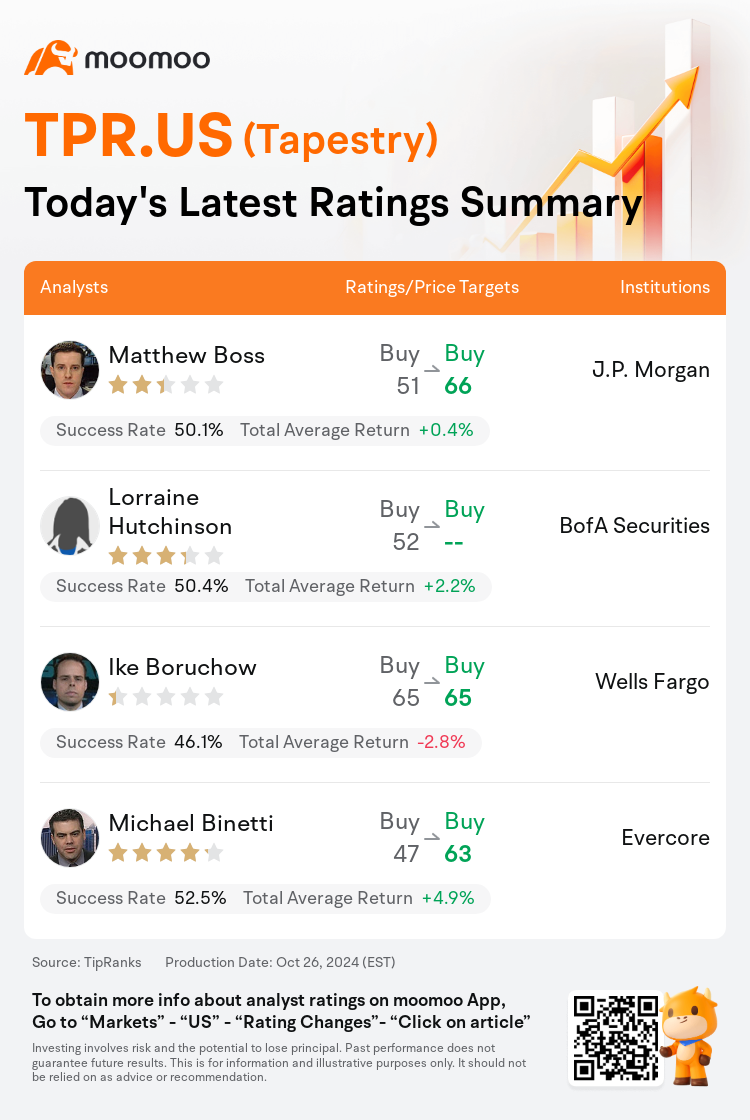

On Oct 26, major Wall Street analysts update their ratings for $Tapestry (TPR.US)$, with price targets ranging from $63 to $66.

J.P. Morgan analyst Matthew Boss maintains with a buy rating, and adjusts the target price from $51 to $66.

BofA Securities analyst Lorraine Hutchinson maintains with a buy rating.

Wells Fargo analyst Ike Boruchow maintains with a buy rating, and maintains the target price at $65.

Wells Fargo analyst Ike Boruchow maintains with a buy rating, and maintains the target price at $65.

Evercore analyst Michael Binetti maintains with a buy rating, and adjusts the target price from $47 to $63.

Furthermore, according to the comprehensive report, the opinions of $Tapestry (TPR.US)$'s main analysts recently are as follows:

The impediment of the Capri Holdings acquisition is seen as beneficial for Tapestry, allowing the company to concentrate on its reliable, high-margin, and strong cash flow generating operations instead of attempting to revitalize a floundering brand. The company is now positioned to reduce the debt incurred for the transaction and revert to a strategy focused on overall shareholder returns, characterized by a consistent and increasing dividend combined with substantial share repurchases.

