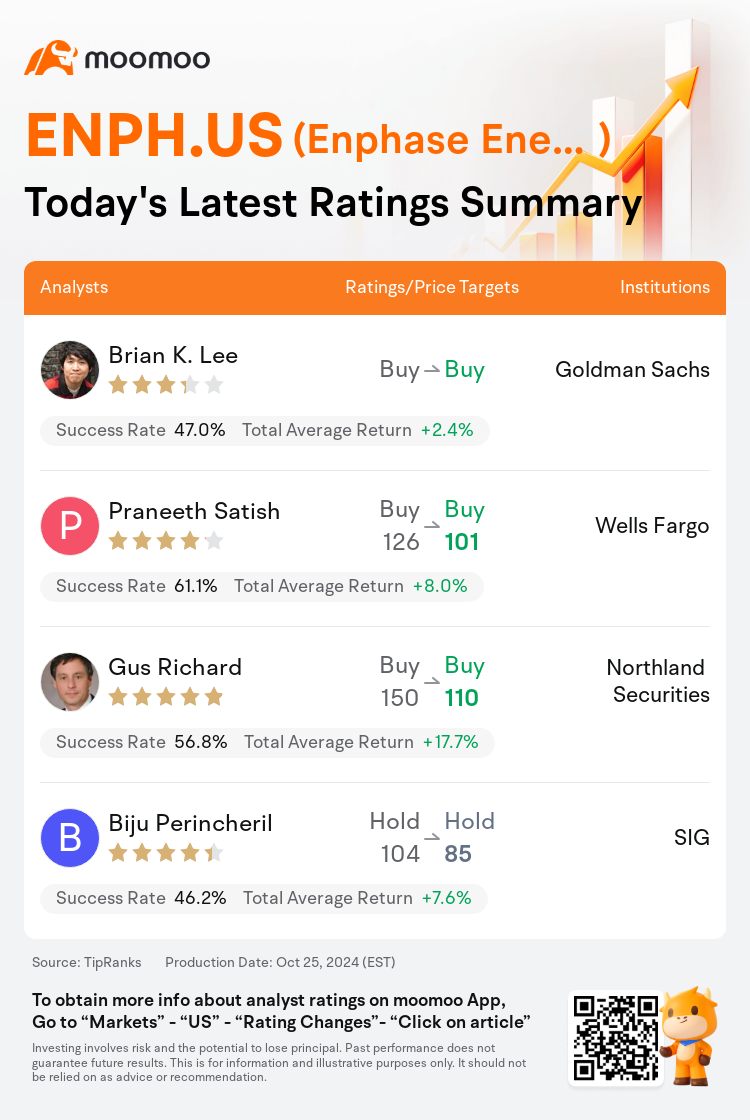

On Oct 25, major Wall Street analysts update their ratings for $Enphase Energy (ENPH.US)$, with price targets ranging from $85 to $110.

Goldman Sachs analyst Brian K. Lee maintains with a buy rating.

Wells Fargo analyst Praneeth Satish maintains with a buy rating, and adjusts the target price from $126 to $101.

Northland Securities analyst Gus Richard maintains with a buy rating, and adjusts the target price from $150 to $110.

Northland Securities analyst Gus Richard maintains with a buy rating, and adjusts the target price from $150 to $110.

SIG analyst Biju Perincheril maintains with a hold rating, and adjusts the target price from $104 to $85.

Furthermore, according to the comprehensive report, the opinions of $Enphase Energy (ENPH.US)$'s main analysts recently are as follows:

Investor expectations may be tempered following the latest earnings report and subsequent guidance from Enphase Energy, as the third-quarter figures did not meet the anticipated range and projections for the fourth quarter suggest a decrease in storage shipments. It is posited that the primary factor behind the third-quarter underperformance and the fourth quarter's outlook adjustment is the European market. This same factor may also have implications for SolarEdge. Despite these challenges, Enphase Energy's introduction of a new battery and meter collar is expected to enhance its competitive stance in the market.

Enphase Energy is anticipated to face multiple challenges that may lead to Q4 revenue falling short of initial expectations. It is suggested that Europe could continue to present difficulties through 2025, potentially impacting the current consensus projections. Projections indicate a possible 17% deviation below the consensus for revenue and EBITDA in the year 2025.

Enphase Energy's third-quarter results fell short of expectations due to reduced volume, and the outlook for the fourth quarter was also below consensus, influenced by difficult demand conditions in Europe and decreased battery shipments. Despite executing several self-improvement initiatives, the company is contending with challenging macroeconomic conditions in Europe and market disturbances in the U.S.

Enphase Energy has exhibited a strong gross margin and operating cash flow despite not meeting revenue expectations. This indicates that the company effectively preserves value capture amidst challenging market conditions. Additionally, it is adapting its product offerings to align with the quickly changing duty cycles in various regions.

