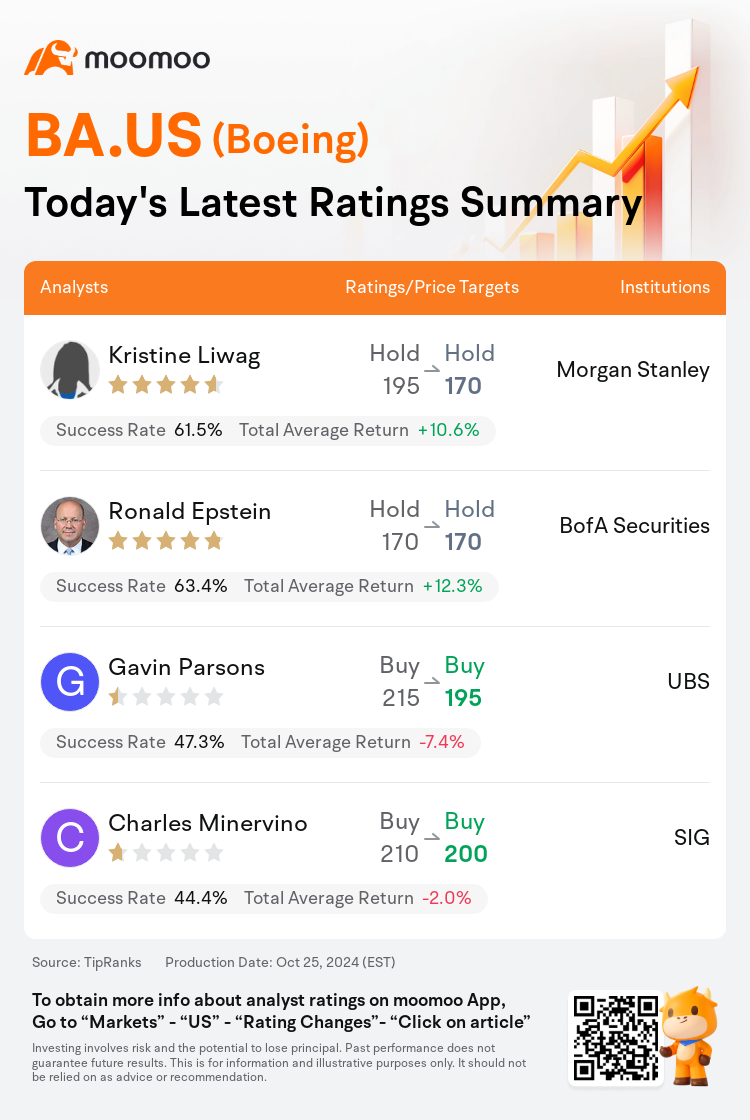

On Oct 25, major Wall Street analysts update their ratings for $Boeing (BA.US)$, with price targets ranging from $170 to $200.

Morgan Stanley analyst Kristine Liwag maintains with a hold rating, and adjusts the target price from $195 to $170.

BofA Securities analyst Ronald Epstein maintains with a hold rating, and maintains the target price at $170.

UBS analyst Gavin Parsons maintains with a buy rating, and adjusts the target price from $215 to $195.

UBS analyst Gavin Parsons maintains with a buy rating, and adjusts the target price from $215 to $195.

SIG analyst Charles Minervino maintains with a buy rating, and adjusts the target price from $210 to $200.

Furthermore, according to the comprehensive report, the opinions of $Boeing (BA.US)$'s main analysts recently are as follows:

The critical next phase for Boeing involves finalizing the strike situation and escalating the production of the MAX series, which is vital for the immediate and future stability of the company and its supply chain. Once short-term obstacles are overcome, it's anticipated that the market will recognize the potent long-term profit prospects of the business, assuming that the demand for new airplanes continues to be vigorous.

The firm observes that Boeing's performance in the third quarter of 2024 was impacted as anticipated by a softer output from BCA, along with escalating losses at BDS due to the recovery being deferred amidst the IAM strike, where there was a 64% vote against the recent proposal, pushing a likely resolution into November.

The latest developments with Boeing indicate that the ongoing strike, due to the union's rejection of the most recent contract proposal, may exert additional pressure on fourth-quarter deliveries and cash flow. The third-quarter earnings discussion also brought to light potential further reductions in cash reserves, which may necessitate a more substantial capital influx.

Here are the latest investment ratings and price targets for $Boeing (BA.US)$ from 4 analysts:

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

美东时间10月25日,多家华尔街大行更新了$波音 (BA.US)$的评级,目标价介于170美元至200美元。

摩根士丹利分析师Kristine Liwag维持持有评级,并将目标价从195美元下调至170美元。

美银证券分析师Ronald Epstein维持持有评级,维持目标价170美元。

瑞士银行分析师Gavin Parsons维持买入评级,并将目标价从215美元下调至195美元。

瑞士银行分析师Gavin Parsons维持买入评级,并将目标价从215美元下调至195美元。

海纳国际分析师Charles Minervino维持买入评级,并将目标价从210美元下调至200美元。

此外,综合报道,$波音 (BA.US)$近期主要分析师观点如下:

波音的关键下一阶段涉及完成罢工局势,并加快MAX系列的生产,这对公司及其供应链的即期和未来稳定至关重要。一旦克服短期障碍,预计市场将认识到业务的潜在长期利润前景,假设对新飞机的需求继续强劲。

公司观察到,波音在2024年第三季度的表现符合预期受到了BCA产量较低的影响,以及在BDS方面因IAM罢工而增加的损失,最近的提案遭到64%的反对票,将可能导致解决方案推迟到11月。

波音的最新进展显示,由于工会拒绝最新的合同提案,持续罢工可能对第四季度的交付和现金流产生额外压力。第三季度的盈利讨论还揭示了现金储备可能进一步减少,这可能需要更大规模的资本注入。

以下为今日4位分析师对$波音 (BA.US)$的最新投资评级及目标价:

提示:

TipRanks为独立第三方,提供金融分析师的分析数据,并计算分析师推荐的平均回报率和胜率。提供的信息并非投资建议,仅供参考。本文不对评级数据和报告的完整性与准确性做出认可、声明或保证。

TipRanks提供每位分析师的星级,分析师星级代表分析师所有推荐的过往表现,通过分析师的总胜率和平均回报率综合计算得出,星星越多,则该分析师过往表现越优异,最高为5颗星。

分析师总胜率为近一年分析师的评级成功次数占总评级次数的比率。评级的成功与否,取决于TipRanks的虚拟投资组合是否从该股票中产生正回报。

总平均回报率为基于分析师的初始评级创建虚拟投资组合,并根据评级变化对组合进行调整,在近一年中该投资组合所获得的回报率。

瑞士银行分析师Gavin Parsons维持买入评级,并将目标价从215美元下调至195美元。

瑞士银行分析师Gavin Parsons维持买入评级,并将目标价从215美元下调至195美元。

UBS analyst Gavin Parsons maintains with a buy rating, and adjusts the target price from $215 to $195.

UBS analyst Gavin Parsons maintains with a buy rating, and adjusts the target price from $215 to $195.