GameStop Options Trading: A Deep Dive Into Market Sentiment

GameStop Options Trading: A Deep Dive Into Market Sentiment

Investors with a lot of money to spend have taken a bearish stance on GameStop (NYSE:GME).

有大量资金的投资者对GameStop(纽交所:GME)持看淡态度。

And retail traders should know.

零售交易者应该知道。

We noticed this today when the trades showed up on publicly available options history that we track here at Benzinga.

我们在这里追踪的公开期权历史记录上看到交易时发现了这一点。

Whether these are institutions or just wealthy individuals, we don't know. But when something this big happens with GME, it often means somebody knows something is about to happen.

无论这些是机构还是有钱人,我们不知道。但是当出现这样大的事情与GME有关时,通常意味着某些人知道即将发生的事情。

So how do we know what these investors just did?

那么我们如何知道这些投资者刚刚做了什么呢?

Today, Benzinga's options scanner spotted 9 uncommon options trades for GameStop.

今天,Benzinga的期权扫描器发现了9笔游戏驿站的罕见期权交易。

This isn't normal.

这不正常。

The overall sentiment of these big-money traders is split between 22% bullish and 77%, bearish.

这些大额交易者的总体情绪分为22%看好和77%看淡。

Out of all of the special options we uncovered, 2 are puts, for a total amount of $84,127, and 7 are calls, for a total amount of $379,697.

在我们发现的所有特殊期权中,有2个看跌期权,总金额为$84,127,有7个看涨期权,总金额为$379,697。

Expected Price Movements

预期价格波动

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $21.5 to $30.0 for GameStop over the recent three months.

根据交易活动,显然一些重要投资者在最近三个月中瞄准了GameStop股票的价格区间,价格从$21.5到$30.0。

Volume & Open Interest Trends

成交量和未平仓量趋势

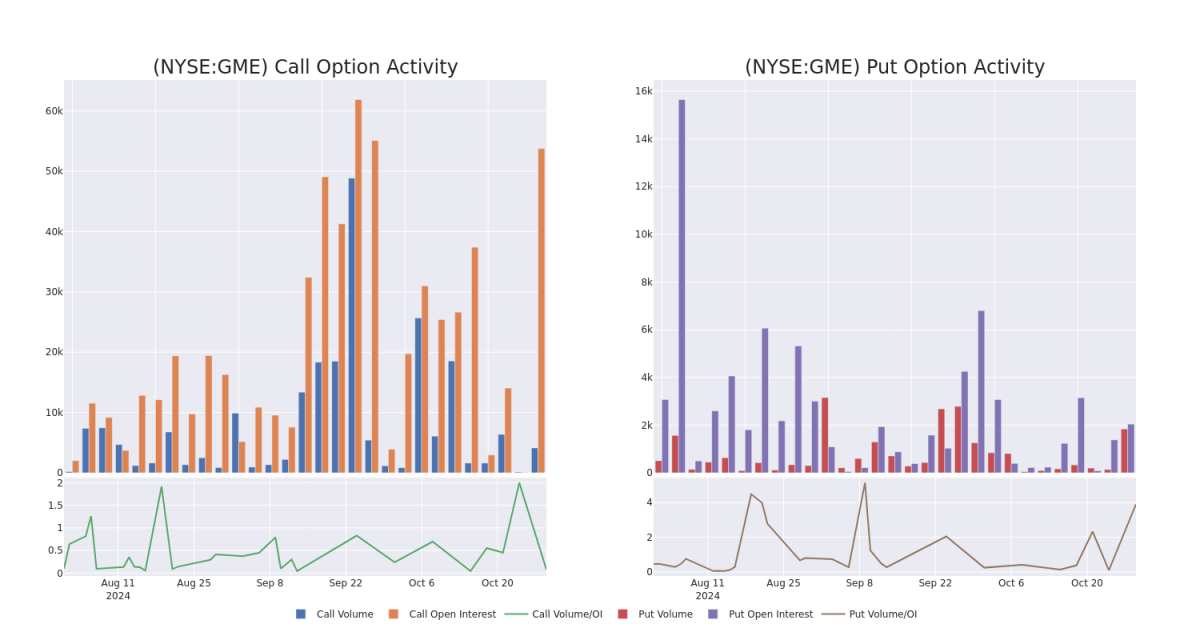

In terms of liquidity and interest, the mean open interest for GameStop options trades today is 6972.0 with a total volume of 5,965.00.

就流动性和利益而言,今天GameStop期权交易的平均未平仓合约是6972.0,总成交量为5,965.00。

In the following chart, we are able to follow the development of volume and open interest of call and put options for GameStop's big money trades within a strike price range of $21.5 to $30.0 over the last 30 days.

