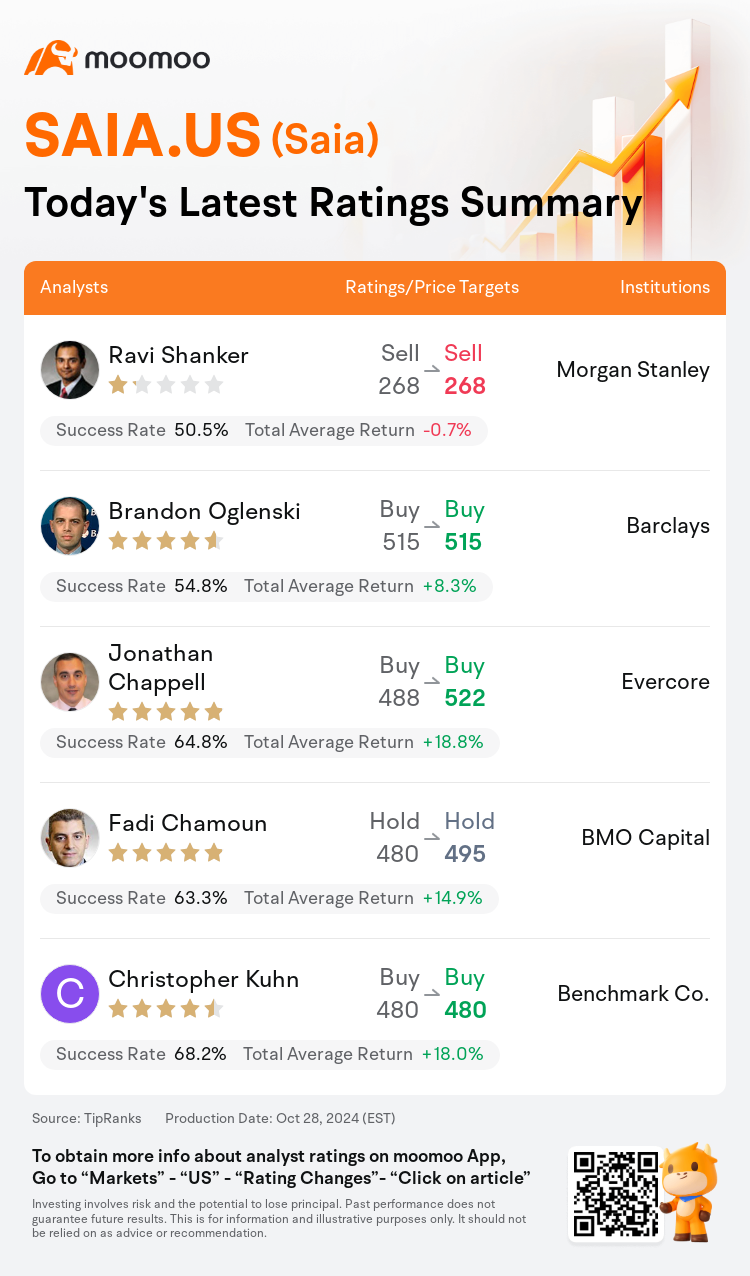

On Oct 28, major Wall Street analysts update their ratings for $Saia (SAIA.US)$, with price targets ranging from $268 to $522.

Morgan Stanley analyst Ravi Shanker maintains with a sell rating, and maintains the target price at $268.

Barclays analyst Brandon Oglenski maintains with a buy rating, and maintains the target price at $515.

Evercore analyst Jonathan Chappell maintains with a buy rating, and adjusts the target price from $488 to $522.

Evercore analyst Jonathan Chappell maintains with a buy rating, and adjusts the target price from $488 to $522.

BMO Capital analyst Fadi Chamoun maintains with a hold rating, and adjusts the target price from $480 to $495.

Benchmark Co. analyst Christopher Kuhn maintains with a buy rating, and maintains the target price at $480.

