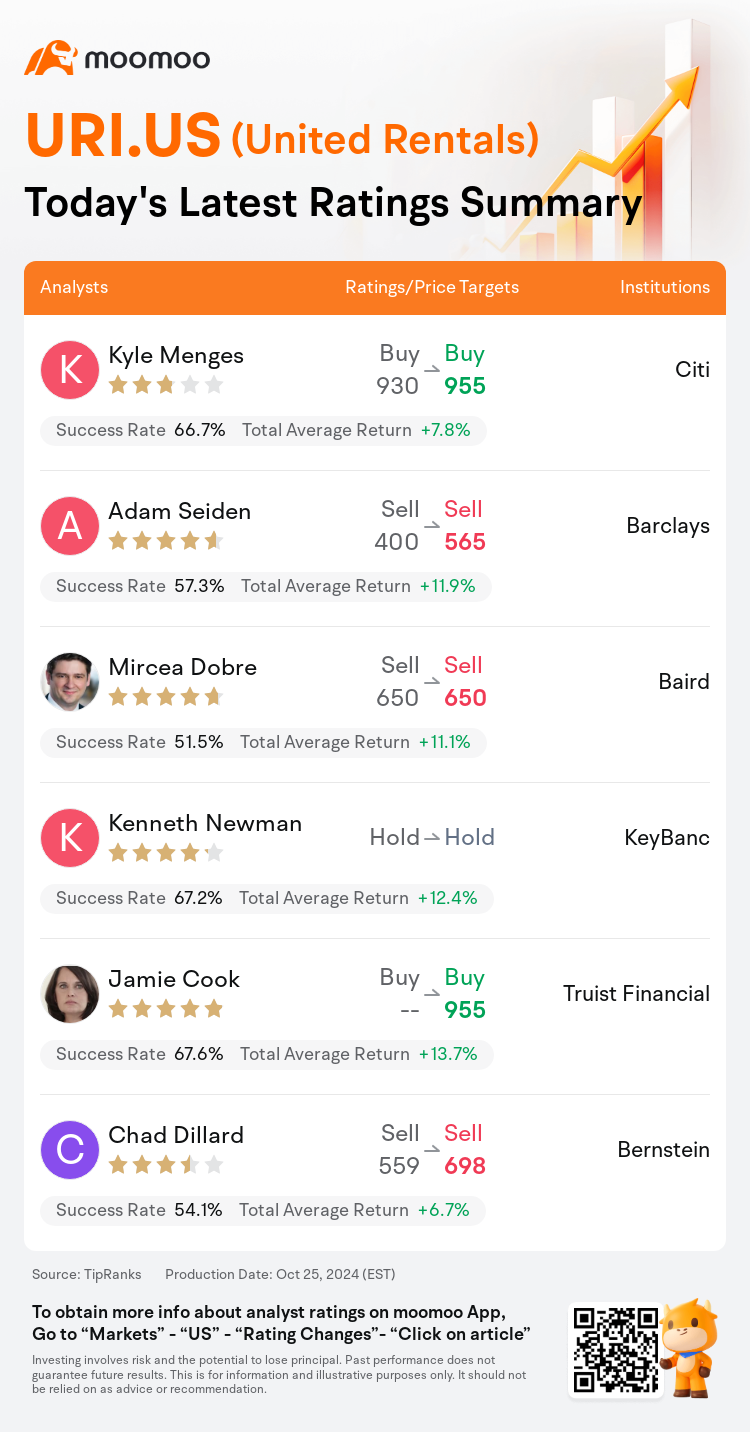

On Oct 25, major Wall Street analysts update their ratings for $United Rentals (URI.US)$, with price targets ranging from $565 to $955.

Citi analyst Kyle Menges maintains with a buy rating, and adjusts the target price from $930 to $955.

Barclays analyst Adam Seiden maintains with a sell rating, and adjusts the target price from $400 to $565.

