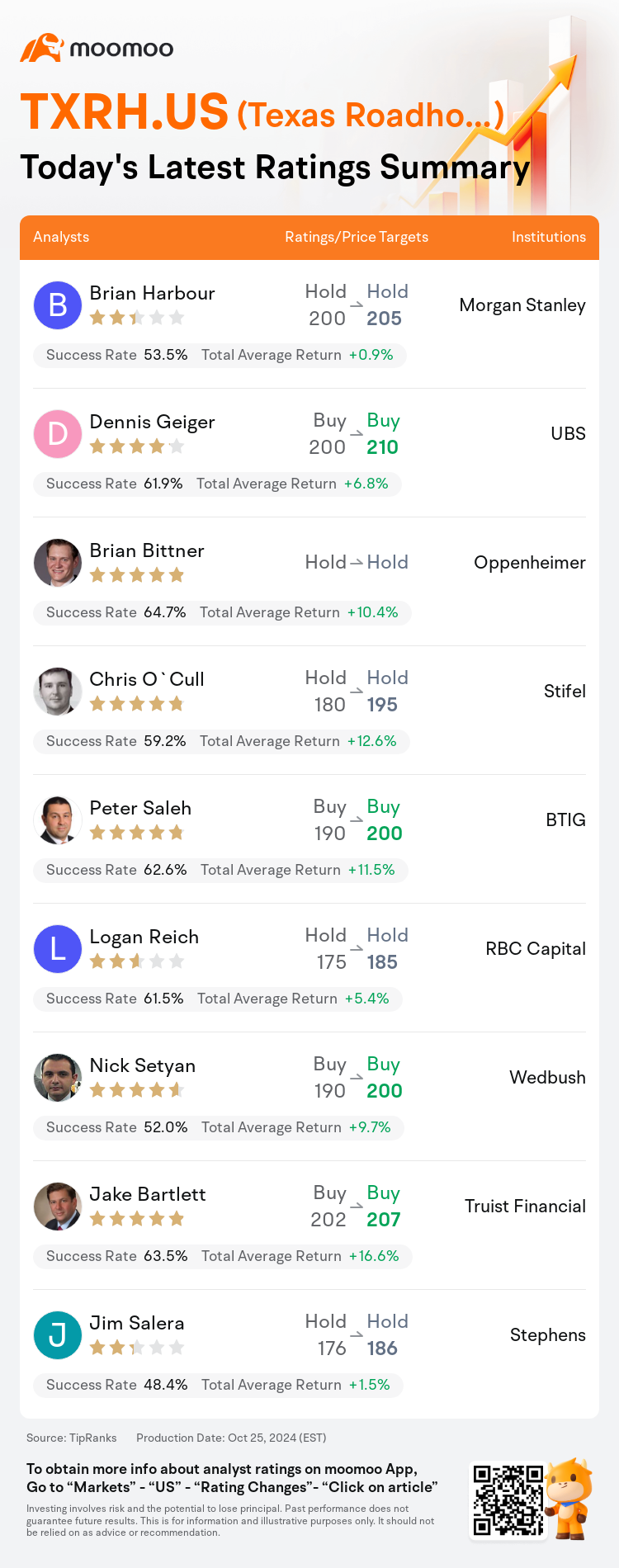

On Oct 25, major Wall Street analysts update their ratings for $Texas Roadhouse (TXRH.US)$, with price targets ranging from $185 to $210.

Morgan Stanley analyst Brian Harbour maintains with a hold rating, and adjusts the target price from $200 to $205.

UBS analyst Dennis Geiger maintains with a buy rating, and adjusts the target price from $200 to $210.

Oppenheimer analyst Brian Bittner maintains with a hold rating.

Oppenheimer analyst Brian Bittner maintains with a hold rating.

Stifel analyst Chris O`Cull maintains with a hold rating, and adjusts the target price from $180 to $195.

BTIG analyst Peter Saleh maintains with a buy rating, and adjusts the target price from $190 to $200.

Furthermore, according to the comprehensive report, the opinions of $Texas Roadhouse (TXRH.US)$'s main analysts recently are as follows:

Texas Roadhouse posted a robust performance for the quarter, which, while not significantly surpassing expectations, has led to a slight increase in projections that remain higher than the consensus.

The company's Q3 performance was robust, despite a shortfall in earnings attributed to challenges with labor and taxes.

