Alector (NASDAQ:ALEC Investor Three-year Losses Grow to 78% as the Stock Sheds US$52m This Past Week

Alector (NASDAQ:ALEC Investor Three-year Losses Grow to 78% as the Stock Sheds US$52m This Past Week

As every investor would know, not every swing hits the sweet spot. But really bad investments should be rare. So consider, for a moment, the misfortune of Alector, Inc. (NASDAQ:ALEC) investors who have held the stock for three years as it declined a whopping 78%. That would be a disturbing experience. Furthermore, it's down 28% in about a quarter. That's not much fun for holders.

正如每位投资者所知道的,不是每一次交易都能命中要害。但真正糟糕的投资应该是罕见的。因此,请稍作思考,想象一下持有Alector, Inc.(纳斯达克: ALEC)股票三年的投资者的不幸,因为股价下跌了惊人的78%。那绝对是一次令人不安的经历。此外,股价在一个季度内下跌了28%。这对持有者来说并不好玩。

Given the past week has been tough on shareholders, let's investigate the fundamentals and see what we can learn.

考虑到过去一周对股东来说是艰难的,让我们调查一下基本面并看看我们能学到什么。

Because Alector made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

由于Alector在过去十二个月出现亏损,我们认为市场可能更关注的是营业收入和营业收入增长,至少目前是这样。一般来说,没有利润的公司被期望能够每年增长营业收入,并且增速要快。正如你可以想象的那样,快速的营业收入增长如果能够持续,通常会导致快速的利润增长。

In the last three years Alector saw its revenue shrink by 25% per year. That's definitely a weaker result than most pre-profit companies report. The swift share price decline at an annual compound rate of 21%, reflects this weak fundamental performance. Never forget that loss making companies with falling revenue can and do cause losses for everyday investors. There is a good reason that investors often describe buying a sharply falling stock price as 'trying to catch a falling knife'. Think about it.

在过去三年里,Alector的营业收入以每年25%的速度下滑。这明显比大多数尚未盈利公司报告的结果要差。以每年21%的复合速率迅速下降的股价反映了这种疲软的基本表现。永远不要忘记,亏损的公司如果营业收入减少,就可能给普通投资者带来损失。投资者经常形容购买急剧下跌股价的股票为“试图接住下跌的刀片”,这并非没有道理。想一想。

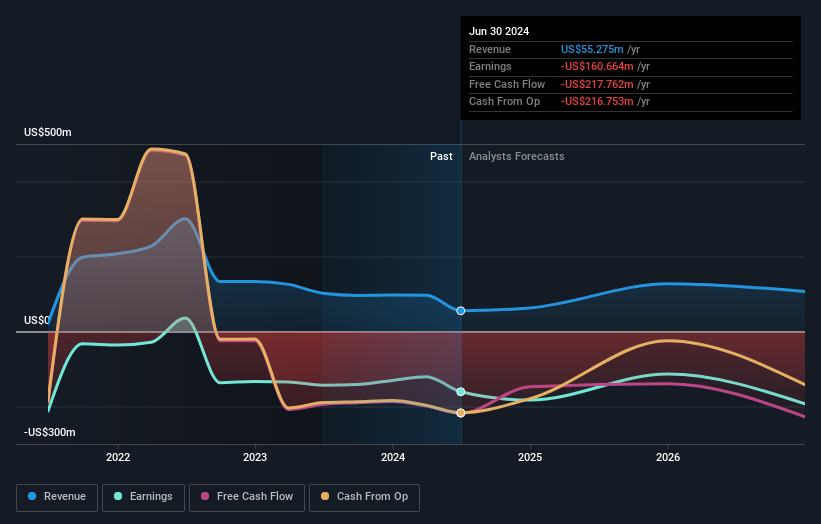

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

您可以看到以下收益和营收的变化情况(通过单击图像了解精确值)。

Alector is well known by investors, and plenty of clever analysts have tried to predict the future profit levels. Given we have quite a good number of analyst forecasts, it might be well worth checking out this free chart depicting consensus estimates.

alector被投资者熟知,许多聪明的分析师尝试预测未来的利润水平。 鉴于我们拥有相当多的分析师预测,查看这份免费图表,其中包含共识预估,可能值得一看。

A Different Perspective

不同的观点

Alector shareholders are down 8.8% for the year, but the market itself is up 40%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. However, the loss over the last year isn't as bad as the 12% per annum loss investors have suffered over the last half decade. We'd need to see some sustained improvements in the key metrics before we could muster much enthusiasm. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. For instance, we've identified 4 warning signs for Alector that you should be aware of.

Alector股东今年下跌了8.8%,但市场本身增长了40%。 但要记住,即使是最好的股票有时也会在十二个月的周期内表现不佳。 然而,过去一年的亏损并不像投资者在过去的五年中遭受的每年12%的损失那么糟糕。 在我们能够表现出太多热情之前,我们需要看到一些关键指标的持续改善。 以股价作为业务表现的一种代理长期观察我觉得非常有趣。 但为了真正获得洞察力,我们还需要考虑其他信息。 例如,我们已经发现了Alector的4个警示信号,您应该注意。

But note: Alector may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

但请注意:Alector可能不是最佳的股票买入选择。 所以看一看这份自由列出有过去盈利增长的有趣公司(以及进一步的增长预测)。

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

请注意,本文所引述的市场回报反映了目前在美国交易所上市的股票的市场加权平均回报。

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

对本文有任何反馈?对内容有任何疑虑?请直接与我们联系。或者,发送电子邮件至editorial-team@simplywallst.com。

这篇文章是Simply Wall St的一般性文章。我们根据历史数据和分析师预测提供评论,只使用公正的方法论,我们的文章并不意味着提供任何金融建议。文章不构成买卖任何股票的建议,也不考虑您的目标或您的财务状况。我们的目标是带给您基本数据驱动的长期关注分析。请注意,我们的分析可能不考虑最新的价格敏感公司公告或定性材料。Simply Wall St没有任何股票头寸。

In the last three years Alector saw its revenue shrink by 25% per year. That's definitely a weaker result than most pre-profit companies report. The swift share price decline at an annual compound rate of 21%, reflects this weak fundamental performance. Never forget that loss making companies with falling revenue can and do cause losses for everyday investors. There is a good reason that investors often describe buying a sharply falling stock price as 'trying to catch a falling knife'. Think about it.

In the last three years Alector saw its revenue shrink by 25% per year. That's definitely a weaker result than most pre-profit companies report. The swift share price decline at an annual compound rate of 21%, reflects this weak fundamental performance. Never forget that loss making companies with falling revenue can and do cause losses for everyday investors. There is a good reason that investors often describe buying a sharply falling stock price as 'trying to catch a falling knife'. Think about it.