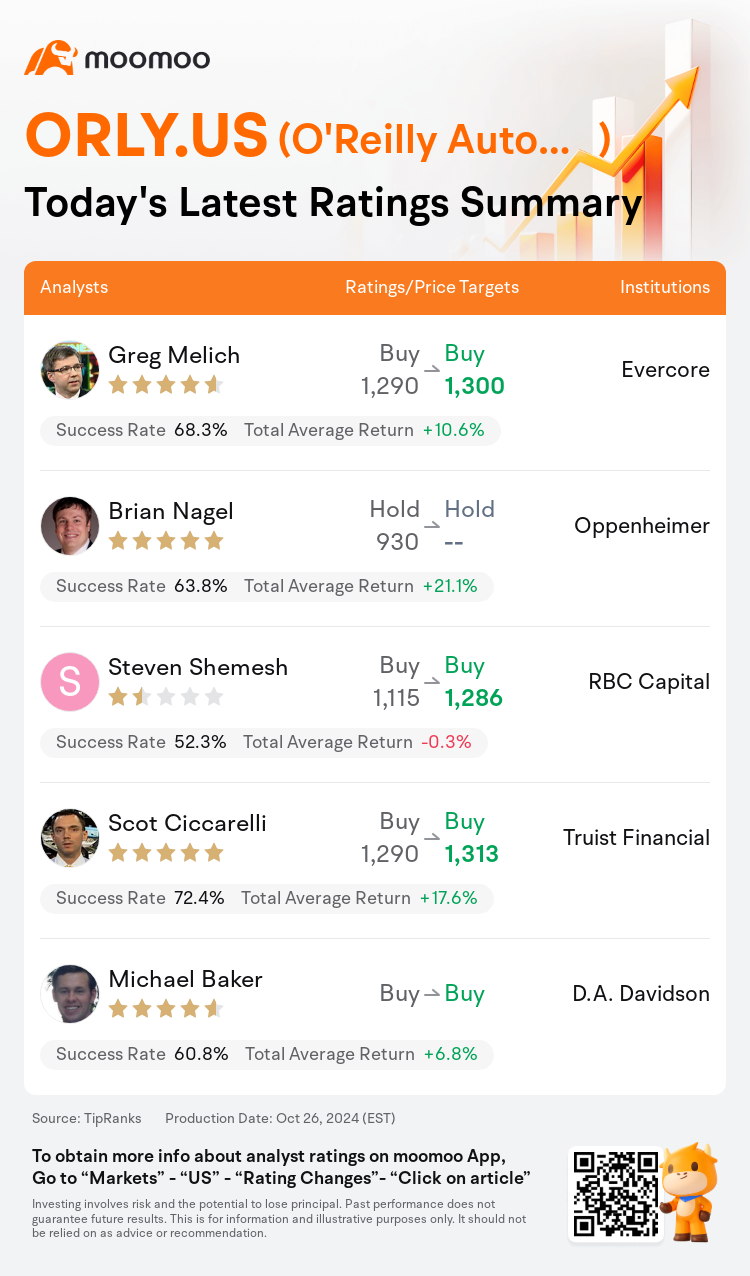

On Oct 26, major Wall Street analysts update their ratings for $O'Reilly Automotive (ORLY.US)$, with price targets ranging from $1,286 to $1,313.

Evercore analyst Greg Melich maintains with a buy rating, and adjusts the target price from $1,290 to $1,300.

Oppenheimer analyst Brian Nagel maintains with a hold rating.

RBC Capital analyst Steven Shemesh maintains with a buy rating, and adjusts the target price from $1,115 to $1,286.

RBC Capital analyst Steven Shemesh maintains with a buy rating, and adjusts the target price from $1,115 to $1,286.

Truist Financial analyst Scot Ciccarelli maintains with a buy rating, and adjusts the target price from $1,290 to $1,313.

D.A. Davidson analyst Michael Baker maintains with a buy rating.

Furthermore, according to the comprehensive report, the opinions of $O'Reilly Automotive (ORLY.US)$'s main analysts recently are as follows:

The firm's third-quarter report for O'Reilly Automotive revealed results that aligned with expectations. Comparable sales experienced a slowdown throughout the quarter, yet this trend was in line with common industry benchmarks.

