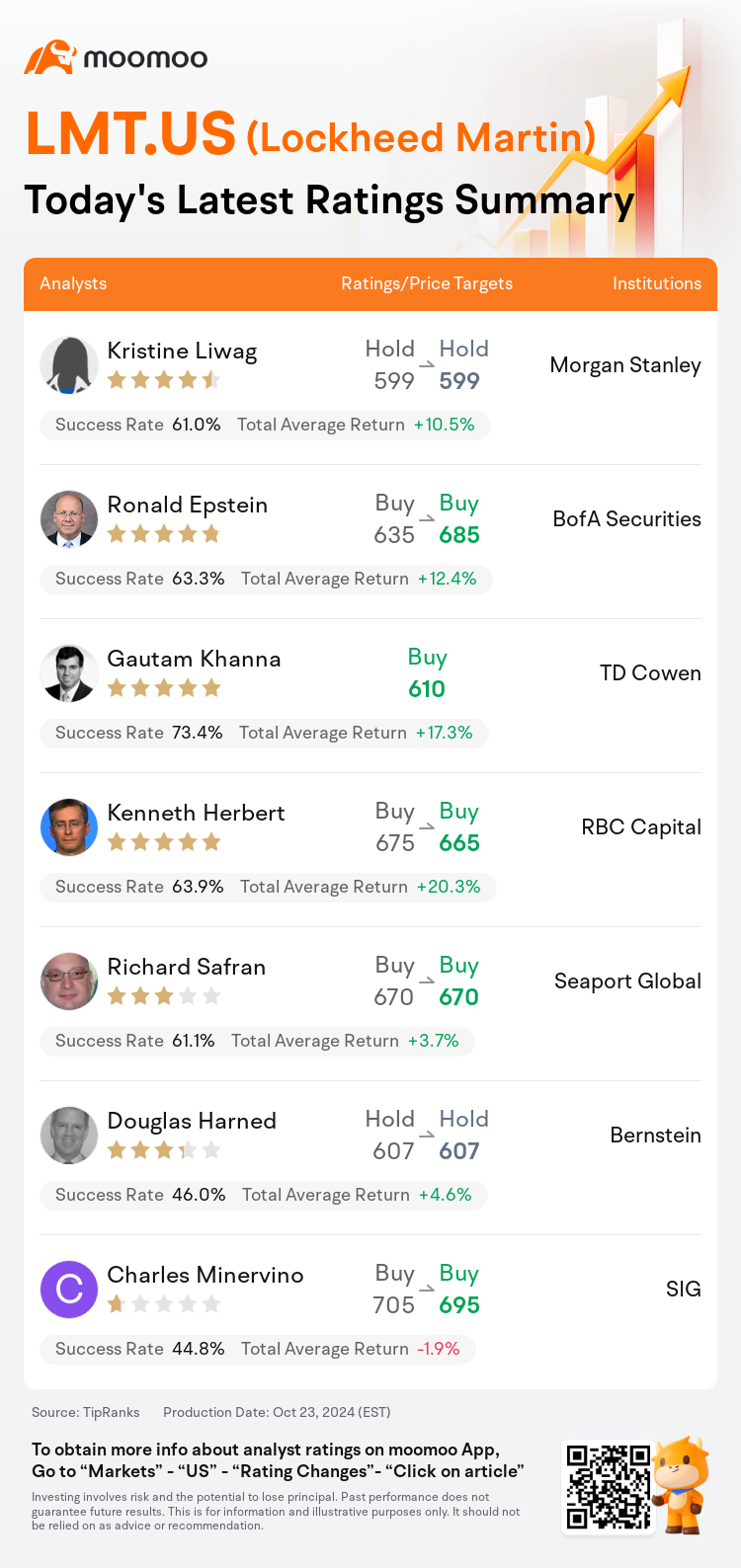

On Oct 23, major Wall Street analysts update their ratings for $Lockheed Martin (LMT.US)$, with price targets ranging from $599 to $695.

Morgan Stanley analyst Kristine Liwag maintains with a hold rating, and maintains the target price at $599.

BofA Securities analyst Ronald Epstein maintains with a buy rating, and adjusts the target price from $635 to $685.

TD Cowen analyst Gautam Khanna initiates coverage with a buy rating, and sets the target price at $610.

TD Cowen analyst Gautam Khanna initiates coverage with a buy rating, and sets the target price at $610.

RBC Capital analyst Kenneth Herbert maintains with a buy rating, and adjusts the target price from $675 to $665.

Seaport Global analyst Richard Safran maintains with a buy rating, and maintains the target price at $670.

Furthermore, according to the comprehensive report, the opinions of $Lockheed Martin (LMT.US)$'s main analysts recently are as follows:

Lockheed Martin's recent 'soft' Q3 sales have impacted the overall sentiment, although the initial outlook for 2025 is probably understated. The company's sales and operating profit growth have been primarily driven by the Missiles and Fire Control segment, which is seen as a significant factor for its future prospects leading into 2025. Additionally, the recovery of the company's F-35 program is progressing as planned.

Lockheed Martin's third-quarter earnings surpassed expectations, but its medium-term guidance fell short compared to mid-single-digit percentage expectations. The company is favored for its leading position within the defense sector, as well as its strong international sales and short-cycle leverage.

Here are the latest investment ratings and price targets for $Lockheed Martin (LMT.US)$ from 7 analysts:

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

美东时间10月23日,多家华尔街大行更新了$洛克希德马丁 (LMT.US)$的评级,目标价介于599美元至695美元。

摩根士丹利分析师Kristine Liwag维持持有评级,维持目标价599美元。

美银证券分析师Ronald Epstein维持买入评级,并将目标价从635美元上调至685美元。

TD Cowen分析师Gautam Khanna首予买入评级,目标价610美元。

TD Cowen分析师Gautam Khanna首予买入评级,目标价610美元。

加皇资本市场分析师Kenneth Herbert维持买入评级,并将目标价从675美元下调至665美元。

Seaport Global分析师Richard Safran维持买入评级,维持目标价670美元。

此外,综合报道,$洛克希德马丁 (LMT.US)$近期主要分析师观点如下:

以下为今日7位分析师对$洛克希德马丁 (LMT.US)$的最新投资评级及目标价:

提示:

TipRanks为独立第三方,提供金融分析师的分析数据,并计算分析师推荐的平均回报率和胜率。提供的信息并非投资建议,仅供参考。本文不对评级数据和报告的完整性与准确性做出认可、声明或保证。

TipRanks提供每位分析师的星级,分析师星级代表分析师所有推荐的过往表现,通过分析师的总胜率和平均回报率综合计算得出,星星越多,则该分析师过往表现越优异,最高为5颗星。

分析师总胜率为近一年分析师的评级成功次数占总评级次数的比率。评级的成功与否,取决于TipRanks的虚拟投资组合是否从该股票中产生正回报。

总平均回报率为基于分析师的初始评级创建虚拟投资组合,并根据评级变化对组合进行调整,在近一年中该投资组合所获得的回报率。

TD Cowen分析师Gautam Khanna首予买入评级,目标价610美元。

TD Cowen分析师Gautam Khanna首予买入评级,目标价610美元。

TD Cowen analyst Gautam Khanna initiates coverage with a buy rating, and sets the target price at $610.

TD Cowen analyst Gautam Khanna initiates coverage with a buy rating, and sets the target price at $610.