Texas Roadhouse's third-quarter results showcased continued strong same-store sales momentum and restaurant margin expansion. The guidance for 2025 on commodities was more favorable than many expected. There is optimism surrounding the significant traffic increases and the acceleration in trends quarter-to-date, in spite of challenging economic conditions and increasingly tough comparisons. It is believed that the company's leading traffic momentum, potential for multiyear earnings growth, and the prospect of returning to sustainable margins of 17%-18% underpin the possibility for upside.

Texas Roadhouse has maintained strong momentum through the quarter, with an acceleration in comparable store sales and an approximately 100 basis point increase in traffic into October. Additionally, the company has seen labor productivity enhancements, with both labor hour growth and traffic growth below 30% in the third quarter, thereby driving leverage.

The company's Q3 earnings did not meet expectations, influenced by higher depreciation, amortization, taxes, and insurance adjustments. Recognition of the company's commendable comparable growth amidst a difficult market condition is noted. However, it is cautioned that the stock's valuation multiple is considered high and that the consensus EPS forecast for 2025 may be overly optimistic.

Here are the latest investment ratings and price targets for $Texas Roadhouse (TXRH.US)$ from 9 analysts:

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

美东时间10月25日,多家华尔街大行更新了$德州公路酒吧 (TXRH.US)$的评级,目标价介于185美元至210美元。

摩根士丹利分析师Brian Harbour维持持有评级,并将目标价从200美元上调至205美元。

瑞士银行分析师Dennis Geiger维持买入评级,并将目标价从200美元上调至210美元。

奥本海默控股分析师Brian Bittner维持持有评级。

奥本海默控股分析师Brian Bittner维持持有评级。

斯迪富分析师Chris O`Cull维持持有评级,并将目标价从180美元上调至195美元。

BTIG分析师Peter Saleh维持买入评级,并将目标价从190美元上调至200美元。

此外,综合报道,$德州公路酒吧 (TXRH.US)$近期主要分析师观点如下:

德州公路酒吧在本季度表现强劲,虽未显著超出预期,但导致投影略微增加,仍高于共识。

公司第三季度表现强劲,尽管营收不足,原因是劳工和税收方面的挑战。

德州公路酒吧第三季度业绩展示了持续强劲的同店销售增长势头和餐厅毛利率扩张。2025年商品的指引比许多人预期的更有利。尽管经济条件严峻且比较要求日益严格,但对于明显的流量增加和本季度趋势加速持乐观态度。人们认为公司领先的流量势头、多年收益增长的潜力以及恢复至可持续毛利率17%-18%的前景支持上行可能性。

德州公路酒吧在本季度保持了强劲的势头,同店销售加速增长,10月份流量增加约100个基点。此外,公司实现了劳动生产率的提高,第三季度劳动小时增长和流量增长均未超过30%,从而带动了杠杆。

公司第三季度收益未达到预期,受到较高的折旧、摊销、税收和保险调整的影响。值得注意的是公司在困难的市场环境中取得了可观的可比增长。但需要警惕的是股票的估值倍数被认为过高,并且对2025年的共识每股收益预测可能过于乐观。

以下为今日9位分析师对$德州公路酒吧 (TXRH.US)$的最新投资评级及目标价:

提示:

TipRanks为独立第三方,提供金融分析师的分析数据,并计算分析师推荐的平均回报率和胜率。提供的信息并非投资建议,仅供参考。本文不对评级数据和报告的完整性与准确性做出认可、声明或保证。

TipRanks提供每位分析师的星级,分析师星级代表分析师所有推荐的过往表现,通过分析师的总胜率和平均回报率综合计算得出,星星越多,则该分析师过往表现越优异,最高为5颗星。

分析师总胜率为近一年分析师的评级成功次数占总评级次数的比率。评级的成功与否,取决于TipRanks的虚拟投资组合是否从该股票中产生正回报。

总平均回报率为基于分析师的初始评级创建虚拟投资组合,并根据评级变化对组合进行调整,在近一年中该投资组合所获得的回报率。

奥本海默控股分析师Brian Bittner维持持有评级。

奥本海默控股分析师Brian Bittner维持持有评级。

Oppenheimer analyst Brian Bittner maintains with a hold rating.

Oppenheimer analyst Brian Bittner maintains with a hold rating.