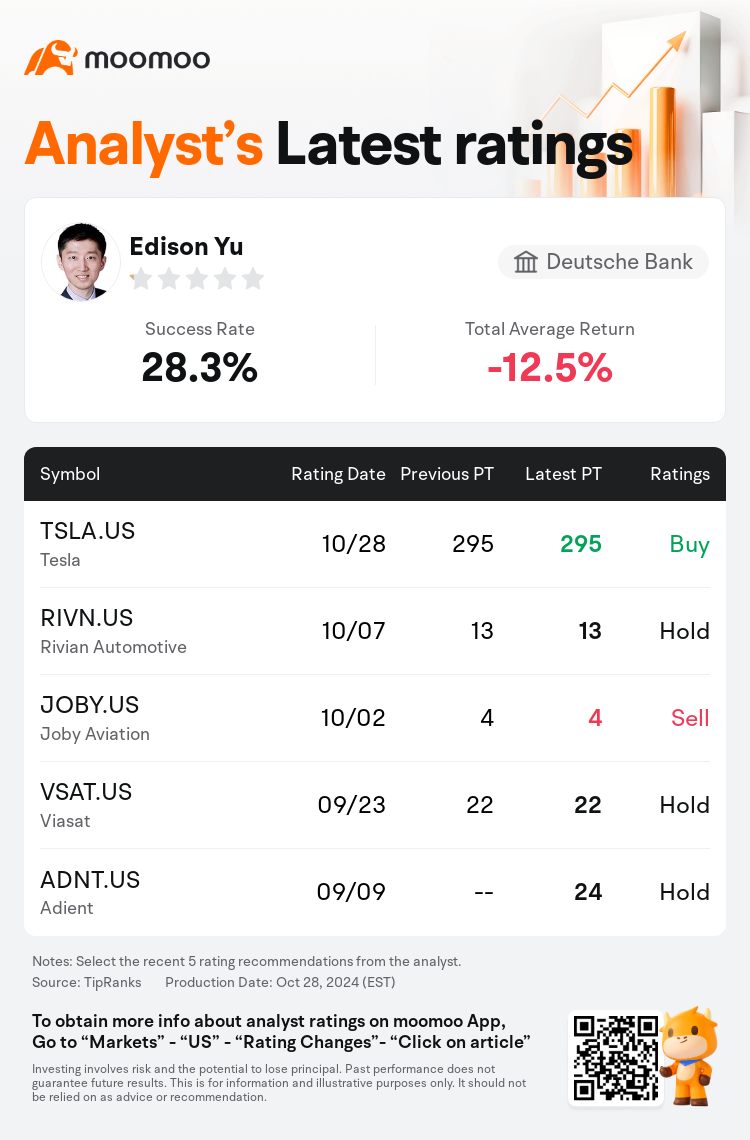

Deutsche Bank analyst Edison Yu maintains $Tesla (TSLA.US)$ with a buy rating, and maintains the target price at $295.

According to TipRanks data, the analyst has a success rate of 28.3% and a total average return of -12.5% over the past year.

Furthermore, according to the comprehensive report, the opinions of $Tesla (TSLA.US)$'s main analysts recently are as follows:

Furthermore, according to the comprehensive report, the opinions of $Tesla (TSLA.US)$'s main analysts recently are as follows:

Tesla reported a substantial gross margin outperformance in their third quarter and provided general guidance for a fourth-quarter volume exceeding 525,000 units, along with an anticipated growth of 20%-30% in 2025. The conversation around Tesla's pivot to autonomous vehicles continues, yet its strengthening fundamentals are acknowledged.

The firm has raised its estimates more significantly for 2024 to account for the Q3 results surpassing expectations and a forecasted robust completion of the year in both Tesla's automotive and energy storage divisions. The Cybertruck, the expansion of energy storage in China, and the progression of the 4680 battery technology are anticipated to enhance the company's margins going into 2025. The analyst notes that Tesla is expected to pass on the majority of its automotive cost savings to fuel further growth.

The firm is adjusting its estimates upwards after Tesla reported strong third-quarter results. Notably, automotive margins exceeded expectations and showed sequential improvement, attributed to reduced costs and the anticipation of less expensive vehicles expected to launch in the first half of 2025. Additionally, the projection of a 20%-30% increase in vehicle sales by 2025 was cited as a significant positive factor.

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

德意志银行分析师Edison Yu维持$特斯拉 (TSLA.US)$买入评级,维持目标价295美元。

根据TipRanks数据显示,该分析师近一年总胜率为28.3%,总平均回报率为-12.5%。

此外,综合报道,$特斯拉 (TSLA.US)$近期主要分析师观点如下:

此外,综合报道,$特斯拉 (TSLA.US)$近期主要分析师观点如下:

特斯拉报告称,其第三季度毛利率大幅跑赢大盘,并对第四季度的销量超过52.5万辆提供了总体指导,预计2025年将增长20%-30%。围绕特斯拉转向自动驾驶汽车的讨论仍在继续,但其基本面走强已得到承认。

该公司进一步大幅提高了对2024年的预期,这是因为第三季度业绩超出预期,而且预计特斯拉汽车和储能部门今年都将强劲完成。预计到2025年,Cybertruck、中国储能系统的扩张以及4680电池技术的进步将提高公司的利润率。分析师指出,预计特斯拉将把节省的大部分汽车成本转用于推动进一步增长。

在特斯拉公布强劲的第三季度业绩后,该公司正在向上调整其预期。值得注意的是,汽车利润率超出预期,并连续改善,这要归因于成本降低以及预计将在2025年上半年推出更便宜的汽车。此外,预计到2025年汽车销量将增长20%-30%,这是一个重要的积极因素。

提示:

TipRanks为独立第三方,提供金融分析师的分析数据,并计算分析师推荐的平均回报率和胜率。提供的信息并非投资建议,仅供参考。本文不对评级数据和报告的完整性与准确性做出认可、声明或保证。

TipRanks提供每位分析师的星级,分析师星级代表分析师所有推荐的过往表现,通过分析师的总胜率和平均回报率综合计算得出,星星越多,则该分析师过往表现越优异,最高为5颗星。

分析师总胜率为近一年分析师的评级成功次数占总评级次数的比率。评级的成功与否,取决于TipRanks的虚拟投资组合是否从该股票中产生正回报。

总平均回报率为基于分析师的初始评级创建虚拟投资组合,并根据评级变化对组合进行调整,在近一年中该投资组合所获得的回报率。

此外,综合报道,$特斯拉 (TSLA.US)$近期主要分析师观点如下:

此外,综合报道,$特斯拉 (TSLA.US)$近期主要分析师观点如下:

Furthermore, according to the comprehensive report, the opinions of

Furthermore, according to the comprehensive report, the opinions of