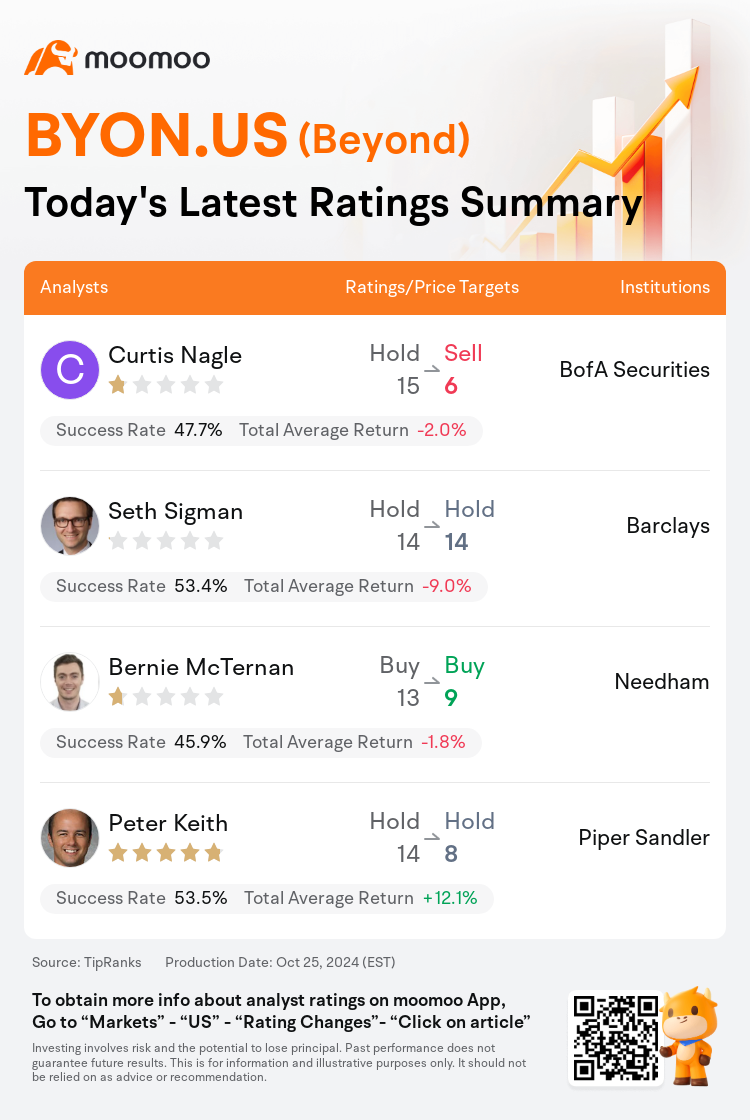

On Oct 25, major Wall Street analysts update their ratings for $Beyond (BYON.US)$, with price targets ranging from $6 to $14.

BofA Securities analyst Curtis Nagle downgrades to a sell rating, and adjusts the target price from $15 to $6.

Barclays analyst Seth Sigman maintains with a hold rating, and maintains the target price at $14.

Needham analyst Bernie McTernan maintains with a buy rating, and adjusts the target price from $13 to $9.

Needham analyst Bernie McTernan maintains with a buy rating, and adjusts the target price from $13 to $9.

Piper Sandler analyst Peter Keith maintains with a hold rating, and adjusts the target price from $14 to $8.

Furthermore, according to the comprehensive report, the opinions of $Beyond (BYON.US)$'s main analysts recently are as follows:

The strategic measures Beyond is implementing to reduce fixed expenses and expand the business are anticipated to result in substantial value for shareholders in the upcoming years. Analysts believe that the company's leadership has a robust plan for propelling profitable revenue growth. Significant enhancements in revenue and earnings are projected starting in 2025, driven by the expansion of the close-out business, the re-establishment of an online presence by Zulily, and Bed Bath & Beyond's increased physical retail presence through broader partnerships.

The potential risk-reward scenario for Beyond is described as 'intriguing with significant upside' based on the possibility of effectively consolidating the operations of Bed, Bath and Beyond, Overstock, and Zulily. Despite these brands having individual peaks and troughs of success, the combined outcome could be favorable. There is an acknowledgement of the considerable number of tasks management faces, which introduces a degree of execution risk. Additional insights regarding the core operations of the three brands are anticipated at the investor event scheduled for later in the week.

Here are the latest investment ratings and price targets for $Beyond (BYON.US)$ from 4 analysts:

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

美东时间10月25日,多家华尔街大行更新了$Beyond (BYON.US)$的评级,目标价介于6美元至14美元。

美银证券分析师Curtis Nagle下调至卖出评级,并将目标价从15美元下调至6美元。

巴克莱银行分析师Seth Sigman维持持有评级,维持目标价14美元。

Needham分析师Bernie McTernan维持买入评级,并将目标价从13美元下调至9美元。

Needham分析师Bernie McTernan维持买入评级,并将目标价从13美元下调至9美元。

派杰投资分析师Peter Keith维持持有评级,并将目标价从14美元下调至8美元。

此外,综合报道,$Beyond (BYON.US)$近期主要分析师观点如下:

Beyond正在实施的战略措施,旨在降低固定费用并扩大业务,预计将为股东在未来几年带来可观价值。分析师认为公司领导层拥有推动盈利营业收入增长的强劲计划。2025年开始预计营收和利润显著增加,这归功于业务的扩张,Zulily重新建立线上业务,以及Bed Bath & Beyond通过更广泛的合作伙伴关系增加实体零售业务的存在。

关于Beyond的潜在风险回报情形被描述为“具有显著上行潜力”,这基于有效整合Bed、Bath和Beyond、Overstock和Zulily的运营的可能性。尽管这些品牌各自存在成功的巅峰和低谷,但综合结果可能是有利的。对管理面临的大量任务的承认引入了一定的执行风险。关于这三个品牌的核心运营方面的进一步见解将在本周晚些时候的投资者活动中得到。

以下为今日4位分析师对$Beyond (BYON.US)$的最新投资评级及目标价:

提示:

TipRanks为独立第三方,提供金融分析师的分析数据,并计算分析师推荐的平均回报率和胜率。提供的信息并非投资建议,仅供参考。本文不对评级数据和报告的完整性与准确性做出认可、声明或保证。

TipRanks提供每位分析师的星级,分析师星级代表分析师所有推荐的过往表现,通过分析师的总胜率和平均回报率综合计算得出,星星越多,则该分析师过往表现越优异,最高为5颗星。

分析师总胜率为近一年分析师的评级成功次数占总评级次数的比率。评级的成功与否,取决于TipRanks的虚拟投资组合是否从该股票中产生正回报。

总平均回报率为基于分析师的初始评级创建虚拟投资组合,并根据评级变化对组合进行调整,在近一年中该投资组合所获得的回报率。

Needham分析师Bernie McTernan维持买入评级,并将目标价从13美元下调至9美元。

Needham分析师Bernie McTernan维持买入评级,并将目标价从13美元下调至9美元。

Needham analyst Bernie McTernan maintains with a buy rating, and adjusts the target price from $13 to $9.

Needham analyst Bernie McTernan maintains with a buy rating, and adjusts the target price from $13 to $9.