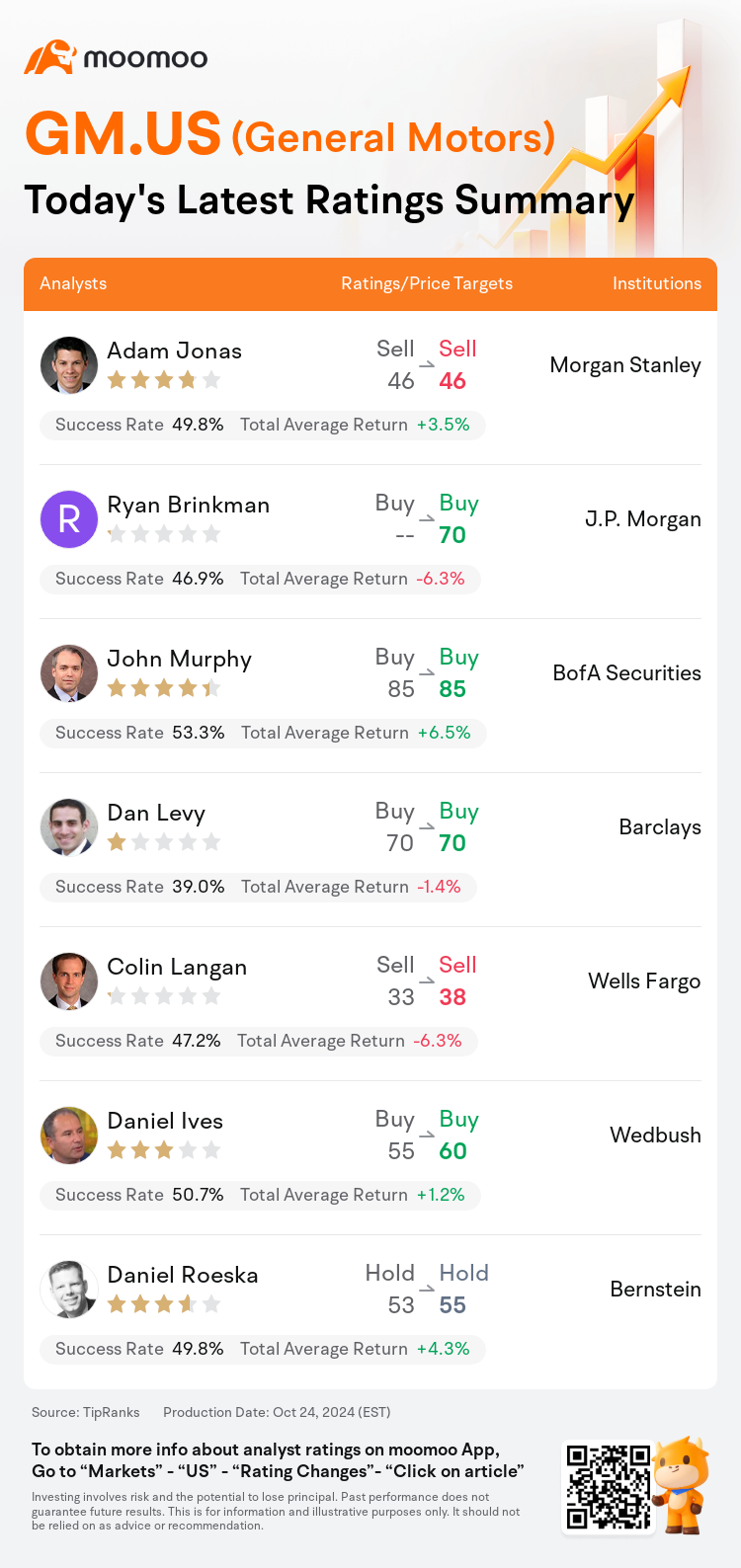

On Oct 24, major Wall Street analysts update their ratings for $General Motors (GM.US)$, with price targets ranging from $38 to $85.

Morgan Stanley analyst Adam Jonas maintains with a sell rating, and maintains the target price at $46.

J.P. Morgan analyst Ryan Brinkman maintains with a buy rating, and sets the target price at $70.

BofA Securities analyst John Murphy maintains with a buy rating, and maintains the target price at $85.

BofA Securities analyst John Murphy maintains with a buy rating, and maintains the target price at $85.

Barclays analyst Dan Levy maintains with a buy rating, and maintains the target price at $70.

Wells Fargo analyst Colin Langan maintains with a sell rating, and adjusts the target price from $33 to $38.

Furthermore, according to the comprehensive report, the opinions of $General Motors (GM.US)$'s main analysts recently are as follows:

General Motors has disclosed Q3 results that were significantly stronger than expected, prompting a slight elevation in the EBIT forecast for the full year of 2024 and a substantially improved free cash flow outlook. This information reinforces the belief in the management's forecast presented during the recent investor day, particularly their plans to expedite share buybacks to achieve a share count of less than 1 billion by the beginning of 2025.

