NuScale Power's Options Frenzy: What You Need to Know

NuScale Power's Options Frenzy: What You Need to Know

High-rolling investors have positioned themselves bullish on NuScale Power (NYSE:SMR), and it's important for retail traders to take note.\This activity came to our attention today through Benzinga's tracking of publicly available options data. The identities of these investors are uncertain, but such a significant move in SMR often signals that someone has privileged information.

高额投资者已将自己定位为看好NuScale Power(纽约证券交易所代码:SMR),散户交易者注意这一点很重要。\ 这项活动今天通过Benzinga对公开期权数据的追踪引起了我们的注意。这些投资者的身份尚不确定,但是SMR的如此重大变动通常表明有人拥有特权信息。

Today, Benzinga's options scanner spotted 8 options trades for NuScale Power. This is not a typical pattern.

今天,Benzinga的期权扫描仪发现了NuScale Power的8笔期权交易。这不是典型的模式。

The sentiment among these major traders is split, with 37% bullish and 25% bearish. Among all the options we identified, there was one put, amounting to $60,350, and 7 calls, totaling $567,520.

这些主要交易者的情绪分歧,37%看涨,25%看跌。在我们确定的所有期权中,有一个看跌期权,金额为60,350美元,还有7个看涨期权,总额为567,520美元。

Projected Price Targets

预计价格目标

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $10.0 to $29.0 for NuScale Power over the last 3 months.

考虑到这些合约的交易量和未平仓合约,在过去的3个月中,鲸鱼似乎一直将NuScale Power的价格定在10.0美元至29.0美元之间。

Volume & Open Interest Development

交易量和未平仓合约的发展

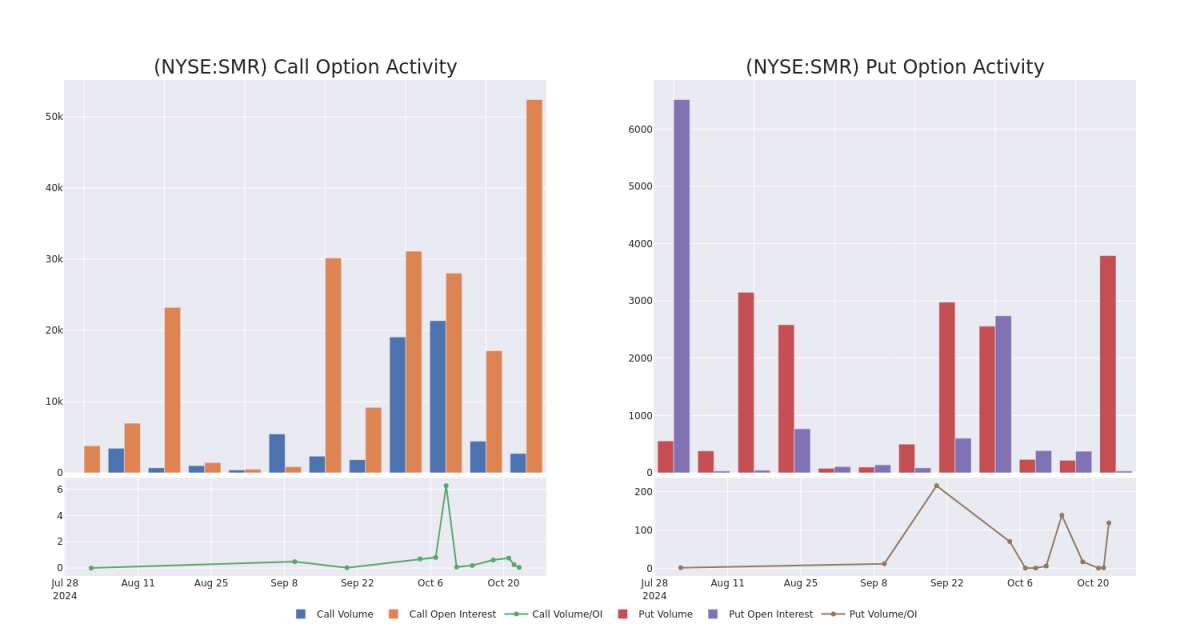

In terms of liquidity and interest, the mean open interest for NuScale Power options trades today is 2295.5 with a total volume of 3,091.00.

就流动性和利息而言,当今NuScale Power期权交易的平均未平仓合约为2295.5份,总交易量为3,091.00。

In the following chart, we are able to follow the development of volume and open interest of call and put options for NuScale Power's big money trades within a strike price range of $10.0 to $29.0 over the last 30 days.

