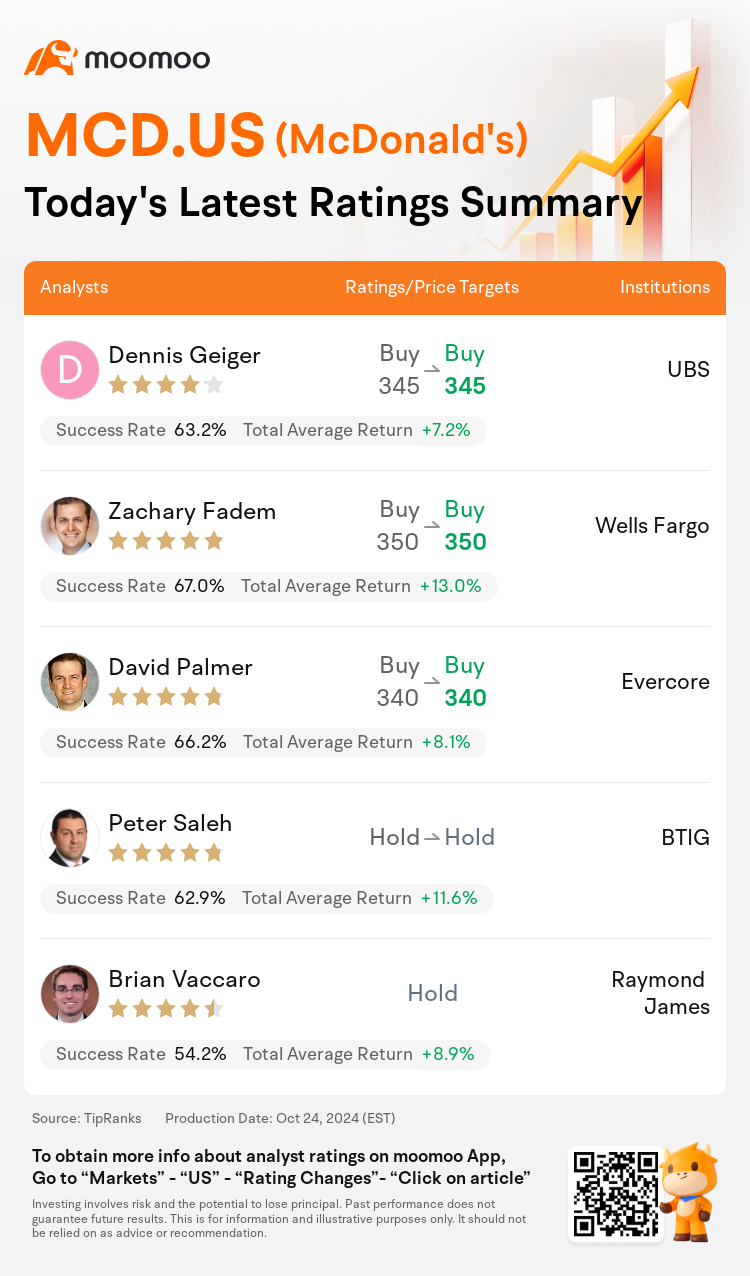

On Oct 24, major Wall Street analysts update their ratings for $McDonald's (MCD.US)$, with price targets ranging from $340 to $350.

UBS analyst Dennis Geiger maintains with a buy rating, and maintains the target price at $345.

Wells Fargo analyst Zachary Fadem maintains with a buy rating, and maintains the target price at $350.

Evercore analyst David Palmer maintains with a buy rating, and maintains the target price at $340.

Evercore analyst David Palmer maintains with a buy rating, and maintains the target price at $340.

BTIG analyst Peter Saleh maintains with a hold rating.

Raymond James analyst Brian Vaccaro initiates coverage with a hold rating.

Furthermore, according to the comprehensive report, the opinions of $McDonald's (MCD.US)$'s main analysts recently are as follows:

The firm is modifying its price targets within the restaurant industry coverage to account for changes in estimates and increased market multiples in anticipation of upcoming third-quarter reports from the sector.

The firm believes that McDonald's has experienced an easing of comparable sales at the beginning of Q3, which then steadied at more modest levels. It is noted that, although susceptible to shifts in lower-income consumer spending, the effectiveness of the quick service segment's emphasis on value has been apparent. Additionally, the overall trends of inflation and pricing are seen to be relenting.

Reports of an E. coli outbreak associated with McDonald's locations in various U.S. states have raised concerns, potentially impacting consumer perceptions as well as the company's U.S. comparable sales—a critical factor for investor sentiment. Additionally, there is perceived risk to McDonald's near-term performance in international markets due to an increasingly challenging global macroeconomic environment. With uncertainties emerging in all business segments, it becomes challenging to predict near-term growth in share value.

