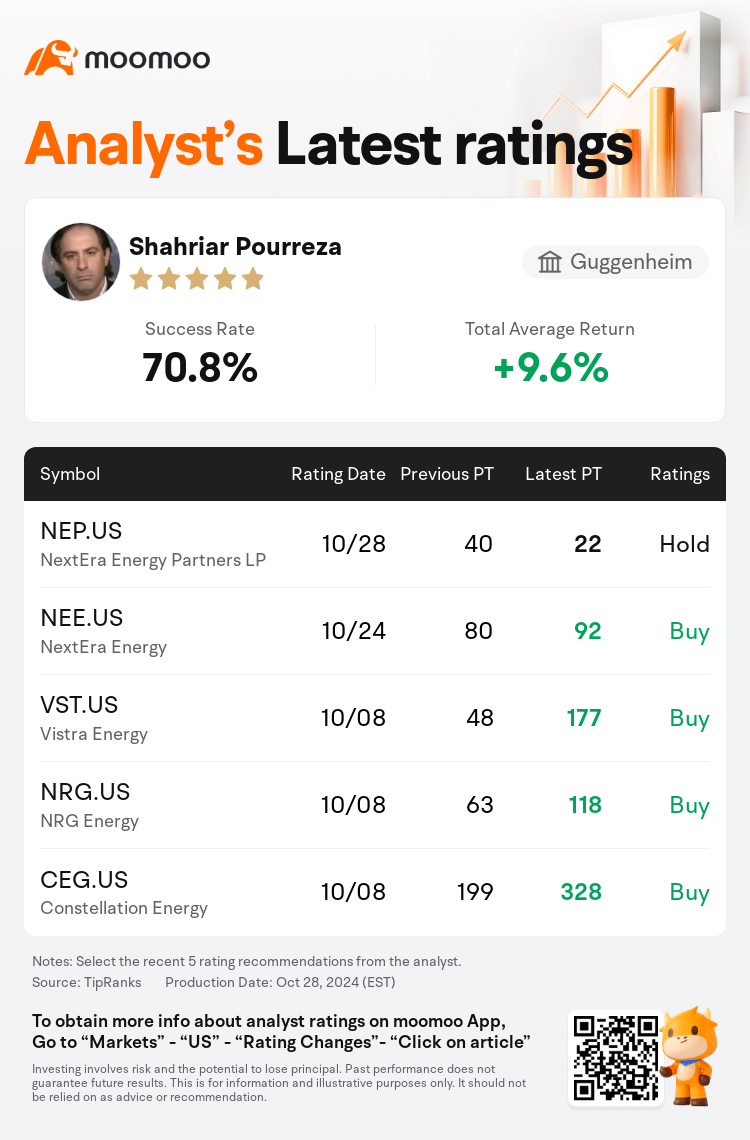

Guggenheim analyst Shahriar Pourreza downgrades $NextEra Energy Partners LP (NEP.US)$ to a hold rating, and adjusts the target price from $40 to $22.

According to TipRanks data, the analyst has a success rate of 70.8% and a total average return of 9.6% over the past year.

Furthermore, according to the comprehensive report, the opinions of $NextEra Energy Partners LP (NEP.US)$'s main analysts recently are as follows:

Furthermore, according to the comprehensive report, the opinions of $NextEra Energy Partners LP (NEP.US)$'s main analysts recently are as follows:

NextEra Energy Partners' third-quarter outcomes fell short of projections, mainly due to a weaker-than-expected wind resource. More crucially, the company has communicated its plans to offer an update by the latest at the fourth-quarter earnings call about its strategic evaluation of the long-term convertible equity portfolio financing obligations and cost of capital. An announcement regarding asset dropdowns, paired with a distribution reconfiguration, could serve as a stimulant for the stock and enhance growth prospects into fiscal 2026 and further.

Following Q3 earnings, it was confirmed that an update on NextEra Energy Partners' approach to capital allocation is expected by Q4, with strong indications of a possible near-term dividend reduction. The subsequent decline in stock value was attributed not directly to this news, but rather to speculations regarding the magnitude of the impending cut. An analyst perceives this adjustment as a strategic move to manage significant CEPF acquisitions and to align the dividend yield with that of industry counterparts.

