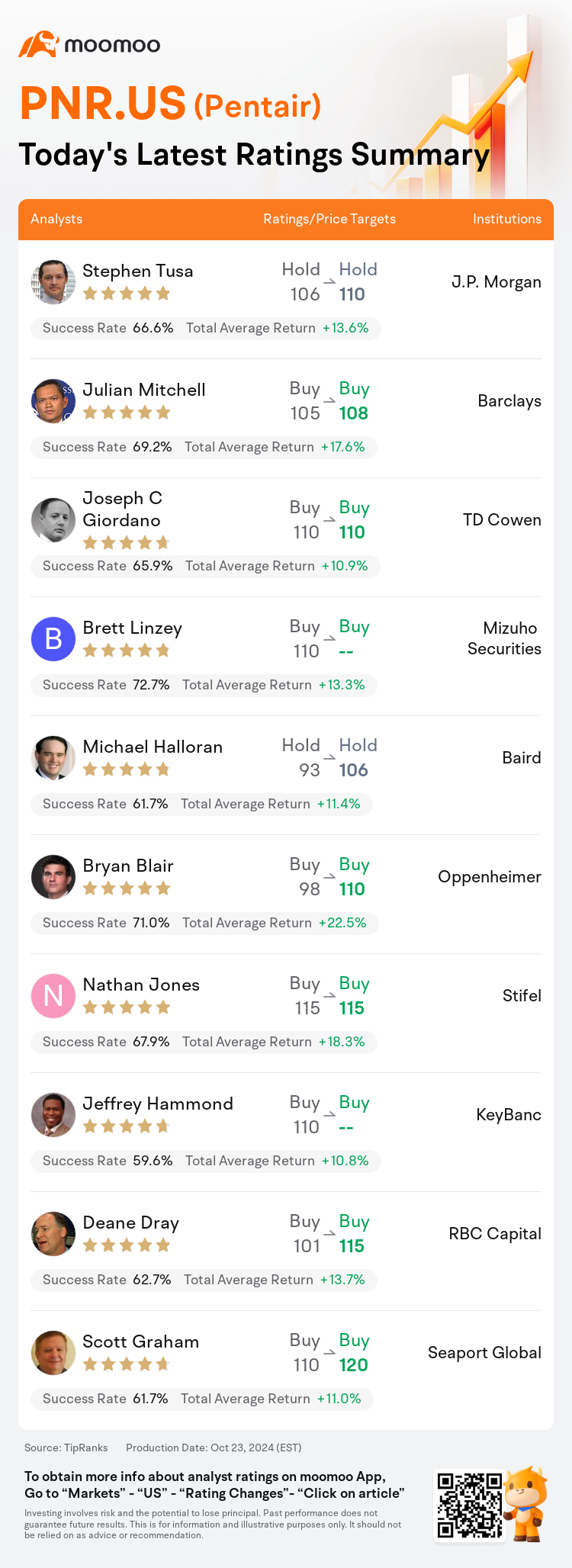

On Oct 23, major Wall Street analysts update their ratings for $Pentair (PNR.US)$, with price targets ranging from $106 to $120.

J.P. Morgan analyst Stephen Tusa maintains with a hold rating, and adjusts the target price from $106 to $110.

Barclays analyst Julian Mitchell maintains with a buy rating, and adjusts the target price from $105 to $108.

TD Cowen analyst Joseph C Giordano maintains with a buy rating, and maintains the target price at $110.

TD Cowen analyst Joseph C Giordano maintains with a buy rating, and maintains the target price at $110.

Mizuho Securities analyst Brett Linzey maintains with a buy rating.

Baird analyst Michael Halloran maintains with a hold rating, and adjusts the target price from $93 to $106.

