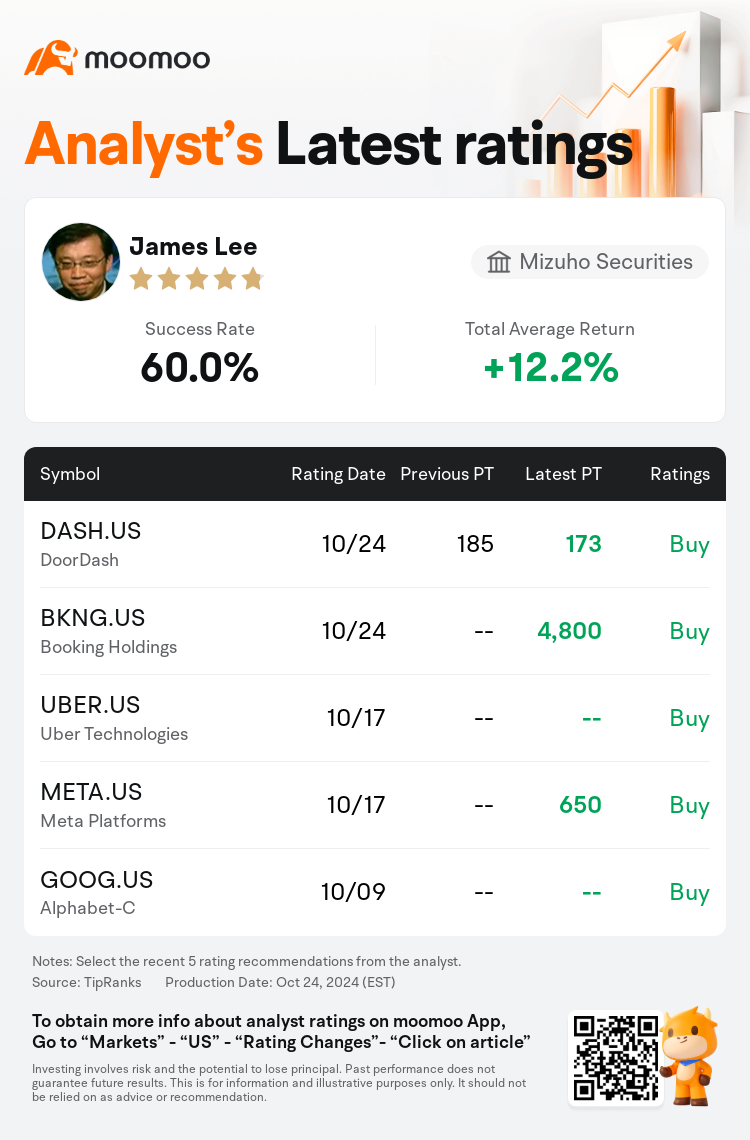

Mizuho Securities analyst James Lee maintains $DoorDash (DASH.US)$ with a buy rating, and adjusts the target price from $185 to $173.

According to TipRanks data, the analyst has a success rate of 60.0% and a total average return of 12.2% over the past year.

Furthermore, according to the comprehensive report, the opinions of $DoorDash (DASH.US)$'s main analysts recently are as follows:

Furthermore, according to the comprehensive report, the opinions of $DoorDash (DASH.US)$'s main analysts recently are as follows:

E-commerce trends exhibited a mixed performance in the initial half of October, with Delivery services demonstrating superior results. Utilizing BSM and SensorTower application data, it's anticipated that the delivery sector experienced a robust third quarter, prompting adjustments in expectations for select gig economy stocks as well as eBay.

Industry data indicates that the demand for gig economy services is holding strong amid slowing inflation and ongoing positive unit economics. Analysts anticipate that the leading companies in ride-sharing and food delivery will expand their market share and enhance their operating efficiency. Meanwhile, the perspective for online travel agencies remains uncertain, as shifts in consumer spending and more spontaneous travel bookings are obscuring revenue projections. It is expected that DoorDash will grow its business volume through intensified marketing efforts, leading to increased operating leverage later in the year.

Preference is indicated for U.S. Internet companies that either cater to high-income consumers or are associated with end-markets on the cusp of a turning point. Companies like DoorDash and Uber are favored for targeting affluent demographics, while firms such as ACV Auctions, CarGurus, and Zillow are noted for their proximity to market inflections. Among these, Zillow is highlighted as the top overall selection, with Uber as the preferred large cap choice.