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

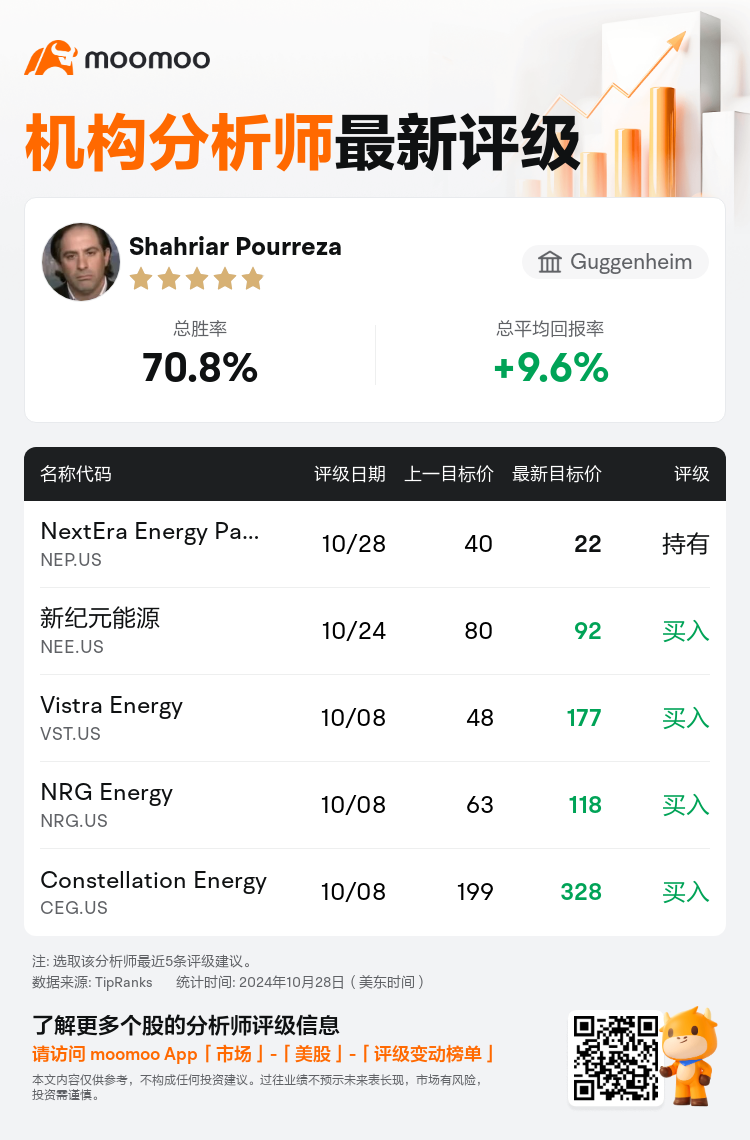

Guggenheim分析师Shahriar Pourreza下调$NextEra Energy Partners LP (NEP.US)$至持有评级,并将目标价从40美元下调至22美元。

根据TipRanks数据显示,该分析师近一年总胜率为70.8%,总平均回报率为9.6%。

此外,综合报道,$NextEra Energy Partners LP (NEP.US)$近期主要分析师观点如下:

此外,综合报道,$NextEra Energy Partners LP (NEP.US)$近期主要分析师观点如下:

新纪元能源合作伙伴第三季度业绩未达预期,主要是由于风资源低于预期。更为关键的是,该公司已经沟通了关于长期可转股权益组合融资义务和资金成本的战略评估,最迟在第四季度业绩会上提供最新更新。关于资产下滑的公告,配合着分配重构,可能会为股票提供刺激,提升到2026财年及更远的增长前景。

在第三季度业绩后,确认新纪元能源合作伙伴资本配置方法的更新预计在第四季度进行,有强烈迹象表明可能会有近期分红调整。股票价值的随后下降并非直接归因于这一消息,而是归因于有关即将发生的削减规模的猜测。一位分析师认为这一调整是为了管理重要的CEPF收购,与行业同行的股息收益率保持一致的战略举措。

提示:

TipRanks为独立第三方,提供金融分析师的分析数据,并计算分析师推荐的平均回报率和胜率。提供的信息并非投资建议,仅供参考。本文不对评级数据和报告的完整性与准确性做出认可、声明或保证。

TipRanks提供每位分析师的星级,分析师星级代表分析师所有推荐的过往表现,通过分析师的总胜率和平均回报率综合计算得出,星星越多,则该分析师过往表现越优异,最高为5颗星。

分析师总胜率为近一年分析师的评级成功次数占总评级次数的比率。评级的成功与否,取决于TipRanks的虚拟投资组合是否从该股票中产生正回报。

总平均回报率为基于分析师的初始评级创建虚拟投资组合,并根据评级变化对组合进行调整,在近一年中该投资组合所获得的回报率。

此外,综合报道,$NextEra Energy Partners LP (NEP.US)$近期主要分析师观点如下:

此外,综合报道,$NextEra Energy Partners LP (NEP.US)$近期主要分析师观点如下:

Furthermore, according to the comprehensive report, the opinions of

Furthermore, according to the comprehensive report, the opinions of