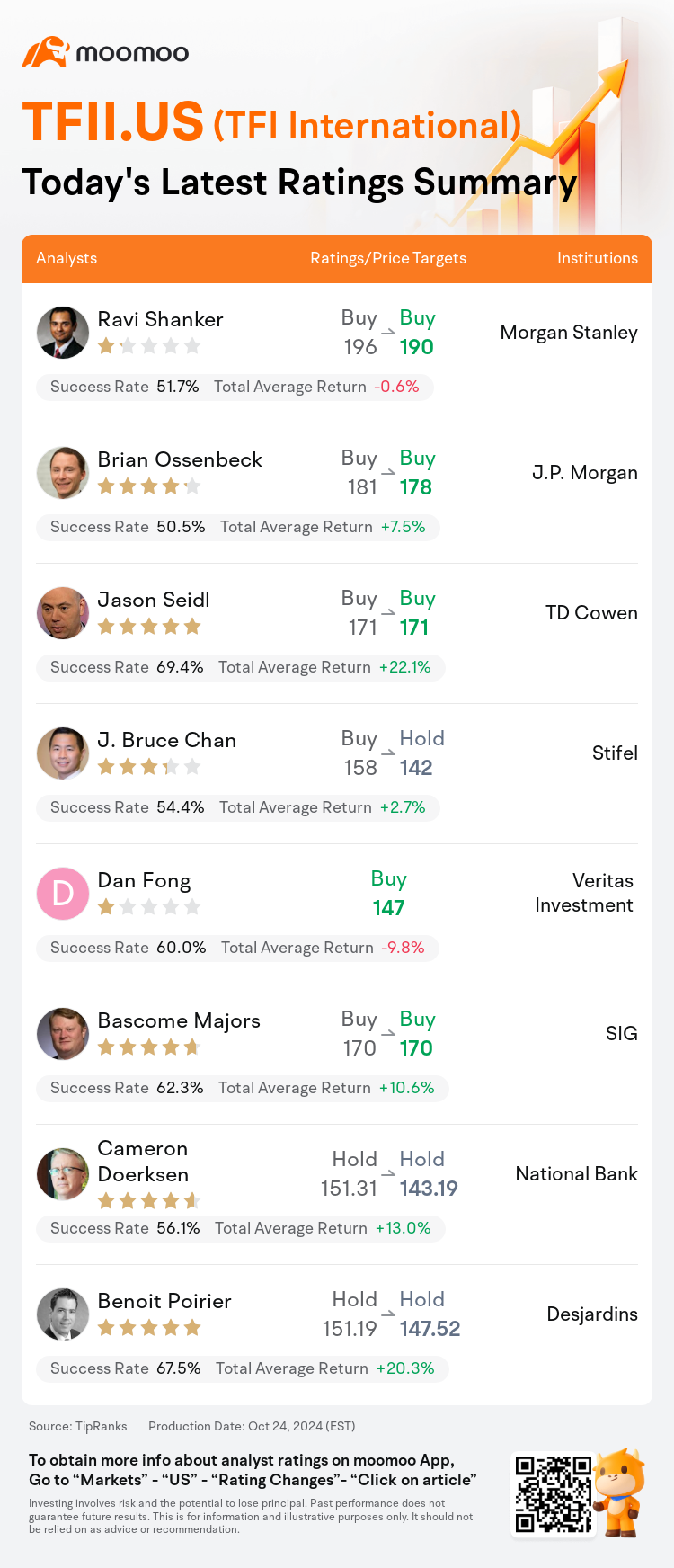

On Oct 24, major Wall Street analysts update their ratings for $TFI International (TFII.US)$, with price targets ranging from $142 to $190.

Morgan Stanley analyst Ravi Shanker maintains with a buy rating, and adjusts the target price from $196 to $190.

J.P. Morgan analyst Brian Ossenbeck maintains with a buy rating, and adjusts the target price from $181 to $178.

TD Cowen analyst Jason Seidl maintains with a buy rating, and maintains the target price at $171.

TD Cowen analyst Jason Seidl maintains with a buy rating, and maintains the target price at $171.