Baird analyst Mircea Dobre maintains with a sell rating, and maintains the target price at $650.

Baird analyst Mircea Dobre maintains with a sell rating, and maintains the target price at $650.

KeyBanc analyst Kenneth Newman maintains with a hold rating.

Truist Financial analyst Jamie Cook maintains with a buy rating, and sets the target price at $955.

Furthermore, according to the comprehensive report, the opinions of $United Rentals (URI.US)$'s main analysts recently are as follows:

Post the Q3 report, it's noted that United Rentals' key performance indicators are exhibiting a downward trend, and the unit economics have been experiencing a decline since the latter part of 2022.

United Rentals is expected to experience growth by 2025, which is anticipated to be driven by mega projects. This outlook persists despite the potential for ongoing softness in local markets, as noted by an analyst.

The company's Q3 outcomes were marginally below expectations, with certain aspects not meeting forecasts. Despite this, the projection for Q4 isn't assured, yet growth is anticipated to continue into 2025 even against a subdued industrial environment. It is believed that the company merits a higher valuation multiple as easing monetary policies begin to take effect. The business model and financial structure are considered to be robust, with the flexibility to adjust to the changes in the economic cycle.

The company noted a minor discrepancy in earnings while maintaining its future projections. Analysts observe indications that are in line with the peak of demand, which is also reflected in the commencement of construction activities and the slowing pace of non-residential expenditure commitments.

Here are the latest investment ratings and price targets for $United Rentals (URI.US)$ from 6 analysts:

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

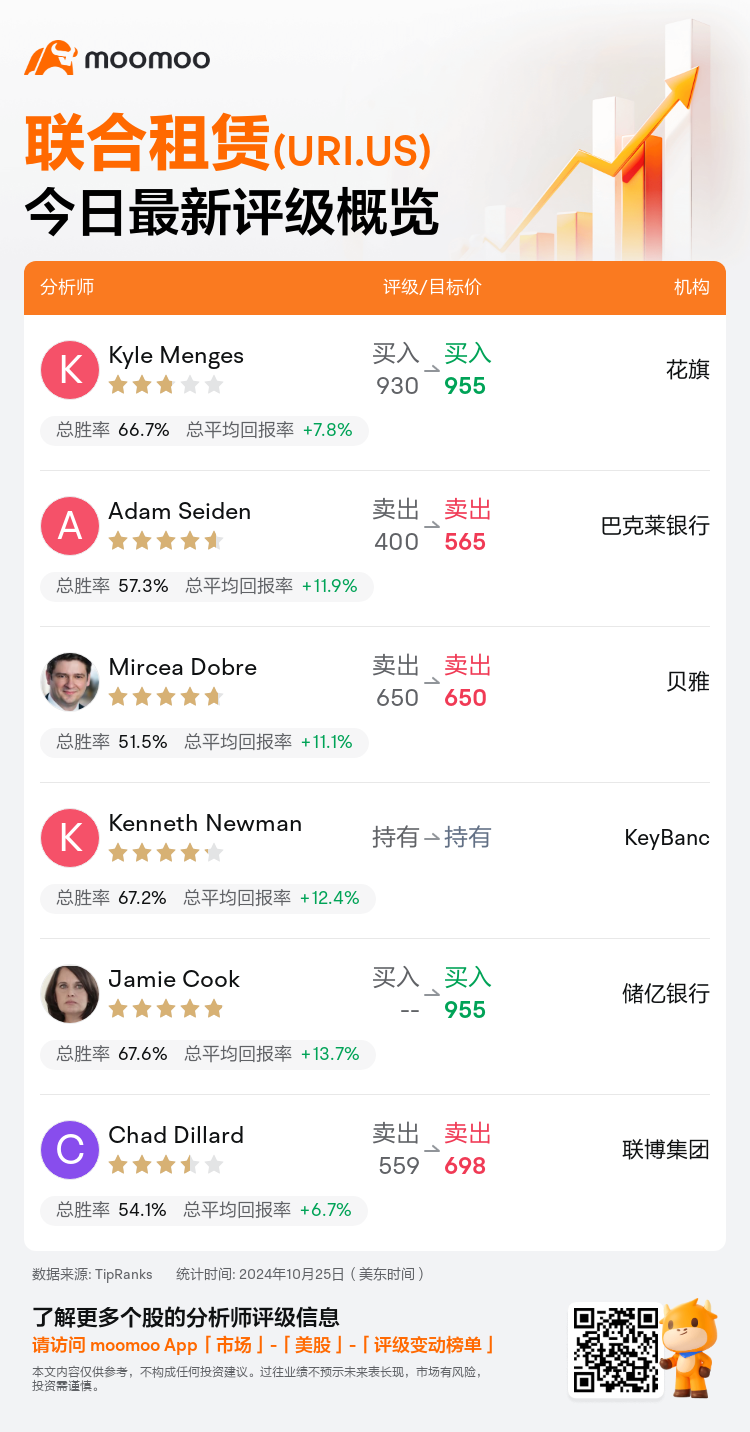

美东时间10月25日,多家华尔街大行更新了$联合租赁 (URI.US)$的评级,目标价介于565美元至955美元。

花旗分析师Kyle Menges维持买入评级,并将目标价从930美元上调至955美元。

巴克莱银行分析师Adam Seiden维持卖出评级,并将目标价从400美元上调至565美元。

贝雅分析师Mircea Dobre维持卖出评级,维持目标价650美元。

贝雅分析师Mircea Dobre维持卖出评级,维持目标价650美元。

KeyBanc分析师Kenneth Newman维持持有评级。

储亿银行分析师Jamie Cook维持买入评级,目标价955美元。

此外,综合报道,$联合租赁 (URI.US)$近期主要分析师观点如下:

发帖第三季度报告时,注意到联合租赁的关键绩效因子正在呈下降趋势,自2022年下半年以来,单位经济一直在下滑。

预计联合租赁将在2025年实现增长,预计这将受到大型项目的推动。尽管分析师指出,尽管当地市场可能持续疲软,但这种展望仍然存在。

公司第三季度的业绩略低于预期,某些方面未达到预期。尽管如此,对第四季度的预测并不确定,但预计增长将持续到2025年,即使在一个不景气的工业环境下。相信随着货币政策的放松开始生效,公司应获得更高的估值倍数。业务模式和财务结构被认为是健壮的,具有灵活性以适应经济周期的变化。

公司在保持未来预测的同时,注意到收入出现轻微差异。分析师观察到这些迹象与需求高峰相符,这也反映在施工活动的开始和非住宅支出承诺步伐的放缓。

以下为今日6位分析师对$联合租赁 (URI.US)$的最新投资评级及目标价:

提示:

TipRanks为独立第三方,提供金融分析师的分析数据,并计算分析师推荐的平均回报率和胜率。提供的信息并非投资建议,仅供参考。本文不对评级数据和报告的完整性与准确性做出认可、声明或保证。

TipRanks提供每位分析师的星级,分析师星级代表分析师所有推荐的过往表现,通过分析师的总胜率和平均回报率综合计算得出,星星越多,则该分析师过往表现越优异,最高为5颗星。

分析师总胜率为近一年分析师的评级成功次数占总评级次数的比率。评级的成功与否,取决于TipRanks的虚拟投资组合是否从该股票中产生正回报。

总平均回报率为基于分析师的初始评级创建虚拟投资组合,并根据评级变化对组合进行调整,在近一年中该投资组合所获得的回报率。

贝雅分析师Mircea Dobre维持卖出评级,维持目标价650美元。

贝雅分析师Mircea Dobre维持卖出评级,维持目标价650美元。

Baird analyst Mircea Dobre maintains with a sell rating, and maintains the target price at $650.

Baird analyst Mircea Dobre maintains with a sell rating, and maintains the target price at $650.