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

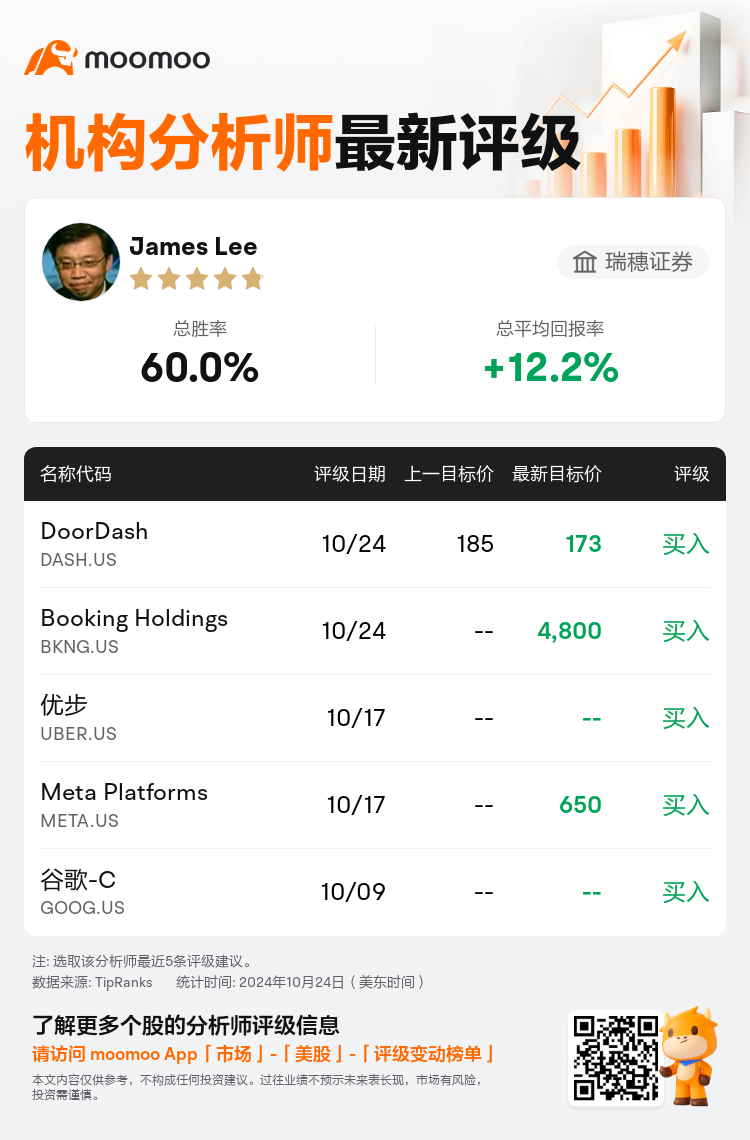

瑞穗证券分析师James Lee维持$DoorDash (DASH.US)$买入评级,并将目标价从185美元下调至173美元。

根据TipRanks数据显示,该分析师近一年总胜率为60.0%,总平均回报率为12.2%。

此外,综合报道,$DoorDash (DASH.US)$近期主要分析师观点如下:

此外,综合报道,$DoorDash (DASH.US)$近期主要分析师观点如下:

电子商务行业在10月上半月表现出现複合表现,外卖概念服务则呈现出色的业绩。利用BSm和SensorTower应用数据,预计外卖板块在第三季度表现强劲,促使对某些零工经济股票以及ebay的预期进行调整。

行业数据显示,零工经济服务需求在通胀放缓和持续正面单位经济情况下依然坚挺。分析师预计,在顺风车和外卖领域领先的公司将扩大市场份额并提高运营效率。与此同时,随着消费者支出转变和更多即兴旅行预订模糊了营收预测,线上旅行社的前景仍不确定。预计doordash将通过加大营销力度扩展其业务量,从而在年底实现增加的运营杠杆。

显示偏好美国互联网公司,这些公司要么针对高收入消费者,要么与即将面临转折点的市场相关联。像doordash和Uber这样的公司受到青睐,因为它们针对富裕人群,而ACV拍卖、cargurus和Zillow等公司则因接近市场拐点而备受关注。在这些公司中,Zillow被视为最佳整体选择,Uber被视为首选的大盘选择。

提示:

TipRanks为独立第三方,提供金融分析师的分析数据,并计算分析师推荐的平均回报率和胜率。提供的信息并非投资建议,仅供参考。本文不对评级数据和报告的完整性与准确性做出认可、声明或保证。

TipRanks提供每位分析师的星级,分析师星级代表分析师所有推荐的过往表现,通过分析师的总胜率和平均回报率综合计算得出,星星越多,则该分析师过往表现越优异,最高为5颗星。

分析师总胜率为近一年分析师的评级成功次数占总评级次数的比率。评级的成功与否,取决于TipRanks的虚拟投资组合是否从该股票中产生正回报。

总平均回报率为基于分析师的初始评级创建虚拟投资组合,并根据评级变化对组合进行调整,在近一年中该投资组合所获得的回报率。

此外,综合报道,$DoorDash (DASH.US)$近期主要分析师观点如下:

此外,综合报道,$DoorDash (DASH.US)$近期主要分析师观点如下:

Furthermore, according to the comprehensive report, the opinions of

Furthermore, according to the comprehensive report, the opinions of