Here are the latest investment ratings and price targets for $McDonald's (MCD.US)$ from 5 analysts:

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

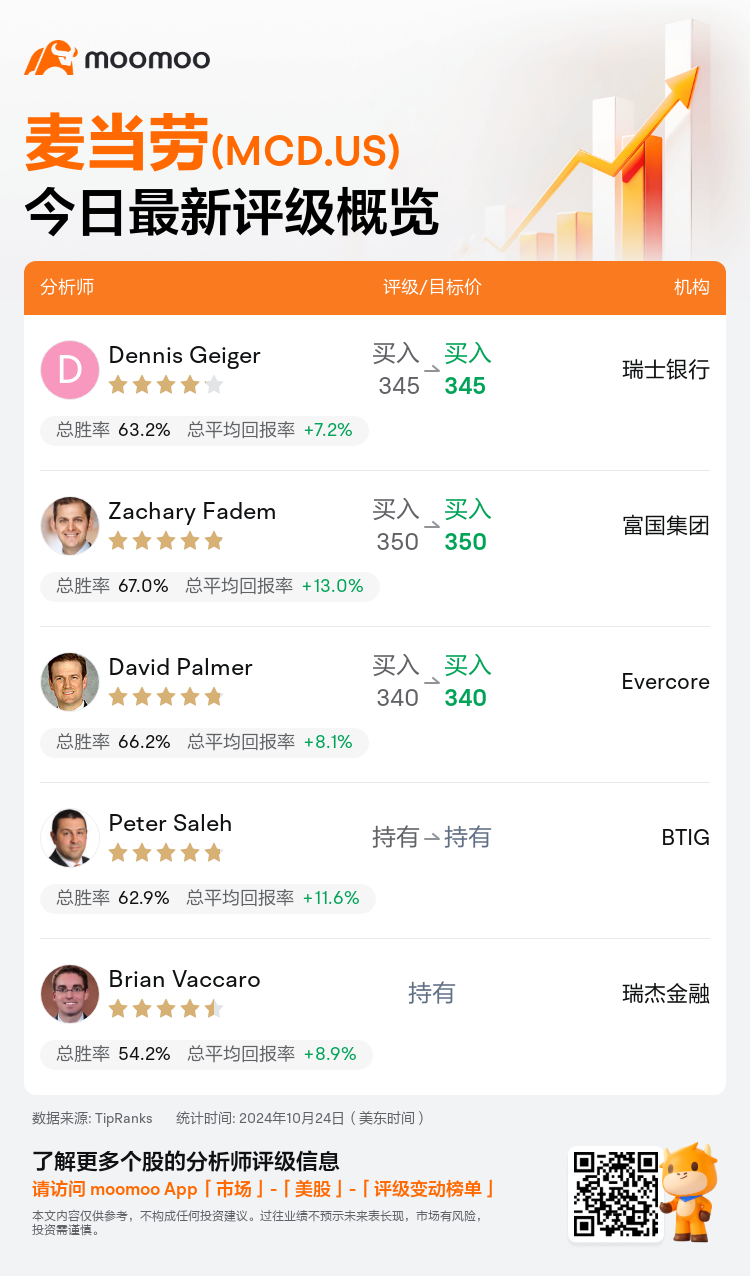

美东时间10月24日,多家华尔街大行更新了$麦当劳 (MCD.US)$的评级,目标价介于340美元至350美元。

瑞士银行分析师Dennis Geiger维持买入评级,维持目标价345美元。

富国集团分析师Zachary Fadem维持买入评级,维持目标价350美元。

Evercore分析师David Palmer维持买入评级,维持目标价340美元。

Evercore分析师David Palmer维持买入评级,维持目标价340美元。

BTIG分析师Peter Saleh维持持有评级。

瑞杰金融分析师Brian Vaccaro首予持有评级。

此外,综合报道,$麦当劳 (MCD.US)$近期主要分析师观点如下:

该公司正在修改其覆盖餐饮行业的价格目标,以反映对第三季度报告的预期中期每股收益和市场倍增率的变化。

该公司认为麦当劳在Q3初有经历了可比销售下降的情况,然后稳定在更为温和的水平。尽管容易受到低收入消费者支出变化的影响,但快餐领域对价值的强调的有效性是显而易见的。此外,通胀和定价的整体趋势似乎在减弱。

有关美国各州的麦当劳餐厅地点发生的E. coli疫情报告引起了关注,可能会影响消费者的认知以及公司在美国的可比销售数据——这是投资者情绪的关键因素。此外,由于全球宏观经济环境日益严峻,麦当劳在国际市场的短期表现存在感知风险。随着所有业务领域出现不确定性,预测近期股值增长变得具有挑战性。

以下为今日5位分析师对$麦当劳 (MCD.US)$的最新投资评级及目标价:

提示:

TipRanks为独立第三方,提供金融分析师的分析数据,并计算分析师推荐的平均回报率和胜率。提供的信息并非投资建议,仅供参考。本文不对评级数据和报告的完整性与准确性做出认可、声明或保证。

TipRanks提供每位分析师的星级,分析师星级代表分析师所有推荐的过往表现,通过分析师的总胜率和平均回报率综合计算得出,星星越多,则该分析师过往表现越优异,最高为5颗星。

分析师总胜率为近一年分析师的评级成功次数占总评级次数的比率。评级的成功与否,取决于TipRanks的虚拟投资组合是否从该股票中产生正回报。

总平均回报率为基于分析师的初始评级创建虚拟投资组合,并根据评级变化对组合进行调整,在近一年中该投资组合所获得的回报率。

Evercore分析师David Palmer维持买入评级,维持目标价340美元。

Evercore分析师David Palmer维持买入评级,维持目标价340美元。

Evercore analyst David Palmer maintains with a buy rating, and maintains the target price at $340.

Evercore analyst David Palmer maintains with a buy rating, and maintains the target price at $340.