Smart Money Is Betting Big In SNOW Options

Smart Money Is Betting Big In SNOW Options

Whales with a lot of money to spend have taken a noticeably bearish stance on Snowflake.

有很多钱可以花的鲸鱼对Snowflake采取了明显的看跌立场。

Looking at options history for Snowflake (NYSE:SNOW) we detected 9 trades.

查看Snowflake(纽约证券交易所代码:SNOW)的期权历史记录,我们发现了9笔交易。

If we consider the specifics of each trade, it is accurate to state that 11% of the investors opened trades with bullish expectations and 66% with bearish.

如果我们考虑每笔交易的具体情况,可以准确地说,有11%的投资者以看涨的预期开盘,66%的投资者持看跌预期。

From the overall spotted trades, 5 are puts, for a total amount of $259,256 and 4, calls, for a total amount of $377,858.

在所有已发现的交易中,有5笔是看跌期权,总额为259,256美元,4笔看涨期权,总额为377,858美元。

Expected Price Movements

预期的价格走势

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $85.0 to $165.0 for Snowflake over the recent three months.

根据交易活动,看来重要投资者的目标是在最近三个月中将Snowflake的价格从85.0美元扩大到165.0美元。

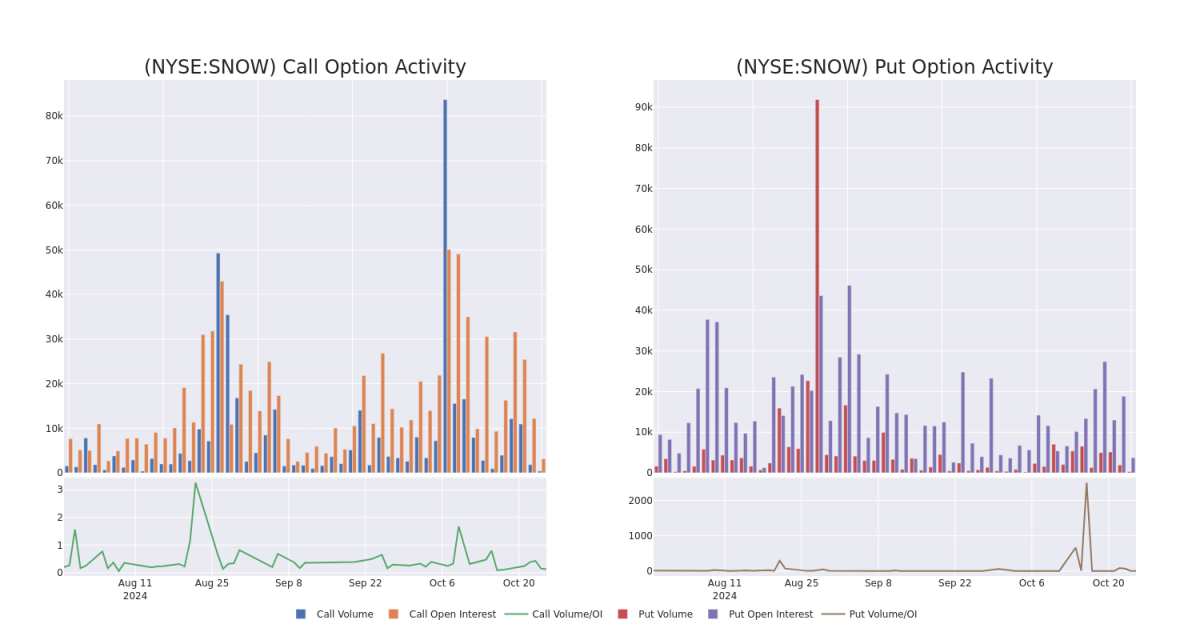

Volume & Open Interest Development

交易量和未平仓合约的发展

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in Snowflake's options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to Snowflake's substantial trades, within a strike price spectrum from $85.0 to $165.0 over the preceding 30 days.

评估交易量和未平仓合约是期权交易的战略步骤。这些指标揭示了指定行使价下Snowflake期权的流动性和投资者对Snowflake期权的兴趣。即将发布的数据显示了与Snowflake的大量交易相关的看涨期权和看跌期权的交易量和未平仓合约的波动,在过去30天内,行使价范围从85.0美元到165.0美元不等。

Snowflake Option Activity Analysis: Last 30 Days

Snowflake 期权活动分析:过去 30 天

Biggest Options Spotted:

发现的最大选择:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| SNOW | CALL | TRADE | BEARISH | 11/08/24 | $22.6 | $22.1 | $22.1 | $95.00 | $221.0K | 0 | 100 |

| SNOW | PUT | SWEEP | BEARISH | 12/20/24 | $9.05 | $9.0 | $9.05 | $115.00 | $105.8K | 2.7K | 135 |

| SNOW | CALL | SWEEP | NEUTRAL | 02/21/25 | $14.9 | $14.6 | $14.72 | $115.00 | $79.5K | 259 | 56 |

| SNOW | PUT | TRADE | BEARISH | 01/16/26 | $54.7 | $54.6 | $54.7 | $165.00 | $65.6K | 95 | 12 |

| SNOW | CALL | SWEEP | BEARISH | 03/21/25 | $4.3 | $4.2 | $4.2 | $160.00 | $46.2K | 2.4K | 134 |

| 符号 | 看跌/看涨 | 交易类型 | 情绪 | Exp。日期 | 问 | 出价 | 价格 | 行使价 | 总交易价格 | 未平仓合约 | 音量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| 雪 | 打电话 | 贸易 | 粗鲁的 | 11/08/24 | 22.6 美元 | 22.1 美元 | 22.1 美元 | 95.00 美元 | 221.0 万美元 | 0 | 100 |

| 雪 | 放 | 扫 | 粗鲁的 | 12/20/24 | 9.05 美元 | 9.0 美元 | 9.05 美元 | 115.00 美元 | 105.8 万美元 | 2.7K | 135 |

| 雪 | 打电话 | 扫 | 中立 | 02/21/25 | 14.9 美元 | 14.6 美元 | 14.72 美元 | 115.00 美元 | 79.5 万美元 | 259 | 56 |

| 雪 | 放 | 贸易 | 粗鲁的 | 01/16/26 | 54.7 美元 | 54.6 美元 | 54.7 美元 | 165.00 美元 | 65.6 万美元 | 95 | 12 |

| 雪 | 打电话 | 扫 | 粗鲁的 | 03/21/25 | 4.3 美元 | 4.2 美元 | 4.2 美元 | 160.00 美元 | 46.2 万美元 | 2.4K | 134 |

About Snowflake

关于 Snowflake

Founded in 2012, Snowflake is a data lake, warehousing, and sharing company that came public in 2020. To date, the company has over 3,000 customers, including nearly 30% of the Fortune 500 as its customers. Snowflake's data lake stores unstructured and semistructured data that can then be used in analytics to create insights stored in its data warehouse. Snowflake's data sharing capability allows enterprises to easily buy and ingest data almost instantaneously compared with a traditionally months-long process. Overall, the company is known for the fact that all of its data solutions that can be hosted on various public clouds.

Snowflake 成立于 2012 年,是一家数据湖、仓储和共享公司,于 2020 年上市。迄今为止,该公司拥有3,000多名客户,其中包括将近30%的财富500强公司作为其客户。Snowflake 的数据湖存储非结构化和半结构化数据,然后可用于分析,以创建存储在其数据仓库中的见解。与传统长达数月的过程相比,Snowflake的数据共享功能使企业几乎可以即时轻松地购买和摄取数据。总体而言,该公司以其所有数据解决方案都可以托管在各种公共云上而闻名。

After a thorough review of the options trading surrounding Snowflake, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

在对围绕Snowflake的期权交易进行了全面审查之后,我们将对该公司进行更详细的审查。这包括评估其当前的市场状况和表现。

Where Is Snowflake Standing Right Now?

Snowflake 现在站在哪里?

- Trading volume stands at 518,636, with SNOW's price up by 1.53%, positioned at $116.68.

- RSI indicators show the stock to be may be approaching overbought.

- Earnings announcement expected in 33 days.

- 交易量为518,636美元,其中SNOW的价格上涨了1.53%,为116.68美元。

- RSI指标显示该股可能接近超买。

- 预计将在33天后公布财报。

Unusual Options Activity Detected: Smart Money on the Move

检测到不寻常的期权活动:智能货币在移动

Benzinga Edge's Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

Benzinga Edge的不寻常期权委员会在潜在的市场推动者发生之前就发现了它们。看看大笔资金对你最喜欢的股票持有哪些头寸。点击此处访问。

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Snowflake options trades with real-time alerts from Benzinga Pro.

期权交易具有更高的风险和潜在的回报。精明的交易者通过不断自我教育、调整策略、监控多个指标以及密切关注市场走势来管理这些风险。借助Benzinga Pro的实时提醒,随时了解最新的Snowflake期权交易。

From the overall spotted trades, 5 are puts, for a total amount of $259,256 and 4, calls, for a total amount of $377,858.

From the overall spotted trades, 5 are puts, for a total amount of $259,256 and 4, calls, for a total amount of $377,858.