在下面的图表中,我们能够追踪GameStop股票在过去30天内$21.5到$30.0行权价区间内的看涨和看跌期权的成交量和未平仓合约的发展。

GameStop Option Volume And Open Interest Over Last 30 Days

GameStop近30天期权成交量和持仓量

Biggest Options Spotted:

最大的期权交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| GME | CALL | SWEEP | BEARISH | 01/17/25 | $2.4 | $2.35 | $2.35 | $30.00 | $111.5K | 13.1K | 1.0K |

| GME | CALL | SWEEP | BEARISH | 11/15/24 | $1.3 | $1.2 | $1.2 | $25.00 | $60.4K | 15.0K | 542 |

| GME | CALL | SWEEP | BEARISH | 11/15/24 | $1.25 | $1.16 | $1.16 | $25.00 | $59.1K | 15.0K | 1.0K |

| GME | PUT | SWEEP | BULLISH | 11/01/24 | $0.65 | $0.51 | $0.52 | $22.00 | $52.4K | 1.8K | 1.3K |

| GME | CALL | TRADE | BEARISH | 01/17/25 | $4.0 | $3.8 | $3.83 | $23.00 | $49.7K | 4.3K | 189 |

| 标的 | 看跌/看涨 | 交易类型 | 情绪 | 到期日 | 卖盘 | 买盘 | 价格 | 执行价格 | 总交易价格 | 未平仓合约数量 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| GME | 看涨 | SWEEP | 看淡 | 01/17/25 | $2.4 | $2.35 | $2.35 | $30.00 | $111.5K | 13.1K | 1.0K |

| GME | 看涨 | SWEEP | 看淡 | 11/15/24 | $1.3 | $1.2 | $1.2 | $25.00 | $60.4千 | 15.0K | 542 |

| GME | 看涨 | SWEEP | 看淡 | 11/15/24 | $1.25 | $1.16 | $1.16 | $25.00 | $59.1K | 15.0K | 1.0K |

| GME | 看跌 | SWEEP | 看好 | 11/01/24 | $0.65 | $0.51 | 0.52美元 | $22.00 | $52.4千美元 | 1.8K | 1.3K |

| GME | 看涨 | 交易 | 看淡 | 01/17/25 | $4.0 | $3.8 | $3.83 | $23.00 | $49.7K | 4.3千 | $ |

About GameStop

关于游戏驿站

GameStop Corp is a U.S. multichannel video game, consumer electronics, and services retailer. The company operates across Europe, Canada, Australia, and the United States. GameStop sells new and second-hand video game hardware, physical and digital video game software, and video game accessories, mainly through GameStop, EB Games, and Micromania stores and international e-commerce sites. The majority of sales are from the United States.

GameStop Corp是美国的一家多渠道视频游戏、消费电子和服务零售商。该公司在欧洲、加拿大、澳洲和美国等地区运营。GameStop主要通过GameStop、Eb Games和Micromania商店以及国际电子商务网站销售新和二手视频游戏硬件、实体和数字视频游戏软件和视频游戏配件。销售收入的大部分来自美国。

After a thorough review of the options trading surrounding GameStop, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

在彻底审查了围绕GameStop的期权交易后,我们进一步研究该公司。这包括评估其当前市场地位和表现。

Where Is GameStop Standing Right Now?

GameStop现在处于什么位置?

- Currently trading with a volume of 1,911,188, the GME's price is down by -1.32%, now at $22.43.

- RSI readings suggest the stock is currently may be approaching overbought.

- Anticipated earnings release is in 36 days.

- 目前成交量为1,911,188,游戏驿站的价格下跌了-1.32%,现在为$22.43。

- RSI读数表明该股目前可能接近超买水平。

- 预计的收益发布还有36天。

Unusual Options Activity Detected: Smart Money on the Move

检测到期权异动:智慧资金在行动。

Benzinga Edge's Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

Benzinga Edge的期权异动模块可以提前发现潜在的市场热点。了解大笔的资金在您喜欢的股票上的仓位变动。点击这里获取访问权限。

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for GameStop with Benzinga Pro for real-time alerts.

期权交易涉及更高的风险,但也提供更高利润的潜力。精明的交易者通过持续的教育、策略性交易调整、利用各种因子并保持对市场动态的敏锐感来减少这些风险。使用Benzinga Pro及时获取GameStop的最新期权交易,以便获得实时警报。

Whether these are institutions or just wealthy individuals, we don't know. But when something this big happens with GME, it often means somebody knows something is about to happen.

Whether these are institutions or just wealthy individuals, we don't know. But when something this big happens with GME, it often means somebody knows something is about to happen.