DJT Continues to Climb: Up 10% Pre-Market on Trump Trade Boost

DJT Continues to Climb: Up 10% Pre-Market on Trump Trade Boost

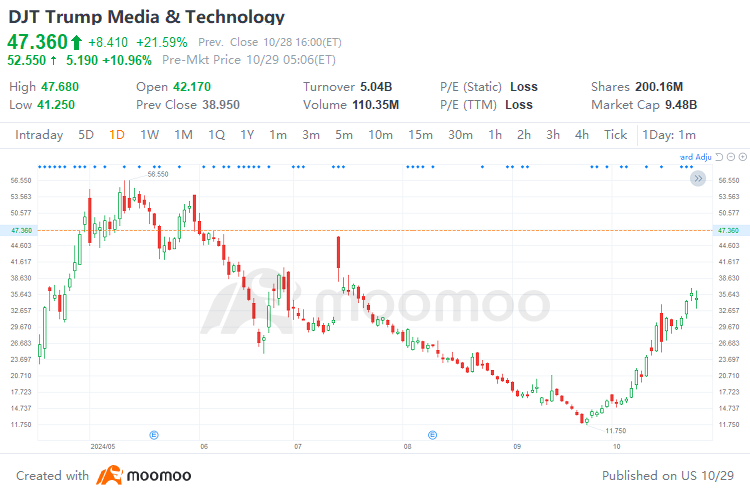

On Monday, $Trump Media & Technology (DJT.US)$ surged by 20%, becoming a focal point in the global market. With Trump holding a 57% stake in the company, it is viewed as one of the top concept stocks for the upcoming U.S. election. As the election progresses, the stock price has risen over 240% from its lows in recent weeks.

周一,苹果在“Glowtime”活动上推出了其Apple Watch Series 10、iPhone 16系列等等。 $特朗普媒体科技集团 (DJT.US)$ 上涨20%,成为全球市场的焦点。特朗普持有该公司57%的股份,被视为即将到来的美国大选中最热门的概念股之一。随着选举的进行,股价已从近几周的低点上涨了超过240%。

After surviving an assassination attempt in mid-July, Trump saw DJT's stock price spike by 30% in a single day, reaching a high of $46. As of yesterday's market close, the stock was priced at $47.36, with market sentiment gradually favoring Trump's chances of victory.

在7月中旬遭遇暗杀行刺未遂后,特朗普看到DJT的股价单日上涨30%,一度飙至46美元。截至昨日收盘,该股价为47.36美元,市场情绪逐渐偏向于特朗普胜选的可能性。

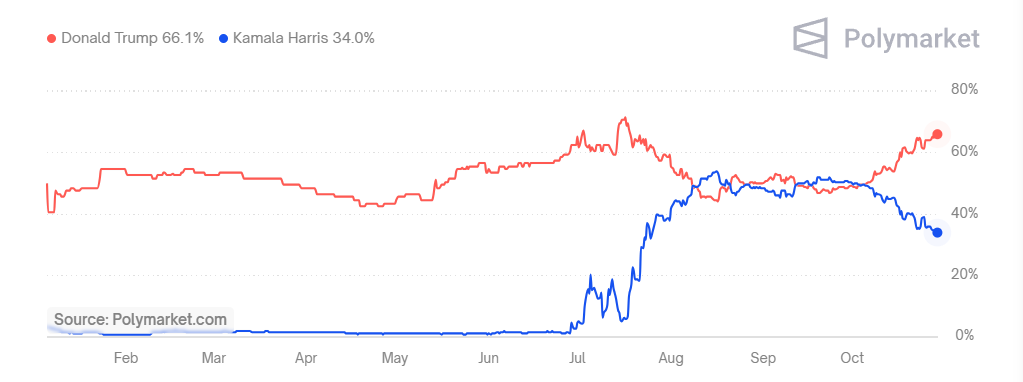

According to the latest data from Polymarket, the probability of Trump returning to the White House has reached 68%.

根据Polymarket最新数据,特朗普重新入主白宫的概率已达到68%。

Increasing signs indicate that the U.S. stock market is re-embracing the "Trump trade," with other Trump-related stocks also regaining attention.$Phunware (PHUN.US)$ which participated in Trump's 2020 campaign, has risen over 200% this month. Additionally, cryptocurrency stocks publicly supported by Trump have rebounded collectively, with Bitcoin rising more than 10% from its lows earlier this month.