Here are the latest investment ratings and price targets for $Enphase Energy (ENPH.US)$ from 4 analysts:

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

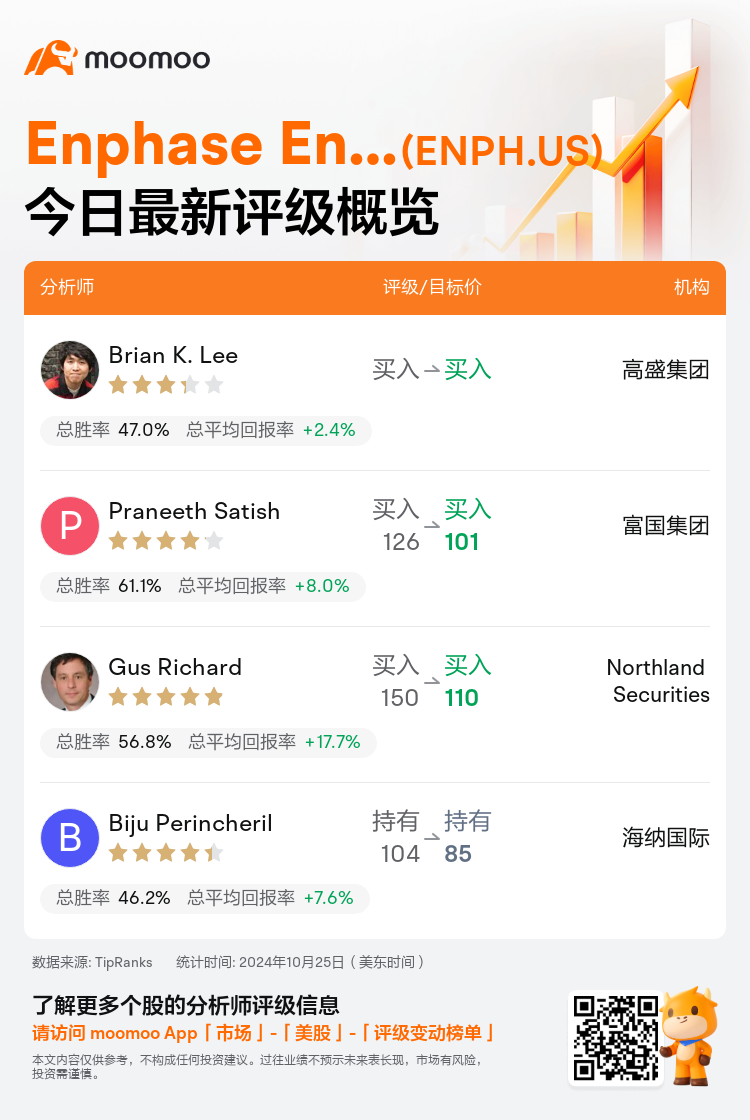

美东时间10月25日,多家华尔街大行更新了$Enphase Energy (ENPH.US)$的评级,目标价介于85美元至110美元。

高盛集团分析师Brian K. Lee维持买入评级。

富国集团分析师Praneeth Satish维持买入评级,并将目标价从126美元下调至101美元。

Northland Securities分析师Gus Richard维持买入评级,并将目标价从150美元下调至110美元。

Northland Securities分析师Gus Richard维持买入评级,并将目标价从150美元下调至110美元。

海纳国际分析师Biju Perincheril维持持有评级,并将目标价从104美元下调至85美元。

此外,综合报道,$Enphase Energy (ENPH.US)$近期主要分析师观点如下:

最新的营收报告和随后的指引显示,预期区间和第四季度的预测并不符合Enphase Energy,投资者的预期可能会有所抑制,并且第四季度的预测表明存储装运量可能会减少。有人认为,导致第三季度业绩不佳和第四季度展望调整的主要因素是欧洲市场。这个因素对SolarEdge也可能产生影响。尽管面临这些挑战,Enphase Energy推出新的电池和表盖预计将增强其在市场上的竞争地位。

预计Enphase Energy将面临多重挑战,可能导致第四季度的营业收入未能达到最初的预期。有人认为到2025年,欧洲可能会持续带来困难,可能会影响当前的共识预测。预测显示到2025年,营业收入和息税折旧摊销前利润(EBITDA)可能会低于共识约17%。

由于成交量减少,Enphase Energy第三季度的业绩未达预期,并且第四季度的展望也低于共识,受欧洲需求状况恶化和电池装运量下降的影响。尽管执行了几项自我改进的举措,但公司仍然面临欧洲的复杂宏观经济环境和美国市场的干扰。

尽管未达到营业收入预期,Enphase Energy表现出强劲的毛利率和经营现金流,这表明公司在充满挑战的市场条件下有效地保持了价值捕获。此外,公司正在调整其产品组合,以适应各个地区快速变化的工作周期。

以下为今日4位分析师对$Enphase Energy (ENPH.US)$的最新投资评级及目标价:

提示:

TipRanks为独立第三方,提供金融分析师的分析数据,并计算分析师推荐的平均回报率和胜率。提供的信息并非投资建议,仅供参考。本文不对评级数据和报告的完整性与准确性做出认可、声明或保证。

TipRanks提供每位分析师的星级,分析师星级代表分析师所有推荐的过往表现,通过分析师的总胜率和平均回报率综合计算得出,星星越多,则该分析师过往表现越优异,最高为5颗星。

分析师总胜率为近一年分析师的评级成功次数占总评级次数的比率。评级的成功与否,取决于TipRanks的虚拟投资组合是否从该股票中产生正回报。

总平均回报率为基于分析师的初始评级创建虚拟投资组合,并根据评级变化对组合进行调整,在近一年中该投资组合所获得的回报率。

Northland Securities分析师Gus Richard维持买入评级,并将目标价从150美元下调至110美元。

Northland Securities分析师Gus Richard维持买入评级,并将目标价从150美元下调至110美元。

Northland Securities analyst Gus Richard maintains with a buy rating, and adjusts the target price from $150 to $110.

Northland Securities analyst Gus Richard maintains with a buy rating, and adjusts the target price from $150 to $110.