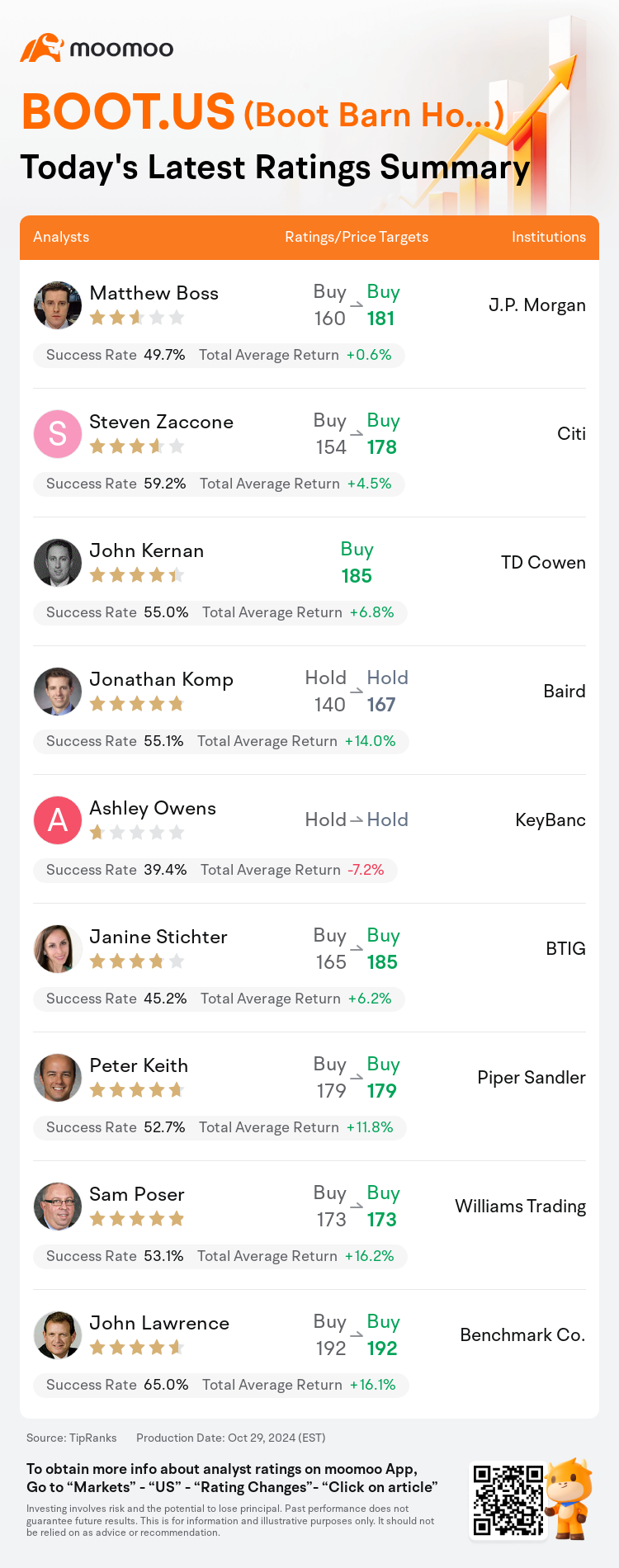

On Oct 29, major Wall Street analysts update their ratings for $Boot Barn Holdings (BOOT.US)$, with price targets ranging from $167 to $192.

J.P. Morgan analyst Matthew Boss maintains with a buy rating, and adjusts the target price from $160 to $181.

Citi analyst Steven Zaccone maintains with a buy rating, and adjusts the target price from $154 to $178.

TD Cowen analyst John Kernan initiates coverage with a buy rating, and sets the target price at $185.

TD Cowen analyst John Kernan initiates coverage with a buy rating, and sets the target price at $185.

Baird analyst Jonathan Komp maintains with a hold rating, and adjusts the target price from $140 to $167.

KeyBanc analyst Ashley Owens maintains with a hold rating.

Furthermore, according to the comprehensive report, the opinions of $Boot Barn Holdings (BOOT.US)$'s main analysts recently are as follows:

Boot Barn's recent fiscal Q2 report surpassed expectations and indicated a positive outlook, according to an analyst. The company's sequential comparative sales acceleration is credited to a significant uptick in transactions. Additionally, it is mentioned that the CEO transition is part of a long-term succession plan.

Boot Barn's robust fiscal Q2 same-store-sales results surpassed expectations, yet earnings flow-through fell short of market anticipations primarily because of elevated incentive compensation and singular legal expenses. Analysts perceive that Boot Barn is regaining solid same-store-sales momentum and the business model is progressively realigning with its 20% earnings growth framework.

Boot Barn's second quarter was robust and aligned with forecasts following a positive update at the beginning of September. Notably, all product categories are now showing positive trends, including the previously underperforming ladies western apparel and boots, as well as work apparel. The company has witnessed seven successive months of positive e-commerce sales, marking a significant turnaround from the long-term negative trajectory and indicating an increasing momentum in the second quarter.