General Motors maintains a trajectory of robust gross margin earnings and strong free cash flow generation, as reflected in the company's Q3 performance. Despite market fluctuations, there is a belief that the company merits a significant valuation multiple, well above the conventional 5x.

General Motors' dominance in the North American large SUV market is contributing to balancing out some of the lower pricing pressures observed in other market segments. It is anticipated that the company's stronger-than-expected Q3 earnings, updated guidance, and the suggested share repurchase in Q4 will lead to an upward revision in consensus estimates and market expectations.

General Motors' recent quarter performance has been compared to an outstanding athletic achievement, showcasing very strong results. This trend is a continuation of previous impressive quarters, with the company maintaining a dedicated focus on optimizing its internal combustion engine (ICE) and electric vehicle (EV) offerings. Simultaneously, the firm is balancing new product launches and prioritizing profitability with a sense of urgency.

General Motors' shares experienced an approximate 10% rise following the reaffirmation of plans to repurchase approximately 100 million shares. The company's Q3 earnings per share outperformance and an increase in gross margin have led to an elevated full-year EBIT forecast. Nevertheless, there continues to be perceived risks related to pricing, volume, and the mix of battery electric vehicles, all of which are factors influencing the conservative guidance for Q4. Additionally, the issue of warranty has emerged as a new area of concern.

Here are the latest investment ratings and price targets for $General Motors (GM.US)$ from 7 analysts:

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

美东时间10月24日,多家华尔街大行更新了$通用汽车 (GM.US)$的评级,目标价介于38美元至85美元。

摩根士丹利分析师Adam Jonas维持卖出评级,维持目标价46美元。

摩根大通分析师Ryan Brinkman维持买入评级,目标价70美元。

美银证券分析师John Murphy维持买入评级,维持目标价85美元。

美银证券分析师John Murphy维持买入评级,维持目标价85美元。

巴克莱银行分析师Dan Levy维持买入评级,维持目标价70美元。

富国集团分析师Colin Langan维持卖出评级,并将目标价从33美元上调至38美元。

此外,综合报道,$通用汽车 (GM.US)$近期主要分析师观点如下:

通用汽车已公布了Q3成绩,大大超出预期,促使2024年整年EBIt预测略微上调,并大幅改善自由现金流展望。这一信息强化了对管理层在最近的投资者日提出的预测的信心,特别是他们计划加快回购股份,以在2025年初之前将股数降至10亿以下。

通用汽车保持强劲毛利率收入和强劲的自由现金流产生的轨迹,如公司Q3的表现所反映的。尽管市场波动,但有一种信念,即公司应得到显著的估值倍数,远高于传统的5倍。

通用汽车在北美大型SUV市场的主导地位有助于平衡其他市场细分中观察到的一些较低的定价压力。预计公司Q3盈利高于预期、更新的指导以及Q4建议的股份回购将导致共识预测和市场期望的上调。

通用汽车最近一个季度的表现被比作出色的运动成就,展示了非常强劲的成绩。这一趋势是之前令人印象深刻的季度的延续,公司继续专注于优化其内燃机(ICE)和电动车(EV)产品。与此同时,该公司正在平衡新产品推出,并优先考虑盈利能力和紧迫感。

通用汽车股票在确认回购约10000万股计划后经历了约10%的增长。公司Q3每股盈利的超预期和毛利率的增加导致了全年EBIt预测的提升。然而,仍然存在与定价、成交量和电动汽车电池混合等因素相关的风险,这些因素影响了Q4的保守指导。此外,保修问题已成为一个新的关注领域。

以下为今日7位分析师对$通用汽车 (GM.US)$的最新投资评级及目标价:

提示:

TipRanks为独立第三方,提供金融分析师的分析数据,并计算分析师推荐的平均回报率和胜率。提供的信息并非投资建议,仅供参考。本文不对评级数据和报告的完整性与准确性做出认可、声明或保证。

TipRanks提供每位分析师的星级,分析师星级代表分析师所有推荐的过往表现,通过分析师的总胜率和平均回报率综合计算得出,星星越多,则该分析师过往表现越优异,最高为5颗星。

分析师总胜率为近一年分析师的评级成功次数占总评级次数的比率。评级的成功与否,取决于TipRanks的虚拟投资组合是否从该股票中产生正回报。

总平均回报率为基于分析师的初始评级创建虚拟投资组合,并根据评级变化对组合进行调整,在近一年中该投资组合所获得的回报率。

美银证券分析师John Murphy维持买入评级,维持目标价85美元。

美银证券分析师John Murphy维持买入评级,维持目标价85美元。

BofA Securities analyst John Murphy maintains with a buy rating, and maintains the target price at $85.

BofA Securities analyst John Murphy maintains with a buy rating, and maintains the target price at $85.