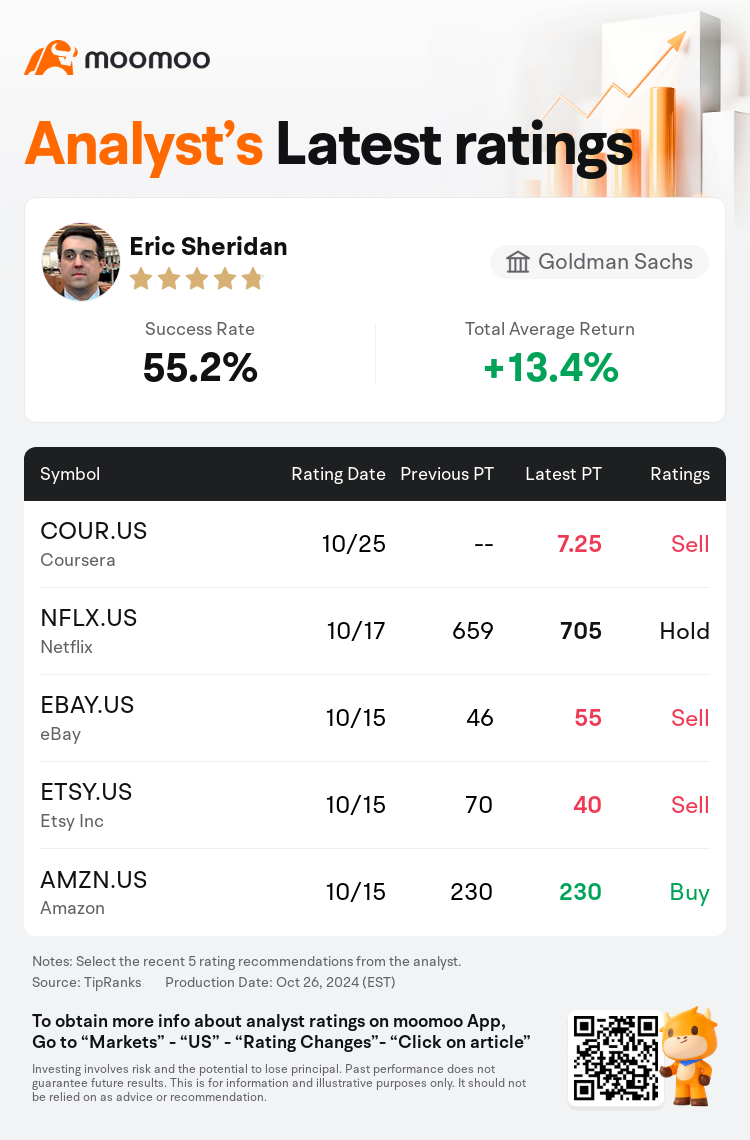

Goldman Sachs analyst Eric Sheridan maintains $Coursera (COUR.US)$ with a sell rating, and sets the target price at $7.25.

According to TipRanks data, the analyst has a success rate of 55.2% and a total average return of 13.4% over the past year.

Furthermore, according to the comprehensive report, the opinions of $Coursera (COUR.US)$'s main analysts recently are as follows:

Furthermore, according to the comprehensive report, the opinions of $Coursera (COUR.US)$'s main analysts recently are as follows:

Following the third quarter results, which surpassed consensus, there was a downward adjustment in the fourth quarter revenue guidance and a reduction in the anticipated revenue growth for FY24 from 10% to 9%. This was attributed to a decrease in consumer retention alongside a 4 point decline in Net Revenue Retention to 89% within the Enterprise segment. This situation is expected to exert downward pressure on the stock. Nevertheless, it is believed that the current valuation of the shares does not fully reflect the company's profitable growth prospects.

It is evident that Coursera is navigating through evolving market dynamics within its target markets, with challenging macroeconomic factors adding to the headwinds, particularly in the North American region. There's also a noticeable demographic pivot towards more cost-sensitive emerging regions and a gradual uptake of Gen-AI technology among educational bodies. Nonetheless, Coursera is seen as being strategically placed to transform the higher education landscape in emerging markets, which tend to be more open to innovation.

The company exceeded expectations slightly with its Q3 revenue and EBITDA, yet projected a softer Q4 revenue, mainly due to a dip in professional certificate retention. Despite the less encouraging forecast, the long-term prospects for the company's enterprise and degree segments continue to be viewed optimistically.