Furthermore, according to the comprehensive report, the opinions of $Pentair (PNR.US)$'s main analysts recently are as follows:

The company's potential to enhance margins beyond the projected 2026 baseline of 24% is gaining confidence, underscored by ongoing margin growth amidst sales challenges. This is attributed to the company's progress through the second phase of its three-phase transformation. Furthermore, the initial stages of the 80/20 initiative are expected to yield positive outcomes by 2025. Additionally, falling interest rates are anticipated to invigorate demand within the consumer discretionary segments of the Pool and Water Solutions businesses in the 2025/2026 timeframe.

The company Pentair is poised for another year of robust double-digit earnings growth in 2025, along with high teens free cash flow margins, according to an analyst's research note.

The company exhibited a strong Q3 performance, producing unprecedented free cash flow for the year thus far and recorded growth in the Pool segment for the second quarter running, along with a 470 basis points year-over-year margin enhancement. It's noted that the ongoing 'transformation benefits' at the company, together with initial successes from their 80/20 strategy, have sufficiently compensated for weaker flows and certain industrial customer capital expenditure postponements.

Management appears to be surpassing their plans, and it is anticipated that FY26 goals may be surpassed next year, excluding market fluctuations. Additionally, the valuation continues to be appealing when compared with counterparts in the water sector.

The firm remains impressed with Pentair's transformation tailwinds, which are believed to more than counterbalance the softer demand trends seen year-over-year. The firm acknowledges that the 80/20 principles present further chances for advancement beyond the existing long-term strategy. Looking ahead, there is a maintained confidence in the potential for a share re-rating as investors fully recognize the value of the company's compelling transformation.

Here are the latest investment ratings and price targets for $Pentair (PNR.US)$ from 10 analysts:

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

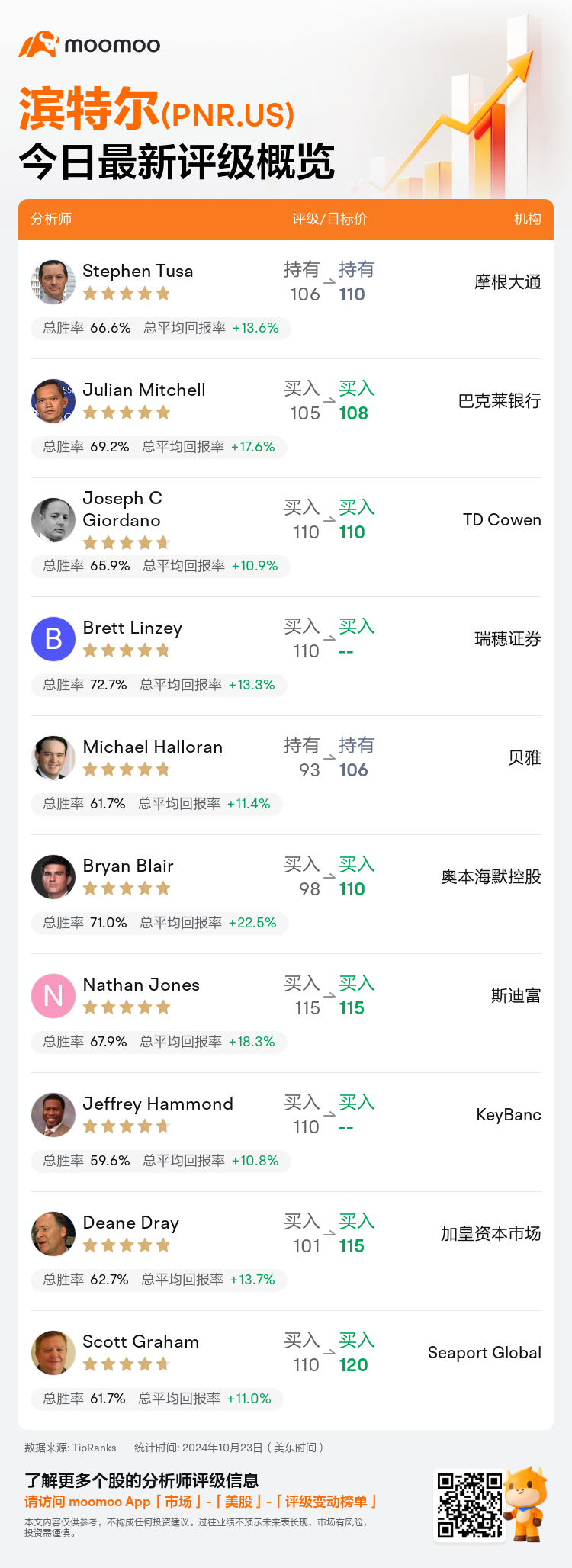

美东时间10月23日,多家华尔街大行更新了$滨特尔 (PNR.US)$的评级,目标价介于106美元至120美元。

摩根大通分析师Stephen Tusa维持持有评级,并将目标价从106美元上调至110美元。

巴克莱银行分析师Julian Mitchell维持买入评级,并将目标价从105美元上调至108美元。

TD Cowen分析师Joseph C Giordano维持买入评级,维持目标价110美元。

TD Cowen分析师Joseph C Giordano维持买入评级,维持目标价110美元。

瑞穗证券分析师Brett Linzey维持买入评级。

贝雅分析师Michael Halloran维持持有评级,并将目标价从93美元上调至106美元。

此外,综合报道,$滨特尔 (PNR.US)$近期主要分析师观点如下:

公司将利用自身潜力在2026年之后将24%的基准线提升至更高水平的信心增强,这一点在销售挑战持续的情况下不断增长的利润率中得到了强调。这归因于公司在三阶段转型的第二阶段取得的进展。此外,80/20计划的初期阶段预计将在2025年前产生积极的成果。此外,预计利率的下降将在2025/2026年期间激发消费性离散部门的需求。

滨特尔公司有望在2025年再次实现强劲的两位数盈利增长,同时实现高青少年水平的自由现金流利润率,根据分析师的研究报告。

公司展现出强劲的Q3业绩,迄今为止产生了空前的自由现金流,并录得泳池板块连续第二季度增长,年度毛利率增幅达470个基点。值得注意的是,公司正在进行的“转型收益”,以及80/20策略的初步成功,已经足以弥补较弱的资金流动和某些工业客户资本支出的推迟。

管理层似乎正在超过他们的计划,预计FY26目标可能在明年实现,除了市场波动。此外,与水务板块中的同行相比,估值依然具有吸引力。

该公司对滨特尔的转型势头印象深刻,据信将会超过年度较软的需求趋势。公司承认80/20原则为当前长期策略之外的进阶提供了进一步机会。展望未来,对该公司引人注目的转型价值完全认可的投资者有着坚定的信心,因此他们对股票重新定价的潜力仍然满怀信心。

以下为今日10位分析师对$滨特尔 (PNR.US)$的最新投资评级及目标价:

提示:

TipRanks为独立第三方,提供金融分析师的分析数据,并计算分析师推荐的平均回报率和胜率。提供的信息并非投资建议,仅供参考。本文不对评级数据和报告的完整性与准确性做出认可、声明或保证。

TipRanks提供每位分析师的星级,分析师星级代表分析师所有推荐的过往表现,通过分析师的总胜率和平均回报率综合计算得出,星星越多,则该分析师过往表现越优异,最高为5颗星。

分析师总胜率为近一年分析师的评级成功次数占总评级次数的比率。评级的成功与否,取决于TipRanks的虚拟投资组合是否从该股票中产生正回报。

总平均回报率为基于分析师的初始评级创建虚拟投资组合,并根据评级变化对组合进行调整,在近一年中该投资组合所获得的回报率。

TD Cowen分析师Joseph C Giordano维持买入评级,维持目标价110美元。

TD Cowen分析师Joseph C Giordano维持买入评级,维持目标价110美元。

TD Cowen analyst Joseph C Giordano maintains with a buy rating, and maintains the target price at $110.

TD Cowen analyst Joseph C Giordano maintains with a buy rating, and maintains the target price at $110.