲的业绩,需求推动订单增长28%。我们的盈利增长了25%,并产生了大量的自由现金流,这两者主要由服务驱动。鉴于我们的业绩和第四季度的预期强劲,我们上调了全年盈利和现金指引,”通用电气航空航天公司董事长兼首席执行官H·劳伦斯·卡普勒(H. Lawrence Culp, Jr.)评论道。分析师一致预期为90.22亿美元。过去五天,公司股价下跌了约7%,并且52周最低价为8432美元。

- RSI数值:26.67

- 通用电气股价走势:通用电气股票周二下跌9.1%,收盘价为176.66美元。

- Benzinga Pro的实时新闻提醒了最新的通用电气资讯。

Lockheed Martin Corp (NYSE:LMT)

洛克希德马丁公司(NYSE:LMT)

- On Oct. 22, Lockheed Martin reported mixed third-quarter results. The company reported net sales growth of 1.3% year-over-year to $17.104 billion, missing the consensus of $17.351 billion. Adjusted EPS of $6.84, up from $6.77 in the prior year, topped the consensus of $6.50. "As a result of our strong year-to-date results and confidence in our near-term performance, we are raising the outlook for full year 2024 sales, segment operating profit, EPS and free cash flow," commented Lockheed Martin Chairman, President, and CEO Jim Taiclet. The company's stock fell around 4% over the past five days and has a 52-week low of $413.92.

- RSI Value: 29.00

- LMT Price Action: Shares of Lockheed Martin fell 6.1% to close at $576.98 on Tuesday.

- Benzinga Pro's charting tool helped identify the trend in LMT stock.

- 洛克希德马丁在10月22日发布了混合的第三季度财报。公司报告净销售额同比增长1.3%,达到171.04亿美元,低于173.51亿美元的共识预期。调整后的每股收益为6.84美元,高于去年的6.77美元,并超过了6.50美元的共识预期。洛克希德马丁董事长、总裁兼首席执行官吉姆·泰克莱特表示:“由于我们强劲的年初到现在的业绩以及对近期表现的信心,我们提升了2024年全年销售、板块营业利润、每股收益和自由现金流的展望。”该公司股价在过去五天下跌约4%,52周最低价为413.92美元。

- RSI数值:29.00

- LMt股价走势:洛克希德马丁股票周二下跌6.1%,收于576.98美元。

- Benzinga Pro的图表工具帮助识别了LMt股票的趋势。

ManpowerGroup Inc (NYSE:MAN)

万宝盛华公司(纽交所:MAN)

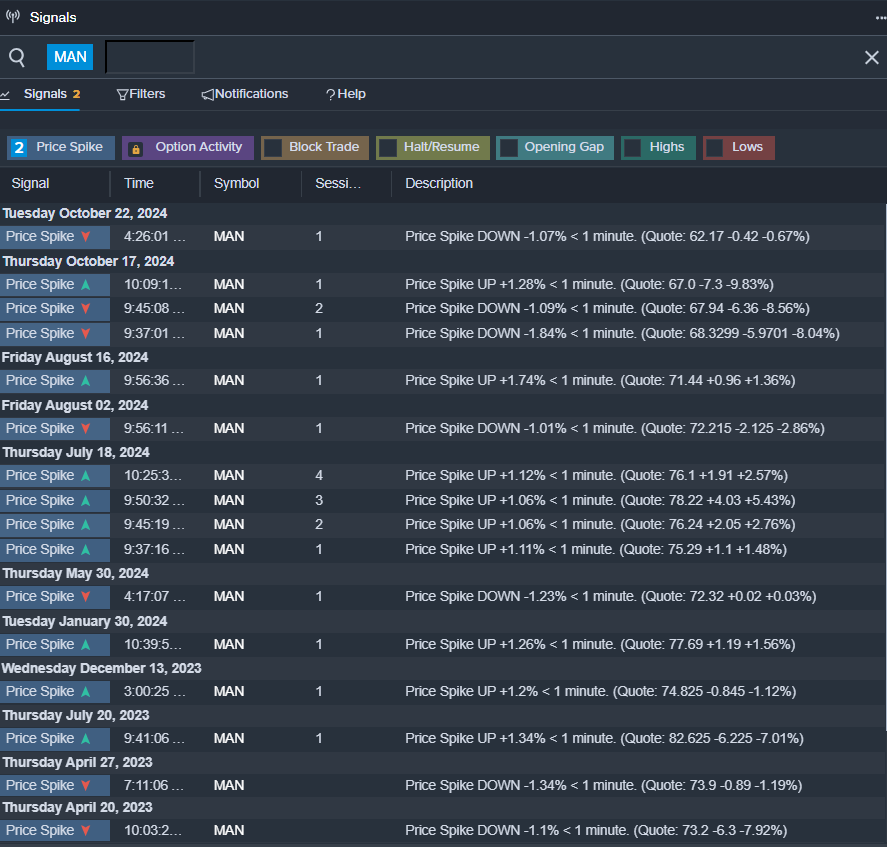

- On Oct. 17, ManpowerGroup issued fourth-quarter EPS guidance below estimates. The company's shares fell around 13% over the past five days and has a 52-week low of $61.53.

- RSI Value: 29.40

- MAN Price Action: Shares of ManpowerGroup gained 0.4% to close at $62.84 on Tuesday.

- Benzinga Pro's signals feature notified of a potential breakout in MAN shares.

- 万宝盛华在10月17日发布了低于预期的第四季度每股收益指引。该公司股价在过去五天内下跌约13%,并且最低为52周的61.53美元。

- RSI数值:29.40

- 万宝盛华股票价格表现:周二,万宝盛华股票上涨0.4%,收盘价为62.84美元。

- Benzinga Pro的信号功能通知了MAN股票潜在突破的可能性。

Read More:

阅读更多:

- Dow Edges Lower As Investors Watch Earnings Reports With Caution: Fear Index Remains In 'Greed' Zone

- 道琼斯指数小幅下跌,投资者谨慎关注财报:恐惧指数仍处于'贪婪'区域