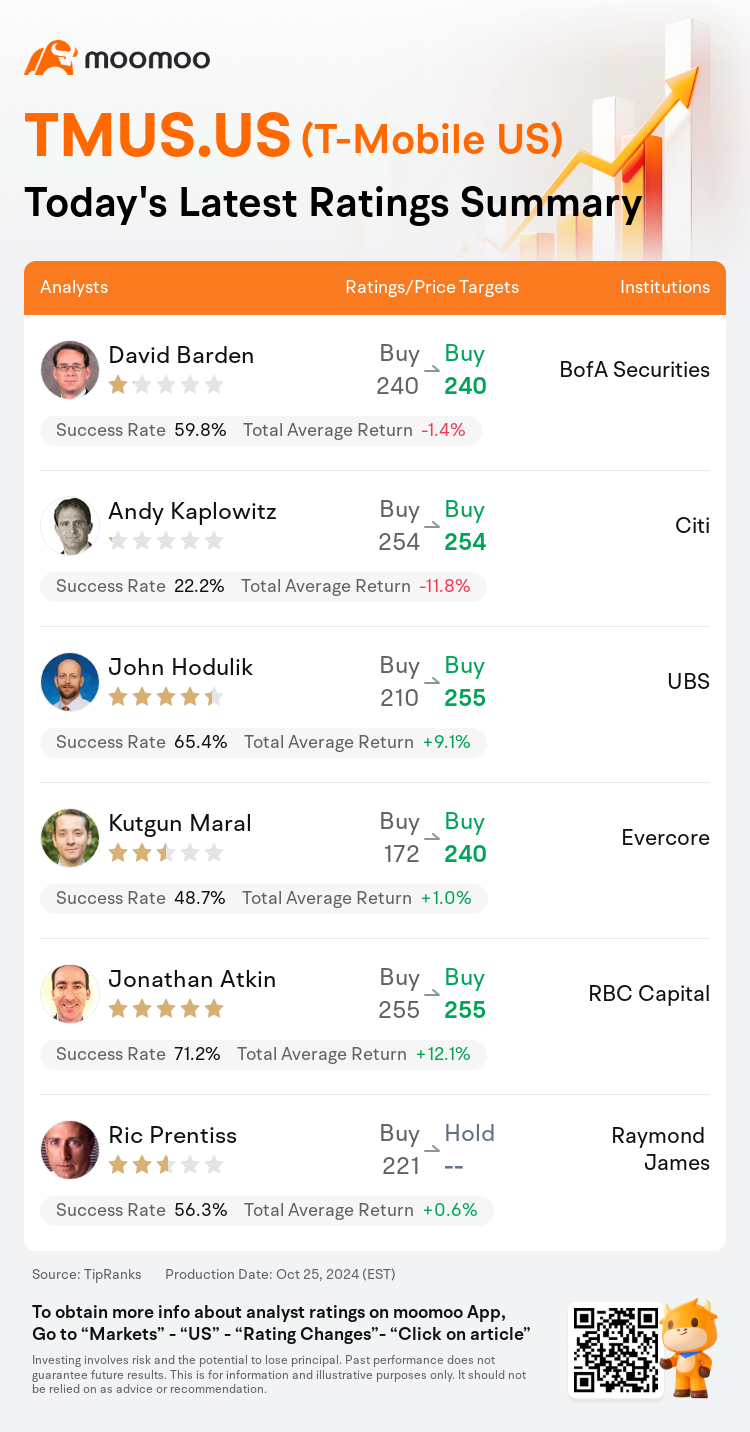

On Oct 25, major Wall Street analysts update their ratings for $T-Mobile US (TMUS.US)$, with price targets ranging from $240 to $255.

BofA Securities analyst David Barden maintains with a buy rating, and maintains the target price at $240.

Citi analyst Andy Kaplowitz maintains with a buy rating, and maintains the target price at $254.

UBS analyst John Hodulik maintains with a buy rating, and adjusts the target price from $210 to $255.

UBS analyst John Hodulik maintains with a buy rating, and adjusts the target price from $210 to $255.

Evercore analyst Kutgun Maral maintains with a buy rating, and adjusts the target price from $172 to $240.

RBC Capital analyst Jonathan Atkin maintains with a buy rating, and maintains the target price at $255.