Stifel analyst J. Bruce Chan downgrades to a hold rating, and adjusts the target price from $158 to $142.

Veritas Investment Research analyst Dan Fong initiates coverage with a buy rating, and sets the target price at $147.

Furthermore, according to the comprehensive report, the opinions of $TFI International (TFII.US)$'s main analysts recently are as follows:

Subsequent to TFI International reporting Q3 adjusted EPS of $1.60, which fell short of the anticipated $1.76 and the general market projection of $1.77, estimates for Q4, 2024, and 2025 EPS have been adjusted downwards by 7%, 4%, and 4%, respectively.

TFI International's Q3 results came in below expectations, and the company has adjusted its guidance accordingly. This recalibration has established a new benchmark for future projections. Despite this, the company's robust generation of free cash flow has contributed to a very healthy balance sheet, providing considerable flexibility for mergers and acquisitions as well as strategic share repurchases.

TFI International's performance fell short of Q3 expectations due to challenges in TForce OR, including pricing inconsistencies and service-related issues. It appears increasingly improbable that the company will meet its 90 OR target in the fourth quarter, and there has been a reduction in the EPS guidance.

The company is facing a challenging operating environment and network turnarounds. Early progress post a significant acquisition is acknowledged, yet it is believed that more ingrained issues may dampen and postpone enhancements in certain margins, potentially neutralizing advancements in other areas of the business. Additionally, the anticipation for potential spinoff benefits may require patience until there is considerable growth in market capitalization.

Here are the latest investment ratings and price targets for $TFI International (TFII.US)$ from 8 analysts:

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

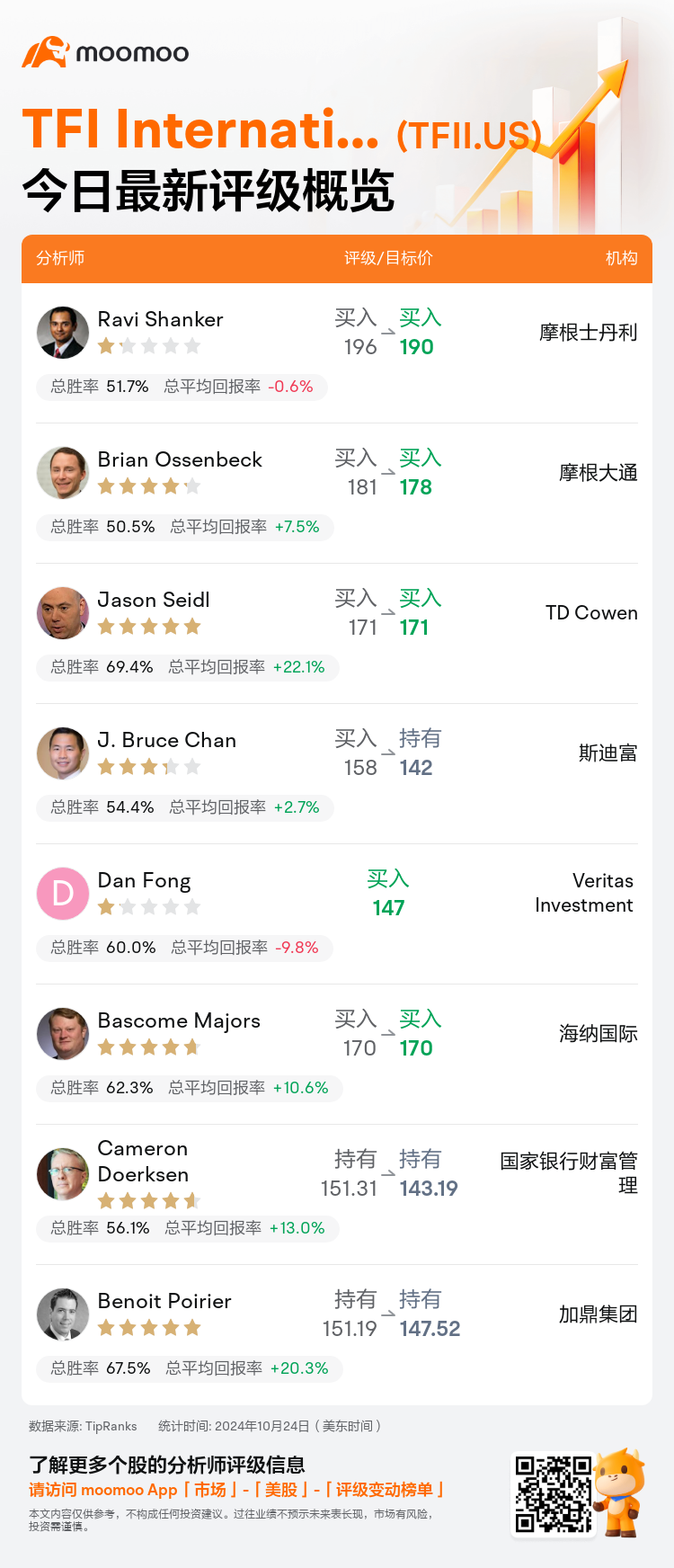

美东时间10月24日,多家华尔街大行更新了$TFI International (TFII.US)$的评级,目标价介于142美元至190美元。

摩根士丹利分析师Ravi Shanker维持买入评级,并将目标价从196美元下调至190美元。

摩根大通分析师Brian Ossenbeck维持买入评级,并将目标价从181美元下调至178美元。

TD Cowen分析师Jason Seidl维持买入评级,维持目标价171美元。

TD Cowen分析师Jason Seidl维持买入评级,维持目标价171美元。

斯迪富分析师J. Bruce Chan下调至持有评级,并将目标价从158美元下调至142美元。

Veritas Investment Research分析师Dan Fong首予买入评级,目标价147美元。

此外,综合报道,$TFI International (TFII.US)$近期主要分析师观点如下:

在tfi international报告第三季度调整后的每股收益为1.60美元后,低于预期的1.76美元和普通市场预期的1.77美元,2024年和2025年第四季度每股收益的估计分别下调了7%,4%和4%。

tfi international的第三季度业绩低于预期,公司相应调整了其指导方针。这一重新校准为未来的预测确立了一个新的基准。尽管如此,公司强劲的自由现金流生成为资产负债表提供了相当大的灵活性,为并购、战略性股份回购提供了相当的灵活性。

由于TForce OR的挑战,包括价格不一致和服务相关问题,tfi international的第三季度表现低于预期。公司在第四季度达到90 OR目标的可能性似乎越来越渺茫,并且EPS指导已经下调。

公司面临着复杂的经营环境和网络转型。对于一次重大收购后的早期进展表示肯定,但人们认为更根深蒂固的问题可能会削弱和推迟某些利润率的提升,可能会抵消业务其他领域的进展。此外,对潜在分拆好处的预期可能需要等待,直到市值有相当大的增长。

以下为今日8位分析师对$TFI International (TFII.US)$的最新投资评级及目标价:

提示:

TipRanks为独立第三方,提供金融分析师的分析数据,并计算分析师推荐的平均回报率和胜率。提供的信息并非投资建议,仅供参考。本文不对评级数据和报告的完整性与准确性做出认可、声明或保证。

TipRanks提供每位分析师的星级,分析师星级代表分析师所有推荐的过往表现,通过分析师的总胜率和平均回报率综合计算得出,星星越多,则该分析师过往表现越优异,最高为5颗星。

分析师总胜率为近一年分析师的评级成功次数占总评级次数的比率。评级的成功与否,取决于TipRanks的虚拟投资组合是否从该股票中产生正回报。

总平均回报率为基于分析师的初始评级创建虚拟投资组合,并根据评级变化对组合进行调整,在近一年中该投资组合所获得的回报率。

TD Cowen分析师Jason Seidl维持买入评级,维持目标价171美元。

TD Cowen分析师Jason Seidl维持买入评级,维持目标价171美元。

TD Cowen analyst Jason Seidl maintains with a buy rating, and maintains the target price at $171.

TD Cowen analyst Jason Seidl maintains with a buy rating, and maintains the target price at $171.