The Return Trends At Academy Sports and Outdoors (NASDAQ:ASO) Look Promising

The Return Trends At Academy Sports and Outdoors (NASDAQ:ASO) Look Promising

There are a few key trends to look for if we want to identify the next multi-bagger. One common approach is to try and find a company with returns on capital employed (ROCE) that are increasing, in conjunction with a growing amount of capital employed. If you see this, it typically means it's a company with a great business model and plenty of profitable reinvestment opportunities. With that in mind, we've noticed some promising trends at Academy Sports and Outdoors (NASDAQ:ASO) so let's look a bit deeper.

如果我们想要找到下一个成倍增长的股票,有几个关键趋势值得关注。一种常见的方法是寻找投入资本回报率(ROCE)不断增长的公司,并且资本投入金额也在增加。如果您看到这种情况,通常意味着这是一个拥有出色商业模式和大量有利可图的再投资机会的公司。考虑到这一点,我们注意到Academy Sports and Outdoors (纳斯达克: ASO) 有一些令人期待的趋势,让我们深入了解一下。

Return On Capital Employed (ROCE): What Is It?

资本雇用回报率(ROCE)是什么?

If you haven't worked with ROCE before, it measures the 'return' (pre-tax profit) a company generates from capital employed in its business. To calculate this metric for Academy Sports and Outdoors, this is the formula:

如果您之前没接触过ROCE,它衡量公司从其业务中投入的资本所生成的“回报”(税前利润)。要为Academy Sports and Outdoors计算这一指标,可以使用以下公式:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

资产雇用回报率(ROCE)是指企业利润,即企业税前利润除以企业投入的总资本(负债加股权)。如果ROCE高于企业财务成本的承受能力,那么企业就会创造出更多的价值。

0.17 = US$633m ÷ (US$4.9b - US$1.1b) (Based on the trailing twelve months to August 2024).

0.17 = 63300万美元 ÷ (49亿美元 - 11亿美元) (基于2024年8月的过去十二个月)。

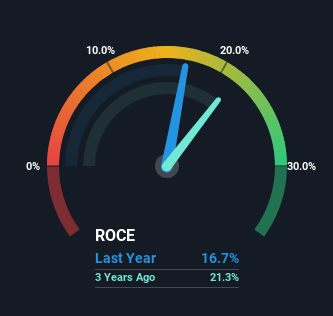

Thus, Academy Sports and Outdoors has an ROCE of 17%. On its own, that's a standard return, however it's much better than the 12% generated by the Specialty Retail industry.

因此,Academy Sports and Outdoors的ROCE为17%。单独看来,这是一个标准回报,但比专业零售行业的12%要好得多。

Above you can see how the current ROCE for Academy Sports and Outdoors compares to its prior returns on capital, but there's only so much you can tell from the past. If you'd like to see what analysts are forecasting going forward, you should check out our free analyst report for Academy Sports and Outdoors .

以上您可以看到Academy体育用品和户外的当前ROCE与其先前资本回报率相比,但过去只能得出有限的结论。如果您想了解分析师对未来的预测,请查看我们为Academy体育用品和户外提供的免费分析师报告。

What Does the ROCE Trend For Academy Sports and Outdoors Tell Us?

Academy体育用品和户外的ROCE趋势告诉我们什么?

The trends we've noticed at Academy Sports and Outdoors are quite reassuring. The numbers show that in the last five years, the returns generated on capital employed have grown considerably to 17%. The company is effectively making more money per dollar of capital used, and it's worth noting that the amount of capital has increased too, by 23%. So we're very much inspired by what we're seeing at Academy Sports and Outdoors thanks to its ability to profitably reinvest capital.

我们注意到Academy体育用品和户外的趋势相当令人 ger。数字显示,在过去的五年中,资本利用率所产生的回报大幅增长至17%。公司有效地让每一美元资本创造更多收益,值得注意的是资本金额也增加了23%。因此,Academy体育用品和户外能够盈利地再投资资本,这让我们感到非常鼓舞。

Our Take On Academy Sports and Outdoors' ROCE

我们对Academy体育用品和户外的ROCE看法

To sum it up, Academy Sports and Outdoors has proven it can reinvest in the business and generate higher returns on that capital employed, which is terrific. And with a respectable 27% awarded to those who held the stock over the last three years, you could argue that these developments are starting to get the attention they deserve. Therefore, we think it would be worth your time to check if these trends are going to continue.

总结一下,Academy体育用品和户外已经证明其可以再投资业务并在投入的资本上获得更高回报,这太棒了。在过去三年中,持有该股票的人被奖励了尊敬的27%,因此,您可以说这些发展开始引起应有的关注。因此,我们认为值得花时间来查看这些趋势是否会持续。

On the other side of ROCE, we have to consider valuation. That's why we have a FREE intrinsic value estimation for ASO on our platform that is definitely worth checking out.

在ROCE的另一方面,我们必须考虑估值。这就是为什么我们在平台上为ASO提供了一份免费的内在价值估算,绝对值得一看。

While Academy Sports and Outdoors may not currently earn the highest returns, we've compiled a list of companies that currently earn more than 25% return on equity. Check out this free list here.

尽管Academy体育用品和户外目前的回报率不是最高的,但我们已经编制了一份目前回报率超过25%的公司名单。在这里查看这份免费名单。

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

对本文有任何反馈?对内容有任何疑虑?请直接与我们联系。或者,发送电子邮件至editorial-team@simplywallst.com。

这篇文章是Simply Wall St的一般性文章。我们根据历史数据和分析师预测提供评论,只使用公正的方法论,我们的文章并不意味着提供任何金融建议。文章不构成买卖任何股票的建议,也不考虑您的目标或您的财务状况。我们的目标是带给您基本数据驱动的长期关注分析。请注意,我们的分析可能不考虑最新的价格敏感公司公告或定性材料。Simply Wall St没有任何股票头寸。

0.17 = US$633m ÷ (US$4.9b - US$1.1b)

0.17 = US$633m ÷ (US$4.9b - US$1.1b)