What's Next: Banco De Chile's Earnings Preview

What's Next: Banco De Chile's Earnings Preview

Banco De Chile (NYSE:BCH) is set to give its latest quarterly earnings report on Tuesday, 2024-10-29. Here's what investors need to know before the announcement.

智利银行(纽交所:BCH)将于2024年10月29日星期二发布最新季度财报。投资者在公布前需要了解以下信息。

Analysts estimate that Banco De Chile will report an earnings per share (EPS) of $0.63.

分析师预计智利银行将报告每股收益(EPS)为$0.63。

Anticipation surrounds Banco De Chile's announcement, with investors hoping to hear about both surpassing estimates and receiving positive guidance for the next quarter.

投资者期待智利银行的公告,希望听到超过预期和获得下个季度正面指导的消息。

New investors should understand that while earnings performance is important, market reactions are often driven by guidance.

新投资者应该了解,尽管收益表现很重要,但市场反应往往受到指引的推动。

Earnings Track Record

历史财报追踪

Last quarter the company beat EPS by $0.03, which was followed by a 1.61% increase in the share price the next day.

上个季度公司的每股收益超过$0.03,随后股价第二天上涨1.61%。

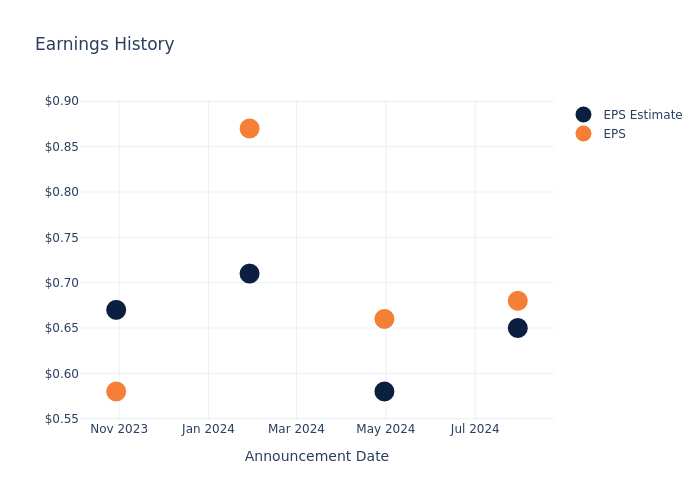

Here's a look at Banco De Chile's past performance and the resulting price change:

以下是智利银行过往表现及结果导致的价格变动:

| Quarter | Q2 2024 | Q1 2024 | Q4 2023 | Q3 2023 |

|---|---|---|---|---|

| EPS Estimate | 0.65 | 0.58 | 0.71 | 0.67 |

| EPS Actual | 0.68 | 0.66 | 0.87 | 0.58 |

| Price Change % | 2.0% | -0.0% | 1.0% | 3.0% |

| 季度 | 2024年第二季度 | Q1 2024 | 2023年第四季度 | 2023年第三季度 |

|---|---|---|---|---|

| 每股收益预估值 | 12,666 | 0.58 | 0.71 | 0.67 |

| 每股收益实际值 | 0.68 | 0.66 | 0.87 | 0.58 |

| 价格变更% | 2.0% | -0.0% | 1.0% | 3.0% |

Market Performance of Banco De Chile's Stock

智利银行股票的市场表现

Shares of Banco De Chile were trading at $24.49 as of October 25. Over the last 52-week period, shares are up 20.51%. Given that these returns are generally positive, long-term shareholders are likely bullish going into this earnings release.

10月25日,智利银行股票交易价为24.49美元。在过去的52周中,股价上涨了20.51%。鉴于这些回报通常是积极的,长期股东很可能对即将到来的财报发布持看好态度。

To track all earnings releases for Banco De Chile visit their earnings calendar on our site.

要跟踪智利银行的所有财报发布,请访问我们网站上的财报日历。

This article was generated by Benzinga's automated content engine and reviewed by an editor.

本文由Benzinga的自动化内容引擎生成并由编辑审查。

New investors should understand that while earnings performance is important, market reactions are often driven by guidance.

New investors should understand that while earnings performance is important, market reactions are often driven by guidance.