Olin Analysts Slash Their Forecasts After Q3 Earnings

Olin Analysts Slash Their Forecasts After Q3 Earnings

Olin Corporation (NYSE:OLN) reported mixed third-quarter financial results, after the closing bell on Thursday. Also, the company said Hurricane Beryl will impact its chemical businesses.

奥林公司(纽约证券交易所代码:OLN)在周四收盘后公布的第三季度财务业绩喜忧参半。该公司还表示,飓风贝丽尔将影响其化工业务。

Olin reported quarterly GAAP losses of 21 cents per share which missed the analyst consensus estimate of 3 cents per share. The company reported quarterly sales of $1.59 billion which beat the analyst consensus estimate of $1.57 billion.

奥林公布的季度GAAP亏损为每股21美分,未达到分析师共识估计的每股3美分。该公司公布的季度销售额为15.9亿美元,超过了分析师共识估计的15.7亿美元。

Ken Lane, President, and Chief Executive Officer, said, "During the third quarter, our Olin team worked tirelessly to recover from the effects of Hurricane Beryl. However, despite the team's hard work, persistent operating limitations related to the hurricane necessitated an additional outage, which we commenced in late September and successfully completed this month. This downtime added $9.4 million to the originally estimated third quarter Hurricane Beryl impact of $100 million and we anticipate a residual fourth quarter impact of approximately $25 million on our Chemicals businesses. Overall, Hurricane Beryl is expected to result in an approximately $135 million headwind in 2024. Our Freeport, Texas assets are now returning to normal operations. Excluding the Hurricane Beryl impact, our Chemicals businesses' performance in the third quarter 2024 was slightly better than we anticipated."

总裁兼首席执行官肯·莱恩表示:“在第三季度,我们的奥林团队不懈地努力从飓风贝丽尔的影响中恢复过来。但是,尽管团队付出了艰苦努力,但由于飓风造成的持续运营限制,我们不得不再次停机,停电于9月下旬开始,并于本月成功完成。这次停机使最初估计的第三季度飓风贝丽尔造成的1亿美元影响增加了940万美元,我们预计第四季度对化工业务的剩余影响约为2500万美元。总体而言,预计飓风贝丽尔将在2024年造成约1.35亿美元的不利影响。我们在德克萨斯州弗里波特的资产现已恢复正常运营。不包括飓风绿柱石的影响,我们的化工业务在2024年第三季度的表现略好于我们的预期。”

Olin said it sees fourth-quarter adjusted EBITDA of $170 million to $200 million.

奥林表示,预计第四季度调整后的息税折旧摊销前利润为1.7亿美元至2亿美元。

Olin shares gained 1% to trade at $41.85 on Monday.

周一,奥林股价上涨1%,至41.85美元。

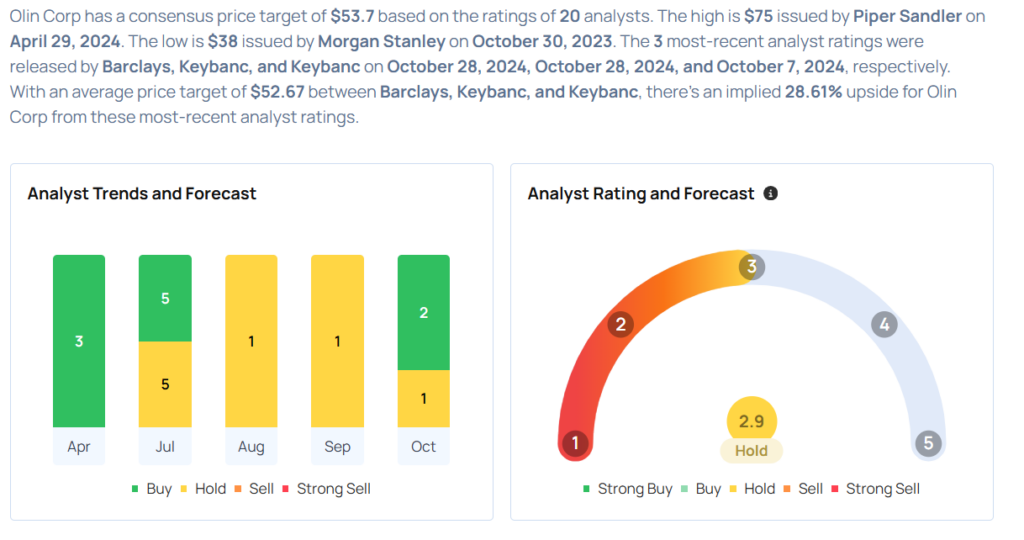

These analysts made changes to their price targets on Olin following earnings announcement.

财报公布后,这些分析师更改了奥林的目标股价。

- Keybanc analyst Aleksey Yefremov maintained Olin with an Overweight and lowered the price target from $57 to $56.

- Barclays analyst Michael Leithead maintained Olin with an Equal-Weight and lowered the price target from $49 to $45.

- Keybanc分析师阿列克谢·叶夫列莫夫维持奥林增持,并将目标股价从57美元下调至56美元。

- 巴克莱分析师迈克尔·莱特黑德维持奥林的同等权重,并将目标股价从49美元下调至45美元。

Considering buying OLN stock? Here's what analysts think:

考虑购买 OLN 股票?以下是分析师的想法:

Read More:

阅读更多:

- Top 3 Industrials Care Stocks That Plunge This Month

- 本月暴跌的三大工业护理股

Olin said it sees fourth-quarter adjusted

Olin said it sees fourth-quarter adjusted