越来越多迹象表明,美国股市正在重新拥抱“特朗普交易”,其他与特朗普相关的股票也重新受到关注。$Phunware (PHUN.US)$ 参与特朗普2020年竞选的股票本月上涨了超过200%。此外,受特朗普公开支持的数字货币股票集体反弹,比特币从本月早些时候的低位上涨了超过10%。

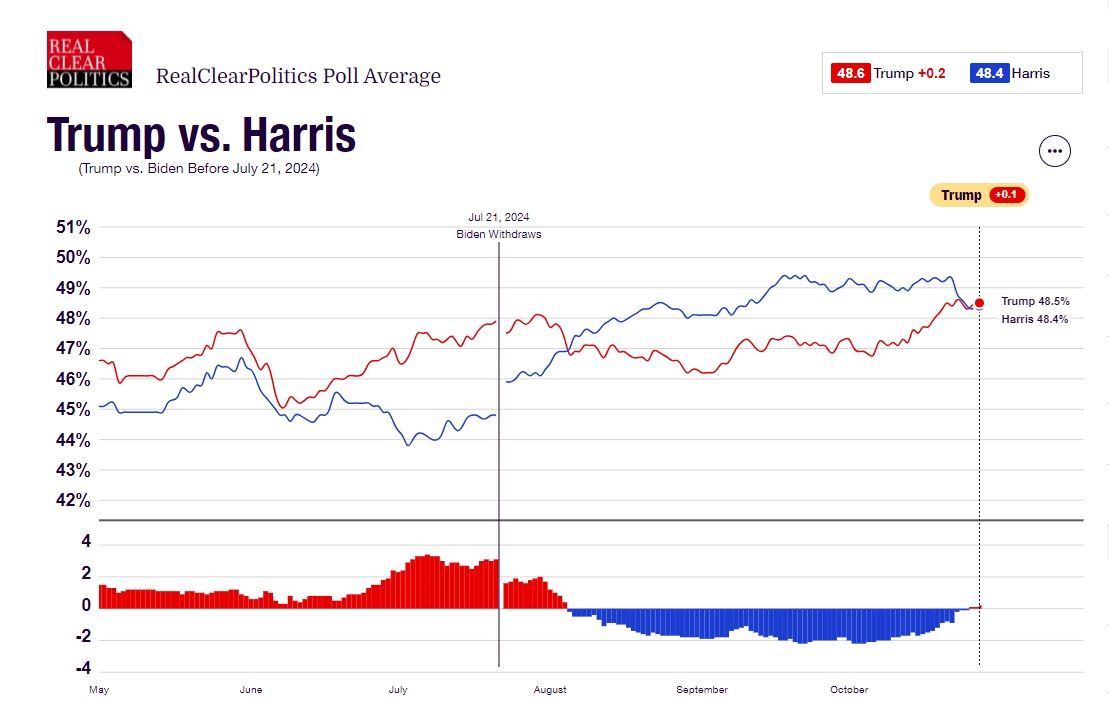

Notably, on Monday, Trump’s polling support surpassed Harris’s by 0.2 percentage points (48.6 vs. 48.4), marking the first time Trump has led since August, though both candidates remain in a statistical tie.

值得注意的是,周一,特朗普的支持率超过了哈里斯的0.2个百分点(48.6比48.4),这是特朗普自8月以来首次领先,尽管两位候选人仍然在统计上处于并列。

As some investors have noted, markets often develop amidst divergence and conclude with frenetic surges. The election results are expected to be announced on 5 November, and we may witness the gradual fading of one-sided market bets, with expectations shifting towards favorable industries under a new regime.

正如一些投资者所指出的,市场经常在分歧中发展,并在狂热的激增中收尾。预计选举结果将于11月5日宣布,我们可能会目睹单边市场投注逐渐消退,预期转向在新政权下的有利产业。

Currently, the market generally believes that, given Trump's positions, his policies will support cryptocurrency, traditional energy, infrastructure development, and tax cuts. Conversely, if Harris were to take office, she would likely favor welfare policies, healthcare, green energy, and support for U.S. exports and housing.

当前,市场普遍认为,鉴于特朗普的立场,他的政策将支持数字货币、传统能源、基础设施发展和减税。相反,如果哈里斯上台,她可能更倾向于福利政策、医疗保健、绿色能源以及支持美国出口和住房。

With the 2024 U.S. presidential election in a state of flux, how can bullish and bearish investors seize profit opportunities? Find out more>>

在2024年美国总统选举陷入动荡的状态下,看好和看淡的投资者如何抓住利润机会? 了解更多>>

The U.S. election is a tight race! How to track related concept stocks? Open moomoo> U.S. stocks> Concept sectors to see Trump and Harris concept stocks at a glance!

美国大选竞争激烈!如何追踪相关概念股?打开moomoo>美国股票>概念板块,一目了然地查看特朗普和哈里斯的概念股!

Increasing signs indicate that the U.S. stock market is re-embracing the "Trump trade," with other Trump-related stocks also regaining attention.

Increasing signs indicate that the U.S. stock market is re-embracing the "Trump trade," with other Trump-related stocks also regaining attention.