Furthermore, according to the comprehensive report, the opinions of $T-Mobile US (TMUS.US)$'s main analysts recently are as follows:

T-Mobile's recent performance exceeded predictions, showcasing yet another period of leading growth within the industry. This reinforces the optimistic perspective regarding the company's prospects. The expectation is that core business metrics will underpin mid- to high-single digit compound annual growth rates for revenue, EBITDA, and free cash flow. Additionally, these fundamentals are anticipated to facilitate $50 billion in capital returns and provide $20 billion in leeway for potential mergers and acquisitions, debt reduction, and further returns extending up to the year 2027.

T-Mobile's third-quarter performance was strong, surpassing expectations in several key financial metrics such as service revenue, core adjusted EBITDA, free cash flow, and post-paid phone net additions. The company's distinct approach to providing shareholder value is reflected in its substantial commitment to share buybacks and dividend payouts over a three-year period, alongside additional capacity for enhancing shareholder returns and a projected rise in free cash flow per share in 2025.

T-Mobile delivered robust third-quarter results and enhanced its subscriber and financial forecasts comprehensively. This performance and the raised guidance for 2024 underscore the investment thesis, positioning T-Mobile as a favored long-term selection.

T-Mobile delivered a robust quarter, although its outlook is accompanied by some reservations. Despite strong headline growth figures, challenges such as margin pressure due to high volumes and a decrease in wholesale revenues are being counteracted by certain one-off positive factors.

T-Mobile's Q3 outcomes aligned with or surpassed the general expectations, underpinned by a sustained increase in postpaid phone net additions and productive free cash flow conversion. Additionally, the company's management raised its 2024 forecasts concerning postpaid net additions, EBITDA, and free cash flow, while maintaining capital expenditures at the same level.

Here are the latest investment ratings and price targets for $T-Mobile US (TMUS.US)$ from 6 analysts:

