Guangdong Fuxin Technology (SHSE:688662) Will Want To Turn Around Its Return Trends

Guangdong Fuxin Technology (SHSE:688662) Will Want To Turn Around Its Return Trends

There are a few key trends to look for if we want to identify the next multi-bagger. Typically, we'll want to notice a trend of growing return on capital employed (ROCE) and alongside that, an expanding base of capital employed. Put simply, these types of businesses are compounding machines, meaning they are continually reinvesting their earnings at ever-higher rates of return. In light of that, when we looked at Guangdong Fuxin Technology (SHSE:688662) and its ROCE trend, we weren't exactly thrilled.

如果我们想要识别下一个巨额持有者,就需要留意几个关键趋势。通常,我们会希望注意到资本雇用回报率(ROCE)不断增长的趋势,以及资本雇用基数的扩大。简而言之,这类企业是复利机器,意味着它们不断将收益以越来越高的回报率再投资。考虑到这一点,当我们查看广东富信科技(SHSE:688662)及其ROCE趋势时,并未感到激动。

Return On Capital Employed (ROCE): What Is It?

资本雇用回报率(ROCE)是什么?

Just to clarify if you're unsure, ROCE is a metric for evaluating how much pre-tax income (in percentage terms) a company earns on the capital invested in its business. Analysts use this formula to calculate it for Guangdong Fuxin Technology:

只是为了澄清,如果您不确定,ROCE是评估公司在其业务中投资的资本所获得的税前收益(以百分比表示)的度量标准。分析师使用这个公式为广东富信科技计算ROCE:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

资产雇用回报率(ROCE)是指企业利润,即企业税前利润除以企业投入的总资本(负债加股权)。如果ROCE高于企业财务成本的承受能力,那么企业就会创造出更多的价值。

0.033 = CN¥24m ÷ (CN¥993m - CN¥285m) (Based on the trailing twelve months to September 2024).

0.033 = 2400万人民币 ÷ (99300万人民币 - 2.85亿人民币)(基于2024年9月止的过去十二个月)。

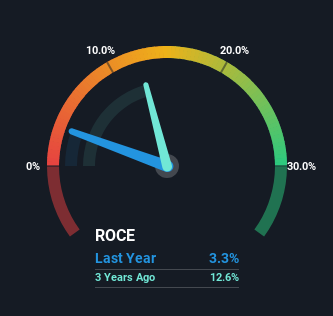

Therefore, Guangdong Fuxin Technology has an ROCE of 3.3%. In absolute terms, that's a low return and it also under-performs the Semiconductor industry average of 4.3%.

因此,广东富信科技的ROCE为3.3%。就绝对值而言,这是一个较低的回报,也低于半导体行业平均水平4.3%。

Above you can see how the current ROCE for Guangdong Fuxin Technology compares to its prior returns on capital, but there's only so much you can tell from the past. If you'd like to see what analysts are forecasting going forward, you should check out our free analyst report for Guangdong Fuxin Technology .

以上您可以看到广东富信科技目前的资本回报率(ROCE)与其之前的资本回报率相比,但从过去中能了解的信息有限。如果您想要了解未来分析师的预测,请查看我们为广东富信科技提供的免费分析师报告。

How Are Returns Trending?

综合上述,Cimpress非常有效地提高了其资本利用率所产生的回报。考虑到股票过去五年保持稳定,如果其他指标也不错,则可能存在机会。因此,进一步研究这家公司并确定这些趋势是否会持续是合理的。

In terms of Guangdong Fuxin Technology's historical ROCE movements, the trend isn't fantastic. Over the last five years, returns on capital have decreased to 3.3% from 25% five years ago. Although, given both revenue and the amount of assets employed in the business have increased, it could suggest the company is investing in growth, and the extra capital has led to a short-term reduction in ROCE. If these investments prove successful, this can bode very well for long term stock performance.

就广东富信科技的历史资本回报率(ROCE)变动而言,趋势并不理想。在过去五年中,资本回报率从五年前的25%下降至3.3%。尽管营收和业务中使用的资产数量均有所增加,这可能表明公司正在投资于增长,额外的资本导致了短期ROCE的降低。如果这些投资证明成功,这对长期股票表现将非常有利。

The Bottom Line

还有一件事需要注意的是,我们已经确定了上海医药的2个警告信号,了解这些信号应该成为你的投资过程的一部分。

In summary, despite lower returns in the short term, we're encouraged to see that Guangdong Fuxin Technology is reinvesting for growth and has higher sales as a result. Furthermore the stock has climbed 28% over the last three years, it would appear that investors are upbeat about the future. So while investors seem to be recognizing these promising trends, we would look further into this stock to make sure the other metrics justify the positive view.

总的来说,尽管短期回报率较低,我们鼓励看到广东富信科技正在为增长进行再投资,并因此销售额更高。此外股价在过去三年已上涨28%,这表明投资者对未来感到乐观。因此,尽管投资者似乎认识到这些有前途的趋势,我们需要进一步研究该股票,以确保其他指标支持积极看法。

If you want to continue researching Guangdong Fuxin Technology, you might be interested to know about the 1 warning sign that our analysis has discovered.

如果您想继续研究广东富信科技,您可能会对我们分析发现的1个警告标志感兴趣。

If you want to search for solid companies with great earnings, check out this free list of companies with good balance sheets and impressive returns on equity.

如果您想寻找财务状况良好、回报卓越的实力强企业,可以免费查看以下公司列表。

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

对本文有任何反馈?对内容有任何疑虑?请直接与我们联系。或者,发送电子邮件至editorial-team@simplywallst.com。

这篇文章是Simply Wall St的一般性文章。我们根据历史数据和分析师预测提供评论,只使用公正的方法论,我们的文章并不意味着提供任何金融建议。文章不构成买卖任何股票的建议,也不考虑您的目标或您的财务状况。我们的目标是带给您基本数据驱动的长期关注分析。请注意,我们的分析可能不考虑最新的价格敏感公司公告或定性材料。Simply Wall St没有任何股票头寸。

0.033 = CN¥24m ÷ (CN¥993m - CN¥285m)

0.033 = CN¥24m ÷ (CN¥993m - CN¥285m)