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

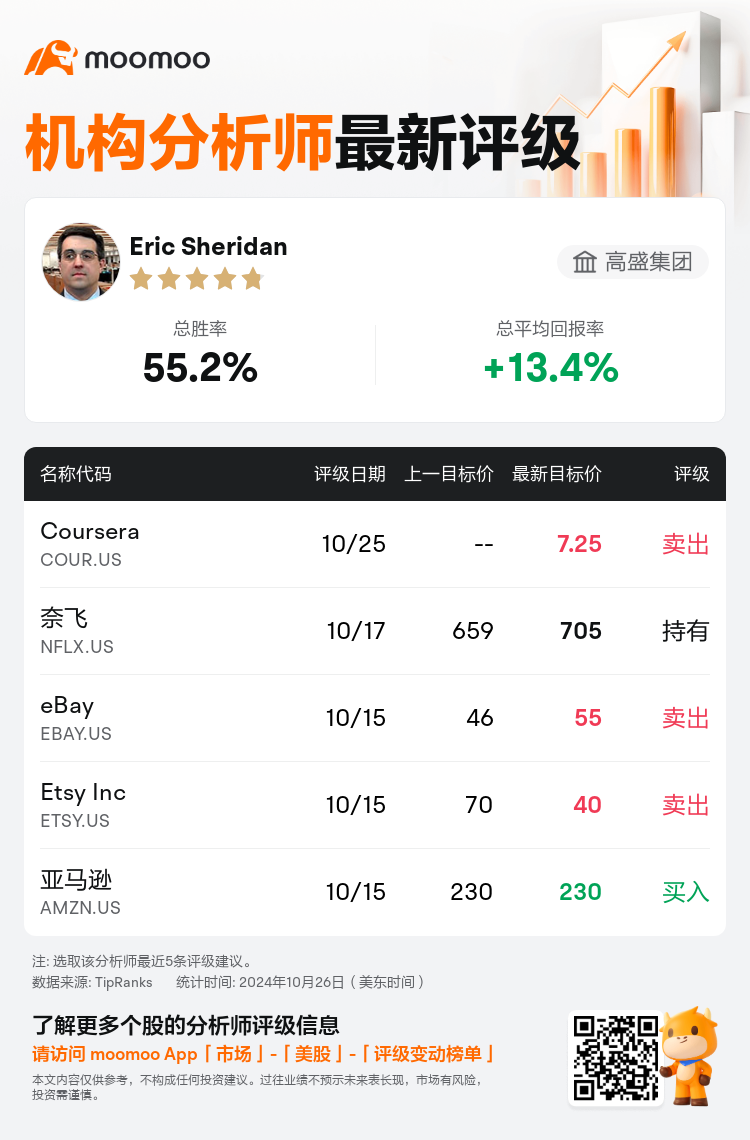

高盛集团分析师Eric Sheridan维持$Coursera (COUR.US)$卖出评级,目标价7.25美元。

根据TipRanks数据显示,该分析师近一年总胜率为55.2%,总平均回报率为13.4%。

此外,综合报道,$Coursera (COUR.US)$近期主要分析师观点如下:

此外,综合报道,$Coursera (COUR.US)$近期主要分析师观点如下:

在第三季度业绩超出共识之后,第四季度的营业收入预测进行了下调,FY24年预期营业收入增长率从10%降至9%。这被归因于在企业部门中消费者保留率下降,净收益保持率下降4个百分点至89%。预计这种情况将对股票施加下行压力。然而,人们认为当前股价估值并未充分反映公司的盈利增长前景。

Coursera正在应对其目标市场内不断变化的市场动态,挑战宏观经济因素加剧,特别是在北美地区。还可以看到人口结构向更注重成本的新兴地区转变,以及教育机构逐渐采用Gen-AI技术。尽管如此,Coursera被认为处于战略有利位置,有望改变新兴市场的高等教育格局,这些市场更愿意接受创新。

公司Q3营业收入和EBITDA略高于预期,但预计Q4营业收入会较低,主要是由于专业证书保留率下降。尽管前景较为不乐观,公司的企业和学位部门的长期前景仍然被乐观看待。

提示:

TipRanks为独立第三方,提供金融分析师的分析数据,并计算分析师推荐的平均回报率和胜率。提供的信息并非投资建议,仅供参考。本文不对评级数据和报告的完整性与准确性做出认可、声明或保证。

TipRanks提供每位分析师的星级,分析师星级代表分析师所有推荐的过往表现,通过分析师的总胜率和平均回报率综合计算得出,星星越多,则该分析师过往表现越优异,最高为5颗星。

分析师总胜率为近一年分析师的评级成功次数占总评级次数的比率。评级的成功与否,取决于TipRanks的虚拟投资组合是否从该股票中产生正回报。

总平均回报率为基于分析师的初始评级创建虚拟投资组合,并根据评级变化对组合进行调整,在近一年中该投资组合所获得的回报率。

此外,综合报道,$Coursera (COUR.US)$近期主要分析师观点如下:

此外,综合报道,$Coursera (COUR.US)$近期主要分析师观点如下:

Furthermore, according to the comprehensive report, the opinions of

Furthermore, according to the comprehensive report, the opinions of