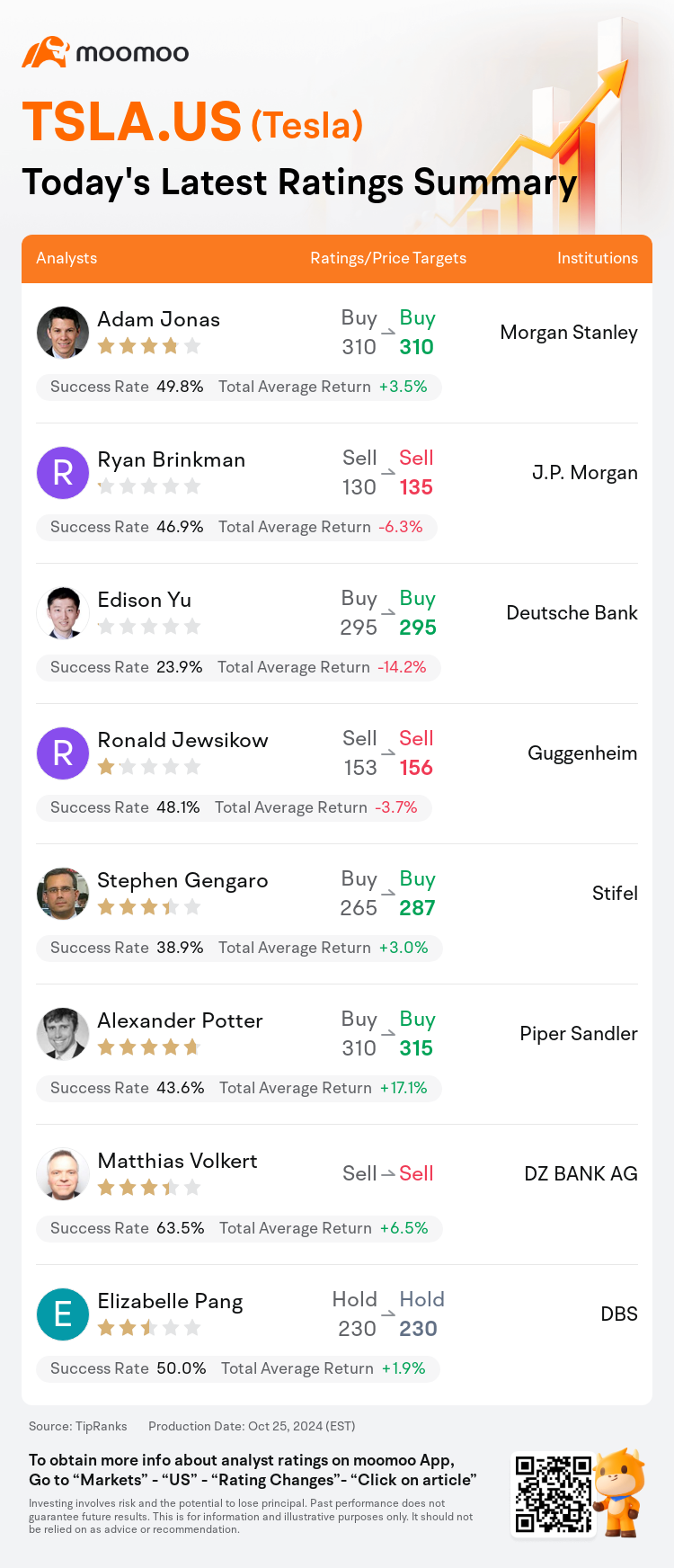

On Oct 25, major Wall Street analysts update their ratings for $Tesla (TSLA.US)$, with price targets ranging from $135 to $315.

Morgan Stanley analyst Adam Jonas maintains with a buy rating, and maintains the target price at $310.

J.P. Morgan analyst Ryan Brinkman maintains with a sell rating, and adjusts the target price from $130 to $135.

Deutsche Bank analyst Edison Yu maintains with a buy rating, and maintains the target price at $295.

Deutsche Bank analyst Edison Yu maintains with a buy rating, and maintains the target price at $295.

Guggenheim analyst Ronald Jewsikow maintains with a sell rating, and adjusts the target price from $153 to $156.

Stifel analyst Stephen Gengaro maintains with a buy rating, and adjusts the target price from $265 to $287.

Furthermore, according to the comprehensive report, the opinions of $Tesla (TSLA.US)$'s main analysts recently are as follows:

Tesla's Q3 non-GAAP EPS of 72c surpassed expectations, with a notable performance that exceeded both a major financial institution's forecast of 59c and the consensus of 60c. This success was largely attributed to a robust Auto gross profit and an increase in regulatory credits. In light of this outcome, there has been a modest upward revision in EPS projections, influenced by an improved gross margin in Q3, which reflects reduced raw material costs, progress with the Cybertruck, effective execution and cost reduction strategies, as well as higher production volume.