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

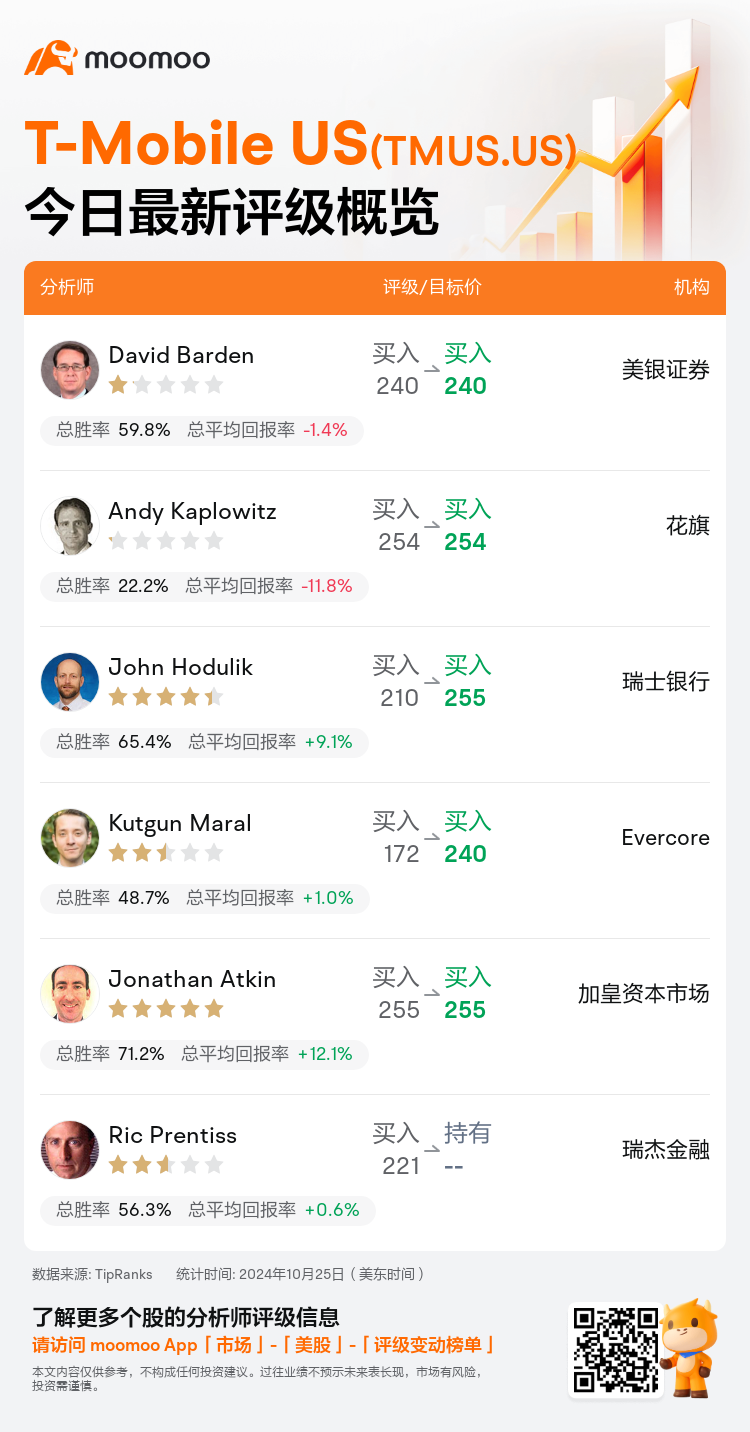

美东时间10月25日,多家华尔街大行更新了$T-Mobile US (TMUS.US)$的评级,目标价介于240美元至255美元。

美银证券分析师David Barden维持买入评级,维持目标价240美元。

花旗分析师Andy Kaplowitz维持买入评级,维持目标价254美元。

瑞士银行分析师John Hodulik维持买入评级,并将目标价从210美元上调至255美元。

瑞士银行分析师John Hodulik维持买入评级,并将目标价从210美元上调至255美元。

Evercore分析师Kutgun Maral维持买入评级,并将目标价从172美元上调至240美元。

加皇资本市场分析师Jonathan Atkin维持买入评级,维持目标价255美元。

此外,综合报道,$T-Mobile US (TMUS.US)$近期主要分析师观点如下:

t-Mobile最近的表现超出了预期,展示了行业内领先增长的又一个时期。这加强了对该公司前景乐观的展望。预期核心业务指标将支撑营业收入、EBITDA和自由现金流中至高个位数的复合年增长率。此外,预计这些基本面将促进500亿美元的资本回报,并为潜在的并购、债务减少和延长至2027年的进一步回报提供200亿美元的余地。

t-Mobile第三季度表现强劲,超出了多个重要财务指标的预期,如服务收入、核心调整后的EBITDA、自由现金流和后付费手机净增长。该公司为股东创造价值的独特方法体现在其在三年期间对回购股份和股利支付的大力投入上,同时还为增强股东回报提供了额外空间,并预计2025年每股自由现金流将会上升。

t-Mobile交出了强劲的第三季度业绩,并全面提升了其订阅者和财务预测。这种表现以及对2024年指引的提高突显了投资论点,将t-Mobile定位为偏爱的长期选择。

尽管t-Mobile交出了强劲的季度业绩,但其前景伴随着一些保留意见。尽管头条增长数据强劲,但由于大量活动和批发收入的减少导致的毛利压力等挑战正受到一些一次性正面因素的抵消。

t-Mobile的第三季度业绩符合或超出了一般预期,得益于后付费手机净增长的持续增加和高效的自由现金流转换。此外,该公司管理层提高了2024年关于后付净增长、EBITDA和自由现金流的预测,同时保持了相同水平的资本开支。

以下为今日6位分析师对$T-Mobile US (TMUS.US)$的最新投资评级及目标价:

提示:

TipRanks为独立第三方,提供金融分析师的分析数据,并计算分析师推荐的平均回报率和胜率。提供的信息并非投资建议,仅供参考。本文不对评级数据和报告的完整性与准确性做出认可、声明或保证。

TipRanks提供每位分析师的星级,分析师星级代表分析师所有推荐的过往表现,通过分析师的总胜率和平均回报率综合计算得出,星星越多,则该分析师过往表现越优异,最高为5颗星。

分析师总胜率为近一年分析师的评级成功次数占总评级次数的比率。评级的成功与否,取决于TipRanks的虚拟投资组合是否从该股票中产生正回报。

总平均回报率为基于分析师的初始评级创建虚拟投资组合,并根据评级变化对组合进行调整,在近一年中该投资组合所获得的回报率。

瑞士银行分析师John Hodulik维持买入评级,并将目标价从210美元上调至255美元。

瑞士银行分析师John Hodulik维持买入评级,并将目标价从210美元上调至255美元。

UBS analyst John Hodulik maintains with a buy rating, and adjusts the target price from $210 to $255.

UBS analyst John Hodulik maintains with a buy rating, and adjusts the target price from $210 to $255.