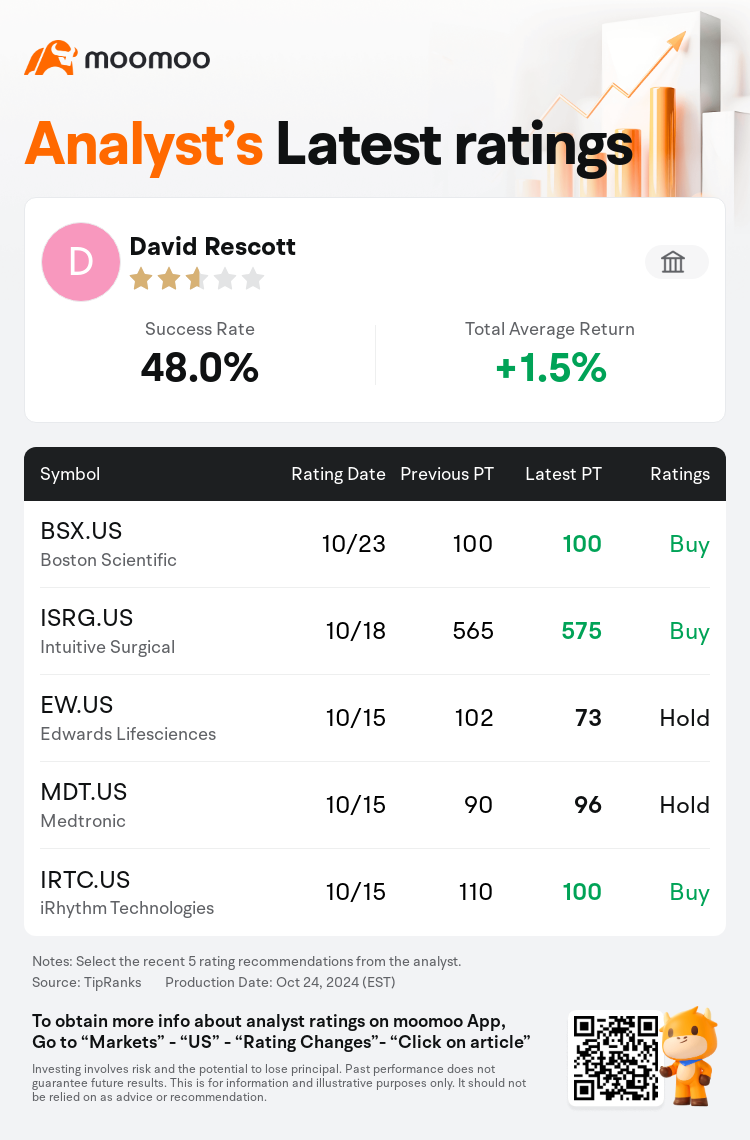

Baird analyst David Rescott maintains $Boston Scientific (BSX.US)$ with a buy rating, and maintains the target price at $100.

According to TipRanks data, the analyst has a success rate of 48.0% and a total average return of 1.5% over the past year.

Furthermore, according to the comprehensive report, the opinions of $Boston Scientific (BSX.US)$'s main analysts recently are as follows:

Furthermore, according to the comprehensive report, the opinions of $Boston Scientific (BSX.US)$'s main analysts recently are as follows:

Boston Scientific has experienced a quarter that exceeded forecasts in all aspects, notwithstanding already lofty expectations. The company's shares are currently experiencing pressure due to the temporary halt of the AVANT GUARD clinical trial, which is investigating Farapulse in a new patient segment. It is critical to recognize that this patient group is not currently receiving treatment, observations are under review, and it is anticipated that enrollment will recommence shortly.

Boston Scientific is recognized for its 'best in medtech growth,' with expectations for its revenue growth to not only be robust but also to contribute positively to margins, bolstered by one of the most extensive pipelines in the medical technology sector.

Boston Scientific's Q3 results were described as 'impressive', with management raising its 2024 guidance to exit the year with a +15% organic sales growth. Despite a temporary pause in the EP trial, AVANTGUARD, and the stock's subsequent decline, such a reaction is deemed excessive following key opinion leader checks.