The company has reported better gross margins in the third quarter and has reaffirmed expectations for vehicle volume growth in 2024, along with a 20%-30% increase in deliveries projected for 2025. Analysts perceive the earnings report to be a slight positive, with margins surpassing expectations. Nevertheless, ongoing discussions center on whether the company will achieve its full self-driving performance and vehicle delivery growth objectives for 2025, in addition to the durability of its profit margins.

Tesla has showcased a substantial Auto gross margin-ex credit in the third quarter, even amidst significant price reductions. Analysts are now turning their attention to more high-value aspects such as regulatory credits, energy storage, and, most notably, autonomous capabilities. Tesla has acknowledged that the third quarter gains were bolstered by the Full Self-Driving feature launch, along with improved freight and logistics conditions. This period underscores the underlying robustness of the company's core automobile business.

Tesla's reported Q3 margins were notably better than the consensus expectations. The company also provided guidance suggesting Q4 volumes could reach approximately 515,000, surpassing the previous estimates of around 495,000, and projected sales volume growth of 20%-30% by 2025. Despite the challenge in substantiating the sales volume growth due to a lack of detailed information on new models and the increasing difficulty to project Cybertruck growth, it is recognized that the guidance may lead to elevated Street estimates.

Tesla's performance post-quarterly results saw an upturn due to impressive auto gross margins excluding EV credits and the projection of 20%-30% delivery growth by 2025. Additionally, the contribution of approximately 150 basis points to the margin from the Full Self-Driving (FSD) release was noted. It was also observed that there was a roughly 3.4% decline in pricing quarter-over-quarter when excluding FSD factors.

Here are the latest investment ratings and price targets for $Tesla (TSLA.US)$ from 8 analysts:

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

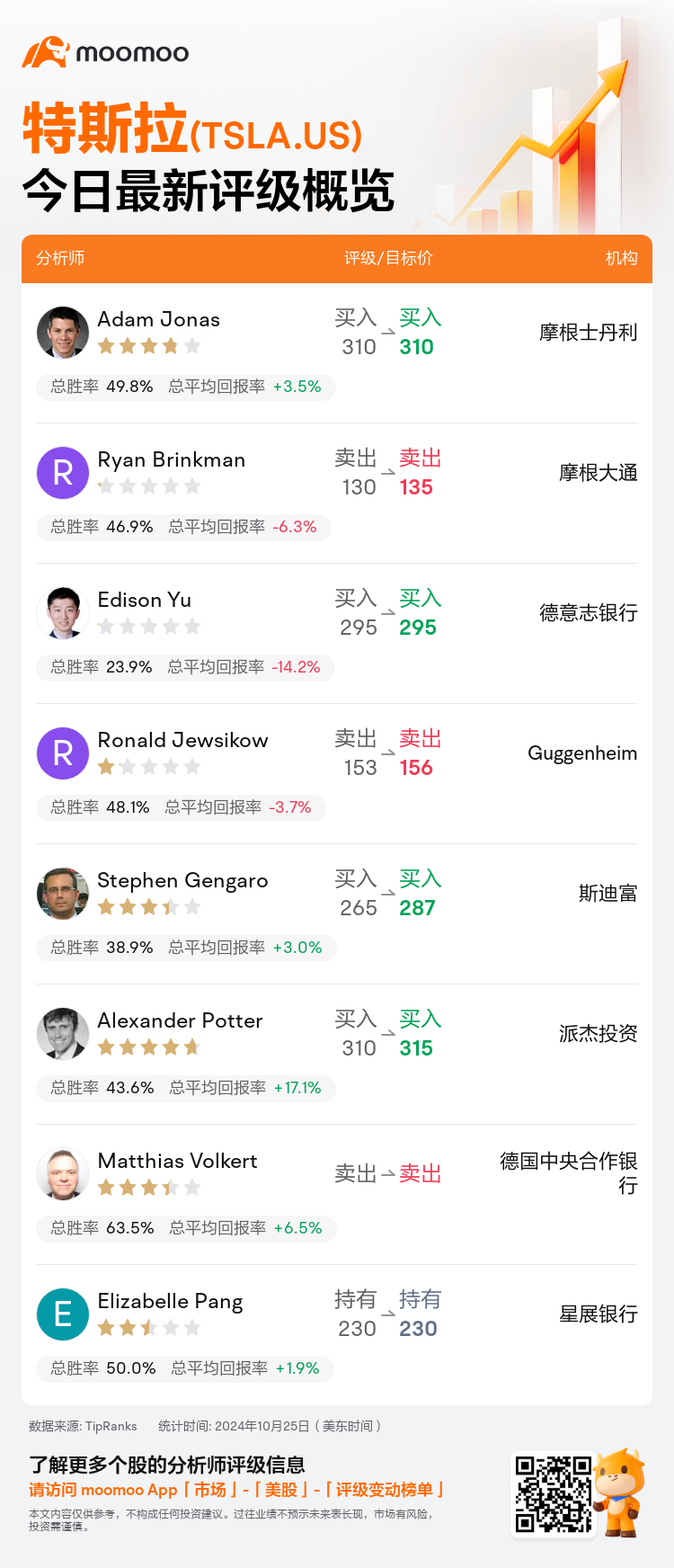

美东时间10月25日,多家华尔街大行更新了$特斯拉 (TSLA.US)$的评级,目标价介于135美元至315美元。

摩根士丹利分析师Adam Jonas维持买入评级,维持目标价310美元。

摩根大通分析师Ryan Brinkman维持卖出评级,并将目标价从130美元上调至135美元。

德意志银行分析师Edison Yu维持买入评级,维持目标价295美元。

德意志银行分析师Edison Yu维持买入评级,维持目标价295美元。

Guggenheim分析师Ronald Jewsikow维持卖出评级,并将目标价从153美元上调至156美元。

斯迪富分析师Stephen Gengaro维持买入评级,并将目标价从265美元上调至287美元。

此外,综合报道,$特斯拉 (TSLA.US)$近期主要分析师观点如下:

特斯拉第三季度的非GAAP每股收益为72美分,超过了预期,表现引人瞩目,超过了一家主要金融机构预测的59美分和市场预期的60美分。这一成功主要归因于强劲的汽车毛利润和监管积分增加。鉴于这一成果,EPS预测略有上调,受第三季度毛利率提高的影响,反映了原材料成本降低、Cybertruck进展、有效执行和降低成本策略以及更高的生产量。

公司第三季度报告了更好的毛利率,并重申了对2024年车辆销量增长的预期,预计2025年交付量将增长20%-30%。分析师认为收益报告稍微积极,利润率超出预期。然而,持续讨论集中在公司是否能实现2025年全自动驾驶性能和车辆交付增长目标,以及利润率的持久性。

特斯拉在第三季度展示了显著的汽车毛利率-减去信贷,即使在价格大幅下调的情况下。分析师现在将注意力转向更高价值的方面,如监管积分、能源存储,最显著的是自动驾驶能力。特斯拉承认第三季度收益增长得益于全自动驾驶功能的推出,以及货运和物流状况的改善。这一时期突显了公司核心汽车业务的稳健性。

特斯拉报告的第三季度利润率明显优于市场预期。该公司还提供了指导,表明第四季度的产量可能达到约515,000辆,超过先前约495,000辆的估计,并预测到2025年将实现20%-30%的销售量增长。尽管由于缺乏有关新车型信息和对Cybertruck增长的预测日益困难,从而困难证明销售量增长的挑战存在,但大家认识到该指导可能导致街头估计水平高涨。

特斯拉在发布季度业绩后看到了上升的趋势,这主要归因于令人印象深刻的汽车毛利率,不包括电动汽车积分,并且预计到2025年交付增长将达到20%-30%。此外,全自动驾驶(FSD)版本对毛利率贡献了约150个基点。观察到在排除FSD因素后,季度定价同比大约下降了3.4%。

以下为今日8位分析师对$特斯拉 (TSLA.US)$的最新投资评级及目标价:

提示:

TipRanks为独立第三方,提供金融分析师的分析数据,并计算分析师推荐的平均回报率和胜率。提供的信息并非投资建议,仅供参考。本文不对评级数据和报告的完整性与准确性做出认可、声明或保证。

TipRanks提供每位分析师的星级,分析师星级代表分析师所有推荐的过往表现,通过分析师的总胜率和平均回报率综合计算得出,星星越多,则该分析师过往表现越优异,最高为5颗星。

分析师总胜率为近一年分析师的评级成功次数占总评级次数的比率。评级的成功与否,取决于TipRanks的虚拟投资组合是否从该股票中产生正回报。

总平均回报率为基于分析师的初始评级创建虚拟投资组合,并根据评级变化对组合进行调整,在近一年中该投资组合所获得的回报率。

德意志银行分析师Edison Yu维持买入评级,维持目标价295美元。

德意志银行分析师Edison Yu维持买入评级,维持目标价295美元。

Deutsche Bank analyst Edison Yu maintains with a buy rating, and maintains the target price at $295.

Deutsche Bank analyst Edison Yu maintains with a buy rating, and maintains the target price at $295.