在下图中,我们可以跟踪过去30天内NuScale Power在10.0美元至29.0美元行使价区间内的看涨期权和看跌期权交易的交易量和未平仓合约的变化。

NuScale Power 30-Day Option Volume & Interest Snapshot

NuScale Power 30 天期权交易量和利息快照

Largest Options Trades Observed:

观察到的最大期权交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| SMR | CALL | TRADE | BEARISH | 05/16/25 | $4.5 | $4.2 | $4.25 | $22.00 | $212.5K | 1 | 500 |

| SMR | CALL | TRADE | NEUTRAL | 05/16/25 | $4.5 | $4.0 | $4.25 | $22.00 | $148.7K | 1 | 850 |

| SMR | CALL | TRADE | BEARISH | 11/15/24 | $1.4 | $1.25 | $1.3 | $20.00 | $96.0K | 11.1K | 1.0K |

| SMR | PUT | TRADE | NEUTRAL | 01/17/25 | $12.2 | $11.9 | $12.07 | $29.00 | $60.3K | 0 | 113 |

| SMR | CALL | SWEEP | BULLISH | 12/19/25 | $7.4 | $7.2 | $7.4 | $15.00 | $29.6K | 1.7K | 40 |

| 符号 | 看跌/看涨 | 交易类型 | 情绪 | Exp。日期 | 问 | 出价 | 价格 | 行使价 | 总交易价格 | 未平仓合约 | 音量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| SMR | 打电话 | 贸易 | 粗鲁的 | 05/16/25 | 4.5 美元 | 4.2 美元 | 4.25 美元 | 22.00 美元 | 212.5 万美元 | 1 | 500 |

| SMR | 打电话 | 贸易 | 中立 | 05/16/25 | 4.5 美元 | 4.0 美元 | 4.25 美元 | 22.00 美元 | 148.7 万美元 | 1 | 850 |

| SMR | 打电话 | 贸易 | 粗鲁的 | 11/15/24 | 1.4 美元 | 1.25 美元 | 1.3 美元 | 20.00 美元 | 96.0 万美元 | 11.1K | 1.0K |

| SMR | 放 | 贸易 | 中立 | 01/17/25 | 12.2 美元 | 11.9 美元 | 12.07 美元 | 29.00 美元 | 60.3 万美元 | 0 | 113 |

| SMR | 打电话 | 扫 | 看涨 | 12/19/25 | 7.4 美元 | 7.2 美元 | 7.4 美元 | 15.00 美元 | 29.6 万美元 | 1.7K | 40 |

About NuScale Power

关于 NuScale Power

NuScale Power Corp is engaged in the development of a new modular light water reactor nuclear power plant to supply energy for electrical generation, district heating, desalination, hydrogen production, and other process heat applications.

NuScale Power Corp正在开发新的模块化轻水反应堆核电站,为发电、区域供热、海水淡化、氢气生产和其他过程热应用提供能源。

Current Position of NuScale Power

NuScale Power 的当前位置

- Currently trading with a volume of 10,201,983, the SMR's price is up by 7.05%, now at $18.54.

- RSI readings suggest the stock is currently may be approaching overbought.

- Anticipated earnings release is in 14 days.

- SMR目前的交易量为10,201,983美元,价格上涨了7.05%,目前为18.54美元。

- RSI读数表明,该股目前可能接近超买。

- 预计财报将在14天后发布。

Expert Opinions on NuScale Power

关于 NuScale Power 的专家意见

2 market experts have recently issued ratings for this stock, with a consensus target price of $18.5.

2位市场专家最近发布了该股的评级,共识目标价为18.5美元。

Unusual Options Activity Detected: Smart Money on the Move

检测到不寻常的期权活动:智能货币在移动

Benzinga Edge's Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.* Reflecting concerns, an analyst from Craig-Hallum lowers its rating to Buy with a new price target of $16.* An analyst from Craig-Hallum persists with their Buy rating on NuScale Power, maintaining a target price of $21.

Benzinga Edge的不寻常期权委员会在潜在的市场推动者发生之前就发现了它们。看看大笔资金对你最喜欢的股票持有哪些头寸。点击此处查看。* 出于担忧,Craig-Hallum的一位分析师将其评级下调至买入,新的目标股价为16美元* Craig-Hallum的一位分析师坚持对NuScale Power的买入评级,维持21美元的目标价。

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest NuScale Power options trades with real-time alerts from Benzinga Pro.

期权交易具有更高的风险和潜在的回报。精明的交易者通过不断自我教育、调整策略、监控多个指标以及密切关注市场走势来管理这些风险。借助Benzinga Pro的实时提醒,随时了解最新的NuScale Power期权交易。

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $10.0 to $29.0 for NuScale Power over the last 3 months.

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $10.0 to $29.0 for NuScale Power over the last 3 months.