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

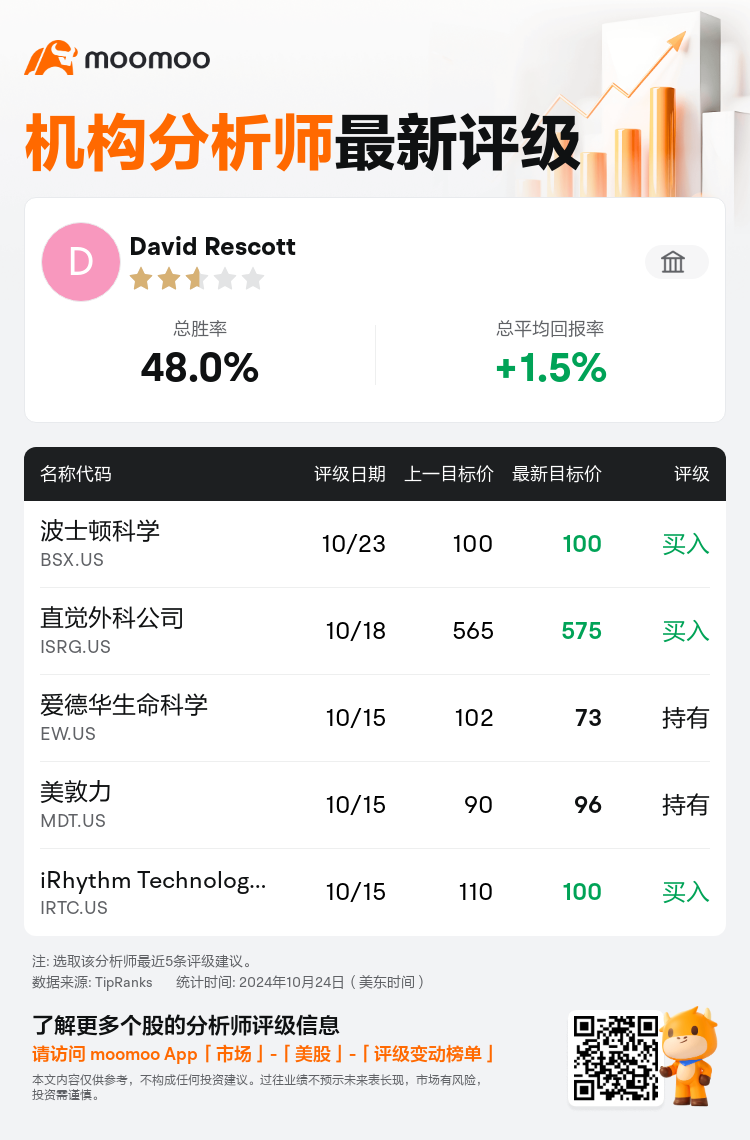

贝雅分析师David Rescott维持$波士顿科学 (BSX.US)$买入评级,维持目标价100美元。

根据TipRanks数据显示,该分析师近一年总胜率为48.0%,总平均回报率为1.5%。

此外,综合报道,$波士顿科学 (BSX.US)$近期主要分析师观点如下:

此外,综合报道,$波士顿科学 (BSX.US)$近期主要分析师观点如下:

波士顿科学在各个方面经历了一个超出预期的季度,尽管市场已经寄予厚望。 由于AVANT GUARD临床试验的暂时暂停,该公司股票目前承受压力,该试验正在研究新的患者群体中的Farapulse。 关键是要认识到这个患者群体目前未接受治疗,正在进行观察,预计招募将很快恢复。

波士顿科学以'医疗技术领域增长最佳'而闻名,预计其营业收入增长不仅稳健,而且将对利润率产生积极影响,这得益于医疗科技行业中最广泛的产品管线之一。

波士顿科学的第三季度业绩被描述为'令人印象深刻',管理层将其2024年的指导信息调高,以+15%的有机销售增长结束这一年。 尽管EP试验AVANTGUARD暂时暂停,股票随后下跌,但这种反应被认为是对重要意见领袖检查的过分反应。

提示:

TipRanks为独立第三方,提供金融分析师的分析数据,并计算分析师推荐的平均回报率和胜率。提供的信息并非投资建议,仅供参考。本文不对评级数据和报告的完整性与准确性做出认可、声明或保证。

TipRanks提供每位分析师的星级,分析师星级代表分析师所有推荐的过往表现,通过分析师的总胜率和平均回报率综合计算得出,星星越多,则该分析师过往表现越优异,最高为5颗星。

分析师总胜率为近一年分析师的评级成功次数占总评级次数的比率。评级的成功与否,取决于TipRanks的虚拟投资组合是否从该股票中产生正回报。

总平均回报率为基于分析师的初始评级创建虚拟投资组合,并根据评级变化对组合进行调整,在近一年中该投资组合所获得的回报率。

此外,综合报道,$波士顿科学 (BSX.US)$近期主要分析师观点如下:

此外,综合报道,$波士顿科学 (BSX.US)$近期主要分析师观点如下:

Furthermore, according to the comprehensive report, the opinions of

Furthermore, according to the comprehensive report, the opinions of