The unsuccessful acquisition attempt of Capri Holdings has streamlined the narrative for Tapestry, offering a 'cleaner' outlook. Despite intentions to appeal the decision, it's possible that the management is quietly relieved. This development redirects attention to Tapestry's robust capacity to generate free cash flow, and it's anticipated that the company will recommence share repurchases in fiscal 2025.

Following a court ruling that supports the FTC in preliminarily blocking the acquisition of Capri Holdings by Tapestry, expectations have shifted, indicating that the stock may respond as if the deal will not proceed. Despite the ongoing appeal process, attention is turning back to company fundamentals. It is anticipated that both Coach and Kate Spade delivered strong performances in the first fiscal quarter, with results due on November 7. Notably, despite the challenges faced by luxury brands in China, Coach's performance in the region may provide a positive surprise for the quarter.

Here are the latest investment ratings and price targets for $Tapestry (TPR.US)$ from 4 analysts:

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

美东时间10月26日,多家华尔街大行更新了$Tapestry (TPR.US)$的评级,目标价介于63美元至66美元。

摩根大通分析师Matthew Boss维持买入评级,并将目标价从51美元上调至66美元。

美银证券分析师Lorraine Hutchinson维持买入评级。

富国集团分析师Ike Boruchow维持买入评级,维持目标价65美元。

富国集团分析师Ike Boruchow维持买入评级,维持目标价65美元。

Evercore分析师Michael Binetti维持买入评级,并将目标价从47美元上调至63美元。

此外,综合报道,$Tapestry (TPR.US)$近期主要分析师观点如下:

卡普里控股收购的障碍被视为有益于tapestry,使公司能够专注于可靠、高毛利和强现金流产生业务,而不是试图振兴一个步履蹒跚的品牌。公司现在定位于减少因交易而产生的债务,并回归到一个以整体股东回报为重点的策略,以稳定且增长的股息结合大量回购股份为特征。

未能成功收购卡普里控股已简化了tapestry的叙述,提供了更"清晰"的展望。尽管有意提出上诉,但管理层可能在悄悄松了口气。这一发展将注意力转向tapestry强大的自由现金流产能,预计公司将于2025财年恢复回购股份。

在法院裁决支持FTC初步阻止tapestry收购卡普里控股之后,预期已经发生变化,表明股票可能会做出反应,就好像交易不会进行一样。尽管上诉程序仍在进行中,但注意力正在回到公司的基本面上。预计Coach和Kate Spade在第一个财季取得了良好表现,结果将于11月7日公布。值得注意的是,尽管奢侈品牌在中国面临挑战,但Coach在该地区的表现可能为这一季度带来积极的惊喜。

以下为今日4位分析师对$Tapestry (TPR.US)$的最新投资评级及目标价:

提示:

TipRanks为独立第三方,提供金融分析师的分析数据,并计算分析师推荐的平均回报率和胜率。提供的信息并非投资建议,仅供参考。本文不对评级数据和报告的完整性与准确性做出认可、声明或保证。

TipRanks提供每位分析师的星级,分析师星级代表分析师所有推荐的过往表现,通过分析师的总胜率和平均回报率综合计算得出,星星越多,则该分析师过往表现越优异,最高为5颗星。

分析师总胜率为近一年分析师的评级成功次数占总评级次数的比率。评级的成功与否,取决于TipRanks的虚拟投资组合是否从该股票中产生正回报。

总平均回报率为基于分析师的初始评级创建虚拟投资组合,并根据评级变化对组合进行调整,在近一年中该投资组合所获得的回报率。

富国集团分析师Ike Boruchow维持买入评级,维持目标价65美元。

富国集团分析师Ike Boruchow维持买入评级,维持目标价65美元。

Wells Fargo analyst Ike Boruchow maintains with a buy rating, and maintains the target price at $65.

Wells Fargo analyst Ike Boruchow maintains with a buy rating, and maintains the target price at $65.