Here are the latest investment ratings and price targets for $Boot Barn Holdings (BOOT.US)$ from 9 analysts:

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

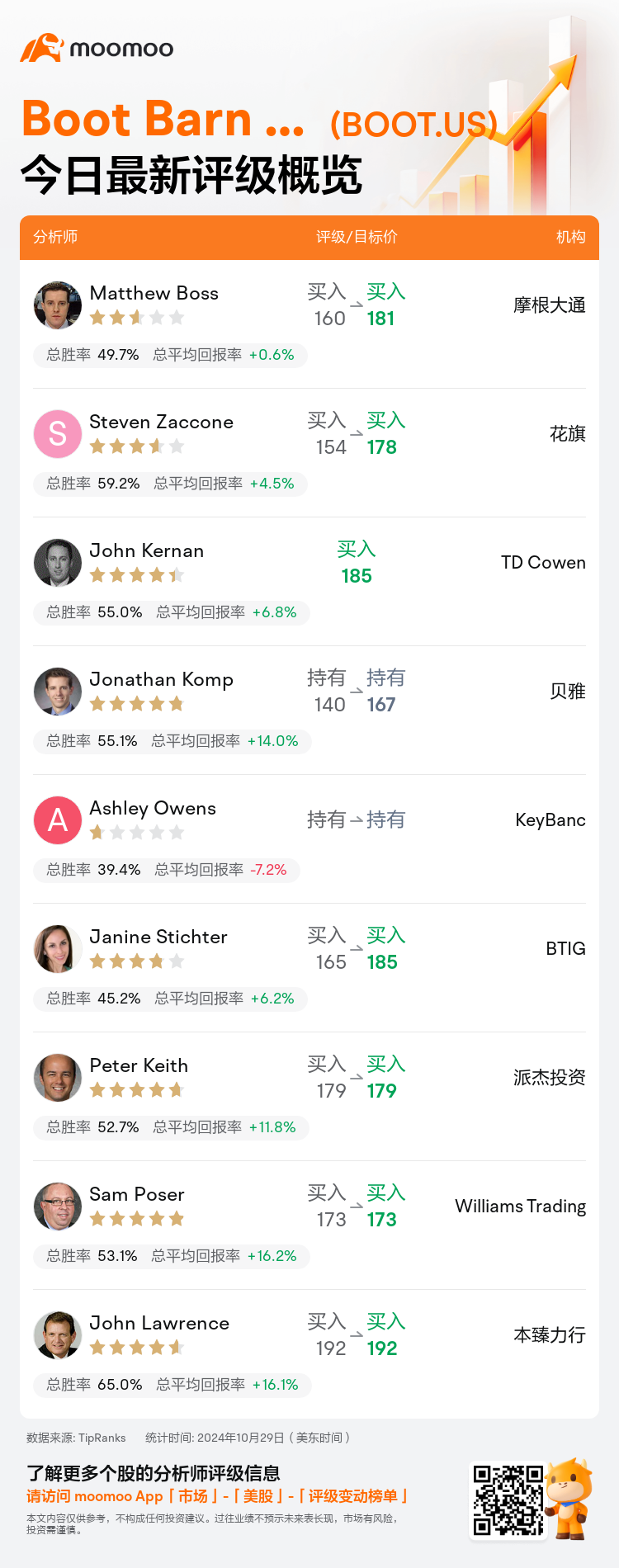

美东时间10月29日,多家华尔街大行更新了$Boot Barn Holdings (BOOT.US)$的评级,目标价介于167美元至192美元。

摩根大通分析师Matthew Boss维持买入评级,并将目标价从160美元上调至181美元。

花旗分析师Steven Zaccone维持买入评级,并将目标价从154美元上调至178美元。

TD Cowen分析师John Kernan首予买入评级,目标价185美元。

TD Cowen分析师John Kernan首予买入评级,目标价185美元。

贝雅分析师Jonathan Komp维持持有评级,并将目标价从140美元上调至167美元。

KeyBanc分析师Ashley Owens维持持有评级。

此外,综合报道,$Boot Barn Holdings (BOOT.US)$近期主要分析师观点如下:

Boot Barn最近的财季第二季度报告超出预期,分析师表示展望积极。公司连续比较销售加速归因于交易显著增加。此外,提到CEO的交接是长期继任计划的一部分。

Boot Barn强劲的财季第二季度同店销售业绩超出预期,但收益增加的不足之处主要是因为激励报酬和单一法律费用的增加未达市场预期。分析师认为Boot Barn正在重新获得稳健的同店销售增长势头,业务模式正在逐步与其20%收益增长框架实现重新对齐。

Boot Barn的第二季度强劲,并符合九月初的积极更新预测。值得注意的是,所有产品类别现在都显示出积极的趋势,包括之前表现不佳的女士西部服装和靴子,以及工作服。公司已经连续七个月出现电子商务销售的正增长,标志着从长期负向轨迹中的显著转变,并表明第二季度增长势头增强。

以下为今日9位分析师对$Boot Barn Holdings (BOOT.US)$的最新投资评级及目标价:

提示:

TipRanks为独立第三方,提供金融分析师的分析数据,并计算分析师推荐的平均回报率和胜率。提供的信息并非投资建议,仅供参考。本文不对评级数据和报告的完整性与准确性做出认可、声明或保证。

TipRanks提供每位分析师的星级,分析师星级代表分析师所有推荐的过往表现,通过分析师的总胜率和平均回报率综合计算得出,星星越多,则该分析师过往表现越优异,最高为5颗星。

分析师总胜率为近一年分析师的评级成功次数占总评级次数的比率。评级的成功与否,取决于TipRanks的虚拟投资组合是否从该股票中产生正回报。

总平均回报率为基于分析师的初始评级创建虚拟投资组合,并根据评级变化对组合进行调整,在近一年中该投资组合所获得的回报率。

TD Cowen分析师John Kernan首予买入评级,目标价185美元。

TD Cowen分析师John Kernan首予买入评级,目标价185美元。

TD Cowen analyst John Kernan initiates coverage with a buy rating, and sets the target price at $185.

TD Cowen analyst John Kernan initiates coverage with a buy rating, and sets the target price at $185.