O'Reilly Automotive's Q3 earnings per share were reported at $11.41 compared to the consensus forecast of $11.54. The company also saw a comparable store sales growth of 1.5%, which fell short of the anticipated 2.5%. This underperformance is attributed to widespread consumer pressures and a tepid demand climate affecting both professional and do-it-yourself segments. Nonetheless, O'Reilly is recognized as a top-tier entity in the auto aftermarket space, a sector known for its resilience relative to the broader Consumer Discretionary sector.

The firm reduced its estimates for O'Reilly Automotive as industry challenges continue and it is anticipated that earnings momentum will stay moderate for the time being. Nonetheless, the argument is that the stock's higher valuation is justified owing to its exceptional execution and gains in market share, justifying a modest increase in valuation estimates.

The firm noted that O'Reilly Automotive's third-quarter comparable sales were consistent with expectations, as the company remains resilient amidst challenging conditions and continues to capture a larger share of the Do-It-For-Me market segment.

Following Q3 outcomes, a market consensus suggests O'Reilly Automotive continues to gain market share, though its competitive edge has somewhat diminished in recent periods amidst broader industry challenges. Current assessments also imply a cautious outlook regarding the sector's revival. Concurrently, there's a slight reduction in earnings projections for the coming years.

Here are the latest investment ratings and price targets for $O'Reilly Automotive (ORLY.US)$ from 5 analysts:

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

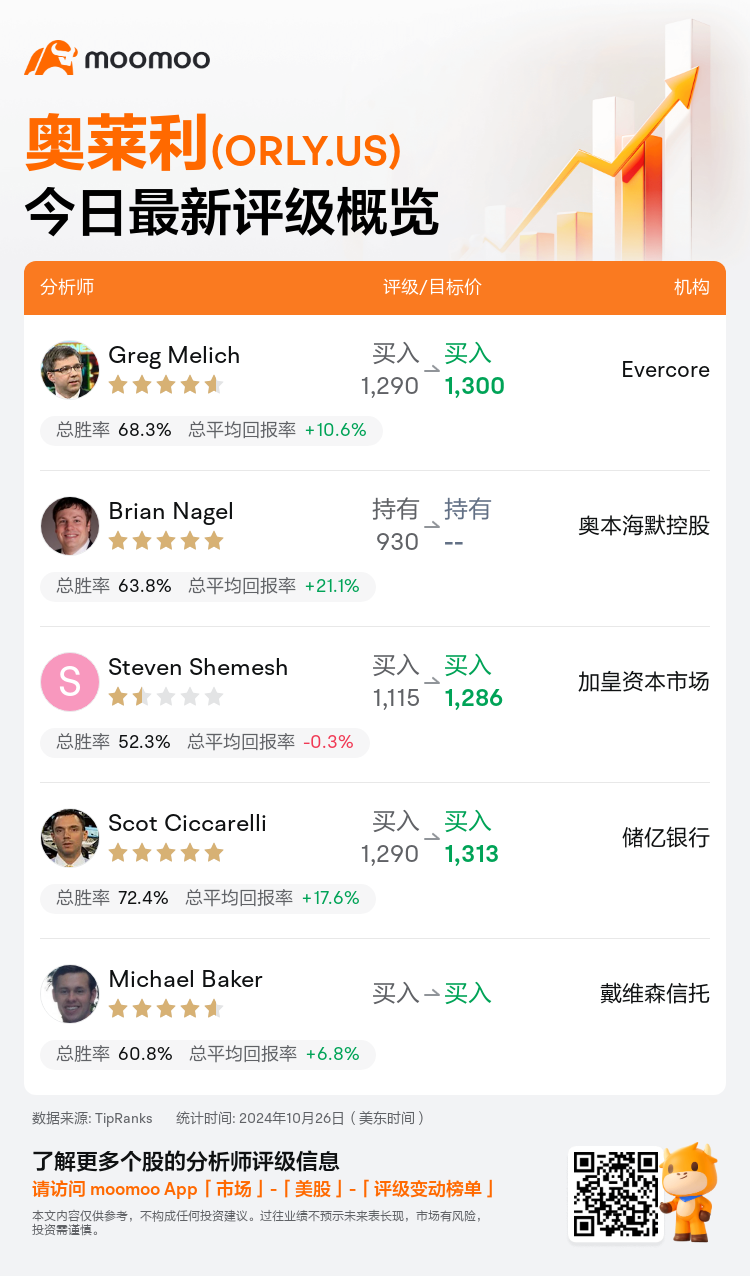

美东时间10月26日,多家华尔街大行更新了$奥莱利 (ORLY.US)$的评级,目标价介于1,286美元至1,313美元。

Evercore分析师Greg Melich维持买入评级,并将目标价从1,290美元上调至1,300美元。

奥本海默控股分析师Brian Nagel维持持有评级。

加皇资本市场分析师Steven Shemesh维持买入评级,并将目标价从1,115美元上调至1,286美元。

加皇资本市场分析师Steven Shemesh维持买入评级,并将目标价从1,115美元上调至1,286美元。

储亿银行分析师Scot Ciccarelli维持买入评级,并将目标价从1,290美元上调至1,313美元。

戴维森信托分析师Michael Baker维持买入评级。

此外,综合报道,$奥莱利 (ORLY.US)$近期主要分析师观点如下:

奥莱利汽车的第三季度报告显示,其结果与预期一致。尽管整个季度可比销售出现放缓,但这一趋势符合通常的行业基准。

奥莱利汽车的第三季度每股收益为11.41美元,低于11.54美元的共识预测。该公司还看到了可比店铺销售增长1.5%,低于预期的2.5%。这一表现不佳归因于消费者压力普遍存在,以及影响专业和DIY领域的温和需求气候。尽管如此,奥莱利被认为是汽车售后市场的一流公司,这是一个以其对较广消费部门的韧性而闻名的板块。

随着行业挑战持续,该公司降低了对奥莱利汽车的估值,并预计收益势头将在短期内保持适度。尽管如此,有观点认为,该股票较高的估值由于其出色的执行力和市场份额的增长而得到了证明,从而证明了对估值预测的适度提高。

该公司指出,奥莱利汽车第三季度的可比销售额符合预期,因为公司在挑战条件下仍然表现出韧性,并且继续占据Do-It-For-Me市场领域的更大份额。

根据第三季度的结果,市场普遍认为奥莱利汽车持续增加市场份额,尽管在广泛的行业挑战中,其竞争优势在最近一段时间略有减弱。目前的评估也暗示着对该行业复苏的谨慎展望。同时,未来几年的盈利预测也出现轻微下调。

以下为今日5位分析师对$奥莱利 (ORLY.US)$的最新投资评级及目标价:

提示:

TipRanks为独立第三方,提供金融分析师的分析数据,并计算分析师推荐的平均回报率和胜率。提供的信息并非投资建议,仅供参考。本文不对评级数据和报告的完整性与准确性做出认可、声明或保证。

TipRanks提供每位分析师的星级,分析师星级代表分析师所有推荐的过往表现,通过分析师的总胜率和平均回报率综合计算得出,星星越多,则该分析师过往表现越优异,最高为5颗星。

分析师总胜率为近一年分析师的评级成功次数占总评级次数的比率。评级的成功与否,取决于TipRanks的虚拟投资组合是否从该股票中产生正回报。

总平均回报率为基于分析师的初始评级创建虚拟投资组合,并根据评级变化对组合进行调整,在近一年中该投资组合所获得的回报率。

加皇资本市场分析师Steven Shemesh维持买入评级,并将目标价从1,115美元上调至1,286美元。

加皇资本市场分析师Steven Shemesh维持买入评级,并将目标价从1,115美元上调至1,286美元。

RBC Capital analyst Steven Shemesh maintains with a buy rating, and adjusts the target price from $1,115 to $1,286.

RBC Capital analyst Steven Shemesh maintains with a buy rating, and adjusts the target price from $1,115 to $1,286.