Furthermore, according to the comprehensive report, the opinions of $Saia (SAIA.US)$'s main analysts recently are as follows:

Following the Q3 report, it is observed that Saia has potentially overcome previous challenges characterized by start-up costs and unfavorable shipment mixes. Indications show that the weight per shipment may have reached a minimum threshold, and there's a notable reduction in the rate of new facility inaugurations.

Despite the earnings miss, Saia's shares experienced an over 10% increase in value. This uptick could be partly due to short covering, as market sentiment appeared to lean negative prior to the earnings report. While there are risks associated with Saia's recent significant terminal expansions, there continues to be a strong belief in the company's attractive pricing, margin, and earnings growth prospects.

It has been noted that despite missing third-quarter expectations and a forecast that could bring consensus estimates significantly lower, the pricing situation appears more favorable than anticipated. Investors seem to be focusing beyond the immediate softness, anticipating a potential margin improvement once the expansion of terminal operations slows and fundamental demand resurfaces.

Saia's recent quarterly results aligned closely with forecasts and were marginally below the consensus. The company's investments throughout the current year place it in a favorable position for 2025, with the expectation of improved margins at new terminals and growth projections that surpass industry averages.

Following a period of reassessment, there is a sentiment that the pessimistic outlook for Saia has lessened due to improved pricing and robust tonnage in September. Saia is recognized for its impressive growth narrative and the year 2025 may surpass expectations, notwithstanding the anticipation remaining high after a moderate reduction in the fourth quarter projections.

Here are the latest investment ratings and price targets for $Saia (SAIA.US)$ from 5 analysts:

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

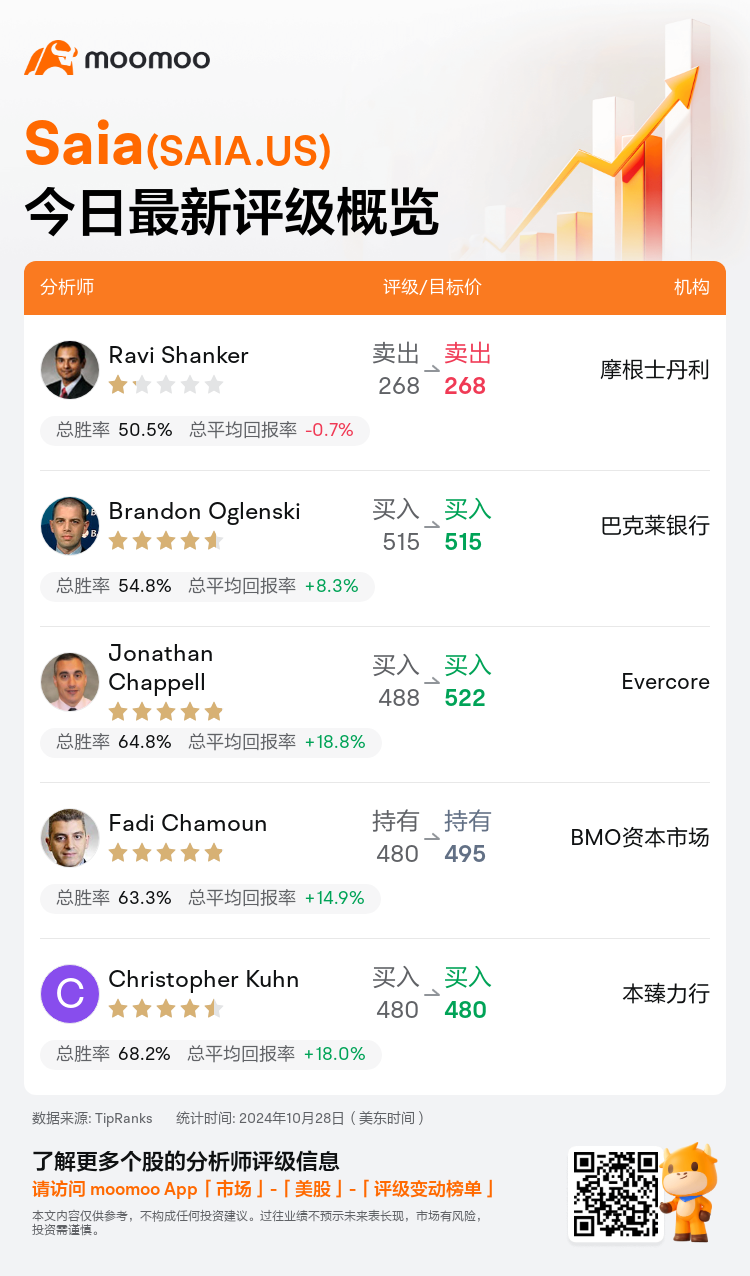

美东时间10月28日,多家华尔街大行更新了$Saia (SAIA.US)$的评级,目标价介于268美元至522美元。

摩根士丹利分析师Ravi Shanker维持卖出评级,维持目标价268美元。

巴克莱银行分析师Brandon Oglenski维持买入评级,维持目标价515美元。

Evercore分析师Jonathan Chappell维持买入评级,并将目标价从488美元上调至522美元。

Evercore分析师Jonathan Chappell维持买入评级,并将目标价从488美元上调至522美元。

BMO资本市场分析师Fadi Chamoun维持持有评级,并将目标价从480美元上调至495美元。

本臻力行分析师Christopher Kuhn维持买入评级,维持目标价480美元。

此外,综合报道,$Saia (SAIA.US)$近期主要分析师观点如下:

根据第三季度报告,观察到saia可能已经克服了之前的挑战,包括初始成本和不利的运输混合。迹象显示,每次装运的重量可能已经达到最低阈值,新设施开幕速度明显减缓。

尽管收益未达预期,saia的股价出现了超过10%的增长。这种上涨可能部分归因于开空交易,因为在收益报告之前,市场情绪似乎趋向于负面。尽管saia最近大规模拓展终端业务存在风险,但对公司的吸引力定价、毛利和收益增长前景依然有着坚定的信念。

尽管未达到第三季度预期和可能会显著降低共识预期的预测,但价格情况似乎比预期更为有利。投资者似乎在关注当前的疲软局面之外,预期终端业务扩张放缓后可能会出现潜在的毛利改善和基本需求复苏。

saia最近的季度业绩与预测紧密契合,略低于共识。公司在当前年度的投资使其处于有利的位置,预计2025年在新终端的毛利率会提高,并且增长预期将超过行业平均水平。

经过重新评估后,有一种情绪认为由于价格改善和九月份交付量的强劲,对saia的悲观前景已有所缓解。saia以其令人印象深刻的增长叙事而闻名,到2025年可能会超出预期,尽管在第四季度预测略微降低后,对预期仍然抱有很高期望。

以下为今日5位分析师对$Saia (SAIA.US)$的最新投资评级及目标价:

提示:

TipRanks为独立第三方,提供金融分析师的分析数据,并计算分析师推荐的平均回报率和胜率。提供的信息并非投资建议,仅供参考。本文不对评级数据和报告的完整性与准确性做出认可、声明或保证。

TipRanks提供每位分析师的星级,分析师星级代表分析师所有推荐的过往表现,通过分析师的总胜率和平均回报率综合计算得出,星星越多,则该分析师过往表现越优异,最高为5颗星。

分析师总胜率为近一年分析师的评级成功次数占总评级次数的比率。评级的成功与否,取决于TipRanks的虚拟投资组合是否从该股票中产生正回报。

总平均回报率为基于分析师的初始评级创建虚拟投资组合,并根据评级变化对组合进行调整,在近一年中该投资组合所获得的回报率。

Evercore分析师Jonathan Chappell维持买入评级,并将目标价从488美元上调至522美元。

Evercore分析师Jonathan Chappell维持买入评级,并将目标价从488美元上调至522美元。

Evercore analyst Jonathan Chappell maintains with a buy rating, and adjusts the target price from $488 to $522.

Evercore analyst Jonathan Chappell maintains with a buy rating, and adjusts the target price from $488 to $522.