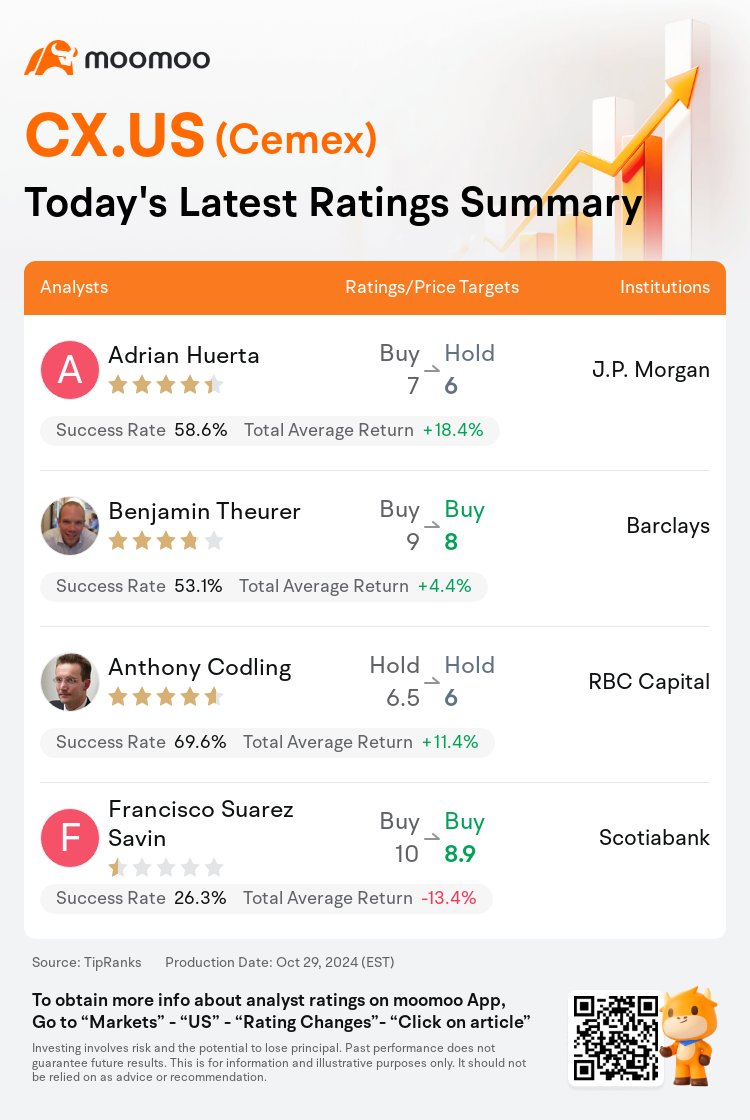

On Oct 29, major Wall Street analysts update their ratings for $Cemex (CX.US)$, with price targets ranging from $6 to $8.9.

J.P. Morgan analyst Adrian Huerta downgrades to a hold rating, and adjusts the target price from $7 to $6.

Barclays analyst Benjamin Theurer maintains with a buy rating, and adjusts the target price from $9 to $8.

RBC Capital analyst Anthony Codling maintains with a hold rating, and adjusts the target price from $6.5 to $6.

RBC Capital analyst Anthony Codling maintains with a hold rating, and adjusts the target price from $6.5 to $6.

Scotiabank analyst Francisco Suarez Savin maintains with a buy rating, and adjusts the target price from $10 to $8.9.

Furthermore, according to the comprehensive report, the opinions of $Cemex (CX.US)$'s main analysts recently are as follows:

The company's fourth-quarter results showed that operating EBITDA was significantly below expectations, coming in at $747M compared to the anticipated $802M. Nevertheless, it is believed that the majority of the negatives are already reflected in the current share price.

The company's recent quarterly performance fell short of the already cautious projections. The anticipation of any substantial fundamental triggers for the company is deferred until at least mid-February, barring a possible rally in the Mexican market. Forecasts for the fourth quarter are also leaning towards the weaker end, with limited clarity regarding the upcoming year's outcomes. Currently, the company's free cash flow is not sufficient to support an increasing dividend in conjunction with reasonable share repurchases.

Here are the latest investment ratings and price targets for $Cemex (CX.US)$ from 4 analysts:

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

美东时间10月29日,多家华尔街大行更新了$西麦斯 (CX.US)$的评级,目标价介于6美元至8.9美元。

摩根大通分析师Adrian Huerta下调至持有评级,并将目标价从7美元下调至6美元。

巴克莱银行分析师Benjamin Theurer维持买入评级,并将目标价从9美元下调至8美元。

加皇资本市场分析师Anthony Codling维持持有评级,并将目标价从6.5美元下调至6美元。

加皇资本市场分析师Anthony Codling维持持有评级,并将目标价从6.5美元下调至6美元。

丰业银行分析师Francisco Suarez Savin维持买入评级,并将目标价从10美元下调至8.9美元。

此外,综合报道,$西麦斯 (CX.US)$近期主要分析师观点如下:

公司第四季度的业绩显示,营运厂榷息税折旧及摊销前(EBITDA)大幅低于预期,仅为74700万美元,而预期为80200万美元。尽管如此,大多数负面因素被认为已经反映在目前的股价中。

公司最近一个季度的表现不及已谨慎的预期。对于公司存在任何重大基本面触发因素的预期推迟至少到二月中旬,除非墨西哥市场可能出现反弹。第四季度的预测也倾向于弱势,对于未来一年的结果也缺乏明确性。目前,公司的自由现金流不足以支持随着合理股份回购而增加的股息。

以下为今日4位分析师对$西麦斯 (CX.US)$的最新投资评级及目标价:

提示:

TipRanks为独立第三方,提供金融分析师的分析数据,并计算分析师推荐的平均回报率和胜率。提供的信息并非投资建议,仅供参考。本文不对评级数据和报告的完整性与准确性做出认可、声明或保证。

TipRanks提供每位分析师的星级,分析师星级代表分析师所有推荐的过往表现,通过分析师的总胜率和平均回报率综合计算得出,星星越多,则该分析师过往表现越优异,最高为5颗星。

分析师总胜率为近一年分析师的评级成功次数占总评级次数的比率。评级的成功与否,取决于TipRanks的虚拟投资组合是否从该股票中产生正回报。

总平均回报率为基于分析师的初始评级创建虚拟投资组合,并根据评级变化对组合进行调整,在近一年中该投资组合所获得的回报率。

加皇资本市场分析师Anthony Codling维持持有评级,并将目标价从6.5美元下调至6美元。

加皇资本市场分析师Anthony Codling维持持有评级,并将目标价从6.5美元下调至6美元。

RBC Capital analyst Anthony Codling maintains with a hold rating, and adjusts the target price from $6.5 to $6.

RBC Capital analyst Anthony Codling maintains with a hold rating, and adjusts the target price from $6.5 to $6.